- Which MA is better?

- How to trade with SMA and EMA?

- How to calculate both?

Investors in the FX market use both to analyze movement in the market as these are technical indications. Chart bars that are averaged over a given time give investors a better picture of what is happening in the FX industry. It is essential to use moving ones not for predicting future trends but for confirming the current trend. Thus, if the price keeps pace with the daily standard, then you can confirm the price movements.

Investors can calculate these MAs by learning past deals to lag behind current trends. Therefore, they often work with others to provide a comprehensive analysis.

SMA and EMA contrast mainly in the estimation method used. There may be many cases where an EMA type is required. Let’s learn the key distinction between SMA and EMA.

Simple vs. Exponential MAs: an overview

Analysts and traders use these averages to analyze patterns and look at the behavior of markets. Investors can use MA to detect movements in the market zone or find out the chart movement that doesn’t exist. It can sometimes change trends.

SMA and EMA are the most common types. It will be easier for traders to choose between them if they understand how the two differ.

Essentially, these metrics describe the mean value of a financial instrument over some time. The way statistics are calculated, which is why various MAs are available. The indicators change as costs move, adding new information.

Simple moving average

Assume you want to find a 10-day SMA. First, pick up the closing values of the previous ten days and add them. After that, divide the added value by ten.

A 20-day moving indicator is determined by summing the closing rates during 20 days and dividing them by 20.

Following are some examples of pricing:

- 10 USD, 11 USD, 11 USD, 12 USD, 14 USD, 15 USD, 17 USD, 19 USD, 20 USD, 21 USD

Data from the past is replaced with data from the present. So, for example, the MA of 10 days automatically updates by adding a new day, dropping the 10th day, and doing this indefinitely.

Exponential moving average

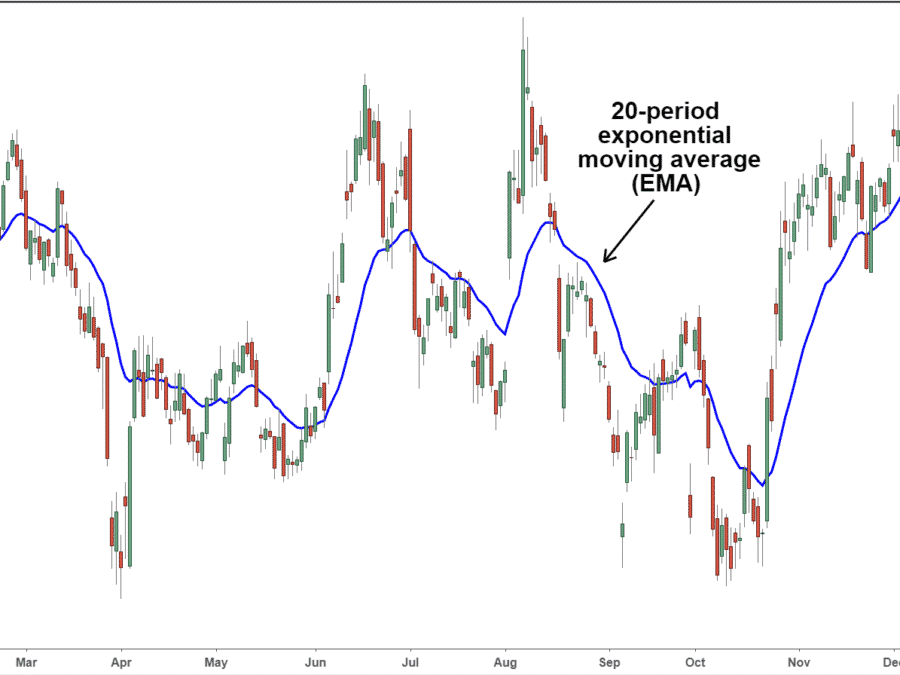

In contrast with SMA, which requires a long series of measurement points, exponential moving indicators prioritize recent trends.

An EMA of ten days places the most recent value at 18.18%, with each subsequent data point becoming lesser and lesser.

The EMA measures the current period’s cost by adding the amount that differs between a recent period and a previous one to the previous EMA. For shorter periods, the newer figure holds greater importance.

Identify the major differences

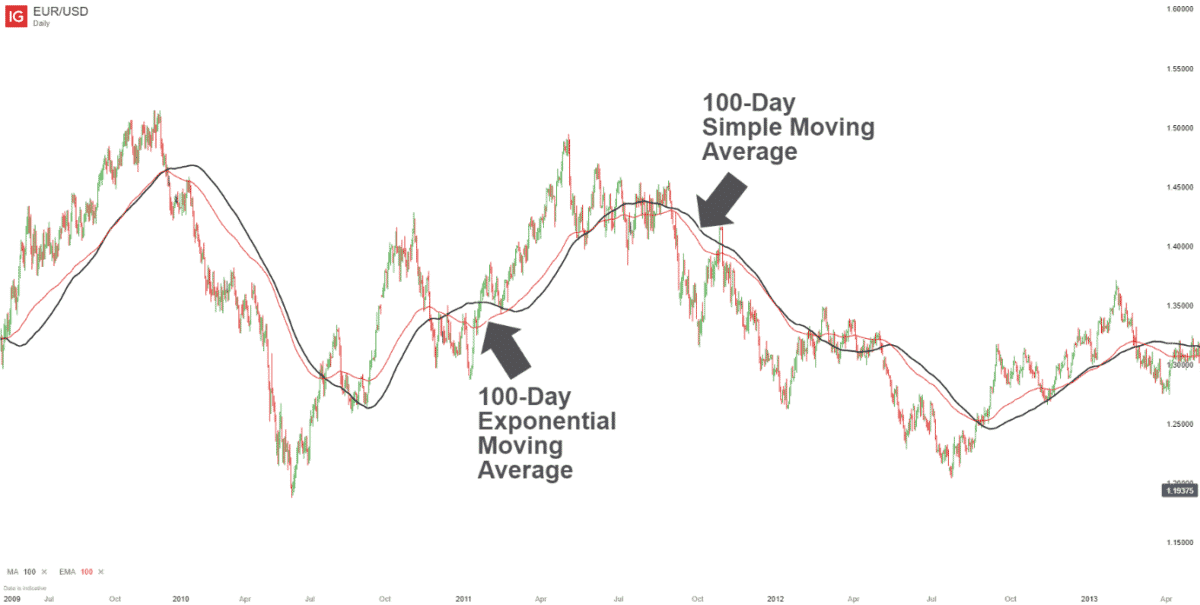

Different formulas compute the SMA and EMA. A comparison shows that the SMA is slower to react to changes in price than the EMA. This is the most crucial attribute that differs between the two. Therefore, one is not necessarily better than the other.

Faster dynamic averages can make a trader exit a trade when a hiccup occurs. Sometimes, the opposite can occur. Still, a slower MA keeps the trader in, ensuring that the trader makes a higher profit after the hiccup passes. EMA’s faster movement than others warns of trouble earlier, thus saving the EMA trader valuable time and money by getting out of danger sooner.

It is important to note that each data point’s significance decreases over time with an EMA until it is eventually removed when new data points are added with higher values. In other words, the value of a new data point on day one would drop to just 6.67% of its original value after five closing rates on the 10-day EMA.

It is up to each trader to determine which MA is suitable for their strategy. Short-term traders mainly use EMAs because they want to be alerted to the opposite direction of price movement as soon as it occurs. Longer-term traders typically use SMAs as they don’t react quickly to events and prefer to be less active in their trades.

In the end, it is a matter of preferences. Test your trading decisions by plotting an EMA and SMA equal length on a chart.

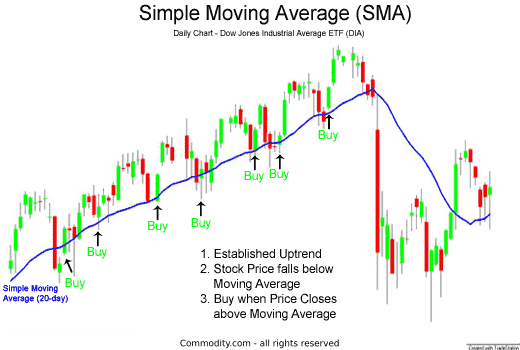

A simple or exponential average indicates an uptrend above the MA. A change in averages should have given insight into trends. The trend changes in the past for these guidelines should be used. When you select a measurement period, the value will generally reverse as time passes. The same is true for MAs, whether they are simple or exponential.

You can experiment with different MAs based on the inputs on your charting platform to determine which one works best. Stocks, among other types of financial instruments, can be analyzed using a variety of indications.

SMA vs SMA

Both of these approaches can be successfully applied in different situations; here is a comparison to help you decide.

| Overview | The best time to use | Keeping in mind | |

| SMA | It is used to confirm trend rather than predict it. | This is a good option for long-term traders. You can also use it to determine EMAs. Charting tools can do it for you. | You might miss a good trade entry point by relying solely on these. |

| EMA | The most recent price data is given greater importance in a faster-MA. | Suitable for short-term trading where current financial information is most relevant. | Because the average reacts quickly to changes in value, you might read too much into price spikes, which might not be part of a trend. |

Final thoughts

The MA is the cornerstone of time series and chart analysis. The exponential indicators smooth price movements and help illustrate patterns in addition to simple moving averages. Although there are different types of MAs, one type may be better suited to a trader, depending on how they are used.

In their estimation, EMAs emphasize recent prices, which is potentially more relevant. Therefore, investors with long-term perspectives should carefully consider what their indicator needs to show them, whereas traders with short-term perspectives will often use whatever indicator they choose.