- Do you know what BTC IRA is?

- What are the risks associated with it?

- What are the potential benefits?

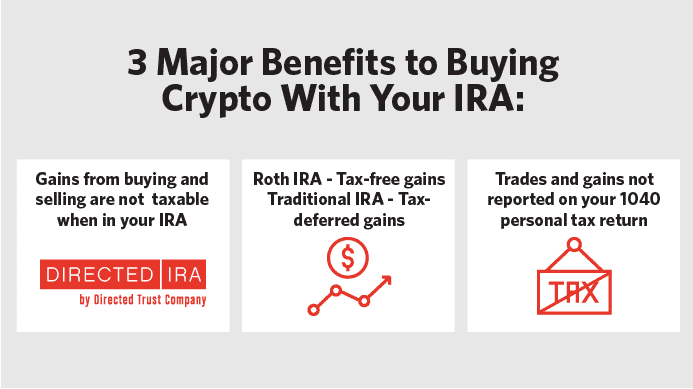

It’s a great way to generate tax-free or tax-deferred earnings on retirement funds by investing in cryptocurrencies. Bitcoin used to be seen as an investment just for computer geeks, but today it’s more popular.

Fidelity, Microsoft, Morgan Stanley, and even Harvard University jumped on the crypto bandwagon. The article will let you go through all the basics and answer all its questions.

What Is Bitcoin IRA?

Bitcoin is a new sort of money that exists as a digital currency. It is one of the oldest, most widely used, and most widely traded cryptos available for trading and investment. Consequently, a BTC IRA is an investment retirement account that includes BTC in its asset allocations.

It’s also known as a self-directed Individual Retirement Account (IRA). Self-directed IRAs self-directed IRAs allow investing in non-traditional asset types such as real estate, precious metals, and crypto. It is not possible to make such investments in traditional retirement accounts. The account may also be used to invest in other digital assets, despite the moniker “Bitcoin.” A few of the most popular ones are Ripple, Ethereum, and Litecoin.

How does BTC work?

A self-directed IRA might be either an IRA or an Employee Retirement Income Security Plan (ERISA). The normal IRA contribution maximum for people under 50 and those above 50 will be $6,000 in 2021 and $7,000 in 2022.

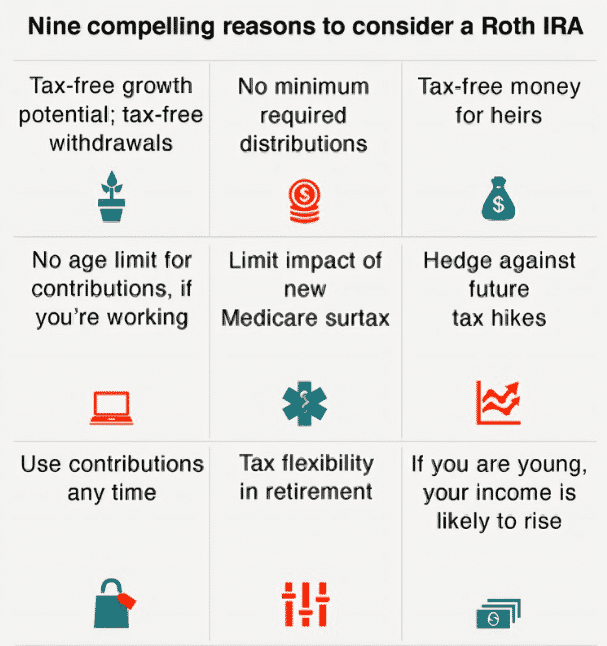

- In a traditional account, donations are tax-deductible, but withdrawals are taxed. There is no tax benefit to contributions to a Roth account when they are in the account, but they are tax-free when taken out.

- A Bitcoin IRA guide may help you figure out which option is better. It would help if you considered the volatility of BTC’s price to see whether it will continue to be a success in the future.

Both types of accounts have advantages and disadvantages, so it’s essential to weigh your options carefully before deciding which one is best for you.

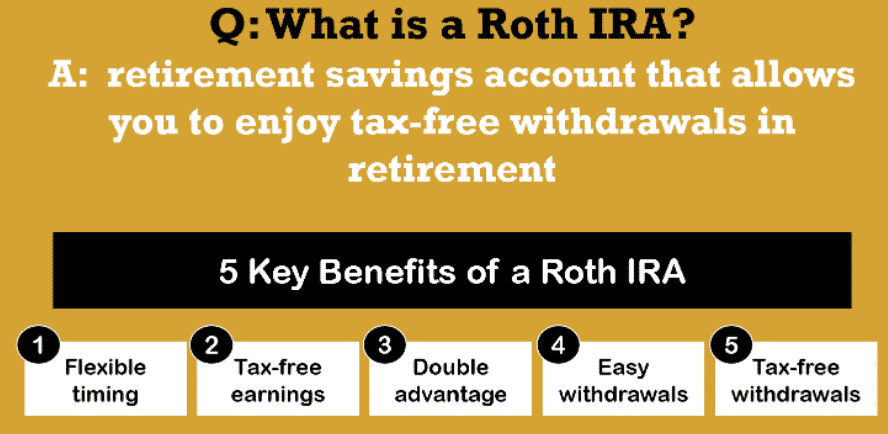

Can you hold crypto in a Roth IRA?

When Roth IRAs were initially launched in 1997, there was no crypto. Consequently, Bitcoin is not covered in the Roth IRA part of the tax code. However, when it comes to Roth IRA contributions and holdings, the laws are pretty specific about the sorts of financial assets that may be included. It’s impossible to directly deposit crypto to your Roth IRA because of these limitations.

According to IRS Revenue Ruling 2019-4, crypto does not qualify as currency under the Internal Revenue Code. Although “cash” is not defined in the statutes, it is interpreted as US currency in the form of dollars, coins, or checks.

It is legal for an IRA to purchase Bitcoin since it falls within the property definition. However, you may use a Roth IRA to invest in crypto. For whatever reason, Roth IRAs don’t appear to have any limits on maintaining “collectibles” or “coins” in their portfolios.

Coins owned in retirement plans are taxed like stocks and bonds because of the IRS’s treatment of Bitcoin and other cryptos as property since 2014. Consequently, when a taxable sale or exchange happens, the gain or loss on cryptos held in a Roth IRA may be calculated using an income tax basis.

In principle, Roth IRA holders who want to fund their retirement accounts with digital tokens may do so by simply finding a custodian that accepts bitcoin as a form of payment. However, in most traditional Roths, you can’t keep your crypto holdings in your account.

Risks of a Bitcoin Roth IRA

Crypto price movements may be both large and violent. If your account was going to be debited, that might pose a serious concern. A market downturn is possible, even though BTC has hit an all-time high. It’s been a while since the crypto market collapsed. The value of the digital assets mentioned above plummeted by roughly 65% during January and February of this year.

Benefits of a Bitcoin Roth IRA

Portfolio security

Most people’s retirement portfolios include stocks and bonds, but crypto is a whole other breed of investment. Digital assets may be risky but may help protect your retirement savings in the long run.

With BTC assets, people may be able to diversify their retirement savings portfolio. According to the study, A portfolio should comprise 6% BTC if appropriately designed. In addition, a 4% allocation should be made to your account even if you are skeptical about this crypto. Even if the stock market crashes, this might help secure your retirement assets in the long run.

Tax benefits

You may be concerned about a large tax payment if you’ve concluded that BTC is a valuable investment instrument for diversification. Due to the unpredictable nature of the cryptocurrency market, you may be subject to capital gains taxes if you trade.

Bitcoin IRAs may be used as a workaround. It is possible to avoid paying transaction taxes by investing in a self-directed account. Savings that aren’t subject to federal income taxes are called tax-advantaged accounts. You may be able to avoid paying taxes on whatever income or profits you’ve made. If you keep the money in your account, you won’t have to pay taxes.

Potential gains

However, Bitcoin’s gains have eclipsed those of other markets, and its losses have been substantial. For Bitcoin, it seems that the price of BTC will rise significantly in the coming years.

Investors believe that crypto is becoming more popular. Not only is BTC expected to climb in value this year, but several others as well. Because of this, Ethereum and other virtual currencies are likely to rise in value this year. As a result, many people may be persuaded to look into such an investment. In light of the recent gains, now is an excellent moment to get involved and look forward to a better year.

With Bitcoin’s high volatility comes the opportunity for enormous riches. Even if you’re investing a small portion of your IRA’s total value, the vast upside potential is worth the risk.

Final thoughts

Since 2014, the IRS has considered Bitcoin and other digital assets property in retirement plans. In other words, you can’t give cryptos to your Roth IRA directly, but you may purchase them and put it in your Roth IRA account instead. Few conventional IRA providers, however, will allow you to do this.

IRAs that allow you to invest in Bitcoin as part of your retirement plan are available. However, investors should consider whether crypto accounts are suitable for retirement planning because of their high fees and volatility.