- What are the rules for Roth 403(b)?

- Are there any benefits of this plan?

- What opportunities does it provide?

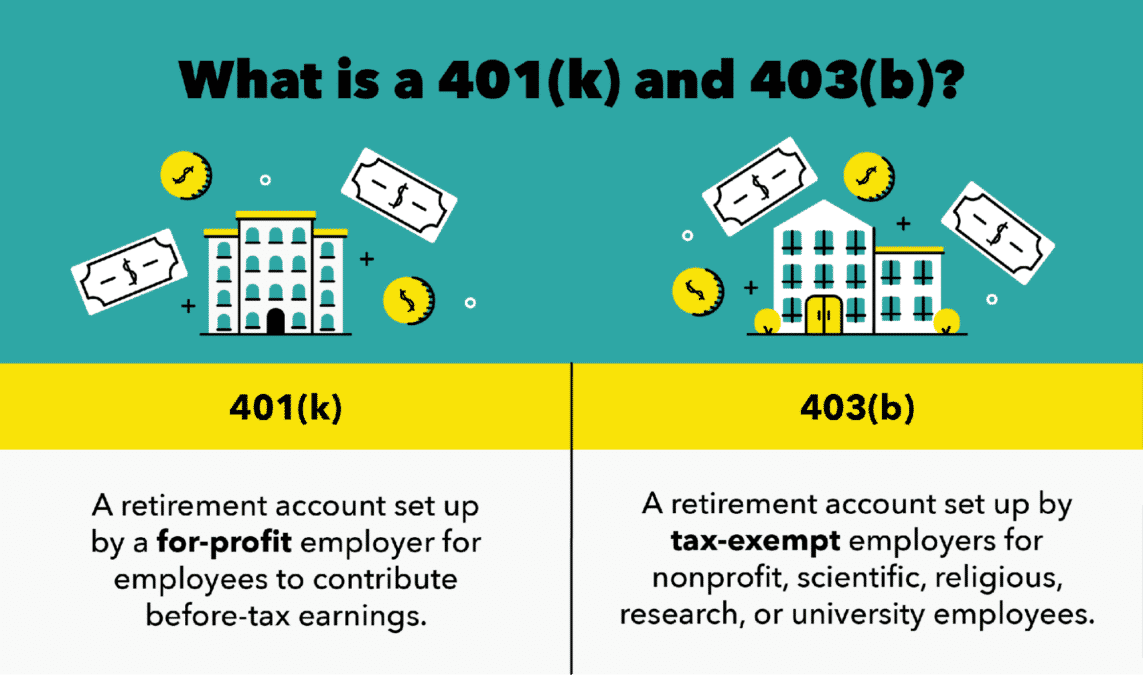

A Roth 403(b) is a retirement account that only specific tax-exempt employers can sponsor. This plan is available if you work as a teacher, healthcare professional, librarian, or minister. Money that has previously been taxed is used to fund this account.

You earn the ability to withdraw money from your Roth account tax-free in retirement by forsaking the tax advantage now.

What are the rules of Roth 403(b)?

Contribution limits

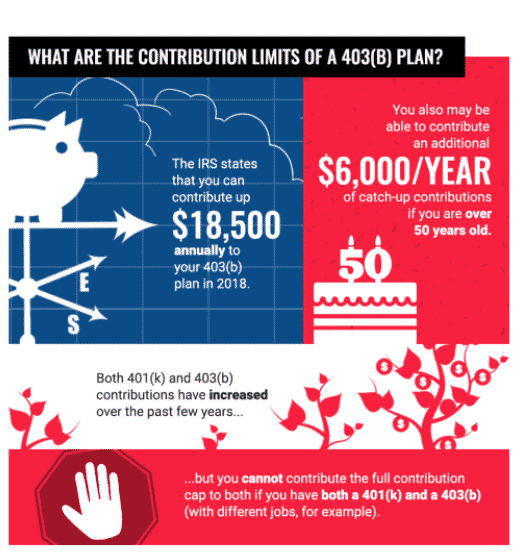

Traditional 403(b), 401(k), and Roth 403(b) have the same yearly contribution limitations for 2021 are $19,500 combined.

If you are 50 or above, you may be eligible for a $6,500 catch-up contribution in 2021. Employees with at least fifteen years of work can make even larger catch-up contributions thanks to unique rules made by the IRS for 403(b).

If your employer matches contributions, the money will be maintained in a separate account from your contributions, along with profits.

The employer’s match to your Roth contribution is taxed as regular income when you withdraw it since it wasn’t taxable income to you when you contributed.

Withdrawals

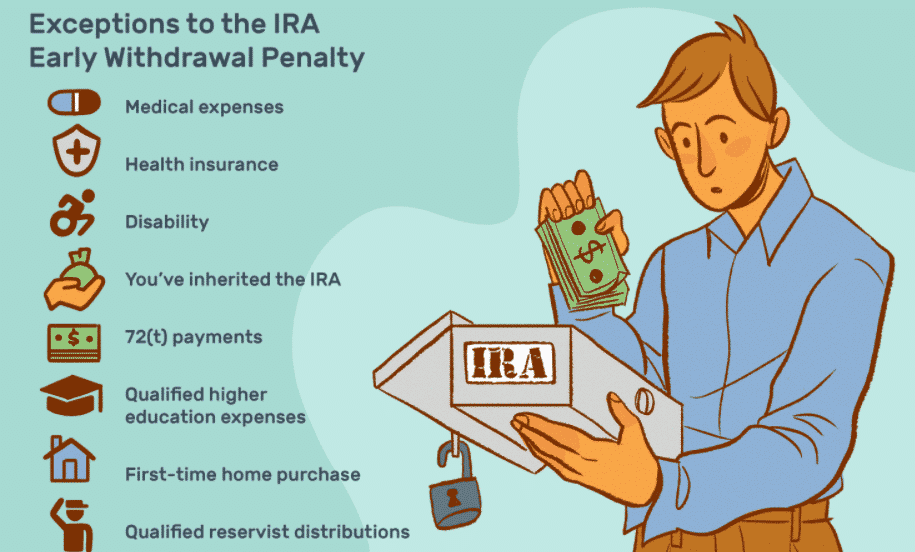

If the account is five years old and you are at least age 59½, the Roth 403(b) and 401(k) give tax-free withdrawals. However, income taxes and a 10% penalty tax may apply to early money pullout.

Tax-free withdrawals are often only possible when you reach the age of 59½, leave your job, or if your plan ends. Other events may be subject to your plan’s limitations, such as hardship, death, or disability.

Unlike the Roth IRA, the Roth 403(b) and 401(k) do not enable penalty-free withdrawals for unique circumstances like a first-time home purchase.

A Roth 401(k) or Roth 403(b) must begin taking required minimum distributions at a specified age, which differs from Roth IRA standards but is consistent with regular 401(k) and 403(b) requirements.

Taxes

If you follow the IRS rules for getting qualifying distributions, money in a Roth 403(b) account grows tax-free and may be taken tax-free in retirement.

If you fund in a Roth 403(b) and your employer matches your contributions, and those matched contributions and earnings are maintained in a standard 403(b) account, you will be responsible for paying income tax on those contributions and earnings. The income tax would be calculated at the time of retirement withdrawal.

What are the benefits of Roth 403(b)?

Employees invest Roth accounts using after-tax funds. These contributions do not lower your taxable income like typical 401(k) or 403(b) contributions do, but they do provide the possibility of long-term benefits.

Let’s find out some of the advantages of the account:

- Tax-free withdrawals

Withdrawals from a Roth 403(b) are not taxed as regular income like from a standard plan. However, it’s important to keep in mind that early money pullout may be subject to income taxes as well as a 10% penalty tax.

- No income restrictions

A Roth 403(b) does not limit or restrict contributions if your adjusted gross income exceeds a specific level.

- Higher contribution limits

This plan provides larger contribution and catch-up limitations than a Roth IRA if you wish to take advantage of a Roth account.

- No income tax for your beneficiaries

If your Roth 403(b) has been open for at least five years, the beneficiaries will not have to pay income tax on your contributions and profits. A state tax may still apply. When the money is withdrawn, they will owe taxes on any employer match payments. Heirs are completely taxed on traditional 403(b) funds.

Roth 403(b): what opportunities does it provide?

If you wish to reduce your taxes in retirement or expect tax rates to rise in general, a Roth 403(b) or other Roth-style retirement plan is an excellent alternative. If you estimate your tax rate in retirement to be higher than your current tax rate, a Roth account is the best option.

In addition to a standard 401(k) or individual retirement account (IRA), contributing to a Roth 403(b) plan might be a sensible tax diversification strategy.

You may take advantage of tax savings now and get money tax-free in retirement by contributing to multiple types of plans.

Because you may contribute to a Roth 403(b) regardless of your income, it’s a good alternative if your yearly salary exceeds the Roth IRA income restrictions. However, because they are employer-sponsored plans, it is your employer’s responsibility to provide one.

Investment options in 403(b) plans are fairly limited in comparison to other tax-advantaged retirement plans. Mutual funds and annuities are the most common options.

Individual equities, ETFs, and REITs are normally not allowed to fund in a 401(k) plan. However, many 403(b) plans will provide you with the low-cost bond and stock index funds most experts suggest for retirement planning.

You should choose a stock-to-bond fund ratio that reflects the amount of time you have until retirement and your willingness to accept risks. So when you’re young, you should invest in more stock funds, and as you age, you should invest in more bond funds.

Which is better: Roth or traditional plans?

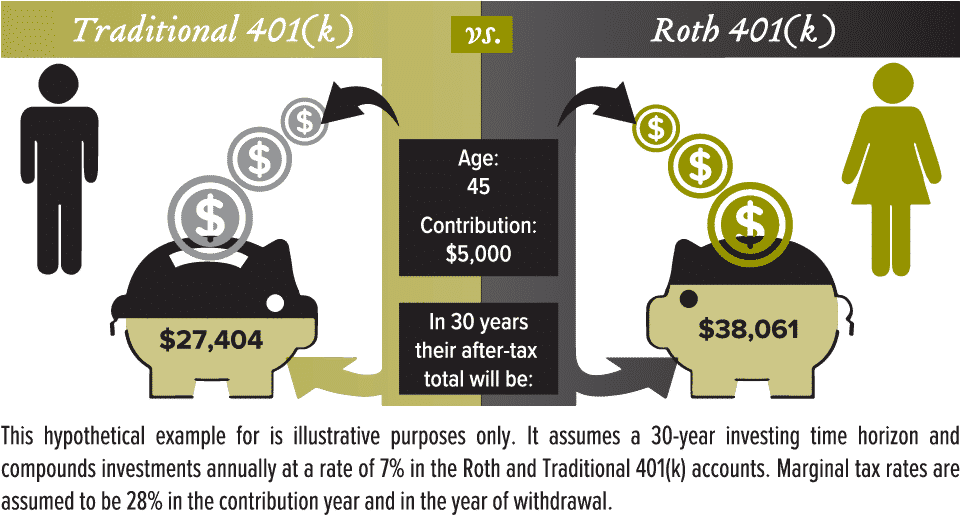

Rebekka is in the 24% tax group and works for an employer that offers Roth 401 (k). She dutifully set aside $15,000 a year in her Roth account for 30 years. She makes an after-tax contribution. That is why it cost her $18,360 a year. Thus, $15,000 plus $3,600 in taxes because that amount is not tax-deferred. After 30 years, she will have paid a total of $108,000 in taxes on her contributions to Roth.

Meanwhile, her friend Mia is contributing to the traditional 401(k). She is also in the 24% tax category and receives a $3,600 annual tax cut on her contributions as they are made pre-tax. Thus, it has reduced its taxes by a total of $108,000 over 30 years. If we assume that both earn an average of 5% of their investments, then by the time they retire, each of them will have about $1 million.

Now suppose that both Rebekka and Mia begin to cash out their plans at the end of the 30 years. They remain in the 24% tax group, and each withdraws $ 50,000 a year.

Mia has to pay $12,000 a year for her mailings, and Rebekka pays nothing. If both women live another 30 years, Mia will pay a total of $360,000 in taxes on her 401 (k) distributions. Plus, Mia’s payments are likely to incur at least a partial tax on her social security benefits.

Final thoughts

A 403(b) plan with excellent mutual fund options might be a fantastic foundation for your goals if you’re a teacher or nonprofit worker. With a little preparation and direction, you can achieve your retirement goals no matter where you work or how much money you make.