- Can a Bear flag turn bullish?

- Are Bear flags reliable?

- Which pattern is best for trading?

The Bear flag is a classical chart setup that suggests the extension of an initial downtrend. After a strong sell-off, it is normal for the price to take a breather in the form of pullback to get more traders to join the trend move. Once the pullback is over, you can expect the downtrend to continue.

A pullback can take many forms. After the price makes a sell-off, it may consolidate in an inclined channel marked by two rising trendlines parallel to each other. Once the price breaks the lower trend line, a Bear flag setup is completed and ready for the taking. Normally, the breakdown should not take too long to occur, and the flag should be completed shortly. Otherwise, it could mean the sellers are losing ground in the trade war.

This article will learn more about the Bear flag setup, understand its elements, and how to trade it theoretically and practically.

Understanding the Bear flag

This is a price pattern that indicates the extension of an existing downtrend. The full pattern is made up of three phases:

- Initial sell-off

- Consolidation in an upward channel

- Final sell-off

The pattern is called this way because the price forms a structure that looks like a flag, though in an inverted manner. The flagpole is the initial downtrend. You take the trade at the end of phase two.

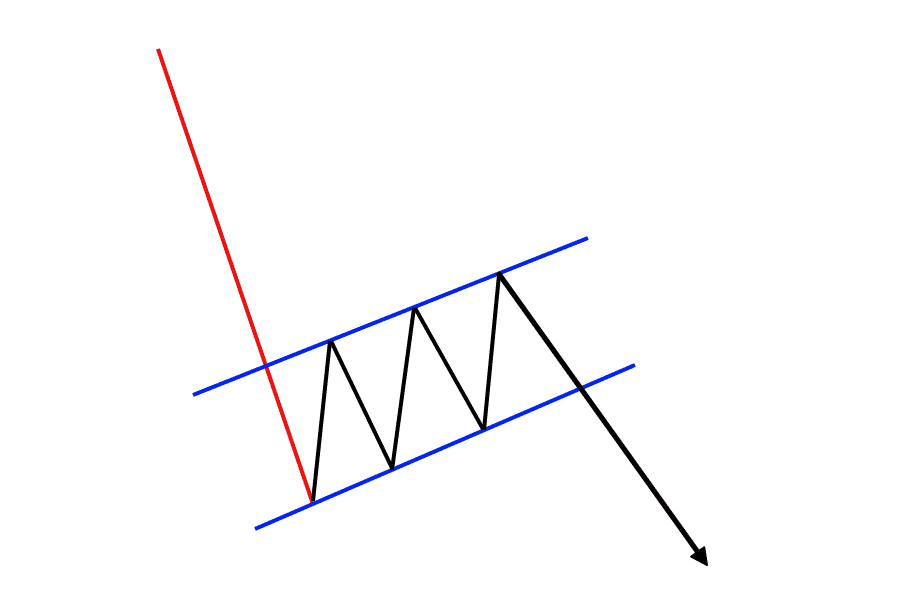

As you can see in the image below, the pattern starts with a sell-off (the red line), fixing a new low. Next is a series of higher and higher low that forms in a tight, slightly tilted channel. This rising channel makes up the flag part of the pattern.

Buyers take advantage of the consolidation to try to take control of the trend from the sellers. Meanwhile, some sellers take a portion of their profits gained from the initial down move and are looking to re-enter the market. As price breaks the channel to the downside, sellers rejoin the action.

In summary, there are three elements of the flag pattern.

- Flagpole

This refers to the initial downtrend, which makes up the first phase.

- Flag

This is the structure formed when the price consolidates after the initial sell-off. The flag makes up phase two.

- Breakdown

This is the second leg of the downtrend, which is triggered by a breakdown of the lower trend line. This makes up the third phase.

How to trade the Bear flag?

As already pointed out, you initiate a sell trade at the end of phase two. When the price consolidates and forms the flag, be patient until you see a breakdown of the lower trend line and a close below. This is the standard way of entering the trade with this setup. The advantage of this entry strategy is that you will not miss any trade opportunities.

If you want to take a high-probability trade, you can wait for a retest of the trend line below or the breakout point. You might not see a retest after a trend line break, though, so you can miss the boat from time to time. The disadvantage is that the breakdown could turn out to be false, with price entering the channel and taking out your stop loss.

Sample of the Bearish flag trade

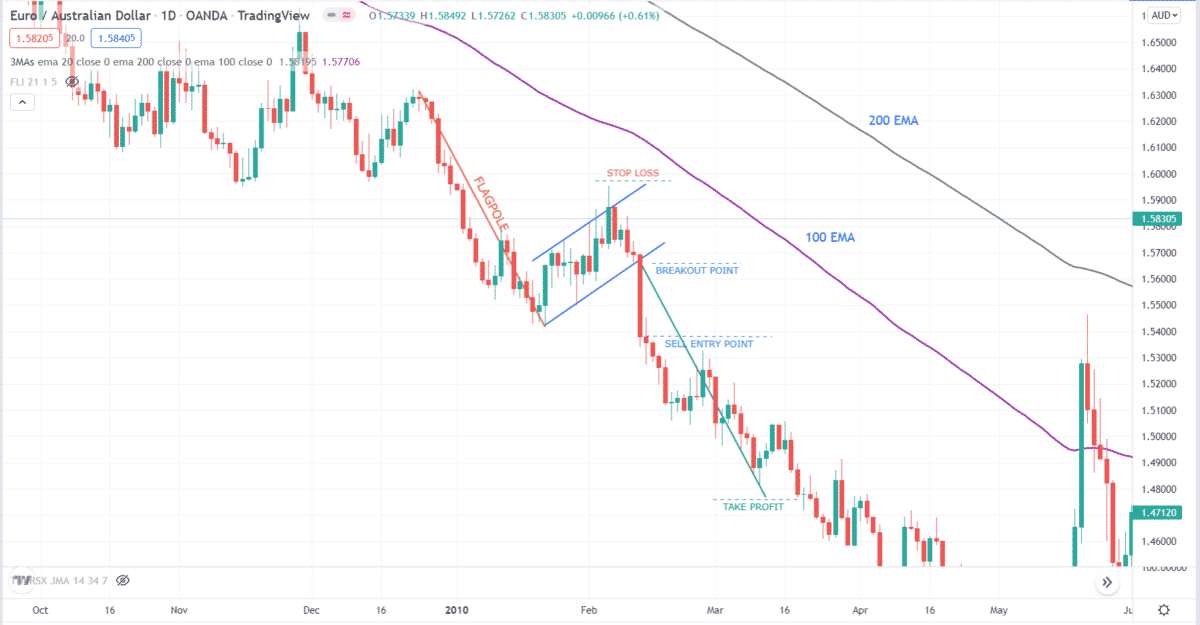

Let us consider a chart example to learn how to trade this setup. Refer to the above EUR/AUD daily chart. This example shows a great setup since the market is heavily trending down. This is evident when considering the direction, slope, and separation of the 100 EMA and 200 EMA. Finding a Bear flag set up in this context is indeed a lucrative opportunity that comes only once in a while.

Entry

The problem with the above setup is the size of the breakout candle. As you can see, this candle breaks and closes not only below the most recent higher low and trend line but also the endpoint of the flagpole. By definition, the sell entry is right after the price breaks and closes on the lower portion of the trend line. That action is justifiable if you pass on this trade because of this drawback.

Stop loss

The textbook standard in setting the stop loss of a Bear flag setup is to put it on the recent swing high prior to the breakout. If the price prints a lower high before the breakout, you can use that level as a stop loss point, which will lead to a smaller risk. In this case, though, we do not see a bearish 123 or a head and shoulders. Therefore, the stop loss may go all the way up to the recent high, which is a bit far from the trade entry.

Take profit

The take profit for this setup is well-defined in textbooks and online resources. The default method is to measure the height of the flagpole and then use this height to find the completion point of the continuation pattern. This height is often expressed in terms of pips. To simplify the process of determining the take profit target, simply draw a line from the origin of the flagpole to the start of the flag. Then copy this line and align the start point of the flagpole with the breakout point. Your take profit is the endpoint of this duplicated trend line.

Final thoughts

The Bear flag is a common and effective classical pattern in existence. It occurs on the charts at any timeframe every single day. If you want to trade this pattern, make sure to perform hand testing. Scour as many charts as possible and count the number of times the pattern works over the total occurrence of the pattern. The 67.72 percent win rate found in one study is high enough to make anyone a profitable trader given a suitable and consistent reward-risk ratio.