- What are retirement taxes?

- Which are the top five taxes that retirees face?

- How can you minimize them?

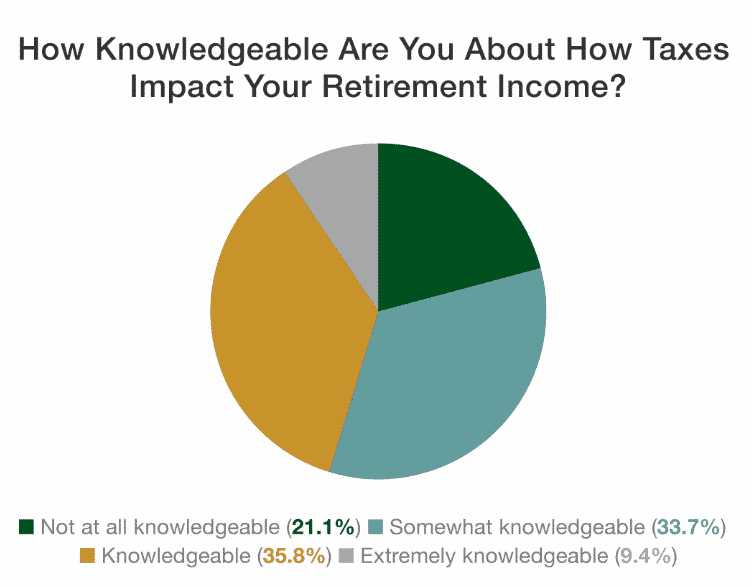

Everyone in retirement has one thing in common: a cost. There is no one-size-fits-all answer regarding the price tag or cost. Even though your price tag differs from your neighbors or acquaintances, we are bound by the same underlying principle. Consideration is given to everything from housing and utility prices to healthcare costs to inflation and taxes.

A daunting endeavor, especially if you’re juggling other commitments, is creating a substantial nest egg for retirement. Analyzing your retirement position begins with determining the sources of income you can count on. Most people’s retirement income will come primarily from their savings and investments. Also, the incomes come from Social Security and their long-term job income. IRAs, annuities, and employer-sponsored retirement plans are examples of personal savings and investment, as are stocks, bonds, and mutual funds held by an individual.

Each of these forms of income is subject to taxation. You may reduce your taxable income by using tax-advantaged measures. Please remember that your scenario will determine the optimum answer for you. Reduce or eliminate taxes on your retirement income by using several strategies. You’ll need to plan if you don’t want the IRS to tax you on various sources of income in your golden years.

What are retirement taxes?

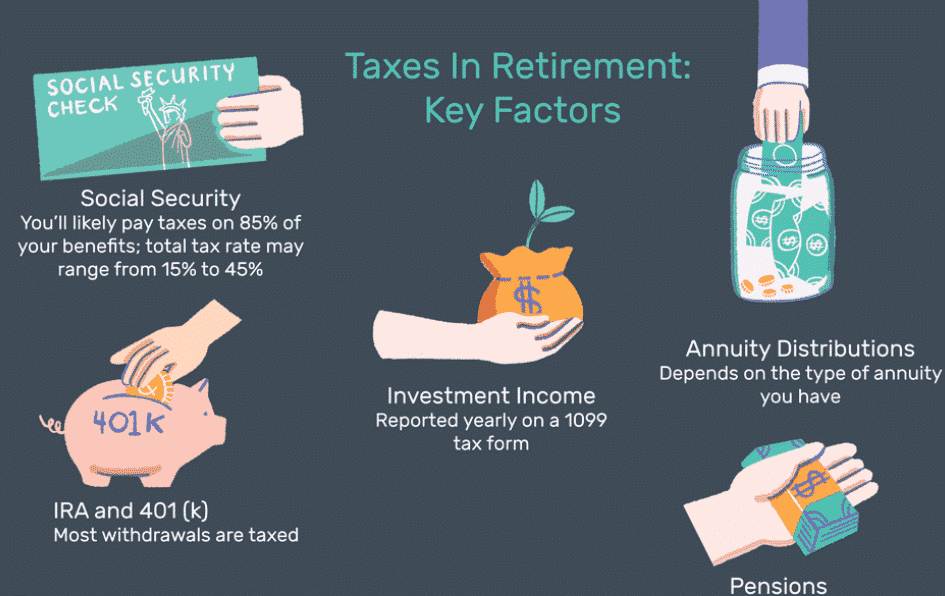

Some tax incentives available to retirees may not be available to younger taxpayers. In contrast, retirees are subject to additional taxes. For example, you may be subject to taxes if you sell assets or deplete your retirement funds. A tax is required on distributions from typical retirement funds such as 401(k)s and IRAs. A hefty penalty is imposed if the minimum distributions are not met by the due date. Depending on the amount of Social Security benefits you get, you may have to pay taxes.

Here are some of the taxes you may face when you retire.

1. Tax-deferred retirement account distributions

After retirement, you’ll have access to the funds you’ve worked so hard to accumulate throughout your working years. In addition, contributions to tax-deferred retirement funds may be deducted from your taxable income while you save the money.

If you start taking money out instead of putting it in, the government will want its share. Withdrawals from tax-deferred retirement accounts, as traditional 401(k)s and IRAs are reported and taxed on your tax returns each year.

You must also begin taking a minimum amount from your tax-deferred accounts each year after you reach the age of 70 1/2. Do so, and you’ll be hit with a 50% penalty on the amount you didn’t withdraw. Tax penalties of $1,000 will be due to the IRS if a minimum legal distribution of $5,000 is not met, even if you only take out $3,000.

2. Social security benefits

It would help if you withheld social security taxes from your wages while you were employed. When you retire and start receiving social security benefits, a new tax may be assessed on your payments: a tax on your income.

In certain situations, up to 85% of your payments may be subject to income taxes, depending on your wages. Single filers earning $25,000 or more per year and married couples filing earning $32,000 or more must pay taxes on a portion of their social security income. Withdrawals from Roth accounts do not count towards the $25,000/$32,000 contribution limit since they are not considered taxable income.

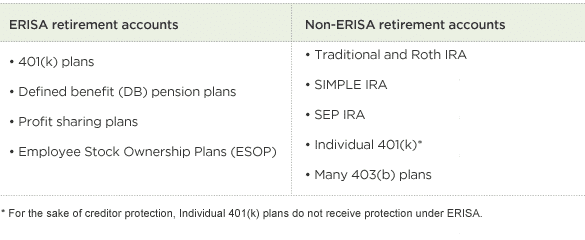

3. 401(k) and IRA penalties

There are tax consequences if you neglect to accept retirement payments from your IRA or ERISA. If you fail to take a required distribution from your retirement accounts before the age of 72, you will be penalized 50%. Withdrawals from retirement accounts are already subject to taxation.

For example, if a retiree in the 24% tax bracket fails to accept the $10,000 IRA payout, they will incur $7,400 in taxes and penalties. Your 401(k) money must be withdrawn one at a time, one at a time. Your required distributions may be taken from your IRA accounts if you have more than one.

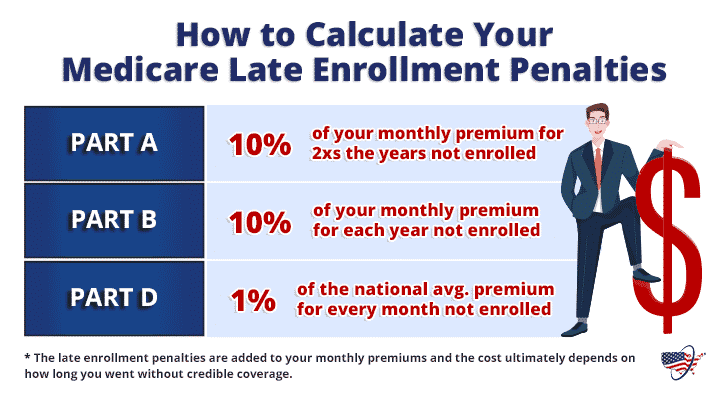

4. Medicare penalties

In the seven months, beginning three months before your 65th birthday, you must apply for Medicare. You may be charged a late enrollment penalty for every 12-month period that you wait after being eligible for coverage, which boosts your Medicare Part B rates by 10%.

Suppose you wait more than 63 days after becoming eligible for Medicare before signing up for prescription drug coverage. In that case, you will be subject to an additional Medicare Part D late enrollment penalty. By enrolling in Medicare within eight months after leaving your job or health plan, you may avoid a penalty if you work at a group health insurance position. Retirees with higher incomes may have to pay higher Medicare premiums.

5. Investment sales

You will probably have to sell some of your assets to fund your living expenses in retirement. You’ll have to report the profit or loss on your taxes when you sell anything. Despite the lower tax rate on long-term capital gains than on other types of income, these funds must still be set aside for retirement expenses. You will be taxed on interest and dividends in the same manner as before you retired.

Final thoughts

Of course, preparing taxes for retirees is far more complex than the average working person. Therefore, you should consult with a tax specialist to organize your distributions and other financial operations to pay the minor taxes. Such an expert will certainly save you enough money in taxes to justify their charge.