- How do you trade crypto with this strategy?

- How do you take advantage of using it?

- What tools are used for this type of trading?

Currently, there are several forex exchange platforms in existence. Crypto traders can use many of them to make the most of arbitrage trading.

To make the most out of the opportunities in assets trading, especially in this strategy, you will have to learn the definition and process of arbitrage trading when you are new.

What is crypto arbitrage?

Market volatility in the crypto industry is regarded as high compared to other financial markets. The price of assets tends to fluctuate over a certain period. These opportunities seem to be receiving more attention in the coin space.

They are traded across hundreds of exchanges 24/7, giving these traders a much more comprehensive range of opportunities to find profitable price discrepancies. To take advantage of a price differential, traders need to spot the difference between two or more exchanges and act accordingly.

Arbitrage traders do not need to predict Bitcoin’s or other coins and futures prices like day traders. Moreover, they don’t engage in trades for which a profit may take hours or days to materialize.

When traders identify arbitrage opportunities and take advantage of them, they can expect fixed profit without necessarily analyzing markets or using other pricing strategies. In addition, depending on the resources available, such trades can be entered or exited quickly.

Arbitrage trading strategies

This article will examine arbitrage and trading strategies that utilize the tactic.

Spatial trading

Trading multiple exchange platforms using the spatial method is a form of arbitrage involving virtual currencies. It can be a simple way for traders to exploit price discrepancies, but it also entails risks, such as transfer times and costs. This method involves a straightforward and easy-to-use procedure.

Spatial trade without transferring

The risks that spatial arbitrage poses, such as transfer costs and times, make some traders shy away from it. They might, as an example, buy Bitcoin on one exchange and sell it on another, and then wait until they see the price of Bitcoin convergence between the two exchanges. In that way, they don’t have to transfer tokens and coins between platforms. Traders may still have to pay a fee, however.

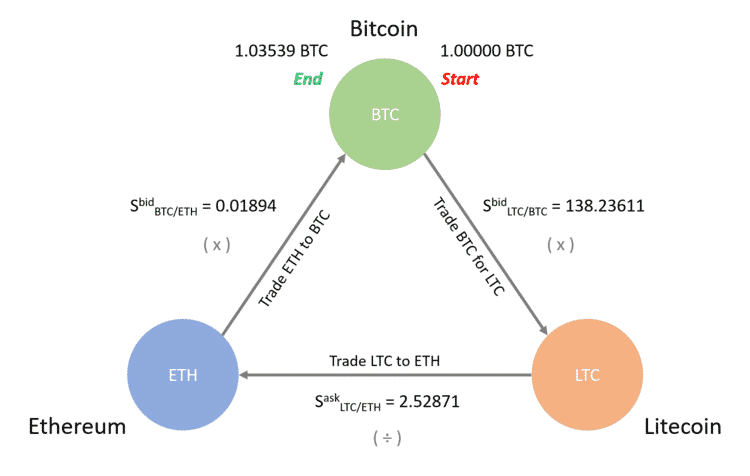

Triangular arbitrage strategy

This method is possible by utilizing the inefficiencies in pricing between different assets on one exchange. For example, an investor uses this strategy to exchange one crypto for another on the same exchange, which is undervalued compared to the first.

After that, the investor will trade that second asset for a third coin that is relatively overvalued in comparison to the first. After that, the investor would exchange the third coin for the first asset, completing the circuit and becoming richer.

Five tools that beginners and experts use to trade crypto arbitrage

Here are the top tools you can use to trade with an arbitrage strategy.

Trade flow

Online order feeds are continuously updated using Tradeflow, Bitfinex, BitMEX, and GDAX. Comparison of orders across exchanges enables an assessment of overall market confidence. BitMEX, for example, may lead the way for other exchanges if it receives a $10 million market buy.

Is it useful?

Besides keeping a tally of the total amount purchased and sold within a preset period, the tool also lets you determine what portion of the reported volume is based on buying and what portion is based on selling, which is an essential indicator of the market sentiment. In addition, this order flow displays the live price orders being bought, succinctly highlighting possible opportunities for this trading among exchanges.

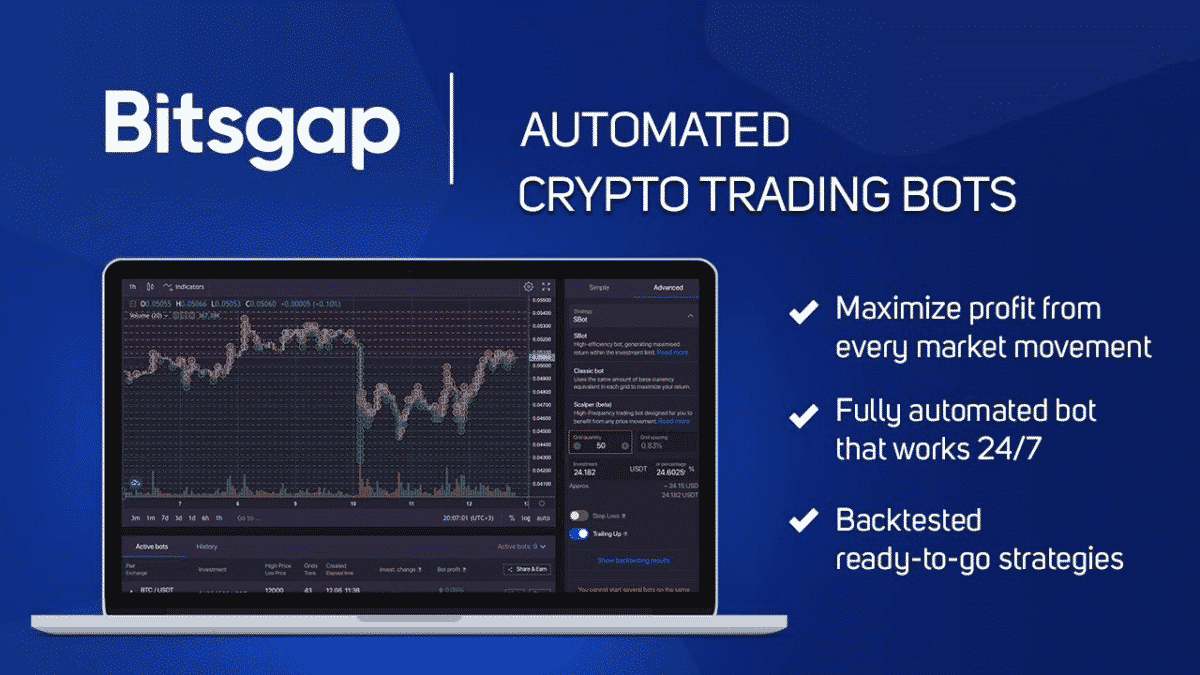

Bitsgap

Investing in Bitsgap as a Bitcoin bot is a good idea because they are regarded as an all-in-one trading platform that helps you with Bitcoin arbitrage and other cryptos.

Is it useful?

You can use intelligent algorithmic orders with them, and they believe that they offer everything you need for managing your investments all in one place. You can sign up for free, and you can watch a one-minute tutorial on how they work to learn all about what they have to offer without feeling like you’re diving in headfirst.

Coinrule

Crypto arbitrage bots like Coinrule are also good options since they can automate trades and make everything a breeze.

Is it useful?

Traders can use their services to compete with professional traders and hedge funds, and the best part is that they don’t require any coding knowledge from you to use them.

Another significant aspect of this crypto arbitrage trading platform is that you can get started immediately for free, and they believe their services are compatible with the top ten exchanges.

Quadency

This crypto arbitrage bot is an excellent option for any trader. Whether you are just starting in the industry and want to dip your toe in the water or are an experienced trader who has been relying on previous platforms in the past. Still, now you want something that will offer you constant assistance.

Is it useful?

The company recognizes the importance of giving their clients an entry point into the world of crypto, so they won’t necessarily hold your hand the entire way. Still, they will show you the ropes, so you’ll feel confident you can do many things yourself.

Napbots

It is another arbitrage bot that focuses on helping clients improve their success rate, no matter where the market is. No matter what market conditions are, they will be able to turn things around for you and make sure that you are making a profit from your cryptocurrency investments.

Is it useful?

Our favorite feature about this arbitrage bot platform is the ability to create trading bots for every type of strategy out there, whether you’re automating your portfolio rebalancing or you’re day trading. Furthermore, all of your assets are kept in your exchange account, which means that third parties and other vulnerable protocols will not have access to your assets.

Final thoughts

Arbitrage occurs in the stock, bond, and commodities markets wherever the same asset trades for a different price in a different location. Cryptos are digital and not based on an underlying asset, making it difficult to price them adequately and assign a value to them, unlike equities and bonds, which measure a company’s performance, municipality’s performance, or nation’s performance.

Dealing with crypto isn’t easy, and arbitrage strategies are even more complex. Nevertheless, the practice is legal, and it can be gratifying and precarious for investors.

Investing in arbitrage is similar to examining any investment strategy. This includes tracking FX exchanges in real-time and looking at less-known cryptos. This includes tracking FX exchanges in real-time and looking at less-known assets.