- What causes the dip in cryptocurrency?

- What indicates if the dip is already falling beyond what you can endure?

- How will you know the right amount of dip to buy crypto?

A country’s legal tender is not the only currency accepted anymore. Cryptocurrency has made its way into the financial system and is used worldwide. In economics, when prices of goods fall, consumers are highly likely to buy them. People love to buy goods at discount prices to save a few bucks because they know prices will eventually return to normal levels. Buying the dip in cryptocurrency has the same logic.

There are a lot of factors to consider upon deciding to buy assets at half the price, especially in cryptocurrency. They say you are not saving 50%; you are spending 50%. There are limits to keep in mind when buying the dip. Learn these tips and get to know more about cryptocurrency as you go along and dig more about buying the dip.

What is crypto trading?

Crypto trading is the act of analyzing cryptocurrency price movements. It is a virtual currency protected by cryptography. Without third-party intermediaries, market participants engaging in crypto trading use secure online payments.

There are two known ways of crypto trading:

- One is via a trading platform

- Another is buying and selling coins via an exchange

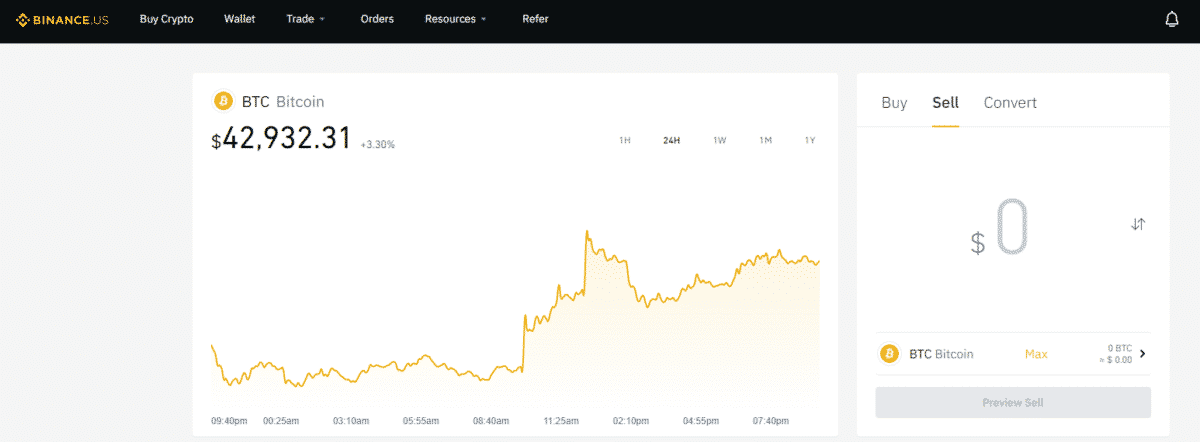

Bitcoin is the most widely held crypto asset and is generally considered a store of value. The cryptocurrency was invented in 2008 and began its use in 2009. Approximately 2.1 trillion USD changes hands every day in the crypto market. Examples of crypto are ETH, XRP, BTC, etc. The image below shows BTC’s daily chart and its price behavior over the past year.

How to trade crypto?

There are two main routes in trading cryptocurrencies: buying and selling coins via an exchange. In this option, you will pay the cost directly and gain profit when coins rise in value. There are a lot of exchanges where you can do crypto trading. A few examples are Coinbase, Gemini, Binance. They give you access to decentralized financing services.

The other route is through trading derivatives. You can speculate on the price movement without owning coins by trading derivatives. This gives you the option to pick a long and rising or short and falling position. This feature is not available if you buy coins via a cryptocurrency exchange.

By using derivatives, you can use leverage. This means putting a margin, a small amount of money used as a deposit, to buy and sell vast volumes of crypto assets using borrowed capital. For example, a broker will require a three percent margin to initiate 20 times leverage. If you are planning to buy $6,000 worth of Bitcoin, you must have $300 in your account to execute this transaction.

How to buy the dip in crypto?

Before we tackle how to buy the dip, let us understand what buying the dip means. “Buy the dip” is buying an asset after a drop in value. In other words, it is investing in a coin that has experienced a fall in its price, whether short or long term. These dips in price may be caused by, but are not limited to, fundamental factors, negative remarks from giant entrepreneurs, and market dynamics.

There are two requirements in buying the dip:

- A fall in crypto price

- A sign that the price will grow again

Before deciding to buy the dip, keep these five tips in mind.

Tip 1. Expectations vs. limitations

Buying the dip does not always promise profits. History should tell you a fragment of how the dip happened. Align your expectations according to how the trend was behaving before the dip. As a beginner, check the lowest dip that the asset had for the past three months or so and consider it as the lowest point that you cannot go beyond.

Tip 2. Buy low, sell high

If you buy the dip, this is the strategy you will have in mind. However, managing the risk is vital to ensure you are not holding on too much to a losing asset. See how the trend is performing if it has an upward slope. It means that the movement may be unstable, but if it is going for higher lows and higher highs, the dip may be worth buying.

The image below shows the current bullish trend of Ether. While there are dips along the way, the successive dips are higher than the previous dips.

Tip 3. Futuristic perspective

The value of cryptocurrencies fluctuates all the time, so you might want to check the history of the asset per year. Please note that history will not guide you to an answer of yes or no. It will only lay out how far the asset is going year on year. Before buying, identify the possible direction according to what could have caused the dip now. After that, forecast the likelihood of the trend going on an unstoppable downhill.

Tip 4. You are in 21st century

Buying, selling, and trading have never been as commonplace as before. Buying the dip should not be as scary as it was in the past since there are already a lot of platforms backing up cryptocurrency. Several countries consider virtual currencies as assets and even accept them as legal tender. Moreover, there are platforms offering demo trading accounts for traders to practice their trading skills in a real market environment.

Tip 5. Stop whenever necessary

It can be overwhelming when you think of the dip in price and buy every time a little, or big dip happens. You have to set a limit that you still consider as part of the right move. It does not matter if everyone is buying; if the price is way below your target, you must stop. Not everyone wins every day. The important thing in buying the dip is controlling the risk of losing.

Final thoughts

No one can hit the jackpot all the time, even if you want to, but you will not also stay rock bottom. A crucial attribute when dealing with the dip is consciousness. You must know when to sell if the asset is losing already. Do not let feelings get ahead of your decisions involving lower than usual dips. Formulating strategies will always be the best surfing board in riding these cryptocurrency tides.