- What is ETFs investment?

- What indicators to use when screening ETFs?

- What factors to consider before investing in ETFs?

An ETF, an exchange-traded fund, is defined as an investment instrument made up of a pool of investment assets traded throughout the day in the stock exchange markets. By being a pool of different investment assets, ETFs give investors exposure to different markets at relatively low prices and without the hassle of managing a multitude of assets.

Those mentioned above, coupled with the low expense ratio, fees for investing in them are the most significant contributors to the rise in the popularity of ETFs. In most cases, ETFs represent either the whole economy or a segment of the economy. According to W. Buffett, investing in ETFs is investing in the long run.

As such, ETF investing for the long haul tends to be a guaranteed winner. ETFs have many advantages over other investment instruments, and despite their endorsement by the leading global investors, they pose serious financial risks if their investment is not well thought out.

This guide answers the main fundamental questions when getting into the ETF market.

Factors to consider before investing in ETFs

Like all decisions involving finances, investing in ETFs, if approached haphazardly, can lead to financial ruin. There is no doubt that exchange-traded funds are the go-to investment instruments for instant diversification and exposure to a basket of assets for the price of one. ETF history also shows to a large extent; a long-term investment could result in tidy returns.

However, this does not mean investing blindly in the ETF markets. To ensure investment objectives are met, the following considerations have to be the cornerstone of an ETF portfolio.

Investment objective

Exchange-traded funds composition informs the fund manager on what to invest in and the investment strategy to adopt. Individual investment goals, in turn, notify the ETFs to choose to make up a portfolio.

An investor has to answer the following:

- Am I investing to hedge against a particular investment?

- Why the interest in the ETF market?

- Do you want exposure to a specific industry or segment or the entire economy?

- Is it an investment for wealth creation or income generation?

Answering these questions ensures the ETFs chosen operate in line with individual investment objectives, ensuring the realization of such goals.

Risks

All investment instruments have an element of risk. ETFs have a lower risk element than most other investment instruments, but if mitigating strategies are not put in place can also result in huge losses fast. Always look at the ETFs prospectus to fully understand the principal risks a particular ETF faces.

ETF investing exposes investors to risks such as:

- Foreign currency risk for ETFs with a global composition

- Authorized participant concentration risk

- Discount volatility risk

- Exchange-traded fund risk

- Tracking deviation risk

- Fees and expenses risk

- Management risk

- Financial services risk

- Capitalization risk

Understanding all the different risks ensures investment in an ETF in line with individual risk tolerance levels.

Costs

The pitfall of many investors is failing to factor in all associated investment costs. In ETF investing, most investors consider only the management fees and forget that depending on the ETF. Other related costs include commissions, administrative fees, premium/discount volatility fees, and the spread.

Compared to other investment instruments, ETFs tend to be a relatively cheaper investment option, but the actual costs can be found in the prospectus. An analysis of these costs facilitates the calculation of solid investment returns objectively.

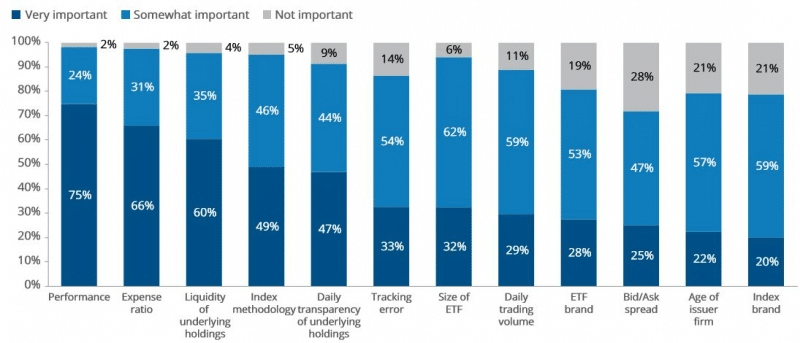

ETF evaluation metrics

Once an investor considers all of the above and is ready for the ETF market, they then have to screen between the multitude of choices available in the markets. Four primary indicators assist investors in screening ETFs, and their weights are dependent on individual investment goals and objectives.

№ 1. Performance

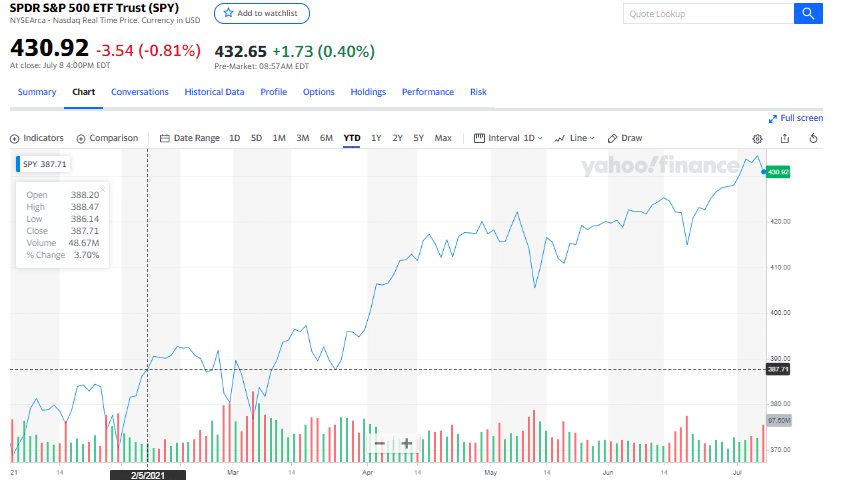

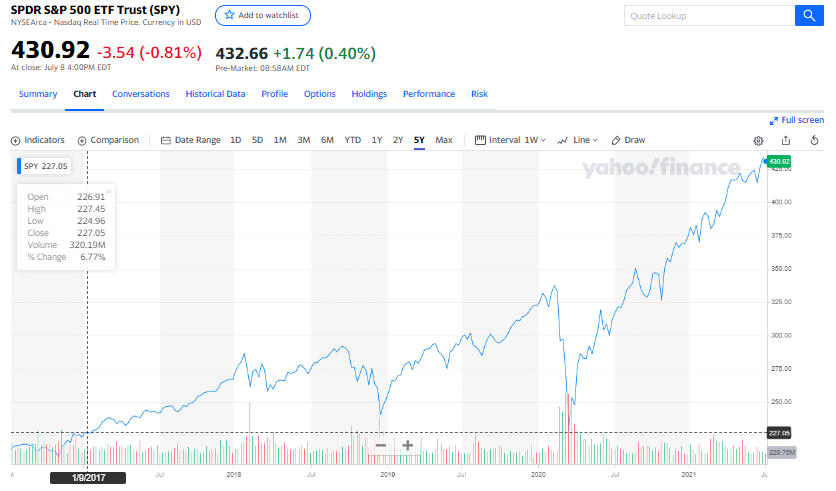

Investors have to look at the performance of the ETF since inception. Many make the mistake of looking at the year-to-date and 1-year performance rather than looking at the long-term performance, 3-year, 5-year, 10-year, and average annualized returns since inception. Looking at the performance over a more extended period eliminates biases.

For example, some ETFs performed below average during the pandemic but have been very profitable in the long term. It is, however, worth noting that past performance is not a guarantee of future positive performance.

The charts above are of the SPY ETF. The year-to-date charts show more of a sideways market, while the 5-year chart shows a strong bullish market.

№ 2. Expense ratio

Nothing good comes for free. ETFs might be relatively cheaper than other investment instruments, but they also have coupled costs; commission fees, brokerage fees, administrative fees, wrap fees, and additional indirect costs.

Brokers are currently providing ETF options that don’t attract commission fees and brokerage fees to compete effectively. Investors should shop around for an ETF option with a low expense ratio to ensure the desired return is achieved.

№ 3. Liquidity

Liquidity measures the ease with which an asset is transferable or tradable between market participants. An exchange-traded fund with high liquidity is easy to offload in times of market downturn and scale during market upturn times.

Highly liquid ETFs are a result of highly liquid underlying assets. Liquidity also affects the spread hence the cost of an ETF — the higher the liquidity, the lower the spread.

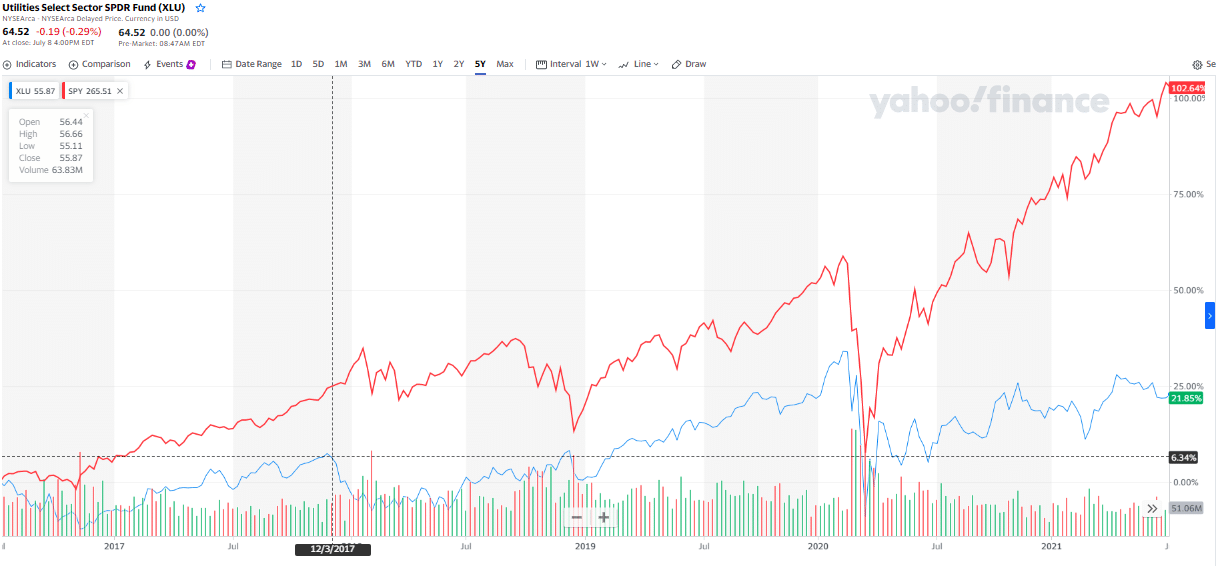

№ 4. Diversification

The objective informs the ETF composition of the ETF’s sponsor. Some ETFs track the whole economy and follow a particular segment of either the economy or industry. If an investor’s objective is to profit from a specific industry segment, an ETF tracking an index with underlying holdings in that niche is ideal.

Suppose an investor wants to diversify their portfolio by having a stake in the broader economy, then an ETF tracking an economy-wide index is perfect.

The charts above are of the SPY and the XLU. The SPY has a smoother curve than the XLU because it cuts across the economic divide. Diversification ensures more resilience to external forces that don’t act on the whole economy.

№ 5. Tracking deviation

Tracking deviation refers to the difference in performance between an ETF and its benchmark index. From an ETF prospectus, investors get to understand the sponsor’s vision for an ETF and how it will perform relative to its index.

The cumulative performance results from operating expenses, investment strategies, adopted rebalancing strategies, and management actions. An analysis of the tracking difference helps investors gauge how well an ETF performs relative to its index; an ideal scenario is an ETF performing better than its index or slightly below par.