- How does Roth IRA differ from Roth 401k?

- Which is better to use?

- Which option should I choose if I have limited funds?

The relationship between Roth IRA and Roth 401k is like that of cousins. They are similar in many respects but are different in several ways. Knowing how they relate and vary can help you decide which one is better for you.

Here is a little secret you should know. You do not have to choose between the two. You can use both if you have enough funds. If that is not possible, you can go for one or the other as your circumstance requires.

So how does Roth IRA differ from Roth 401k? The other pressing question is, “Which plan is suitable for you?” You will get the answers to these questions later. For now, let us find out the similarities between the two types of accounts.

Similar aspects of Roth IRA and Roth 401k

Hailed from the same origin, Roth IRA and 401k share a few similarities as outlined below:

- Savings to both plans are not deductible from the income in the year the plan holders make the contributions.

- Capital gains, interests, and dividend payments generated by the assets held in both accounts are not taxed. Therefore, you can grow your investment tax-free.

- Income tax does not cover withdrawals or distributions.

- You can cash out funds from a Roth account without penalties if you satisfy specific guidelines and withdraw savings only, not profits.

Roth IRA vs Roth 401k: which plan is better?

Roth IRA has a lot of essential distinctions from Roth 401k. You have to know the distinctions to make the right choice. This section presents these distinctions.

Contribution ceiling

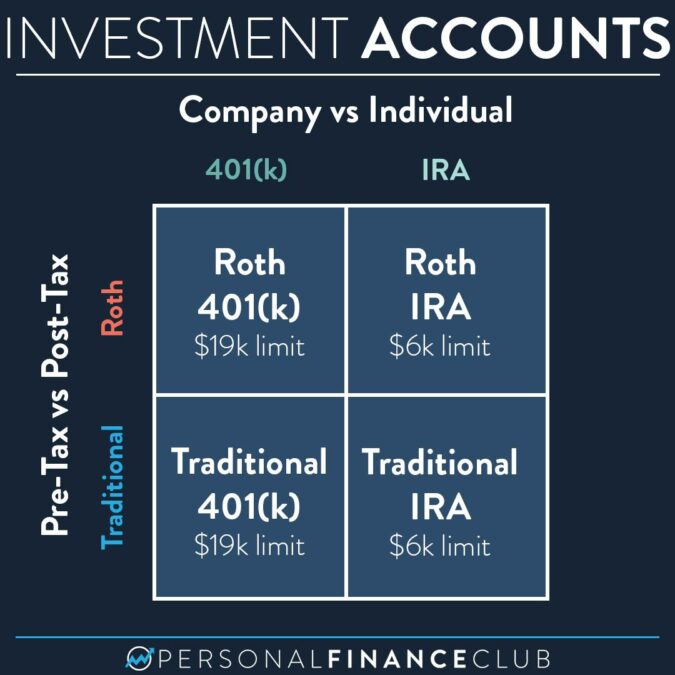

Roth 401k is known to have a tall contribution ceiling. By 2021, account holders can stash away up to $19,500 yearly. Employees aged above 50 have a maximum limit of $26,000 for the same year. In contrast, Roth IRA has a ceiling of $6,000, and employees aged above 50 have a limit of $7,000. See the image below for reference.

Distributions

Roth 401k requires plan holders to take a minimal amount from the plan when they reach 72 years old. However, they have the option to move funds from the account to a Roth IRA. This way, they can get around this specification.

Meanwhile, Roth IRA does not require account holders to withdraw a certain minimum amount at a specific age. This is true even if the account holder is alive or has passed away. When the plan holder dies, the spouse can inherit the account without any tax obligation. If an heir happens to be someone besides the spouse, they must cash out a minimal amount yearly.

Employer counterpart

One feature of Roth 401k that is not present in Roth IRA is employer counterpart. Employees may enjoy counterpart contributions provided by their employers if that feature is activated. This employer share is basically free cash that can boost your 401k. If you have Roth IRA, the additional fund will go to a regular 401k. If you have both Roth 401k and the basic 401k, your employer’s counterpart will go to your basic 401k plan. Refer to the image below for guidance.

Investment options

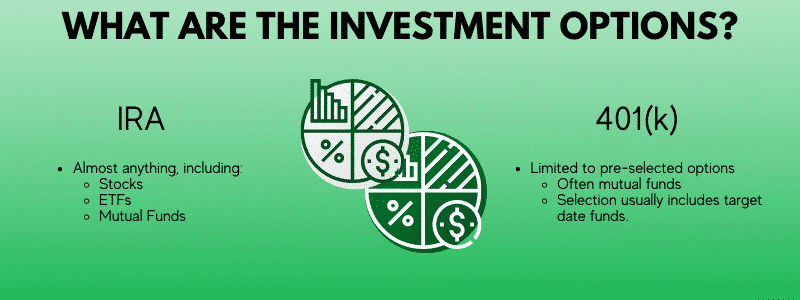

Roth IRA provides plan holders more freedom in managing their plans than Roth 401k does. If you have a Roth IRA, you will have access to bonds, stock, and funds. Meanwhile, Roth 401k plan holders are restricted in investment selection to whatever options are made available by their employers.

If you are in this situation, the best way to go is to max out your 401k plan and then channel spare cash to Roth IRA. This way you can enjoy the best that both plans have to offer.

You have to take into consideration the expense ratios of the assets under your Roth 401k. According to a report published by Morningstar.com in 2019, 401k plan holders incurred a 0.45% fee on average for the assets under their plans.

You would like to see a lesser expense ratio to have better returns. If your 401k plan’s holdings have expense ratios over one percent and your employer has paid his due in full, your best bet is to open a Roth IRA.

Early withdrawal

You will not pay any taxes when you cash out money from both accounts provided you meet the following requirements:

- The plan is five years old at minimum.

- You are already 59.5 years old, or your beneficiary withdraws funds following your death or disability.

You will not pay taxes when you withdraw from your Roth IRA. On the other hand, 401k premature withdrawals are subject to a 10-percent penalty when you cash out earnings. If you cash out contributions, no penalty applies. If you need to tap into your Roth 401k without incurring penalties, your only option is to get a loan from your plan, provided this feature is available.

Roth IRA maximum withdrawal is $10,000, and you may utilize this money to purchase, erect, or renovate your first home. You will not pay any taxes when you do so. Also, the 10-percent penalty will not apply even if your age is below the retirement age of 59.5. If you need money for your child’s education, you can source the fund from your Roth IRA without incurring fines and taxes.

Final thoughts

Selecting a better plan boils down to understanding your present situation and projecting your future financial objectives. If you are earning high and you want to put money for retirement every year, Roth 401k is suitable for you as it has a higher limit. Take note that Roth 401k has three times more savings capacity than Roth IRA.

If you want to be flexible with your funds and you do not like the idea of required contributions, consider taking a Roth IRA. This is mainly a sound idea if you plan to bequeath the plan to a beneficiary. Be aware that you can still move funds from Roth 401k to Roth IRA at some point in the future.