- How do you risk management in trading?

- Why is it so important?

- What are the top ways to manage your risk for fewer losses?

Risk management helps identify the threats to plan and analyze them by standard predefined approaches or other means, eventually determining measures to moderate them.

By using proper risk: reward ratio, say even 1:3, traders can potentially make 15-18% consistent profit from their invested capital. It will also keep you safe from unwanted situations and bad market phases by stopping you out.

Traders may use any risk management tools and strategies but finding some important ones are crucial. Do you want to know a few of those tools that can help you manage your risk?

Please pay attention to this article as it has some straightforward five top risk management tools for fewer losses.

Why is trading risk management important?

Understanding the importance of risk management is crucial and must be known by every trader irrespective of the market he is trading in.

You probably can make some profit, but you won’t be in the market for an extended period without a proper risk management strategy. It has to be very clear in your mind that trading has millions of sentiments and is unpredictable.

Following firm risk management will help you save your capital from losses so that you can trade in the market for long.

What is risk management in trading?

It is a strategy that allows you to be safe even if the market is against you. It also safeguards you from different emotions that you must keep in check.

You can think of it as an example of you going into a war but with just your sword and not your shield. Meaning you will have a tool to fight but no tool to defend yourself from the opponent.

Now, an opponent in trading is the players who are trading against you. Managing your risk will give you confidence, and you will trade better after knowing you will be safe even after the market is moving against you.

How does trading risk management work?

It is essential to know that a good trader is not someone who takes the trades, makes a good percentage once or twice. Excellent and professional traders are those who follow a strategy and make some decent percentage consistently. And to make this consistent, you will need a risk management strategy.

One thing is guaranteed in trading, and that is that you will make losses. Without a proper risk management strategy, your losses will increase, affecting you psychologically with time. Therefore, you must keep losses to a minimum, and there are various things you can do to achieve this.

However, your mental ability will help you maintain a trading discipline, which is where the psychology of risk management comes in.

The psychology of risk management

Trading is mostly psychology; even if you have an excellent winning ratio, you won’t survive in the market if you do not follow proper risk management tools and strategies.

The application of such management tools is like starting a new habit; the more you do it, the more disciplined you will be. It is like training your mind to follow a methodology to not fall into the trap, so many traders find themselves.

The same way losses influence your psychology, so winning does. Traders often think that if they have an excellent winning ratio, they can now increase their risk to make bigger profits. However, this is another downfall of so many traders.

Top five ways to manage your risk for fewer losses

There are numerous ways you can manage your risk. As risk management is more of a psychological aspect, it depends on individual sentiments on what strategy to adopt and follow.

Nevertheless, some best risk management tools and strategies work and can also pave your journey to become a professional trader.

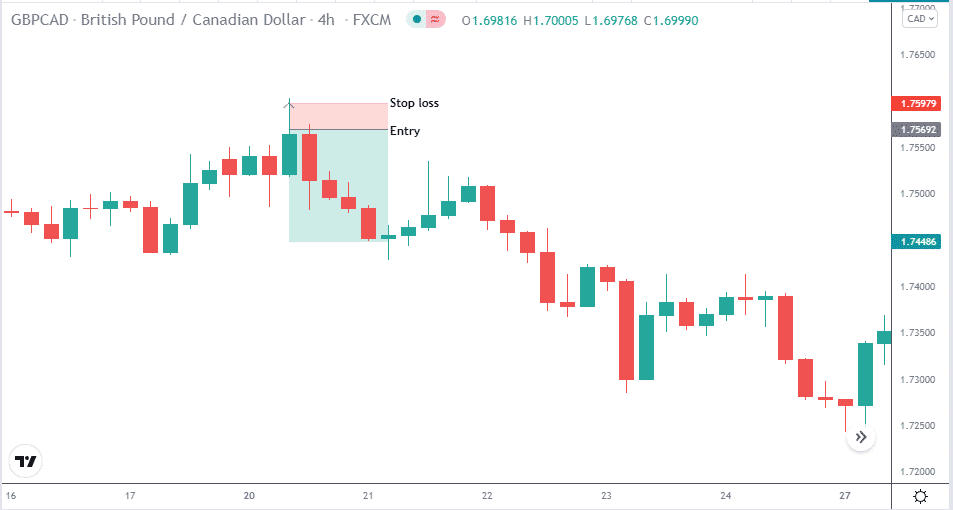

1. Place the stop loss

As a trader, the very first thing you should do is decide on your stop loss. Many traders get into the trade and do not place their stop loss, but those traders do not last long in the market.

Not placing your stop loss brings a lot of emotions in you if the trades go wrong. The trader waits for the market, hoping it will come to the entry price again, but unfortunately, the market does not care about the individual’s feelings. Hence, it is always better to lose some amount, accept your mistake, come out of the market, and get back into the trade with better and rewarding trade opportunities.

To lock your profit, you can also use a trailing stop loss.

2. Take the right lot size

The majority of the risk is because most traders try to make more money in a short period. This, in terms, brings the feeling of greed in the trader, and they take a bigger lot size.

Lot size must be decided before entering the market, according to the capital you have in your account and the amount you can manage to risk to make a desirable profit.

Every time you enter the market, the lot size will differ according to the trade setup.

3. Use the right strategy

Out of so many strategies in the market, you must have your strategy or something that works for you. Making your strategy is worth it but takes a lot of practice, dedication, and knowledge.

Not following the right strategy is just like gambling, as you won’t know why you took the trade when to take profit and come out of the market. When you use a strategy that works for you, you can better align your risk management techniques.

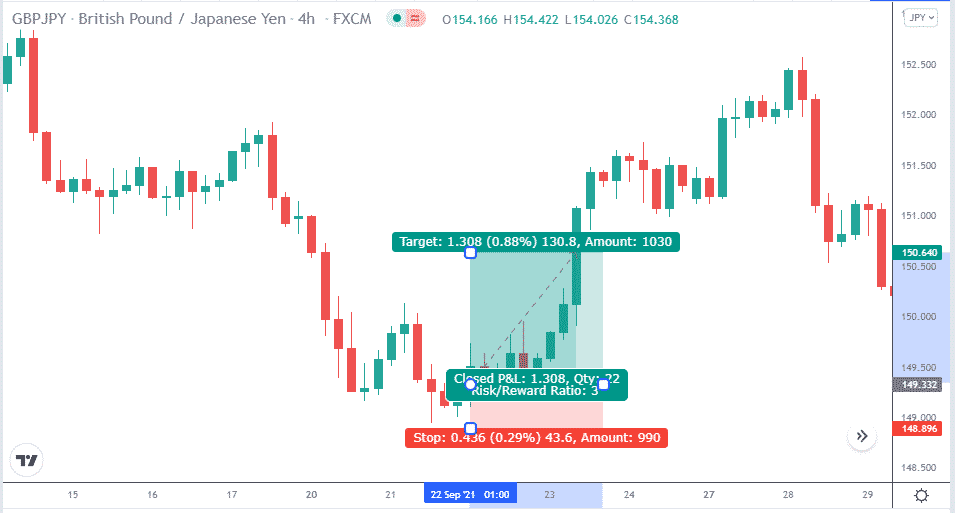

4. Focus on proper risk: reward

A popular risk management tool is the risk: reward ratio that works by taking calculated risk per trade. For example, you take a 1% risk per trade to gain 3%; this is 1:3 risk: reward. Even if your winning ratio is 50%, you will still make insane profits as when you are losing, you are losing $1, and if in profit, you are gaining $3.

5. Understand and control leverage

Leverage means that you can trade more money than your initial deposit, thanks to margin trading. Your broker will only ask you to put aside a small portion of the total value of the position you want to open as collateral.

Traders often take more leverage on their accounts to ensure more profit. But leverage works both ways around, no doubt, when you make a profit, it will be more, but when you end up at a loss, you will lose more also. So always keep your leverage moderate.

Final thoughts

Now, if all these risk management techniques seem overwhelming, that’s because there’s a lot to consider.

This is a tricky business that will humble you. But by implementing the trading risk management tips above, you can work to stay in the game longer. Risk management is crucial at every stage of trading. Learn it early and continue to work at it.