- How to accumulate a decent retirement?

- What strategies enhance the retirement fund account?

- What is the type of investments offered under 401k accounts?

Securing a fun and comfortable retirement life is not a guarantee because you contribute to a retirement account. It takes careful planning and investment portfolio rebalancing until when the first withdrawal is made.

Ensuring a fact retirement fund to live off as a king requires an understanding of the above questions.

Investments offered under 401k accounts

To ensure that the populace does not suffer in retirement, the government restricts the investment assets available to 401k accounts to those with very low-risk levels. Most 401k account managers invest in mutual funds, although most have adopted investing in exchange-traded funds.

Depending on individual retirement needs and risk tolerance levels, you can choose from among the following options like your 401k investment vehicle:

- Conservative fund

A portfolio of the most risk-averse investment instruments, usually government bonds. Results in slow but consistent account growth.

- Balanced fund

A portfolio comprises low, medium, and high-risk investment assets to ensure low to moderate portfolio risk and moderate account growth.

- Value fund

Made up of undervalued equities of blue-chip companies. Excellent for a steady income flow through dividend payouts and average account growth due to undervaluation.

- Target-date fund

It is a portfolio whose investment strategy is time bond; aggressive initially and very conservative when retirement approaches. Associated fees of this portfolio are relatively higher.

- Aggressive growth fund

It is a high-risk, high-return investment asset portfolio, constantly screening for the next Tesla and Amazon. Not advisable for those nearing retirement because the probability of losing all your investment is high.

- Specialized funds

A portfolio comprising assets is considered outside the scope of normal market activities; emerging markets, pharmaceuticals, and the tech industry, especially new technologies.

Strategies to enhance ROTH 401k account

Now that you have chosen the best portfolio for your 401k account to meet your retirement benefits while giving you peace of mind, how do you enhance its performance? Investing in retirement life should be about survival and living the desired life given all the sacrifices up to retirement.

These six strategies are a good starting point for ensuring a 401k retirement account akin to the king’s ransom.

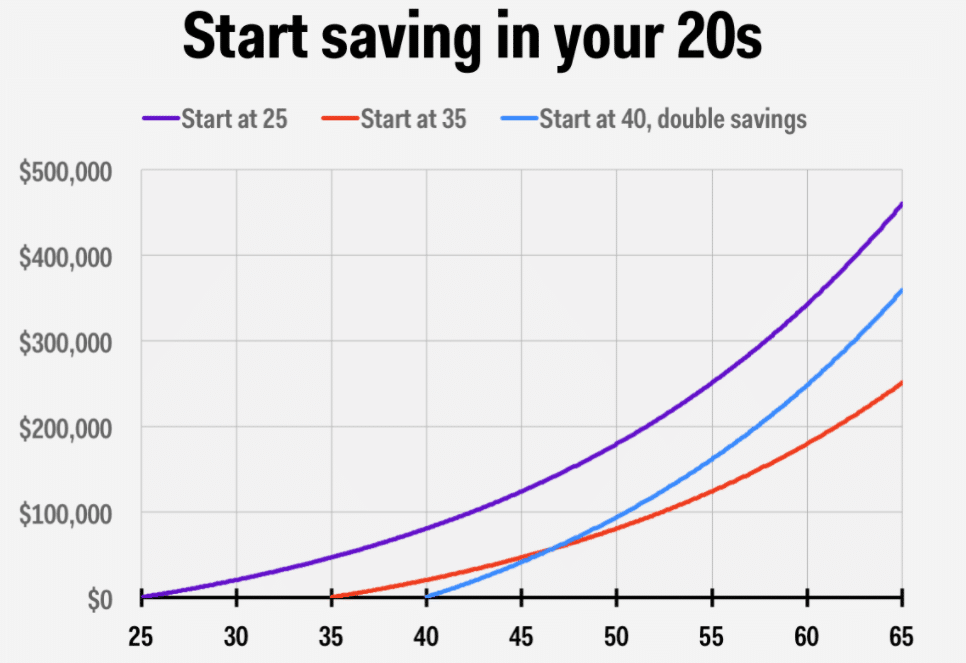

№ 1. Commence early

With investment and almost anything else in life, procrastination is not advisable. Early in someone’s career, the annual income is low, and so is the tax burden. Opening a 401k, especially a ROTH account, results in a reduced tax burden compared to the tax burden payable towards the end of one’s career, assuming income grows as the years’ pass.

Starting investing early also results in more compounding time, allowing for the portfolio to grow consistently over a more extended period. An early start also allows for experimentation with different portfolios for maximum returns during retirement.

№ 2. Limits

Being knowledgeable on the maximum allowable contribution helps one structure their 401k accounts for a fat balance on retirement. As of 2021, the maximum permissible contribution for 401k accounts is $19500 for individuals aged 50 and below.

Individuals aged over 50 have an additional $6500 allowable add-on contribution. The total allowable annual contribution remains even when split between traditional 401k accounts and the ROTH version.

The IRA also has limits on how much an employer can match individual 401k contributions. The 2021 maximum allowable limit is $58000. Knowing the limits ensures the chosen 401k contribution plan takes advantage of the employer matchup benefits to the maximum.

№ 3. Withdrawals’ planning

At present, the IRA requires anyone without an income to withdraw from both their regular 401k account and 401k Roth accounts a minimum amount, Required Minimum Distributions. RMDs, Required Minimum Distributions, attract a 50% fine on the amount withdrawn. Transferring 401k accounts into a ROTH IRA account eliminates the need for RMD and paying hefty penalties for wishing to continue enjoying investment compounding effects.

Before the age of RMD, 72-years, rather than withdraw funds and incur taxes on a traditional 401k account, take out a loan. The law allows individuals to borrow up to 50% of the retirement account fund, with a 5-year repayment period.

№ 4. Hedging

To hedge means to mitigate against a particular risk. Life as we know it is unpredictable, and tomorrow is uncertain. Funding both traditional 401k accounts and ROTH 401k accounts act as a hedging strategy against taxes. The consensus is that with experience and the passage of time, individual income rises.

However, there are occasions where the income at retirement is lower than at the beginning. Both account types ensure you enjoy lower taxes now and either lower or higher taxes at retirement, depending on the prevailing income situation.

№ 5. Roth IRA

The IRS allows individuals to fund both 401k accounts and ROTH IRA accounts as long as the income limits of the ROTH IRA accounts are not exceeded. Both accounts allow for transfer from 401k accounts to ROTH IRA accounts as a hedging strategy against RMD and the associated fees.

№ 6. Continuous monitoring

401k accounts and other retirement accounts are all about steady growth over the long term. Unfortunately, this does not mean leaving these portfolios unattended. The advisor should look at the account statement annually to identify assets doing well and those performing below average and rebalances the portfolio accordingly.

Final thoughts

It is never too late nor too early to start saving for retirement. After a life full of sacrifices, one deserves to sit back, relax, and eat off the work of their hands. The strategies discussed herein are the first steps towards a blissful retirement life.