- Why should I care about retirement right now?

- How many funds should I have at the time of my retirement?

- What are the benefits of saving in a 401k?

Attaining a comfortable retirement will not happen accidentally. You will have to make it happen. You might think retirement is still too far away; why bother about it now? Since your savings will go to investments, starting early will give your money ample time to grow. This will allow compound interest to do its magic and make the investment survive momentary downturns in financial markets.

If you wonder how much money you should have on your retirement, here is a simple guideline. Fidelity.com suggests employees have at least ten times their salary stashed away in a retirement account at retirement time.

If you are an employee, the standard 401k could be your best retirement option. Setting aside a portion of your paycheck each month to your 401k will go a long way toward building an abundant retirement life.

This article will provide the basics of a standard 401k, such as advantages, eligibility, contributions, distribution, and more. In the next section, let us understand 401k further.

What is a 401k plan?

The term 401k comes from a section of the Revenue Code. This plan is designed for employees who want to have money to enjoy the twilight days of their lives. With this plan, you will allocate a part of your salary for savings, and your boss will deduct this amount from your salary before you pay tax.

The amount of money withheld from your salary is known as deferral. Making 401k contributions ahead of taxes is greatly beneficial as it lessens taxable income. Naturally, this will result in a lower tax amount.

What are the benefits of a 401k?

You can enjoy a lot of benefits out of saving money in a 401k. This section lists down and explains these benefits.

Tax advantages

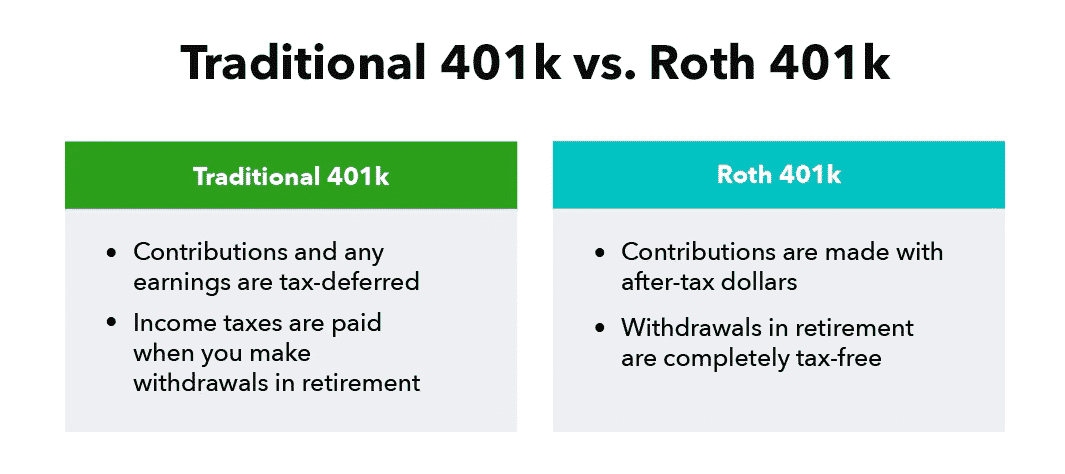

Your employer will deduct a part of your salary for your 401k savings. This deduction is made ahead of your withholding tax. As a result, you end up having less taxable income, which translates to lesser tax due. The image below shows the difference between basic 401k and Roth 401 k in terms of the tax scheme.

Flexible contribution level

If the IRS and your plan permit, you could save a flexible amount. You can adjust your contribution level anytime (again if your plan allows) as your situation dictates.

Compounding is your best friend

Saving money as early as possible gives your investment enough time to grow. This is because of the compounding effect. Compound interest works its magic on long-term investments. The sooner you begin your retirement preparation, the bigger money you will have on your retirement.

Your 401 k follows you

Your 401k savings and profits are yours to keep, and you can take them with you when you move to another job. If this happens, explore what options you have about your 401k from your former boss.

Ease of making contributions

You can automate the process of saving for your 401k. You can ask your employer to automatically debit an amount from your salary and channel it to your plan. This will make saving money effortless.

Who may participate in a 401k?

You and your employer can partake in this plan. When your employer enrolls you in a 401k, you will get a document containing the plan’s details. This document covers the features, eligibility, requirements, and design.

How do I start a 401k?

To start a 401k as an employer, follow the steps below:

- Create the plan document, which defines how the plan works.

- Determine your prospective plan providers.

- Be aware that you must file annual returns to the US government.

- Appoint someone to monitor profits, contributions, and distributions. Assisting in the preparation of annual returns is also part of the job of this person in charge. Instead of a real person, you can use a system or program to manage the plan.

401k investment options

In terms of investment, your 401k plan often covers plenty of choices. This can include stocks, mutual funds, or bonds. However, the number of available options is solely decided by your employer, usually with the assistance of a financial expert. Then you can select investments from among those included in your 401k plan.

401k employer contributions

To motivate workers to put money toward retirement savings, employers give out counterpart contributions. While some companies may choose to chip in funds until a predetermined percentage is reached, others may elect to give a 100% match. On rare occasions, employers add funds at their discretion.

401k participant contributions

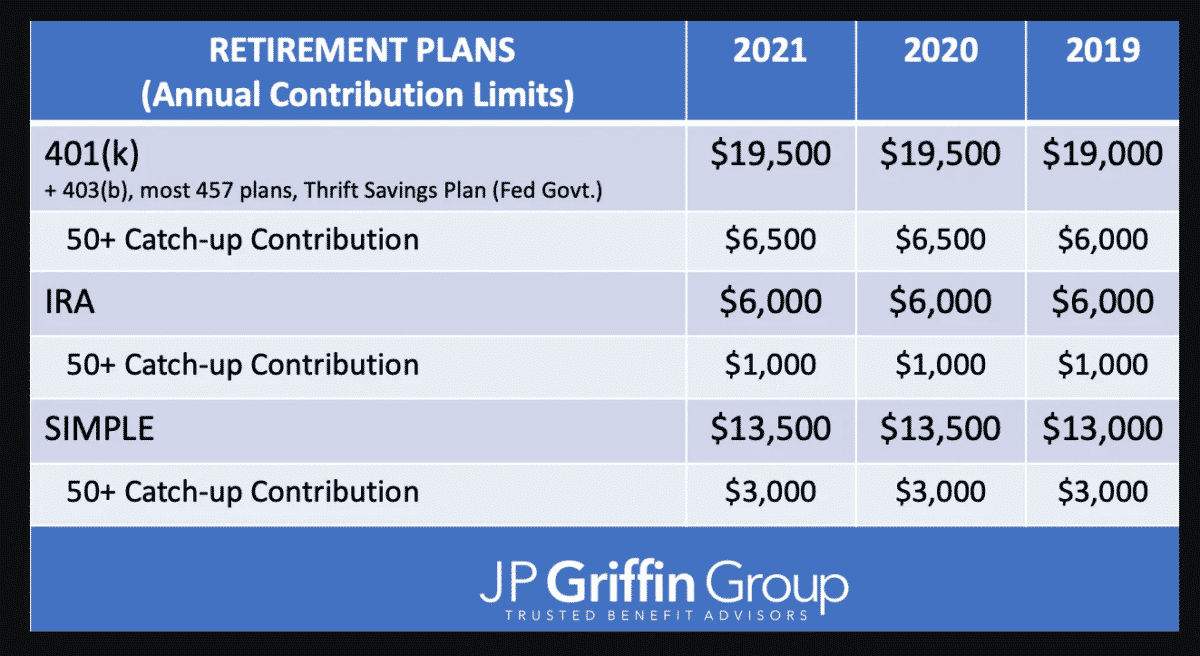

When you enroll in a 401k, you will tell your employer how much you would like to save, which the latter will deduct from your pay in each payroll period. Usually, the highest amount you can contribute in a year is $19,500. If you are 50 years old or above, your maximum limit is $26,000. Refer to the table shown in the image below.

As already pointed out, 401k contributions are made before tax deductions. Therefore, you will not pay any tax while growing your account. On your retirement, that is the time you will pay taxes on your distributions and profits every time you make a withdrawal. Hopefully, your tax bracket at that time will be lower than at present.

401k vesting

All your 401k contributions are 100 percent yours. Your boss debits this amount from your pay anyway. Concerning your employer’s counterpart contributions, you might need to wait for a while until that fund becomes yours as well. Refer to the vesting schedule specified in the plan document for guidance.

401k distribution

The majority of 401k plans will require you to reach an age of 59.5 years old to withdraw cash without penalty. This is also possible if you have a qualified disability. However, in some plans, you can withdraw funds earlier than the threshold age. It all depends on how your employer designs your plan.

Final thoughts

401k will work in your favor, so you must take advantage of it. Once the plan has been set, growing your account will happen passively in the background. What you will have is peace of mind knowing you are preparing for yourself an abundant future. The earlier you start, the better. This way, your investment can ride the rollercoaster movement of financial markets and tap into the power of compounding.