- Which plan is better, 403b or Roth IRA?

- How do 403b and Roth IRA differ?

- How to max out my retirement savings?

The majority of Americans are lagging concerning their retirement preparations. Federal Reserve states that around 25 percent of Americans do not have any nest egg for retirement. About 75 percent of adults not yet retired are not sure about their retirement future.

Although the above figures do not sound so good, they should not bog you down. Remember, it is not too late or too soon to prepare for retirement. You can start right where you are and whatever your current circumstance.

If you have not started working on this area, we provide a helpful guide to get you on board. If you are in the groove of your savings routine, we will show you how to save more on your 403b or Roth IRA.

What is 403b?

This plan applies to specific people working in particular fields. If you are a public teacher, an employee of a tax-exempt company, or a minister, you are eligible to apply for a 403b plan. This plan is a bit related to the workplace 401k plan available for private-sector employees.

Among those who commonly use the 403b are medical practitioners, government employees, ministers, librarians, and public school workers such as administrators and teachers.

What is Roth IRA?

Roth IRA got its name from William Roth, a politician, and lawyer from Delaware. People started using the Roth IRA in 1997. What makes Roth IRA great is withdrawal without taxes if done for a valid reason and satisfy specific requirements.

You will get your Roth IRA contribution from what is left after you satisfy your tax obligation. Therefore, you pay higher taxes now. Your tax benefits will come later, that is, as you begin to cash out earnings. That is the time when you can take out money free of taxes.

403b vs. Roth IRA: which is better?

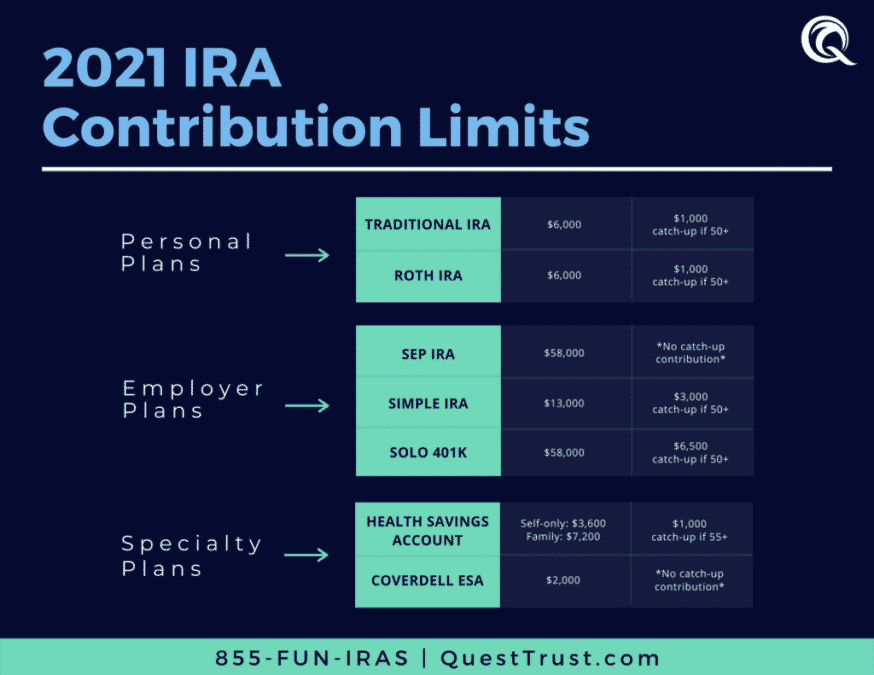

These two options have several differences. One difference is the contribution ceiling. You can put more money into the 403b as it has higher limits. In the year 2021, the highest 403b contribution anyone can make is $19,500 per year. Compare this to the $6,000 limit for the Roth IRA, and you can see the difference. Refer to the table in the image above. If you can set aside more than the Roth IRA limit, you can go for the 403b.

We cannot say which option is better in your situation. It all comes down to what matters to you. If you desire more freedom in your choice of investments, go for an IRA. If your company gives matching funds, then 403b is the better choice. However, you do not have to choose between the two options. There is no stopping you from opening both accounts. Just keep the contribution ceilings allowed for each account in mind, and you will be fine.

How to max out your retirement game?

Preparing for retirement is challenging, but you can make it. What you need is a process to do it consistently. We outline here five steps so you can start working on your retirement future right away.

№ 1. Establish a retirement goal

Figuring out how much to save when looking to get a house or a new car is relatively easy. Meanwhile, coming up with a retirement amount is more complex. To do the latter, you have to take many factors into account. This may include asking the following questions:

- Are you going on vacation? How much money should you set for that?

- How much money should you allocate for unexpected medical expenses?

- At what age do you plan to retire from work?

- How many years into retirement do you intend to enjoy life?

However, there is an easy way to determine your target savings. Assuming you have a ballpark figure on your expected yearly expenses, use the 25x rule to define a retirement goal. Just multiply your anticipated annual expenses by 25. Then you can come up with a retirement amount. For instance, if your expected yearly expense is $40,000, you will need $1 million stashed away in a retirement plan.

№ 2. Open an account

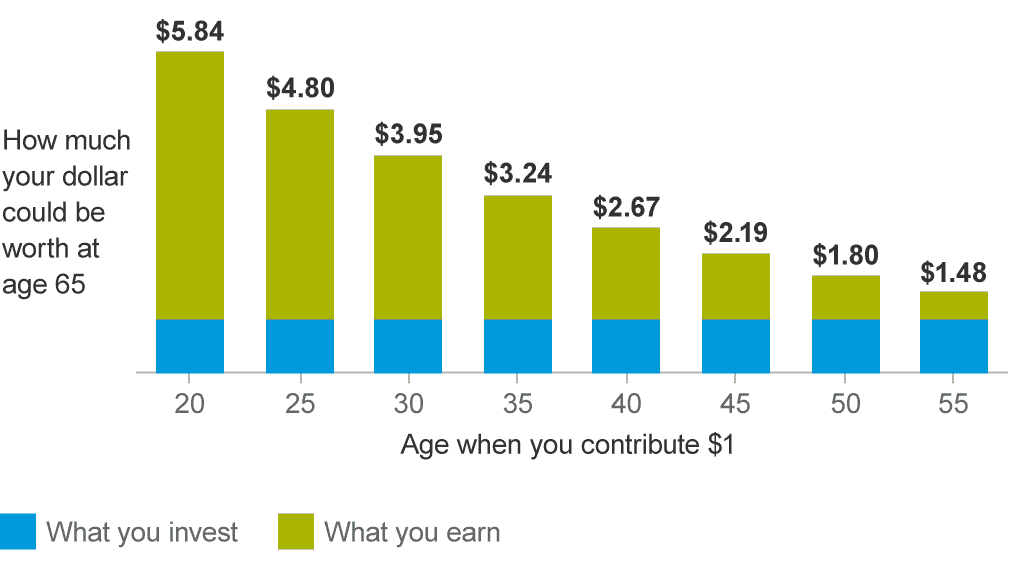

From the previous step, you must have determined your retirement objective already. Now it is time to apply for a retirement package. While it is straightforward to put money in a bank savings account, it is not the best thing to do for one reason. Because of the meager annual interest, the growth in your savings will not be enough to cover inflation. Putting your money in an account that invests in the stock market is the way to go.

There is a wide selection of retirement packages you can utilize to grow your investment effectively. Of course, no one solution is best for all investors. Some plans are developed to cater to the needs of specific groups of people. Find one or two that best suits your needs.

№ 3. Select investments

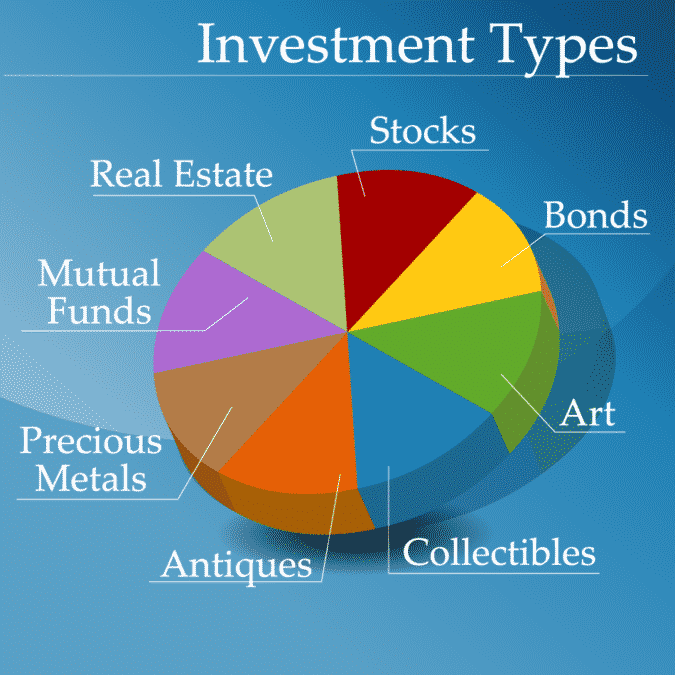

Whether you get an IRA or 403b, you have several options for which assets to put in your account. Since preparing for retirement is a long game, your ideal choices are ETFs, equity funds, and bonds. See other investment choices in the image below.

To get the most of your retirement efforts, you must develop your asset allocation methodology. This strategy outlines how many to include in your portfolio and what percentage of your account you should put in each fund. Determining your system is a factor of your risk appetite and time horizon before retirement.

№ 4. Automate your deposits

Financial experts suggest automating your savings, be it for a workplace plan or an IRA. For a 401k, automatic deferral is standard practice, so you do not have to worry about it anymore. For an IRA, you have to find a way to automate your deposits and make sure you do not exceed your limit.

№ 5. Save more over time

Many financial advisors recommend taking out 15 percent of your income and allocating it for retirement. If you cannot do this immediately, do not fret over it. You can start small and slowly increment your savings by one percent each year. Do this until you get the suggested 15 percent goal.

Final thoughts

To answer the question posed at the outset, the choice between 403b and Roth IRA is personal. Only you can tell which one is better. Your decision primarily hinges on the issue of tax category you will likely fall into after you retire. Based on this, you can choose whether to go for pre-tax (403b) or after-tax (Roth IRA). Whatever you end up picking, the important thing is to get started right away.