Who could have imagined a world where you don’t need to spend hours every week hunting for trading opportunities by automating the entire process? Well, this is the world forex robots have offered millions of traders around the globe, hence why they’ve become increasingly popular and quite attractive.

It’s the dream of many to have a robot consistently churning money day in, day out on autopilot. Unfortunately, the reality is quite different. While forex robots offer some unique advantages over self-directed trading, they are not the be-all and end-all.

In a semi-regulated industry like forex, scams involving automated systems are plentiful, making it easy even for the smartest people to throw caution to the wind.

This article will show you the bright side by reviewing some of the best forex robots, along with some valuable educational material to better understand this subset of currency trading.

7 best forex trading robots for 2022

The 6 best options for robots we’ll cover in this article are:

First, let’s learn about trading robots, how they work, and some vital things to consider before investing in them.

What are forex trading robots?

A trading robot is a program or algorithm on charting software that automatically executes positions based on pre-coded parameters. It is also often referred to as an expert advisor, typically on MetaTrader 4 and MetaTrader 5 since these are the most popular platforms globally for automated trading.

A forex trading bot is programmed with signals designed from technical analysis according to a particular strategy with specific stop loss, entry, exit, and position sizing dynamics.

Which are the best forex trading robots for 2022?

Let’s now look at the four best forex robots with a brief review highlighting some of the pros and cons for each.

1. TechBerry: Best Self Learning Algorithm With Social Trading

TechBerry offers multiple annual subscription plans for traders to generate more than 10% on their funds each month. The platform works by collecting data from over 100K MT 4 accounts which are shared by professionals. It then formulates the most profitable strategy with a win rate of nearly 100% and executes it on the trading account. TechBerry supports 50+ brokers, all of which are regulated by top-tier authorities.

The social trading platform has multiple packages that differ based on the annual costs, service fee, loss reimbursement, and access to a personal manager. There is also a free trial to test out the service.

Pros:

- It does not require any prior trading experience

- Uses an advanced neural network

- A high win rate of 99%

- Multiple subscription offers

Cons:

- Only works with MT4/MT5

- No lifetime license

2. The Fund Trader: Great Forex Robot With Copy Trading

The Fund Trader is developed by a former proprietary trader Gordon Francis who has been in the market since 2006. He analyzes the market on fundamental and technical levels to get the exact entry point for each position. After the execution, semi-automated software is used for trade management and exit.

The robot can trade on multiple currency pairs and can work on accounts with a small balance. Traders can purchase it for a three-month or yearly membership at $297 and $597. The author provides free updates, best set files, and a 30-day money-back guarantee with each purchase. Read full review…

Pros:

- Beginner-friendly

- Comes with pre-optimized set files

- A high win rate of 86%

- It can work with any account size

Cons:

- No backtesting records are available

- No life time lisences

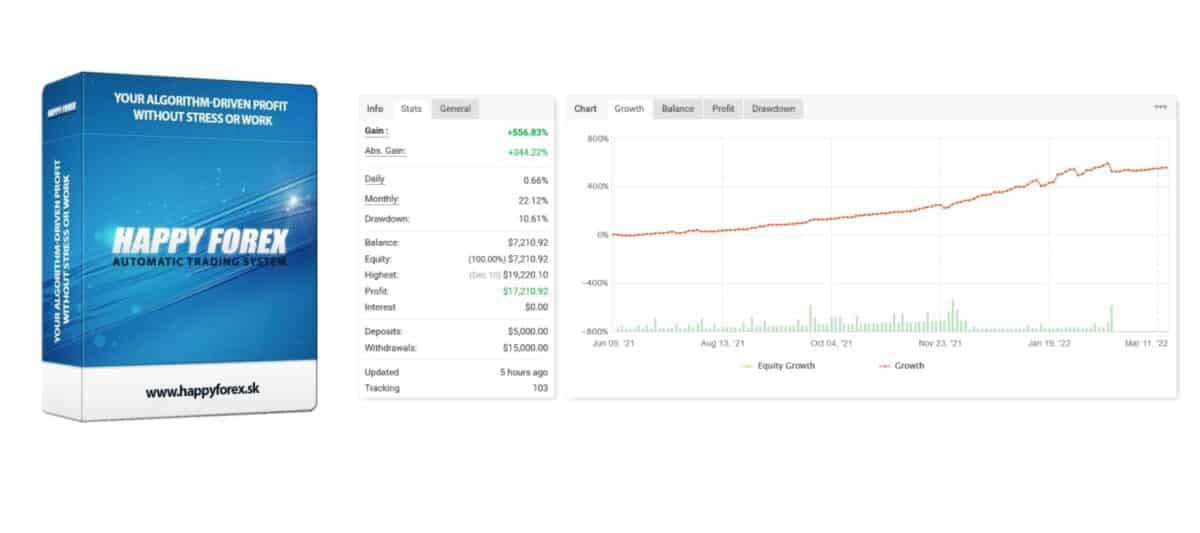

3. Happy Forex: Best Forex Robot With Frequent Updates

Since its initial release, Happy Forex has been subjected to continuous updates from the developer. This ensures that the system is updated according to the current market conditions.

The algorithm uses technical analysis to enter the market and implements a news filter to avoid unfavorable trading conditions. If the position enters a loss, it will use averaging approach without martingale to recover.

Various settings are available to tweak the EAs’ performance according to your liking. Traders can set the stop loss, take profit, equity stop, max orders per day, and the max spread. Read full review…

Pros:

- The purchase comes with nine free robots

- A complete tutorial is available for easy installation

- The developer provides free updates and upgrades

- Fully automated with auto-detection of 4-5 digit brokers

Cons:

- Works on MT4 only

- Little transparency on the developer

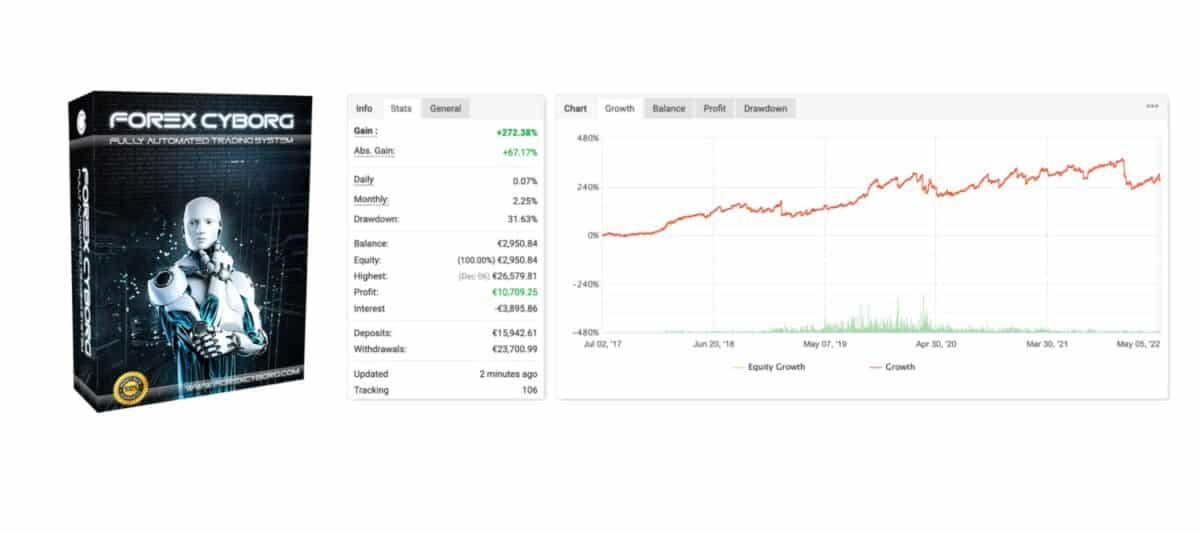

4. Forex Cyborg: Best Forex Robot With Multiple Backtesting Records

Forex Cyborg presents backtesting records for over ten different currency pairs with detailed statements. The developer does not shy away from testing their system using the advanced quant analyzer for the best possible statistics.

The system trades during 17:00-23:30 GMT and uses money management techniques to maintain the drawdown. There are no grid or martingale strategies involved, and traders can select the deposit, leverage, and broker of their choice while trading.

Gold and premium packages are available with unlimited demos and 1-3 live keys at €499.99 and €599.99. The developers are keen to offer lifetime upgrades and dedicated support to investors post-purchase. Read full review…

Pros:

- Fully automated with 24/7 support

- Extensive backtesting and live records

- No implementation of risky grid or martingale

- A 30-day money-back guarantee for the peace of mind

Cons:

- Poor monthly gain/drawdown ratio

- Can incur successive losing months

5. Forex Robotron: Best Forex Robot With Extensive Backtesting Results

If you’re interested in seeing a forex trading bot boasting more than 15 years of backtesting results with real tick data, slippage, and trading costs, Forex Robotron may be one of the few options in this regard.

Strategy-wise, the Robotron favors scalping ranging markets a few hours between the New York and Asian trading sessions on the 5 minutes time-frame with the EURAUD, EURCAD, EURCHF, EURGBP, and EURUSD pairs.

According to their website, you can expect roughly 600 positions from the EA in one year. You can choose from four plans ranging from $299 (basic) to $999 (premium), depending on how many live accounts you want to install the robot on.

Pros:

- Provides email support and has a loyal user base

- Usable with any MT4 broker

- Does not use any risky money management techniques

- The robot uses a fixed stop loss

- Has viewable live verified stats

Cons:

- Does not provide any refunds

- Only works with MT4

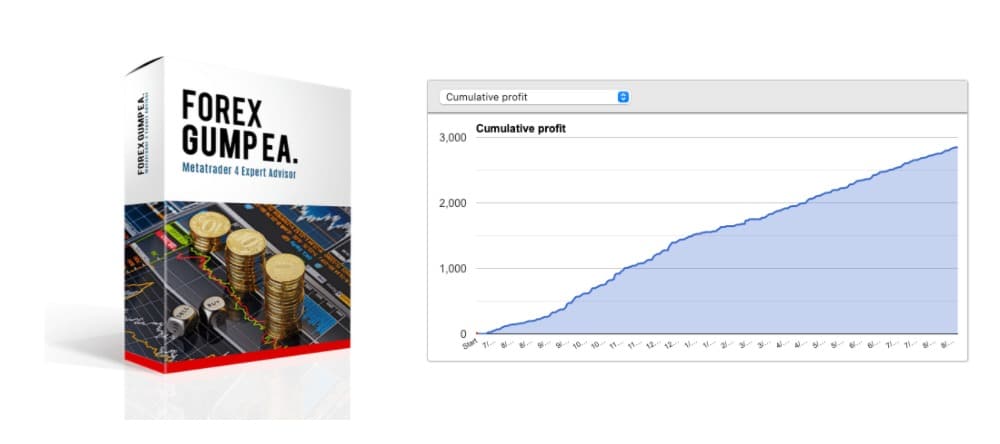

6. Forex Gump: Best Forex Robot With Records Of High Win Percentage

Developed in 2017, Forex Gump is a very profitable MT4 EA for both newbies and pros. Forex Gump leans towards scalping as the FX Blue records reflect an average of close to 10 days daily.

Moreover, the owners suggest the robot performs primarily on the 1-minute time-frame on nine highly liquid pairs, namely AUDUSD, EURCHF, EURGBP, EURJPY, EURUSD, GBPUSD, USDCAD, USDCHF, and USDJPY.

Such is the confidence in the robot’s profitability that the developers offer a 30-day moneyback guarantee for any unsatisfied customers. The programmers behind Forex Gump recommend users start with $4000 on a standard account or $40 on a nano account with leverage above 1:100 to gain the best out of the trading system.

Forex Gump is a paid-for robot and costs €199 (for use on one live and demo account) or €399 (for use on three live accounts and an unlimited number of demo accounts).

Pros:

- Provides 30-day moneyback guarantee

- Live verified stats available reflecting a fairly high win rate and over a year of trading

- Works on MT4 and with all brokers using this platform

- Offers email support

Cons:

- Average loss according to FX Blue is lower than the average win, suggesting possibly high drawdown

- Only works with MT4

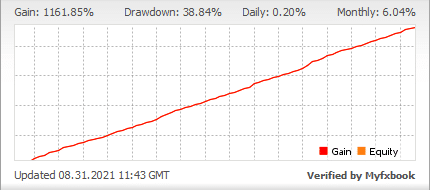

7. Forex Fury: Best Forex EA For MT4 And MT5

Forex Fury is one of the most popular expert advisors and is a viable option if you’re looking for an EA trading one particular pair for each account. This is what separates it from others encouraging trading on a few other markets. Hence, steadier growth with the one-pair approach is likelier.

Forex Fury has proven an exceptionally high win rate based on several years of records despite some periods of abnormally high drawdown.

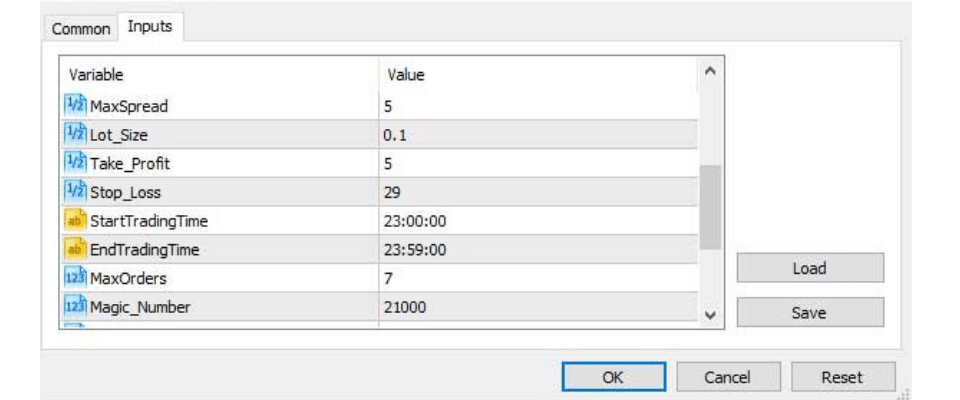

One of the other benefits for Forex Fury is the system was developed on both MT4 and MT5, offering you a wider choice. Depending on their knowledge and preferences, users can alter several settings like trade direction, max orders, max slippage, max spread, etc.

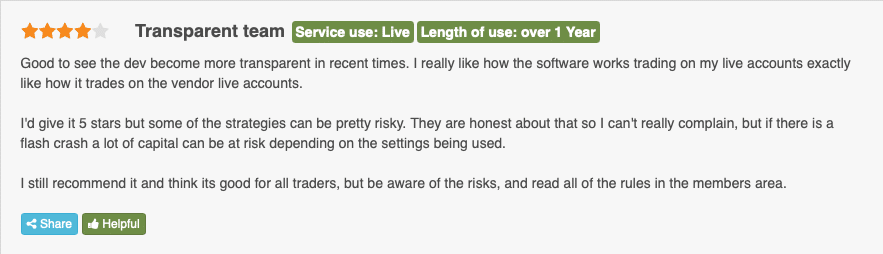

The developers have afforded these so users can choose between the robot trading low risk, medium risk, or high risk. Similar to the Robotron, Forex Fury trades ranging markets that can work well in low volatility periods for an hour daily. The robot presently has a 4.4 out of 5 rating score on Trustpilot from 150 reviews.

Price-wise, you are looking to spend either $229.99 for one live account license or $439.99 for a two live account license.

Pros:

- Verified results available

- Works with MT4 and MT5 brokers that support trading robots

- Best for use on one pair

- Provides details on the strategy and risk management used

- Offers refund (after meeting a few terms and conditions)

- Delivers email support

Cons:

- Some chances of high drawdown

- Important to choose the right broker

- Relatively low gains

What are the advantages of forex trading robots?

Forex trading robots fall under the branch of mechanical systems, which are the opposite of discretionary systems. The former deals with automated strategies, while the latter involves a human making buy and sell decisions through intuition and discretion.

This is where the advantages of trading robots shine as they are designed to exclude any emotions during execution completely. The best forex robots strictly follow a set of well-defined rules and execute without deviation or uncertainty, which is difficult to maintain when using discretion.

A robot has no subjectivity and instead works according to objectivity based on what has been programmed. Another significant benefit of forex trading robots is their time-saving factor since you only need a strong internet connection (preferably from a VPS) to run the EA.

Having this luxury allows you to focus on other tasks while the robots perform trades automatically on your behalf, unlike self-directed trading that is both physically and time-consuming. Lastly, using forex robots allows for faster execution because of their autonomous nature.

How to choose the best forex trading bot?

Here are some key considerations to observe when looking at forex robots.

Look at some key verified performance statistics

The first step in choosing any robot is to see its verified performance through a known analytics platform such as FX Blue and Myfxbook. These services provide real-time data of how the robot has performed since inception without any manipulation.

You can easily tell if the account is live or demo, with the former is more significant. Some experts argue investors must view the backtesting results of a robot.

While this information is useful, it’s only a little indication of how the system will perform in real life.

It’s prone to curve fitting, where developers purposefully show only the most profitable results of a robot during the testing phase.

Seeing how a robot has worked over time on a live account (essentially forward testing) is far more accurate. After establishing the live records through platforms like FX Blue and Myfxbook, you need to consider a few critical performance stats. The drawdown is one of the most crucial as it paints a picture of the extent of losses.

In simple terms, this statistic refers to the reduction of capital below an account’s current balance. Generally, you’ll want to consider any forex trading bot with a drawdown rate not above 20%. Although it’s easy to be tempted to choose a robot with higher gains, a higher drawdown increases the likelihood of the account being blown or receiving a margin call.

Another vital consideration is how long the robot has been running, as this shows you how it performs in different market conditions. Anything above one year is exemplary. Other valuable stats to note are the profit factor (above 1 is good, above 2 is even better) and a win rate above 50%.

Observe ratings and reviews from established websites

While ratings from other users won’t directly translate to your personal circumstances because of our unique experiences, they are still worthwhile to note nonetheless. Just looking at the top 10 results of Google for a particular EA should give a clear idea of the overall performance, accounting for factors like the strategy, win rate, trade frequency, drawdown, customer support and so on.

Other platforms to consider where traders are less likely to be biased are TrustPilot, Forex Peacy Army, and Myfxbook, dedicated to reviewing the performance of most known robots online.

Consider the costs of purchase, live account, and VPS

Purchasing the best forex robots can come at a considerable amount depending on your financial circumstances. As you can imagine, the costs of buying an automated trading system vary widely depending on where it’s bought and how good it has been marketed to be.

Firstly, you’ll have to meet the affordability of the robot in question. It’s also worth noting some robots may require a particular amount of live capital based on the strategy, risk management principles, leverage, etc.

For example, an expert advisor executing frequently would naturally need to have a higher deposit to maintain the margin of all positions. A feature that can help users get the best out of their robots is a VPS (virtual private server), which comes at an additional cost or a reduced fee with certain brokers.

A virtual private server is merely a dedicated server provided to clients allowing for far superior execution connection, a quality that’s paramount for the efficient performance of a robot. Moreover, a VPS runs an EA 24/7 with zero downtime regardless of any shutdowns or whether the trader is near their computer or not.

Know the strategy behind the robot

There’s a tendency for most forex robots to lean on the side of high frequency. Hence, you need to know the strategy and trading style behind the robot to align your expectations more realistically.

For instance, if the expert advisor has been programmed for longer-term trades, it’s natural to expect only a few positions. There’s also a tendency for some robots not to use fixed stop losses or utilize martingale techniques, which can be particularly risky and increase the risks of losing your money.

Therefore, understanding the strategy, including the pairs being traded, time-frames, risk management parameters, etc., is beneficial to better anticipate the performance of an expert advisor after purchase.

Moreover, it’s recommended to trade the robot on a demo account until the refund period is over (should one exist) to gain more confidence in the live stage.

Refund or money back policies

Robots can be a sizeable investment, especially for those with less knowledge about the markets. Hence, it’s best to consider services with some free trial, along with a refund policy or moneyback guarantee since some trading systems may perform worse than initially anticipated.

FAQs about the best forex trading robots

What is the best forex robot?

All the robots in this guide show pretty similar performance metrics and costs.

The only aspect separating other EAs on the list is whether you can get a refund or not. Based on this factor, Forex Gump and Forex Fury are better options than Robotron since you can at least get your money back should you not feel satisfied after purchase.

Are forex trading robots profitable?

Yes, with a few caveats. While forex robots do make money, you have to consider the risk parameters and strategies behind them. As already mentioned, most EAs execute pretty frequently and are prone to significant drawdown periods that may be too precarious for some.

These are some of the considerations you need to investigate before investing in any robot on the market.

How do you buy a forex robot?

In most cases, you purchase directly from the developer’s official website after thoroughly reviewing the robot and understanding all the risks involved. After this, you should receive precise and straightforward installation instructions.

Are forex robots legal?

Yes, using robots is legal. However, some brokers, primarily those with a so-called dealing desk, prohibit using them because their high trading frequency makes it difficult to hedge.