- What are battery ETFs?

- Are they worth investing in?

- Which are the top three funds for investing?

Switching from fossil fuels to battery-powered automobiles is essential to combating climate change. So, in addition to Tesla shares, an EV battery ETF is another method to invest in electric automobiles.

This article will briefly introduce battery ETFs and discuss the top three battery funds to invest and earn.

What is a battery ETF?

ETFs for battery technology and electric cars that track the success of companies globally. The list includes software developers, semiconductor suppliers, component and part producers, battery manufacturers, and lithium miners.

Now that mobility is a crucial focus; more attention is being paid to environmentally friendly transportation options, which are expected to promote the new global economy.

Electric vehicles will soon be available from Volvo, Jaguar, Ford, and even General Motors. Therefore, these funds are among the most acceptable methods to establish an extensive investment portfolio in the following years because of the increasing support for electric cars.

Is it a good idea to invest in these assets?

Tesla and other electric vehicle companies have made a lot of money because of their well-established battery technology. However, customers may now fill up their Tesla automobiles at a charging station at record speed due to the new supercharge option. In addition, battery-building materials are projected to be in demand in the coming months as economies transition to greener energy sources.

Top 3 battery ETF

Investing in a wide range of worldwide battery technology firms is easy and convenient via battery funds. Many investors regard battery funds as an excellent method to get into the upcoming investing prospects.

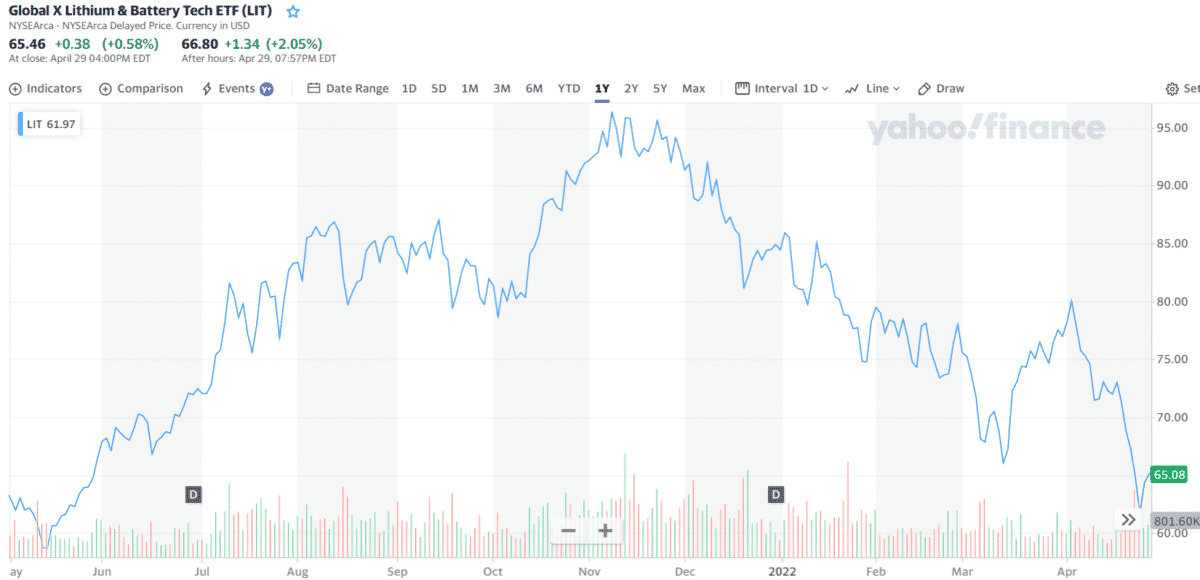

Global X Lithium & Battery Tech ETF (LIT)

Price: $66.68

Assets under management: $4.8 billion

Expense ratio: 0.75%

The fund was founded in 2010 and it is the largest lithium and battery ETF. A total of 40 companies involved in lithium mining or lithium battery production are invested, and the Solative Global Lithium Index is monitored. Moreover, 40% of the assets of LIT are held outside the United States, with China taking second place with 22%. China is the world’s largest lithium refiner and battery maker and the world’s largest market for electric cars.

Albemarle Corp., Ganfeng Lithium Corp., and BYD Co Ltd. are among its top ten investments, which are account for more than half of its assets in the lithium mining and battery manufacturing industries.

The ETF holds an expense ratio of 0.75%, representing the initial costs to cover management expenses when investing in the fund. The ETF had a great year in 2021, returning close to 30%, despite a history of volatility. But by 2022, it’s down about 9%.

How much would you earn if you invested in LIT 1 year ago?

Its share price on April 30, 2021, was $63.45. A year later, the share price closed at $65.46. So if you had invested $1,000 last year, your account could have gained $31.67.

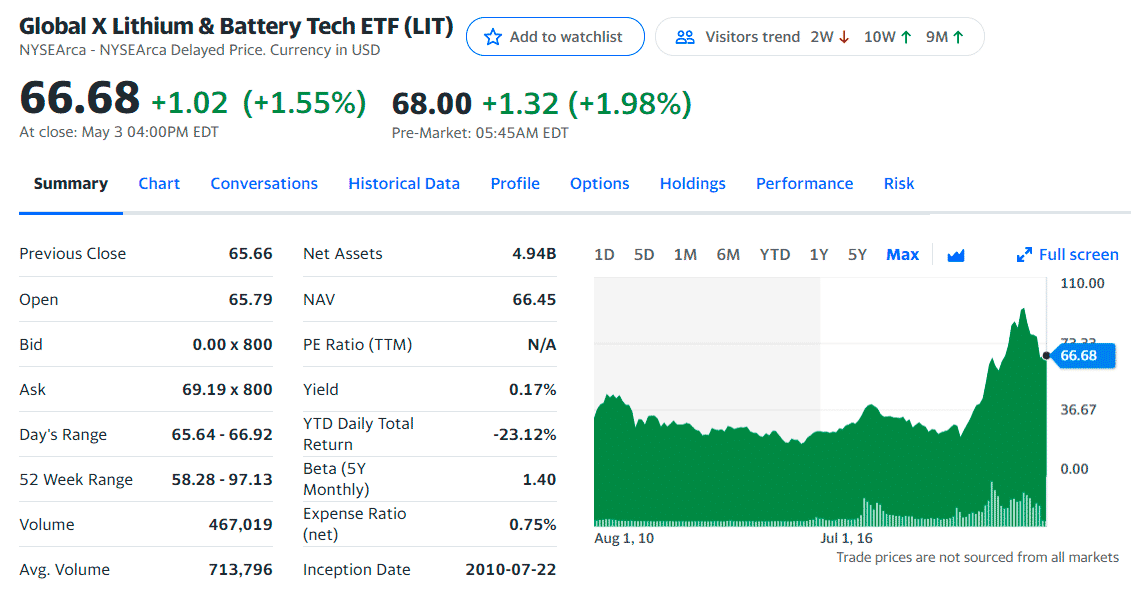

Amplify Lithium & Battery Technology ETF (BATT)

Price: $14.83

Assets under management: $225 million

Expense ratio: 0.59%

Investments are being made in battery material suppliers and manufacturers all around the globe by BATT. It was established in 2018. Electric car manufacturers are also highlighted. China, the United States, and Australia are the top three countries. However, the fund is far more scattered worldwide than the LIT.

The fund has more than 90 holdings, which is more than twice as many as LIT, and each investment is limited to 7% of the fund’s total value. Since the ETF is less concentrated than the LIT, only about 40% of its total assets are held by the fund’s top ten holdings. You’ll find battery makers CATL, BYD, and LG Chem; electric vehicle companies Tesla, Rivian, and Lucid Group; and green metal miners BHP and SQM.

Its cost-to-income ratio is 59.1%. There was just a 9% return in 2021 and a 6% decline in 2022 for the fund.

How much would you earn if you invested in BATT one year ago?

Its share price on April 30, 2021, was $15.63. A year later, the share price closed at $14.56. So if you had invested $1,000 last year, your account could have lost $68.45.

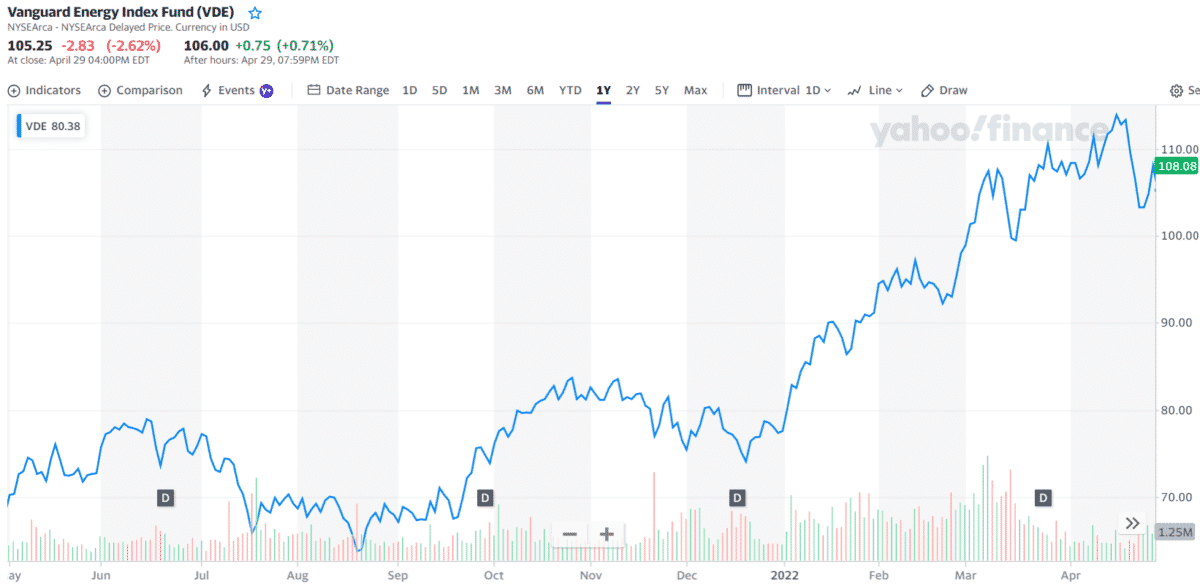

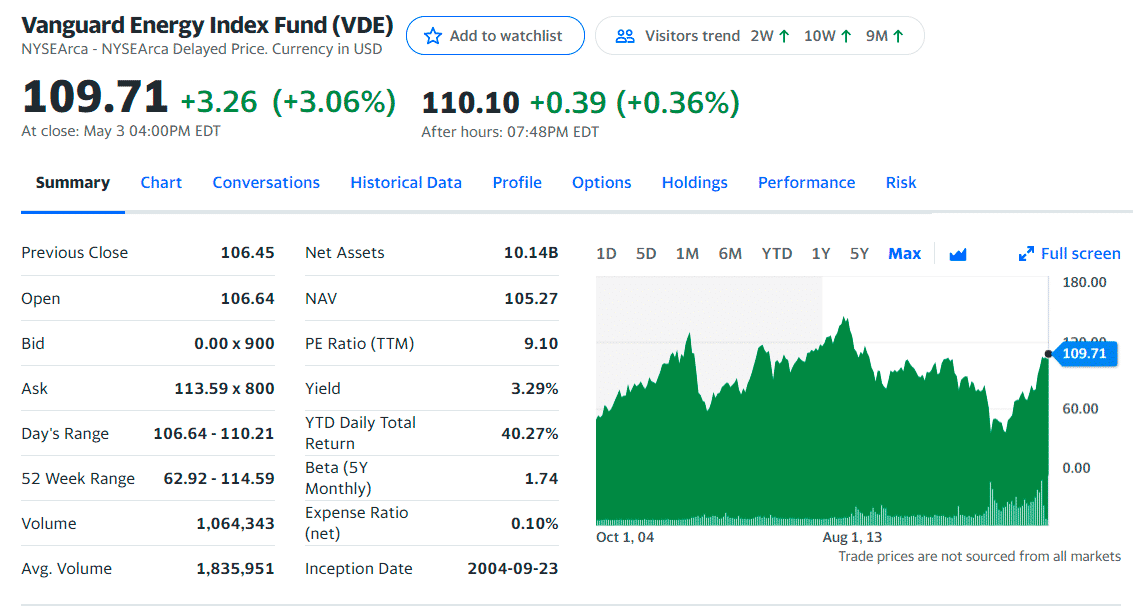

Vanguard Energy Index ETF (VDE)

Price: $109.71

Assets under management: $10.14B

Expense ratio: 0.10%

The fund makes investments in firms dedicated to exploring and producing fossil fuels. With its first trading scheduled for September 23, 2004, the fund is set to become operational. An energy company investment provides the fund with a high return on investment. Investments are made following two different approaches: complete replication and sampling. Managers become sinister when the first option is not an option.

There are several energy stocks in the fund’s portfolio. Shares must be traded on the secondary market and held in brokerage accounts to purchase and sell. It’s possible to pay more than the stock’s NAV when buying it and get less when selling it because of a brokerage fee. ETF shares can only be redeemed for millions of dollars in large quantities at the company issuing the fund at the time of purchase.

Oil and gas drilling accounts for 0.7% of the portfolio, coal and consumable fuels for 0.1%, integrated oil and gas for 44.9 percent, equipment and services for 9.1%, exploration and production for 22%, refining and marketing for 11.7%, and storage and transportation for 11.7%. The GICS system is used to classify the companies.

ConocoPhillips Inc., Exxon Mobil Corp., and Chevron Corp. round out the top three holdings.

How much would you earn if you invested in VDE 1 year ago?

Its share price on April 30, 2021, was $65.54. A year later, the share price closed at $105.25. So if you had invested $1,000 last year, your account could have gained $1,605.8.

Final thoughts

For investors, these ETFs include companies in the mineral and mining industries that produce high-end electric automobiles or battery storage solutions, along with electric vehicle and battery storage companies. A fund’s sector weighting has a significant impact on its overall performance. Several industries have been disrupted by technology in recent years, resulting in a lot of debate in the general market. Hedge funds are also feeling the effects of the current economic climate.