- What is leverage trading crypto?

- How does it work?

- Should you use margin trading?

Margin or leveraged trading is borrowing money from a broker or exchange to raise one’s position. Leveraged trades allow investors and market participants of all skill levels to grow their funds more quickly than they could with more conventional trading and investing methods.

An example of margin trading is a ten-time use of leverage. Your first order is essentially multiplied by ten. When we use margin trading, we can place a $1,000 bet as if we had $10,000 to stake. After the deal is concluded, whatever profit we make is compounded tenfold.

However, this advantage is not without risk. The original order is liquidated when a transaction goes the opposite way due to the leverage. For example, Bitcoin will be liquidated at $32,000 if a long position with 10x leverage starts at $35,000. To put it another way, a similar short position will be liquidated for around $38,600 in the same manner. However, the key point to note is that leverage trading is offered in futures trading only in the crypto markets, unlike the FX, which provides leverage for spot trading.

Even the smallest level of leverage should be avoided at all costs in the cryptocurrency market since it is so volatile. As a result, the primary goal of this course is to assist you in unraveling the many nuances of margin trading.

What is cryptocurrency leverage trading?

It is a term used to describe how investors may borrow money from brokers to enhance their buying power. In most cases, these funds exceed the investors’ account balances, but this facility is available for staking or for futures trading.

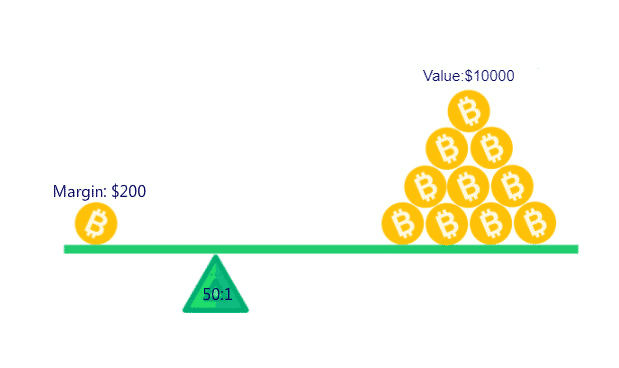

Consequently, increasing one’s purchasing power is an excellent way to raise one’s income. The best part of this kind of trading is that it only requires a small sum of money to get started. For example, starting with a $100 margin, a trader may trade up to $10,000 in margin size. In ordinary business, you can’t even imagine anything like that.

On the other hand, leverage trading involves a very high degree of risk and massive losses. To prevent themselves from making the same mistakes as more experienced traders, newcomers should stay away from this kind of trading. In contrast, experts in traditional trading may invest in smaller amounts for margin trading in crypto assets.

How does margin trading in cryptocurrency works?

Now that we’ve covered the essentials, it’s time to go further into some of the topics we briefly discussed before.

When you feel good about your possibilities, it makes sense to take a risk. Margin trading is just borrowing money to enhance your investment size. In return for a greater reward, you take on more risk.

Theoretically, you could buy $10,000 worth of BTC for $5,000 via margin trading. Thus, 50 percent borrowing is often referred to as leveraging 2:1 or 2X.

A lender, typically the exchange or other market participant, lends you an additional $5,000, which you immediately put down, and you may or may not pay interest while selling. As a result, you must pay back the money you borrowed, as well as any fees that may have been assessed.

It means that if you bet on Bitcoin going up and it goes down or stagnates, and you have to wait on your position, you’ll accumulate interest. That also means that if it fails, you’ll be liable for the loan’s principal plus interest, even if you lose money in the process of borrowing it.

Liquidation costs are high on most exchanges. Therefore it’s preferable to get rid of a position early rather than wait for it to be liquidated. Using stops is a smart idea in light of those mentioned above.

You may use short or long leverage. In short selling, you’re wagering that the stock price will go down in the future, and if it goes up, you lose money on paper. You’re wagering that the price will climb if you go long, and if it goes down, you lose money on paper.

Risk management is essential since the amount you lose is directly proportional to the size of your total bid. If you manually close the trade at a predetermined price or the exchange calls it in because you’ve used all of its allotted funds, the position will not close.

How much leverage am I allowed to use in crypto?

Leverage of up to one hundred times is possible on certain exchanges. On the other hand, most exchanges only provide 1x-20x, with more conservative exchanges only offering 3x-10x. For example, on one exchange, BTC/LTC may have the leverage of 5x, yet on another exchange, BTC/USD may only have the leverage of 2x. Study the documents before acquiring margin since other specifics might differ from exchange to exchange.

Is it a good idea to trade with leverage?

Do your research and don’t engage in margin trading unless you have a specific purpose for doing so. Without borrowing money to establish leveraged positions, trading cryptocurrency may be a stressful experience. Trades on leverage caused many traders to lose money because they believed things would be different when volatile markets. Even if you don’t have the same level of caution that we do, you may still trade on margin.

Sample of the leverage-based crypto trading

We’ve now arrived at the next logical conclusion. You must have enough money to pay the wager, as previously specified. If you don’t have the money, your position will be closed, “liquidated,” or “called in.” You will be responsible for any losses and expenses incurred due to using the lender’s funds to margin trade. According to the friend who loaned you $50 in the Investopedia quote, “the lender is letting you borrow money, not having it to lose.”

Whenever the market moves against you and falls below the “Maintenance Margin Requirement (MMR),” the exchange will either sell your assets to recoup its money. Otherwise, it may ask you for the cash. The latter is almost always the case in crypto since most exchanges have an automated “liquidation engine”.

A “liquidation” or “margin call” is a technical term. To avoid it, you may add more money to the order book where the margin is stored. For example, BTC/USD. Depositing more money increases your margin ratio and hence your call price.

For those unfamiliar with the jargon, margin trading is a technique to make more outstanding bets at the price of increased charges and risks. Using the lender’s money for a gamble is OK, but if the wager loses, you’ll have to pay for it yourself. However, if you cannot make your margin call, the exchanges typically retain an insurance fund and, as the last option, may socialize losses among other margin traders. Isn’t it true that money needs to come from somewhere?

Sample trade

Let’s find out how to trade a bearish and bullish setup.

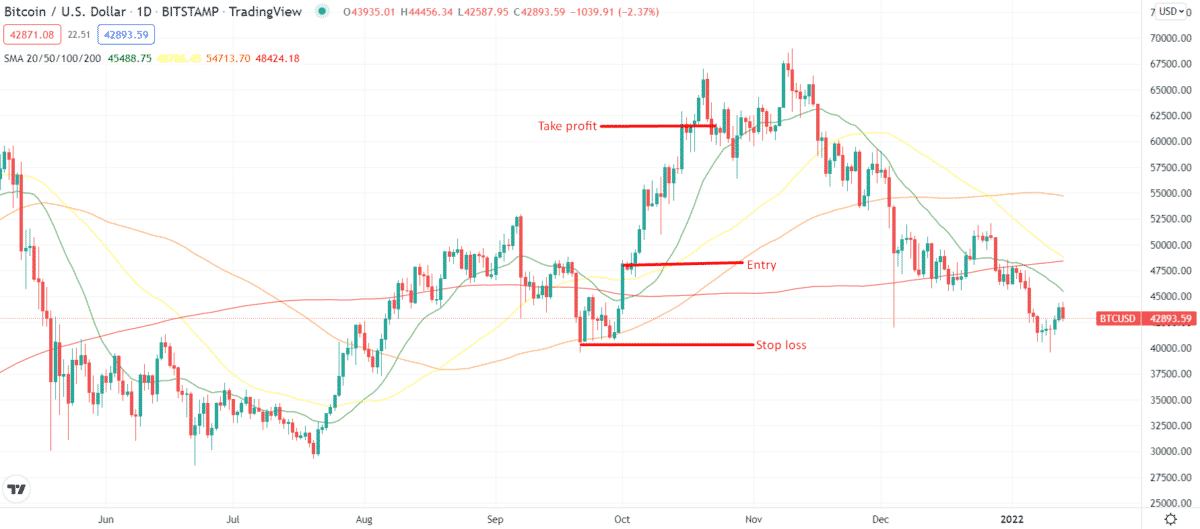

Bullish setup

Here’s the bullish trade setup explained.

- Wait for a big bullish candle to form on the chart.

- Enter after confirming the signal from the 20-period SMA.

- Place stop-loss around the swing low.

- Exit the position in profit when the price starts consolidating.

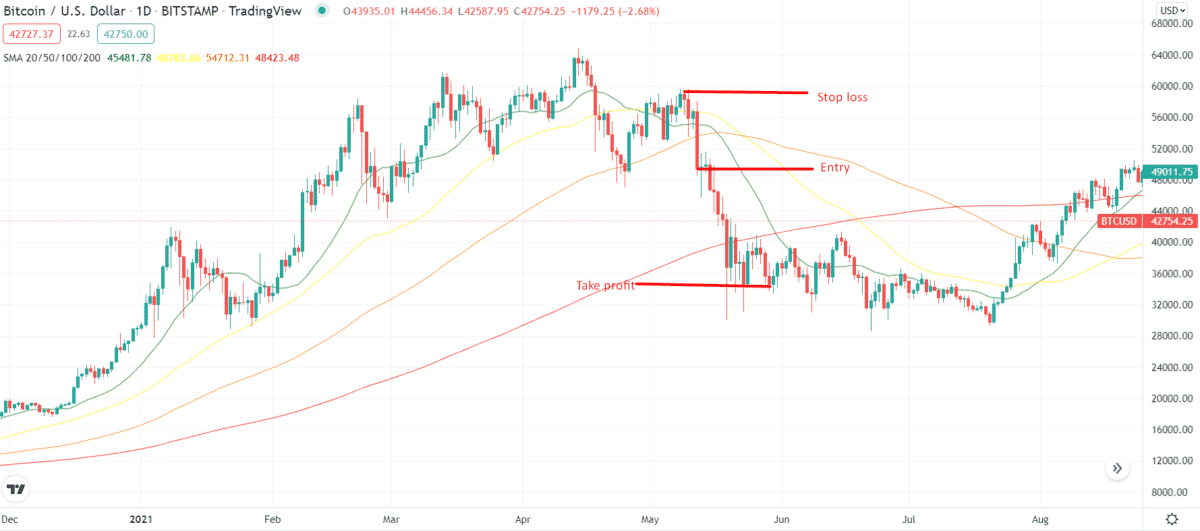

Bearish setup

Here’s the bullish trade setup explained.

- Wait for a big bearish candle (engulfing bar) to form on the chart.

- Enter after confirming the signal from the 20-period SMA.

- Place stop-loss around the swing high.

- Exit the position in profit when the price starts consolidating.

Final thoughts

Leverage trading, at first look, seems to be a little daunting. Unfortunately, the high-yield market is only accessible to traders with expertise. Make sure you’re aware of the risks and peculiarities of cryptocurrency trading before getting into action.

Many different resources exist for learning about leverage trading, but you must put your hard-earned money into the right place. Leveraged trading allows you to learn while minimizing the risk of huge losses if you invest smaller money.