- How do you save money on crypto?

- How do I make more money with crypto?

- Can crypto make you rich?

The cost of a cryptocurrency exchange transaction typically ranges between 0.1 and 1 percent, though it can vary widely. For example, if you invest $1,000 or more in a crypto, the transaction fees may range anywhere from $100 to $1,000.

There could be many consequences when investing in crypto due to fees. A Bitcoin exchange transaction, for instance, costs an average of $4.38 to $62.77 between April and June 2021. Similar price movements have occurred for other cryptocurrencies as well, like Ethereum.

Dealing with such a wide variety of expenses requires carefully planning your time and strategy. Below are five suggestions to help investors and traders save money on crypto transfers.

Save money by sending cryptocurrency tips

The risk of investing is inherent in all investments, but some experts view cryptocurrencies as one of the riskiest. The following tips can help you make educated choices regarding investing in cryptocurrencies.

Learn what cryptocurrency exchanges are before investing. There are an estimated 500 different exchanges out there. Research your options, read reviews and talk to more experienced investors before investing.

Investing in cryptocurrencies can be a rewarding experience if you follow these tips.

1. Have a strategy for crypto trading

Many sharks are waiting to steal your money; it can be hard to separate genuine cryptocurrency recommendations from scams. Seven thousand one hundred eighteen cryptocurrency investment scams took place during the first nine months of 2021. According to Action Fraud, the average loss per victim in 2020 was $20,500, 30% over the previous year.

When you come upon a lot of information about a cryptocurrency, take a step back and see it from a different perspective.

Analyze the platform or project critically. How many users is it expected to have? What is its purpose? Ignore coins offering the moon but failing to deliver.

2. Read the small print

Do not be swept away by fantastic offers when selecting a cryptocurrency and an exchange. Despite the unique characteristics of cryptocurrency investment, nothing comes free. So never accept promises of super-profits without looking for the catch.

Take a moment to remember the cautionary tale of PlusToken, a Chinese service that promised investors a return of 10%-30% per month. Instead, by the spring of 2021, there were more than three million+ token users. It resulted in a value of $17 billion at its peak.

Some early investors received a return on their investment, but others were less fortunate. There was nothing revolutionary about the platform, only a Ponzi scheme. Chinese authorities arrested several scammers, but most of the money disappeared without a trace.

The creators of most Ponzi schemes do not go as far as PlusToken did, but that does not mean they are any less clever. The company, XtraderFX, recently shut down in the United Kingdom, fraudulently advertised its services using well-known and trusted faces from TV and finance.

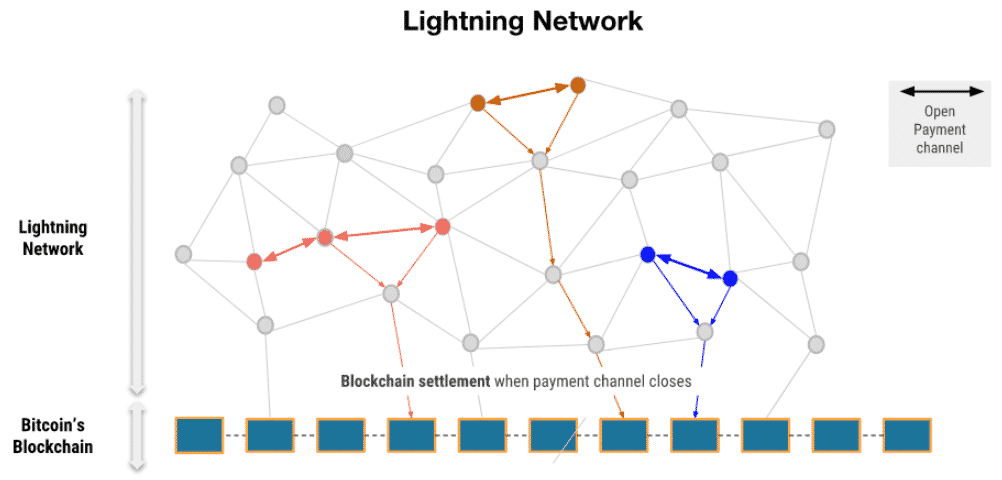

3. Lightning to the rescue

Lightning transactions are just one cent more than BTC transactions in transaction costs. In anticipation of more people using BTC, developers have predicted that transaction costs will rise. Lightning networks rely on BTC and can facilitate more transactions while reducing congestion. A customer who plans to buy numerous items shortly could benefit from this long-term option.

If you want to start a Lightning channel, you’ll need to spend money. Clients will not send as many transactions upon receiving their first few free transactions, if they have enough money in their account.

And to top it all off, Lightning is still under development. No matter how far technology advances, customers are still concerned about going bankrupt. It would help if you didn’t spend all of your money on it.

4. Use wallets with scaling technology

Compared to earlier Bitcoin community transactions established in 2017, SegWit transactions could cost 30 percent less. The best-case scenario is that a SegWit transaction costs as little as $10.50.

However, despite SegWit being widely available for quite some time, not every wallet and exchange has adopted it. Several services currently support SegWit transactions. As a result of SegWit’s benefits and reduced costs, Bech32 addresses could be an essential addition. However, only the bech32 file format has made it to the mainstream.

As technologies like SegWit and BCH32 become more advanced, keeping up is more challenging. You have several options to save on fees, including wallets and exchanges.

The more checkmarks or green squares a company has on its app are more likely it is to save money. Keep in mind, though, that some posts may be outdated. For example, the recent SegWit adopter BitPay isn’t listed because it hasn’t adopted the technology yet. It is essential that users explicitly choose SegWit when creating their wallets to save on transaction fees.

5. Automate purchases

Using pound-cost averaging can help you take advantage of automated crypto purchases just as it does with regular stocks and shares.

You can set up recurring buys on Coinbase, Gemini, and other cryptocurrency exchanges.

Using this service, cryptocurrency investors tell the platform to buy a certain amount of their preferred cryptocurrency every month. So, for example, you can order £100 in Bitcoins. When prices are high, they receive less currency, and when prices are low, they receive more.

Then you don’t have to worry about predicting the market by either buying or selling a currency at what you believe is the lowest possible price. This is a difficult task for even experienced market professionals.

Final thoughts

There you go — a few suggestions to help you the next time you work with cryptocurrency. First, you can reduce your cryptocurrency transaction costs by planning your transactions. Make sure you do your homework before joining an exchange and steer clear of risky transactions at first.To protect yourself against sudden price drops, diversify your cryptocurrency holdings to reduce your risks. For example, you can avoid Ponzi schemes by carefully examining altcoins before investing. In addition, you should store most of your cryptocurrency in an offline wallet and keep your password in a secure location.