- Options contract expire: close or open?

- What is the expiration date?

- What should traders know before starting?

The reason for the emergence of fixed-term contracts was the desire of the business to insure against the risks of changes in commodity prices. As the economy developed, the terms of contracts began to change, and their number grew. Nowadays, many of them are used for speculative trading to make money.

Options are temporary and expire on a specific date. Let’s take a closer look at how this process occurs and what it entails.

Options usually expire on the 3rd Saturday of each month at 11:59 pm EST. Understanding expiration time (ET) is vital in options trading, as you should never confuse it with the last day. The due dates are usually the third Friday of each month after the expiration date. Basically, forfeiture means that the option has been permanently canceled and you are no longer entitled to use it.

What are the possibilities of expiration?

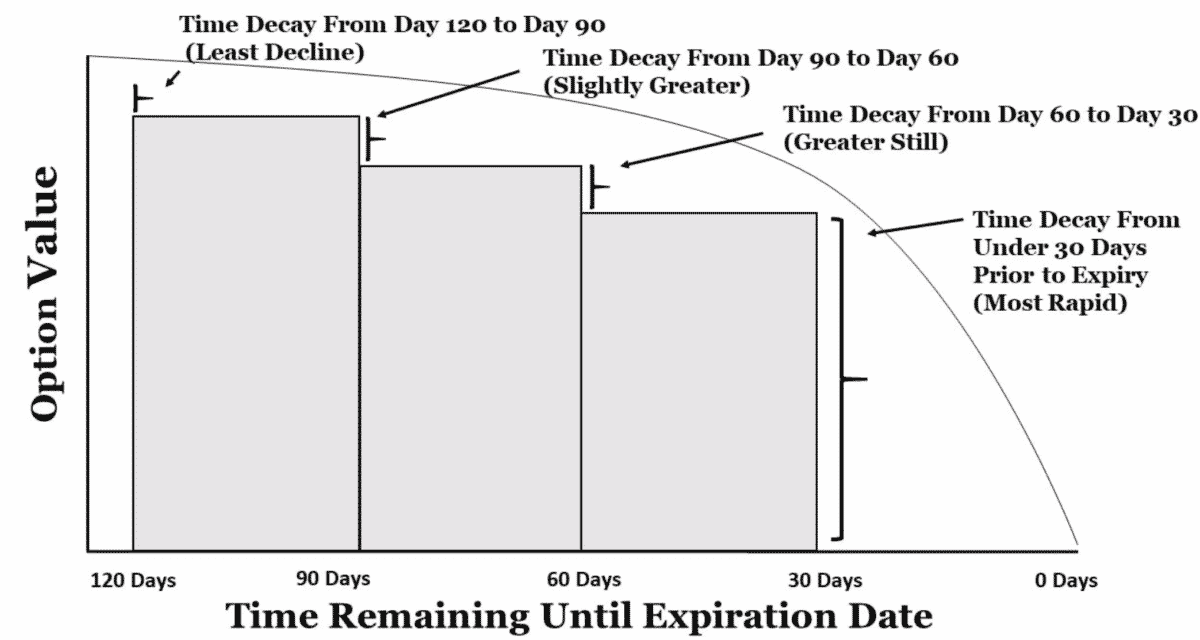

We have already discussed that a trader will no longer trade options once the contract expires. Hence, it is important to understand the worth and standing of ET options in different trading situations.

You may effectively acquire the legal rights to sell or buy assets as you wish by purchasing options. These assets are already part of a fixed-price contract with a limited term.

The set time is also known as the expiry date. The buyer can no longer use it when the contract reaches the agreed time/expiration date. It becomes completely useless and has no value.

It is always a good idea to practice options before they expire. Failure to do so could result in trading losses.

What is options trading?

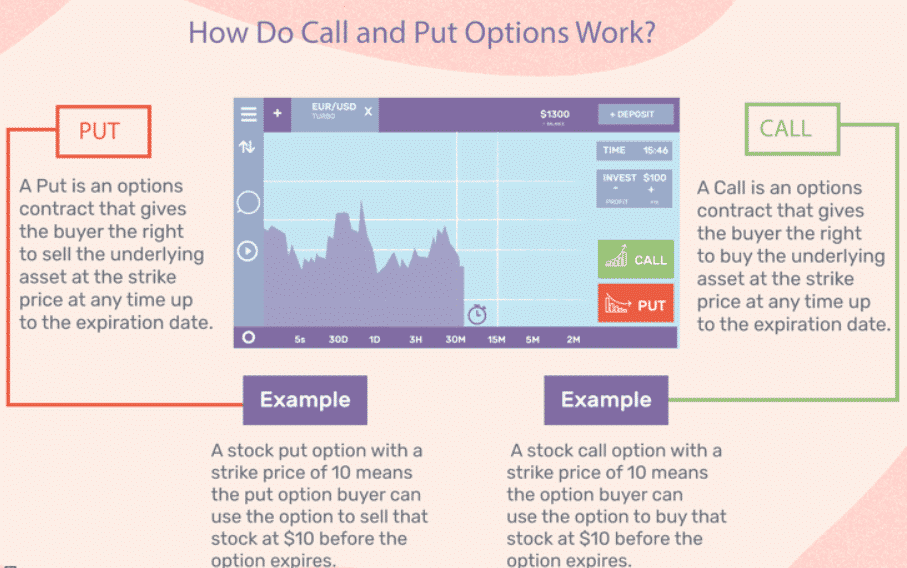

In options trading, a buyer purchases a contract that entitles him but does not authorize him. You cannot sell or buy financial assets at a specific strike price on a particular date of expiration. A call option is a term that refers to purchasing the security at a specific price over some time. A put option is a term commonly used to sell a security at a specific price over some time.

The owner must take full advantage of this opportunity without exceeding the expiration day (ED) limits. In addition, the owner later pays a small amount as a premium for the opportunity to acquire the rights granted to him under this contract.

Option contract duration: closed or open?

These contracts typically expire at 11:59 pm EST. However, they have a strangely set expiration date — Saturday. All government holders who have contracts must always be valid until 5:25 pm so that the expiration date cannot be exceeded.

Several contracts follow a proper flow system in an exchange trading scenario. For example, when we talk about stocks listed on the US stock exchange, they run on Saturday and then on the third Friday of the same month.

Therefore, there is an exception during the market holidays if the process occurs on Thursday and not on Friday.

Additionally, owners should be aware of the notification restrictions. The notification limit usually depends on where you are trading. Some traders avoid holding options until the ED is reached. This is a big mistake. It is a foolish decision to give it up and not use it.

All traders should contact their online broker to understand options trading concepts and various notification limits.

What is the difference between weekly and regular contracts?

One of the main differences between the (weekly) options is slightly shorter than the monthly (normal) options. This is because monthly options expire each week once the market closes on Friday.

On the contrary, with a few exceptions, such as on public holidays, the usual options are included. The weekly contract usually closes on Thursday, not Friday, during the market holidays.

What is the expiration date for weekly contracts?

When we talk about the expiration date for weekly options, they are usually freed every week. This happens when the market is closed every Friday. On market holidays, ED appears on Thursday, not Friday.

Can you use parameters automatically?

It can only be done if the owner or broker is asked to do it automatically. Otherwise, the options contract will always be executed out of sequence or ET.

You cannot automatically use options if the options run out of money when they expire.

What is options trading after hours?

When looking for options for the first time, it is important to understand the concept of options trading after business hours. After normal business hours, Eastern Standard Time starts at 4:00 pm. At this time, the US stock market is completely closed.

So, it starts at 16:00 from 16:00.

Trading options outside of business hours is generally considered a challenging task for traders. This is because stocks have some liquidity to trade at this time. This results in a higher bid-ask price range, which could even be called a spread.

Aside from the high risk, many investors are interested in experimenting with this trading condition. This is because they want to take advantage of the latest news and get out of a losing position early.

To be on the safe side, option holders should understand what the after-hours market is and how it works. Familiarize yourself with the exchange on which the options are traded and make the broker clear about your intentions.

Final thoughts

At the end of the discussion, we conclude that all options will be deemed wholly void and no value to you upon expiration.

The expiration date and time may change according to your broker. It may even depend on which stock exchange the investor is trading the option on.

Remember that an option must always be exercised before it gets close to the expiration date.