- Can you retire with five hundred thousand USD?

- How can you save money comfortably?

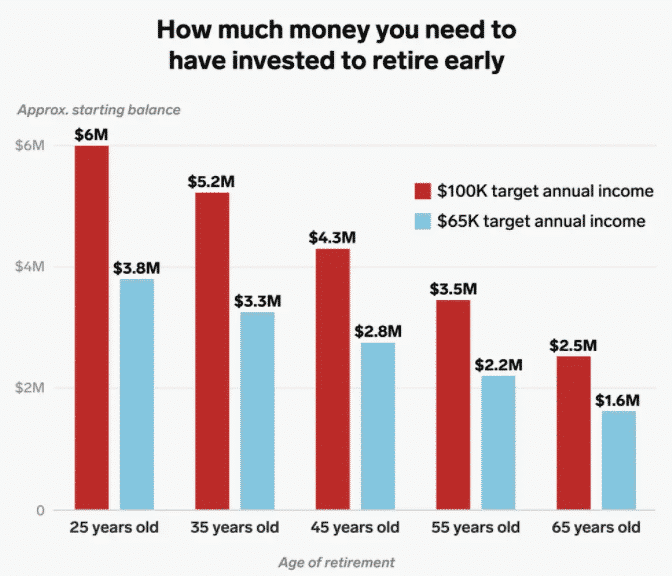

- How much money do you need to have invested for early retirement?

Millions of baby boomers and Gen-Xers are approaching or have reached retirement age, and they’re curious about their magic number. Many people in their forties and fifties question if they can retire at 60 with only $500,000.

Can you retire at 60 with 500k?

The answer to this question depends on where you reside, your lifestyle, the sorts of investments you make, and your other sources of income.

If you’re like most individuals, you’ll seek assistance from sources other than your savings. For instance, Social Security alone replaces nearly 40% of the average American’s pre-retirement income.

For higher-income retirees, the proportion is often smaller, but for the vast majority of individuals, Social Security represents a significant source of income.

If you have any pensions from current or previous work, make sure to factor them into this step. The same is true for any other reliable and permanent sources of income, such as an annuity that pays out after you leave your job.

A word of advice

When budgeting your retirement income, consider all of your assets and resources, not simply your pension.

For example, someone with other investments may discover that the tax applied to their pension fund on death is less than the inheritance tax applied to other assets in their estate.

They could be better off accessing alternative sources of income in retirement while keeping their pension account intact.

Meanwhile, if your pension will be your primary source of income for the remainder of your life, income drawdown may not be the ideal option since the danger of blowing your fund is too great.

Although annuities aren’t as popular as they once were, purchasing one with at least a portion of your savings might be a wise decision.

How can you retire comfortably?

Let’s find out how you can leave your job without breaking too much sweat.

Plan a retirement budget

Making a mock-up retirement budget might help you figure out if your $500,000 goal is realistic for the lifestyle you want to live.

Basic living expenditures, such as housing, food, utilities, and transportation, should be included in the budget and health care, hobbies, and travel. If you’re not sure where to start, look at your present spending habits. To ensure that your money lasts, experts recommend taking no more than 4% of your retirement assets each year.

If you have five hundred thousand dollars in your retirement account, you may feasibly take $20,000 in your first year. Then, assuming no portfolio growth, that amount would decrease each year gradually.

Combining that $20,000 with the most recent average Social Security payout of $1,544, your total yearly income is around $38,500. But, of course, if you wait until you reach full retirement age to file for Social Security. Taking Social Security at the age of 62 reduces your benefit amount, but deferring benefits until age 70 increases your payout.

If your projected retirement budget exceeds your anticipated retirement income, you may want to consider downsizing or moving to a cheaper place to save funds.

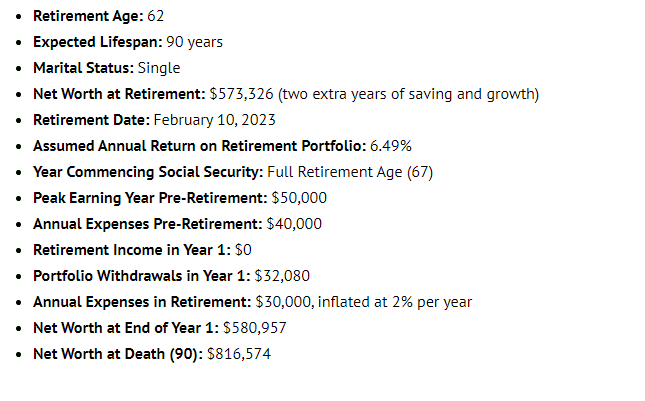

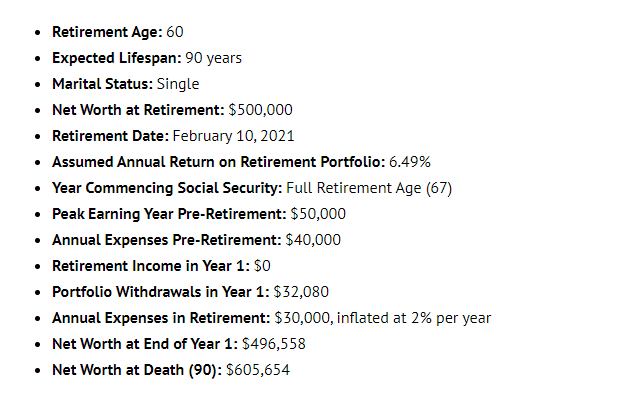

Here are some of the scenarios for retiring with five hundred thousand USD.

| Retirement scenario at 62 | Retirement scenario at 60 |

|

|

Cut down housing costs

Downsizing makes sense in retirement, according to popular belief, because a smaller home is less expensive to live in and maintain. However, smaller square footage does not always imply a lower cost when it comes to housing expenses.

Healthcare is another high price for seniors, but you can keep your costs low by picking the correct Medicare coverage.

Alternatively, you can consider retiring on a cruise ship or traveling abroad. Malaysia, Panama, and Slovenia frequently rank among the most affordable retirement destinations, allowing you to immerse yourself in a new culture.

Saving and investing

If you want to retire on $500,000, an essential thing you can do is be aggressive about saving and investing. The sooner you begin, the more time you have to benefit from compound interest.

Most individuals should start by opening an employee retirement plan, such as a 401(k) (k). They contribute enough to receive a full employer match, at the very least. Increase your donations to the maximum amount permitted each year. The maximum 401(k) contribution for 2021 is $19,500.

Pay your debts

Along with sticking to a budget, living within your means, and even downsizing to a smaller house, it’s critical to pay off high-interest debt, such as credit cards.

If you have any outstanding credit card debt, pay them off immediately so they don’t eat into your retirement savings later. Credit card debt may last for years if you don’t pay off your balances in full, and late penalties can add up quickly.

How long will 500k last after retirement?

Many retirees wonder how long the money will last after retirement. Will a 500k figure be enough for all expenses? To answer this question, we have to go back to the 4% rule.

The 4% rule

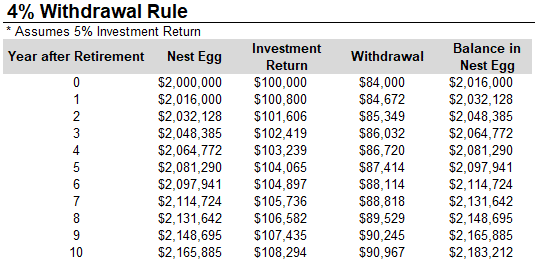

This rule is based on research released in 1994 by William Bengen. He discovered that if you put at least 50% of your money in stocks and the balance in bonds, you’ll be able to extract an inflation-adjusted 4% of your nest egg every year for the next 30 years.

The strategy is straightforward. In the first year, take out 4% of your savings, and each year after that, you take out the same monetary amount plus an inflation adjustment.

However, one thing to keep in mind concerning typical yearly returns is that they rarely occur. Instead, boom and bust years are more likely to occur in quick succession.

As a result, timing your withdrawals becomes a forecasting exercise, which is laden with great risk. It’s generally not a good idea to increase your withdrawal rate during a recession to maintain your expenditure constant, as a rule requires.

Final thoughts

Without question, life after work provides you with a new set of financial obstacles to overcome. However, if you’re debt-free, healthy, and don’t expect high costs during your senior years, retiring on $500,000 will be simpler.