- How can you use Roth IRAs?

- How do you decide the right number of these accounts?

- What are the pros and cons of multiple Roth IRAs?

As there are many factors to consider, planning one’s retirement savings can be a long process. There are several retirement plan alternatives, each with its own set of benefits and drawbacks.

A Roth IRA is a good choice, as it can provide a favorable alternative. There’s no limit to the number of Roth IRAs you can open. However, it is set to a maximum limit.

How can you use multiple Roth IRAs?

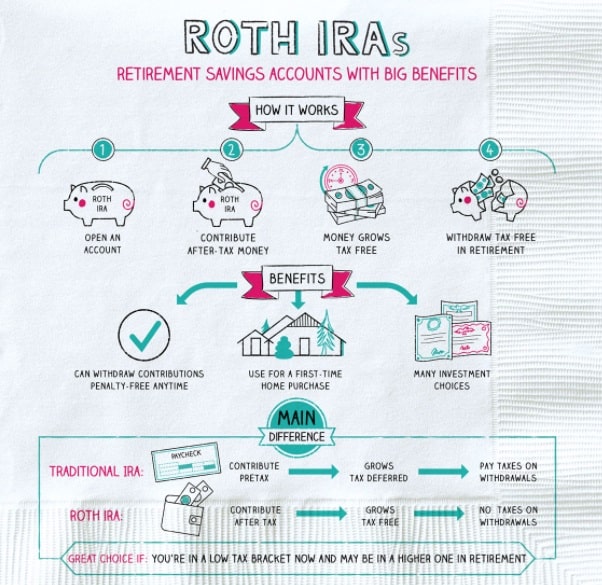

The Internal Revenue Code defines a Roth IRA as a type of individual retirement savings plan. The federal government regulates these savings accounts, which specifies deposit limits and tax implications for Roth IRA accounts.

The key difference between a Roth IRA and a regular savings account is that certain tax restrictions apply while you are legally allowed to withdraw money from a Roth IRA at any time. You have already paid taxes on the income you put into a Roth IRA account, so you won’t have to pay them again when you withdraw it.

Additionally, profits on a Roth IRA may be “qualified,” which means they will not be taxed when you remove the funds.

To be eligible, you must have contributed to an IRA for at least five years and be 59 years old. In addition, if you are withdrawing cash to put toward the purchase of your first home or have become handicapped, you may be eligible to claim a qualifying deduction.

Unless you qualify for a special exception, you will have to pay an extra 10% tax on the Roth IRA profits if you withdraw money out of a Roth IRA before it is qualified.

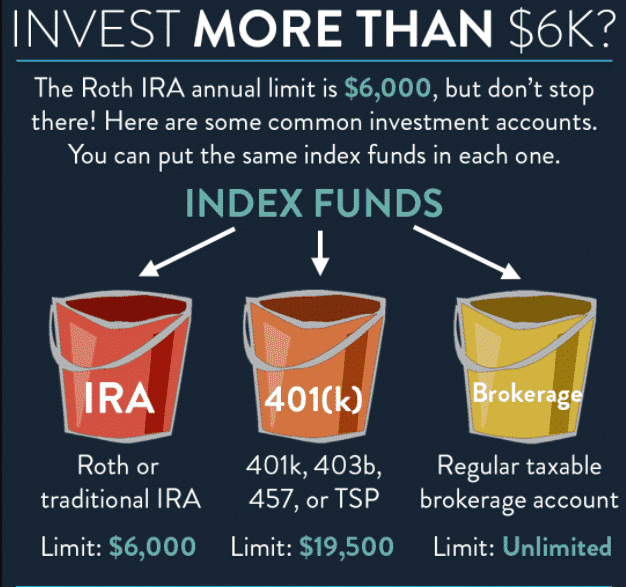

In addition, Roth IRA contributions are limited to a certain amount each year. The cap for 2021 and 2022 is $6,000. A total of $7,000 is accessible to anyone over the age of 50.

How do you decide the right number of Roth IRA accounts?

If anything unforeseen happens, you’ll also have the option of withdrawing donations early. If you’re married, you should consider establishing an account for your spouse if they don’t have one already.

Although combined retirement accounts are not permitted, you and your spouse can contribute to your individual accounts.

Even if your partner has little or no income, you’ll be able to make spousal contributions, thereby doubling your retirement savings.

Pros of multiple Roth IRAs

- Tax diversification

The Roth IRA allows you to make after-tax contributions early in your career when you’re more likely to be in a lower tax range. If anything unforeseen happens, you’ll also have the option of withdrawing donations early.

- An investment strategy

You can use various investing methods in each account if you have many. Splitting your contributions can help you keep on track with your long-term investing strategy while also allowing you to invest independently.

- Multiple withdrawals

You’ll be able to take advantage of the differing withdrawal regulations that each account provides if you have both IRAs.

You can withdraw contributions to a Roth IRA, but not the growth from investments, at any time without penalty. If you take funds out of a traditional IRA early, you’ll usually have to pay the penalty.

Traditional IRAs also compel you to begin taking money out at 72, but a Roth IRA does not require taking required minimum distributions.

- Insurance coverage

Bank and brokerage failures are uncommon, but the Federal Deposit Insurance Corporation and the Securities Investor Protection Corporation will protect you if they do happen. The FDIC will cover you up to $250,000, and the SIPC will cover you up to $500,000.

If you have a Roth and a regular IRA with the same company, they are treated as independent entities, and each account is insured up to $500,000. A key point to add here is this policy does not cover investment losses.

- Beneficiary options

When you set up your IRA accounts, you’ll identify beneficiaries. Still, it’s easier for your heirs if each of them is listed as the primary beneficiary on a separate IRA account.

When estates are resolved, tensions might occur, so if one person is the principal beneficiary and others are named as dependent beneficiaries, this could cause issues. Multiple accounts can help offset this concern.

Cons of multiple Roth IRAs

- Lot of paperwork

One of the most significant disadvantages of having several accounts is the added paperwork and complexity. Each account will have its disclosure documents, investment alternatives, and tax considerations. Although most of this may be done online, it is still a nuisance to keep track of.

When you have many accounts, often at different businesses, it’s also more difficult to gain a snapshot of your whole portfolio.

- Fees

Some businesses may charge account fees for having an IRA, so be sure you’re not spending more in costs than you’re getting in advantages from having numerous accounts. Fees chip away at your investment returns over time and may prevent you from reaching your financial objectives.

If your account costs are high, consider shifting your funds to a business with reduced fees or refrain from creating several accounts with that firm.

Final thoughts

You can have as many IRA accounts as you like, but your contributions must stay below the yearly maximum for all of them. Having multiple accounts provides you with additional options for taxes, investments, and withdrawals, but it might make managing your finances a little more difficult.

Consider your financing needs and how many IRA accounts would be most beneficial to you.