- Can you trade FX with just $100?

- How much could you earn?

- What lot size is good for $100 FX?

Trading capital is vital when you want to participate in the financial market. Before 1990, forex trading was only available for banks and financial institutes. Nowadays, it has become more accessible to individual traders with the availability of technology. The initial deposit amount varies from broker to broker, and it is not hard to find a broker that allows you to start trading with $100.

However, the capital size relates to many factors such as trading method, skills, trade management, trading duration, leverage, etc. You may be thinking if it is possible to start trading with a $100 or not, and the answer is yes if you follow some specific guidelines. In the following section, you will find that.

What is a $100 forex trading?

Many people think that $100 is nothing for trade forex as the forex market involves transactions in trillions of dollars per day, which is a wrong concept. Any individual trader with sufficient skills and implementation appropriately on trading practice can make enormous money by starting with a $100. For example, think of that legendary trader Chen Linkuy. The Chinese trader made nearly $100,000 with his $100 in a few weeks from forex trading.

However, we don’t recommend trading like Linkuy, as he violates money management rules and misuse leverage features.

The FX market involves using leverage on capital from 1:1-1:1000. That means it allows making more prominent positions with tiny trading capitals. For example, an account with 1:100 allows participating trades worth $10000 with a $100 capital. There is a big difference between “what can do” and “what should do” in the forex market. Using leverage can be a risky practice. So try following specific trade and money management techniques while starting trading with a $100.

How to trade forex with $100?

Trading with $100 is not an easy practice, and most novice traders lose their first deposit as they ignore many significant facts or don’t follow any guidelines. While you start trading with a deposit of $100, try following the steps below:

Step 1. Identify the trading instrument

In the initiation step, choose a good broker besides the trading instruments. A good broker contains many options for traders to enjoy flexibility in trading. In this step, try to choose a good broker.

Meanwhile, selecting a micro account type will be appropriate with a $100 as if you choose a standard account with a $100 capital, it won’t allow you to participate in frequent trades. However, selecting a good broker and mini account is time to choose the trading instrument. In that case, most traders choose the major pairs of the forex market such as EUR/USD, USD/JPY, GBP/USD, USD/CAD, etc.

The reason is simple: these pairs have sufficient volatility, are widely demandable, and fundamental data are also available. We suggest doing some research and checking the history of price movement before choosing any trading instrument.

Step 2. Try to understand your goal

The forex market is a marketplace with unlimited opportunities. There is no limit to making profits, but it always requires having a goal for individual traders. All beginners to professional traders have goals or targets to archive within a specific time.

For example, a day trader may plan to make a profit of 1% per trading day, and a swing trader may want to make 4-5% on every position they open. So you have to determine your profit target. Most professional forex traders have a 5-20% monthly profit target. Having reasonable goals will help you to participate in the marketplace with discipline.

Step 3. Move to upper timeframe charts

The time frame is another relative factor while trading in the financial market. For example, scalpers or day traders spend a lot of time in front of monitors to analyze and make positions, while a position trader or swing trader may enter a few trades weekly.

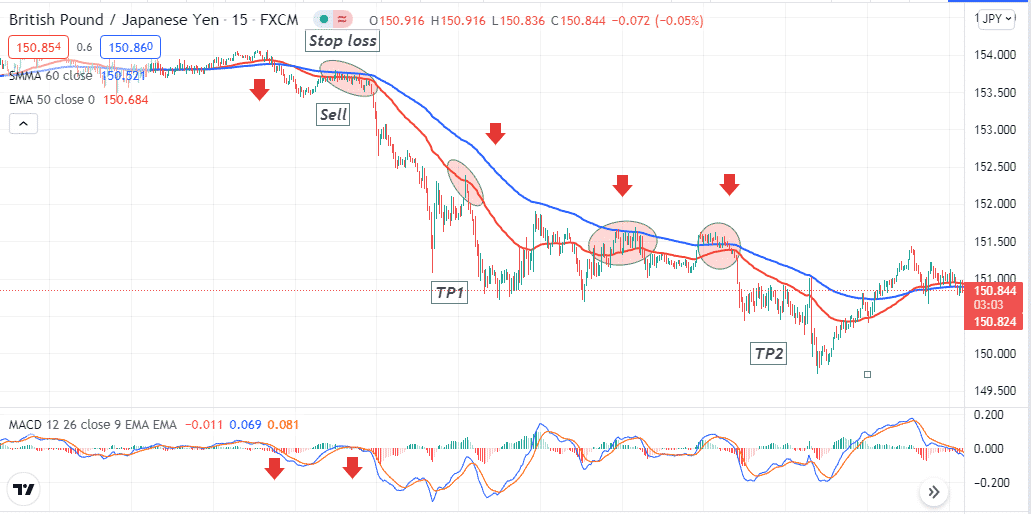

A day trader may not hold positions overnight; meanwhile, a position trader may hold a position for a few days even weeks. You can have a birds-eye view of the asset price movement by doing a multi-timeframe analysis, which is an intelligent decision as it helps to determine the most accurate entry/exit positions. Moreover, keep updated on fundamental events about your target assets by following reliable sources.

Step 4. Use appropriate trading strategy

The trading method is a mandatory fact for any financial trader. It helps to have discipline in trading and execute constantly profitable trades. Moreover, following proper strategies allow traders and investors to reduce trading tension and fear.

Developing any trading strategy includes forming market ideology, choosing trading assets, selecting timeframes, using tools and indicators, executing trades, etc. Remember, a trading method should be quantifiable, consistent, and objective. Proper trading methods allow you to have risk tolerance, increase profitability, and guide you to achieve your goal. We recommend backtesting any trading method before applying it to a live account.

Step 5. Use proper money and trade management rules

In the last step, achieve your goal through having a professional mindset. Follow acceptable trade and money management rules while executing trades. When choosing any trading method, it will suggest entry/exit positions and allow having a reasonable winning rate on executing trades.

Mindset is another essential fact as no trader is hundred percent right all the time. So you will have losing trades that can lead you to have stress. Overcome that stress and don’t let it influence making following trade decisions. Using appropriate money and trade management rules will be easy to avoid trading stresses.

Please don’t misuse the leverage on trading as most novice trades blow their first account by misusing leverage and don’t follow discipline or emotional trading/revenge trading. Most professional forex traders think taking the risk of 2-5% capital on executing trades is tolerable, not more than that.

Final thought

These are the primary procedures to start trading with a $100 deposit. It may seem simple, but 90% of losers do not lose their capital following these textbook rules. You should always be goal-oriented if you want to be a successful forex trader. To survive long in the forex market requires obeying rules and doing more research. Moreover, we suggest not executing trades and avoiding trades during trend-changing fundamental events when you don’t understand or predict the price movement.