- Is breakout strategy profitable?

- Is it a good strategy?

- What is the most profitable FX strategy?

To succeed in currency trading, you have to trade with an edge and let it play out. Of course, hoping to be right 100% of the time is not possible. It would help if you achieved a win rate that complements your risk-reward profile to succeed.

You do not need a holy grail to trade forex. A holy grail does not even exist. You can use a simple strategy with clear rules that you can execute with confidence. If you stick to your plan consistently, you can expect your edge to play out in time.

One way to spot good entries is through the use of breakout trading. In this lesson, you will learn a simple method to trade breakouts. You do not need to memorize price patterns. You will see them before breakouts. You need to know the process of scanning charts, following price action, and finally trading breakouts.

If you are ready, move on to the next section. Let us have a short review about breakouts.

What is a forex breakout?

It occurs when the price penetrates and closes on the other side of a support or resistance level. Be aware that support/resistance levels are not always horizontal. They can be inclined, as in the case of trend lines. They can be curved lines like the moving averages.

When you notice that price fades away after touching a level, that will give you a clue that this level has supporting or resisting power. When the price returns to test that level, be watchful. When this happens, one of two things can happen. Either price breaks through, or it rebounds again.

If price cannot break through a level after several attempts, this is an indication that the level is extreme. However, at some point, a level will eventually break to give way to a new trend. Every time a level is broken, a breakout trading setup exists.

Where do breakouts occur?

They may occur in the context of trend reversal or continuation. A trend reversal breakout occurs when price enters either an accumulation or distribution phase. When a market is trending, the price can stall and form a range or a price pattern.

The best breakout trading setup occurs when the price makes a pullback during a trend. Price often forms a pattern during pullback, the breakout of which in the trend direction is highly tradable.

These are some of the patterns that form during retracement:

- Flags (or rising and falling channels)

- Horizontal trading ranges

- Wedges

- Triangles

- Head and shoulders

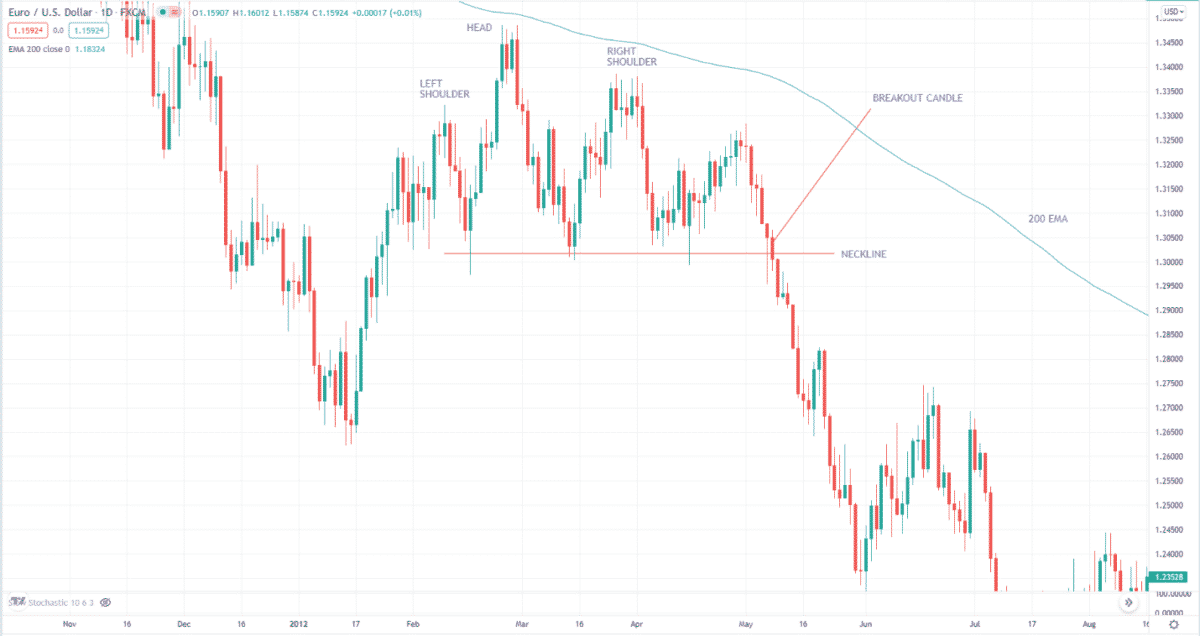

Various types of patterns can form during pullback. The above image shows a head and shoulders pattern during the retracement of a bearish EUR/USD market. Trading the breakout of this pattern in the trend direction is one of the most highly probable setups in existence.

How to trade with the forex breakouts?

Trading breakouts is not only about learning the common patterns. You need to have a trading plan in place that is intended to spot breakout scenarios. Your trading plan should include several elements and should answer the following questions:

- Is the market ranging or trending?

- Is the price oscillating or moving straight?

- Would you trade reversals or pullbacks?

- What indicators and other tools will you use?

- What series of events should transpire before you take an entry?

- Where will you set the stop loss?

- Where will you put the “take profit”?

- What risk-reward ratio will you accept?

How to confirm forex breakouts?

If you are a conservative and patient trader, you can qualify a trade candidate further until it becomes a high-quality entry. The downside is that you could miss some opportunities. If you are such type of trader, you can follow these steps:

- Find a candle break and close beyond a level.

- Wait for a retest of the breakout point.

- Wait for a bounce from the breakout level.

- Wait for the price to break the new high or low after the breakout.

This type of trade entry is known as a break-and-retest strategy, a subset of the breakout method.

Which is the best strategy to trade with forex breakouts?

The best way to trade breakouts is to go with the direction of the overall trend. You can trade any time frame, but the higher time frames such as H4 and daily are better. Whatever chart you end up trading, you must understand the general trend.

Next, wait for some correction in the form of consolidation. This is where patterns develop, and you will trade the breakout of these patterns, expecting the trend to continue.

For example, if the trend is bearish, you want to see a move against this trend. That is what we call a pullback, retest, or correction. The correction may come in the form of a flag, triangle, wedge, horizontal range, etc. Let us consider some examples to illustrate the concept.

Bullish trade setup

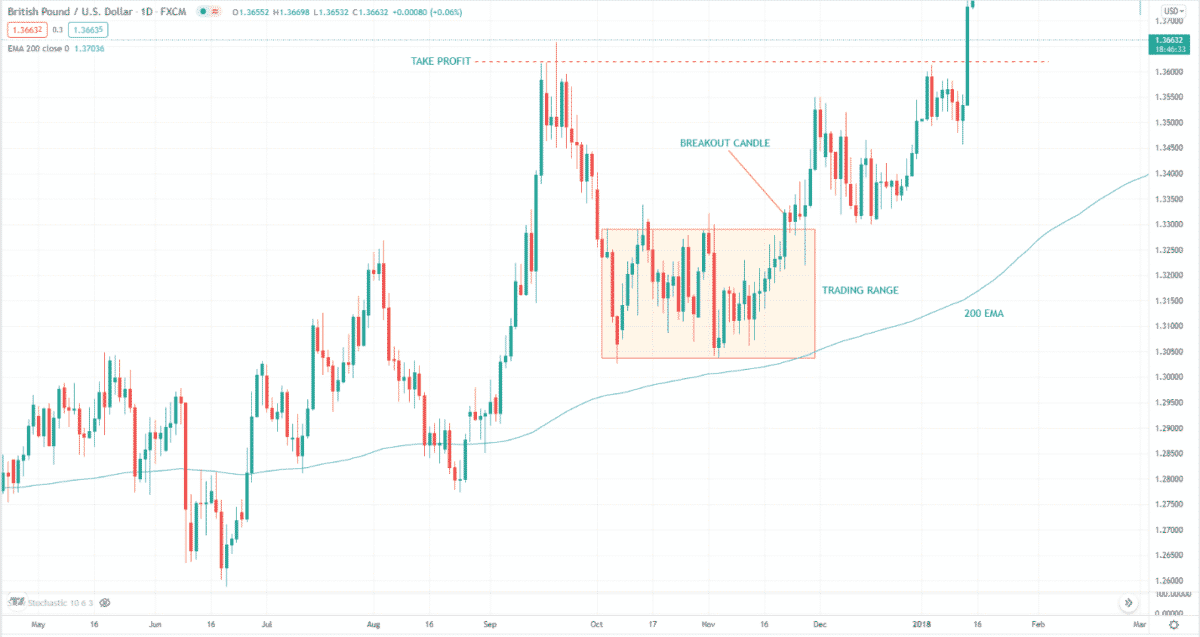

The above image shows an example breakout trade from GBP/USD daily chart. Judging from the price location concerning the 200 EMA, we can conclude that the trend is bullish. When the price corrects, it enters a horizontal trading range.

When the price breaks above the rectangle, we can say that correction is over, and the uptrend may continue. Therefore, you will open a buy trade when a candle breaks out and closes above the rectangle. The stop loss is a bit difficult to set in this scenario. However, you can set the take profit at the recent swing high before the correction.

Bearish trade setup

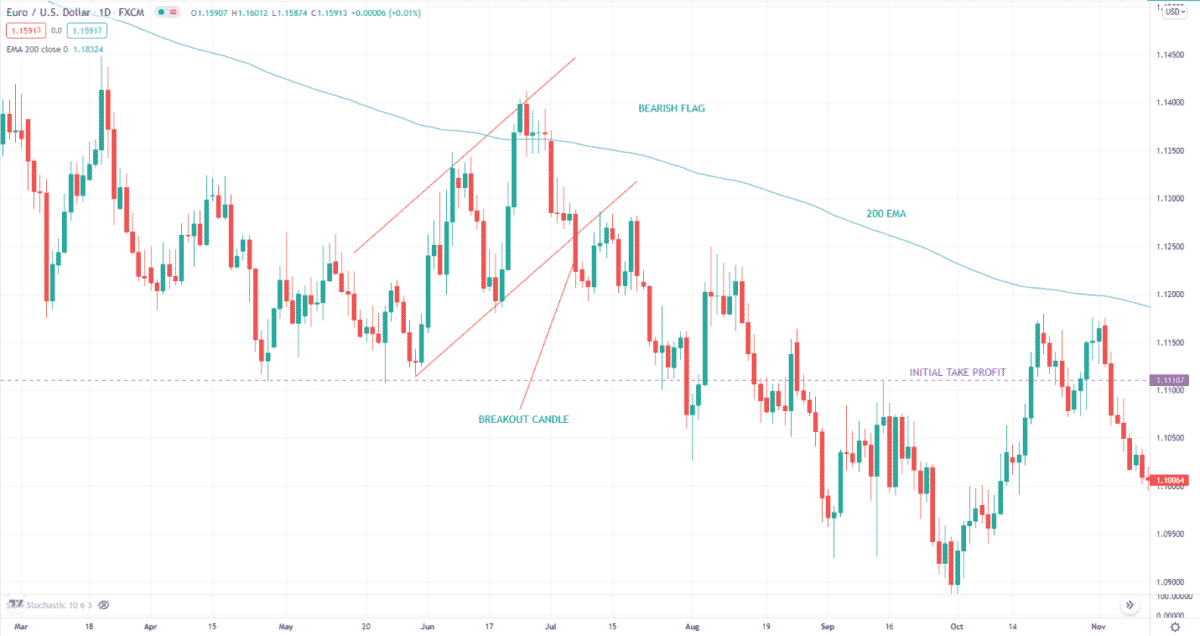

The above image shows the daily EUR/USD chart. Here the trend is bearish because the price is generally moving below the 200 EMA. When the price corrects, it forms a flag in the process. The break of this flag to the downside is your entry signal for a breakout trade.

Setting the stop loss is also challenging. What you can do is use the daily range, say, for the past 20 candles. Whatever this value is, use it as your stop loss. Again, you can place the take profit on the recent swing low before the correction.

How to manage risks?

To manage risk, you have to put a stop loss to each trade entry. Place the stop loss in a level you think is safe. This level should not be too far from your entry. Having a wide stop loss can be good or bad to your results. Regardless, see that your take profit is more significant than your stop loss.

The ratio of reward to risk is entirely up to you. The most common recommendation is a 2:1 reward-risk ratio. However, nothing stops you from using a 1.1 or 1.2. Evaluate your performance and find the best reward-risk ratio after a handful of trades, say, ten trades.

Final thoughts

Trading breakouts is one of the most lucrative entry strategies in forex. You can find plenty of trading opportunities every week with this method alone. You do not have to go to lower time frames to find such opportunities.

If you want to trade this method, you cannot approach it lightly. If you are serious about trading, you cannot do it without a plan. Your trading plan should dictate your trading activities.