- What is a long straddle options strategy?

- What are its most significant gains and risks?

- What are the strategy’s mechanics, and what factors to consider in a long straddling plan?

Options traders utilize the long straddle when buying a long put and a long call for the same stock, strike price, and expiry date. If the strike price is near to or exactly in the money, there is a strong possibility that the option will be profitable. If the underlying asset price does not change considerably, both options are worthless. As the asset’s value increases or falls from its present level, this trading technique profits most from speculation on future volatility.

What is the long straddle options strategy?

Single option techniques are used to profit from the underlying asset’s movement in just one direction. For example, long put options can help you profit if the asset’s value falls; long call options may help you profit if the asset’s value increases.

When it comes to price movements up or down, the market often provides its circumstances. But, first, there must be a breach of the existing price limit (a flat or triangle, i.e., the market state in which normal trading is either impossible or too hazardous) for the prices to rise.

Those who buy call and put options simultaneously may profit from rising and falling markets. Strike price options are used in the long straddle strategy. Long straddles are our go-to strategy when the odds are even.

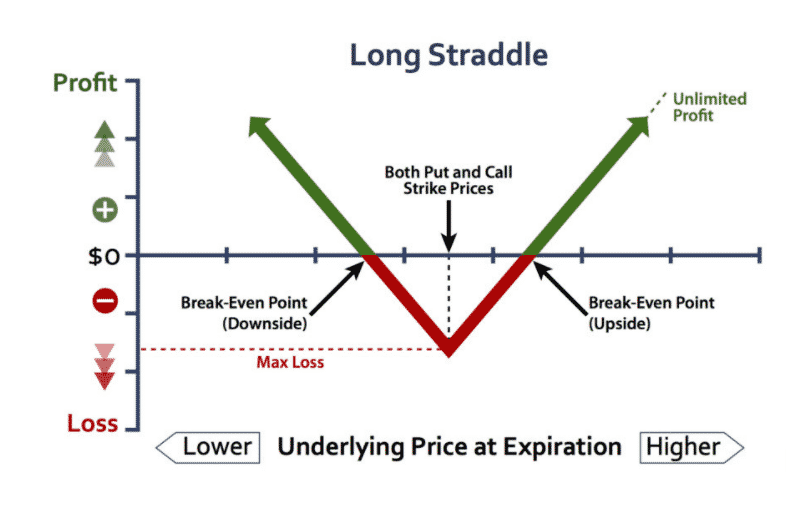

You’ll need both a long call and a long put to achieve a long straddle. Both options expire simultaneously and have the same price on the same stock. It’s possible to construct and use a long straddle when the underlying stock rises above or falls below the higher breakeven point. However, the upside and downside profit possibilities are considerable. Only when all costs, including fees, are taken into account that the maximum loss is recognized.

Gaining the most profit as possible

Profits are almost limitless since the stock price will only climb in the future. Investors might gain a lot of money if the stock price crashes to zero.

Highest risk possible

There is no way to recover this loss if the position is kept open to expiry and both options expire worthlessly. Both options have no inherent value in this situation since the stock price will have reached the strike price when they expire.

The mechanics of the long-straddle option strategy

The strike prices and expiration months of the call and put options must match for a long-straddle option to be valid. Long straddle options, which are put and call options with the same price, may generate money on the stock market.

- Call options must outperform the put option’s loss to profit from the put option.

- The put option must fall far enough to make the call option unprofitable to earn money.

Without a significant movement in either direction, there will be no value in either option’s time premiums. It is a dangerous course of action. The amount of money simultaneously made via long-term straddling is almost limitless. Keeping the position until the option expires with the underlying stock price precisely at the option strike price is the position’s most dangerous move.

Which aspects of a long-term strategy should you keep in mind?

This strategy may be concerned with implied volatility (IV) and time decay. A greater IV is required for the long straddle approach to be successful. For investors, IV’s quick rise may provide an opportunity to profit by closing out their straddle positions early.

The passage of time may have an impact on the outcome. You might lose all of your money if the Bitcoin price stays the same for an extended period. Call or put contracts must be lucrative to make a trade profitable. As the expiration date approaches, the pace at which time passes increases.

Numerous widely used options trading strategies may manage risk and optimize positions in crypto derivatives. However, inexperienced traders should avoid derivatives trading due to its complexity and hazards.

Final thoughts

Options strategies enable a trader to make money in situations that can lead to rapid market movement in any direction. The simultaneous purchase of the options makes the strategy immune to incorrect determination of the direction of the market movement.

A loss can occur if the price does not go beyond the break-even points by a certain date. In this case, the investor will incur losses equal to the sum of the option premiums. Based on the preceding, we can highlight specific aspects of the implementation of such strategies:

- Straddles and strangles need to be bought when the market and implied volatility is low.

- The best time to apply the strategy is to anticipate a breakout of key support and resistance levels in any direction.