- What will happen to my trade if the market moves in a specific direction?

- What elements factor into the computation of trade gain?

- What is pip value, and why is it essential in calculating gains?

Foreign exchange is the largest financial market in the world. Because of this colossal size, trading is very liquid. You can get in and out of positions very quickly, that is, in a fraction of a second. With a computer and internet, you can set up a trading station right inside your home. You can even trade anywhere through a mobile device.

While forex trading is convenient, becoming profitable is difficult. You have to monitor your performance to improve your results. This includes understanding the profit or loss in trades. Trade profit or loss is computed automatically by your trading platform. Knowing how to compute it is not necessary. However, if you want to build a trading algorithm, you can learn it fairly quickly.

What are forex trade gains?

When you open a trade, the result is either win or loss. If the market moves in your favor, you will win and make money. If the market moves against you, on the other hand, you will lose money. The chance of winning or losing is 50 percent.

A forex trade gain occurs, for example, if you take a buy trade and the market goes up. Conversely, if you sell or short the market, you will make money when it goes down. There are at least three elements to become familiar with when it comes to computing trade gains:

- Currency pair

Your trading platform typically offers various instruments, such as EUR/USD, GBP/JPY, USD/CAD, etc. It would help if you stuck to the major pairs to pay lower transaction fees.

- Entry price

You have to determine which price you like to enter the market. You can decide this ahead of time. It usually depends on your entry strategy.

- Closing price

What price did you close the trade at? It does not matter what happens to the instrument after you initiate your trade. Even if the market goes with your trade initially but does not close the trade, you will not make money. Where you close your trade-in reference to your point of entry determines whether the trade wins or loses.

How to calculate forex trade gains?

Many variables go into the equation of computing the forex trade gain. We outline them below:

- Account type (i.e., standard, micro, mini, etc.).

- Base units (e.g., 100,000 units for a standard account).

- Pip value. This is the value of one pip of movement of a traded currency pair.

- Lot size or volume. This is the trade size that you define in your trading platform.

- Point. This refers to the fractional price change of a currency pair.

Let us take an example to illustrate the profit calculation clearly. Suppose you have a mini trading account. You bought EUR/USD at the price of 1.20252 with a volume of 0.15. To make a profit, the exchange rate should go up. If it does go up and reaches 1.20752, how much profit did you make?

| Account type | Base units | Pip value |

| Standard | 100,000 | $10 |

| Mini | 10,000 | $1 |

| Micro | 1,000 | $0.10 |

| Nano | 100 | $0.01 |

| Cent | 10 | $0.001 |

First, let us determine the amount of pip gained. Take note that 1 point of EUR/USD is equal to 0.0001.

Pip gain = (closing price – entry price)/point = (1.20752 – 1.20252)/0.0001 = 50

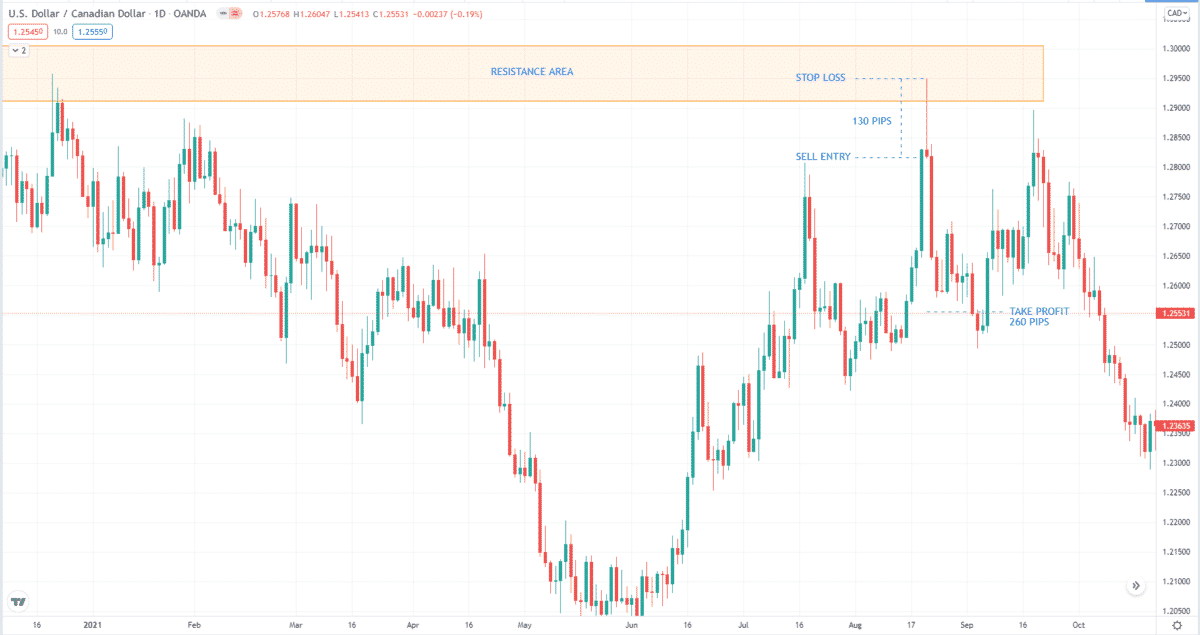

Next, let us compute the pip value. Be aware that the pip value listed in the table above is for one standard lot. For example, one lot for a mini account corresponds to $1 per pip. By ratio and proportion, we can get the desired lot size:

Pip value = (0.15/1.0) ($1) = $0.15

Then we can determine the actual profit in dollars using the formula below:

Profit = Pip gain x pip value = 50 x $0.15 = $7.5

Trade samples

You can use any trading strategy to catch forex pips. Of course, these trades are profitable. However, in reality, you will have losing trades and quite many of them. Here we provide buy and sell setups to help you understand how to compute gains in both directions.

Bullish trade setup

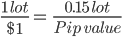

Consider the above buy setup. This strategy is known as candlestick trading with support and resistance. Our entry trigger here is the bullish candle (we call it “pin bar”) that makes a false break of the obvious support area. The strong rejection suggests that a bullish move is likely to occur.

You can trade this setup as shown above. Your entry is at the close of the pin bar, and the stop loss is the low of the pin bar. The distance between entry and stop is 165 pips. Using a risk-reward ratio of 2:1, we get the take profit of 330 pips above entry. Continuing with the example above, if we use a mini account and trade with a volume of 0.15, the trade profit would be $49.5 (330 x $0.15).

Bearish trade setup

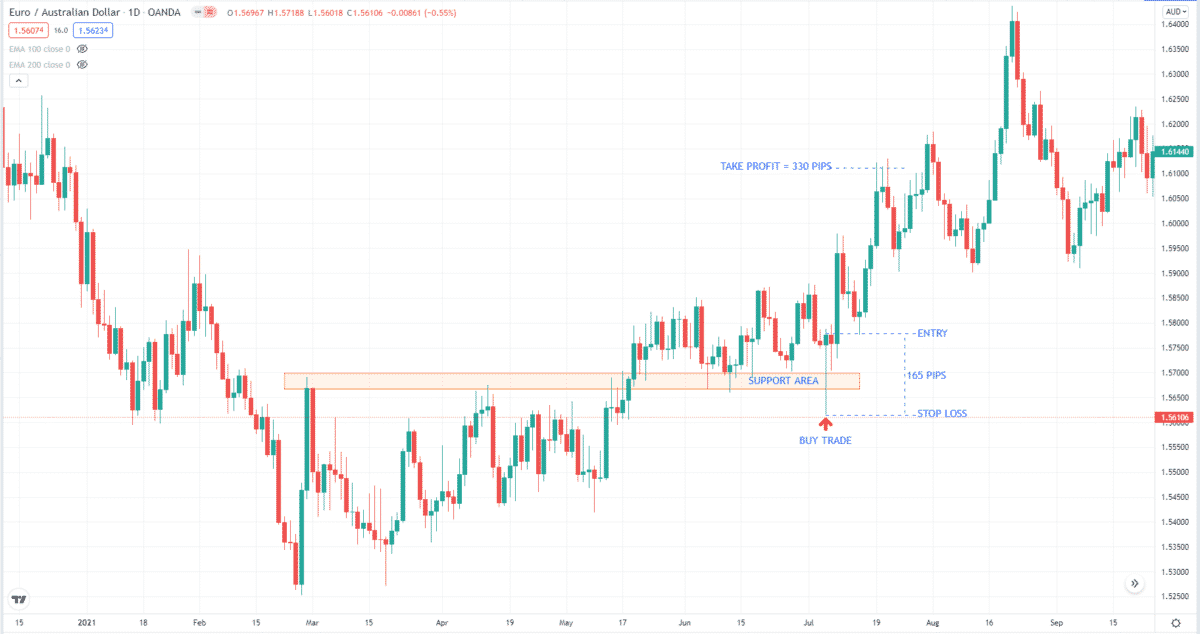

Let us consider the above sell setup on the USD/CAD daily chart. This strategy is known as candlestick trading. Other traders call it price action trading.

This trade works due to two factors:

- First, we have a resistance that price retested and rejected. This is not obvious in the chart above because the structure is on the left and not visible in our frame of reference.

- Second, the price rejected the area with a bearish pin bar.

After the pin bar closes, you can open a sell trade. Your stop loss goes to the top of the pin bar. The distance from entry to stop is 130 pips. With a 2:1 reward-risk ratio, the take profit goes 260 pips below entry. When the price hits our target, the profit is $39 (260 x $0.15), assuming a mini account and 0.15 lot.

Final thoughts

Knowing how to calculate gains in your forex trades is a basic knowledge that every market participant should know. It will allow you to understand how much you can make in a trade entry.

At the same time, you will learn how much risk your trade exposes to your account. You need to know certain concepts and terms before you can compute the trade gain. As you do this process repeatedly, you will calculate the potential profit or loss mentally rather quickly.