- How are they safe?

- How do these coins affect the crypto market?

- Which of them offers the best security?

There has been a trend on Twitter and Google search for “crypto crash.” it is a type of crypto pegged to the value of a government-backed currency, such as the dollar, or commodities like silver or gold. The total value of all cryptos is now reportedly $1.12 trillion, nearly a third of what it was in November, with a lot of that loss happening this week alone.

As a result of TerraUSD’s collapse, what we used to call the “panic” has begun. Major financial institutions have been selling large chunks of assets, and others have been trying to make money out quickly,” economist Frances Coppola noted. “We’re seeing panic.”

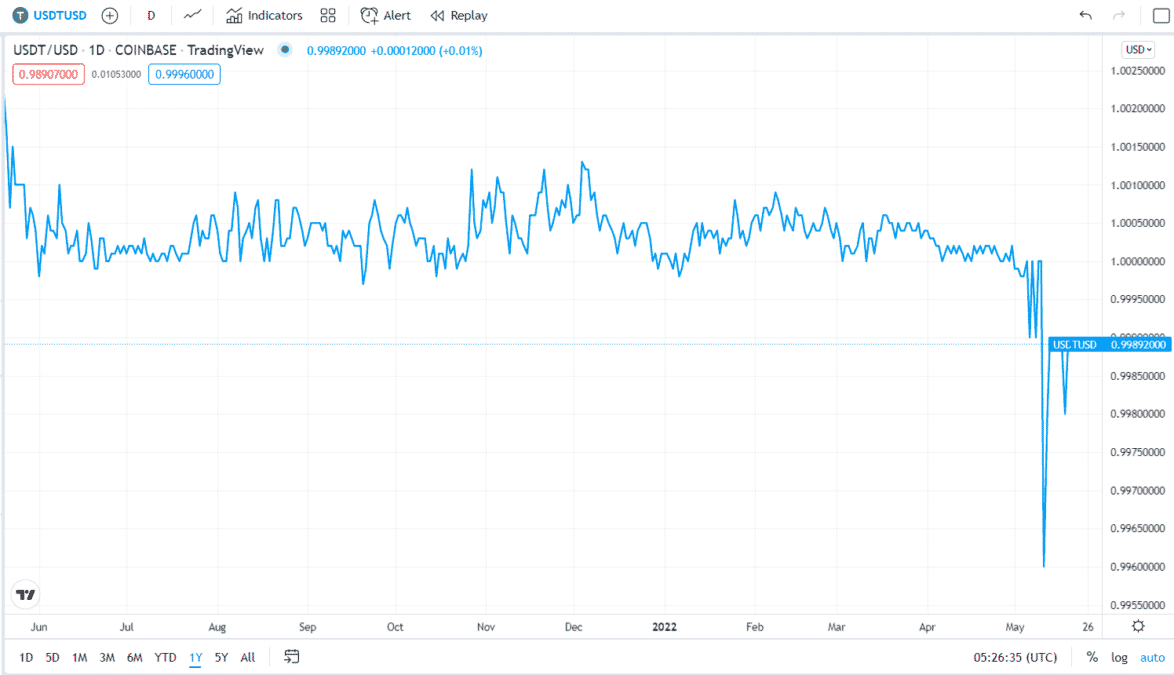

In light of TerraUSD’s collapse and Tether’s brief de-pegging, stability coins are increasingly under scrutiny. Although they can give investors flexibility, they should not lock in their capital.

What are stablecoins?

Stablecoins are cryptos with a pegged value to another currency, commodity, or financial instrument. It aims to offer an alternative to the high volatility of popular digital currencies such as Bitcoin, which has made them less suitable for wide-ranging use in transactions.

How do they affect the cryptocurrency market?

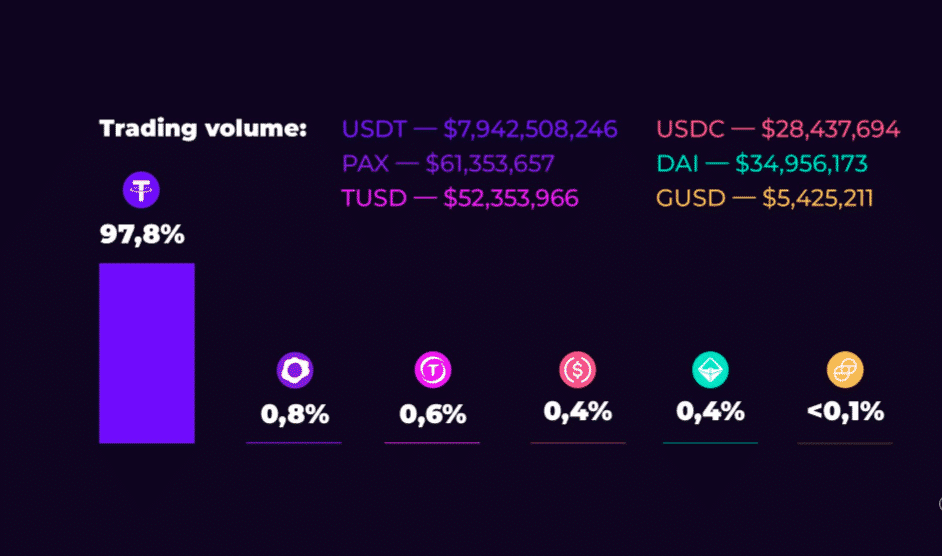

In the crypto world, stablecoins help reduces the volatility of digital assets. Reuters reported that a stablecoin attempts to keep its exchange rate constant with fiat currencies 1:1 with the US dollar. Approximately $1.2 trillion worth of cryptos trade on CoinMarketCap.

The crypto market includes $170 billion in stablecoins. It is a tiny portion of the total. However, they are assigned specific tasks. “Stablecoins are increasingly used in leveraged trades of other cryptocurrencies, according to the US Federal Reserve.”

“Stablecoins such as Tether, USD Coin, and Binance USD are reserve-backed; they claim sufficient US dollar assets to maintain a 1:1 currency exchange rate.” One dollar usually stands for a stablecoin by companies. They have been used to avoid capital controls in international trade since 2018.

Why are stablecoins used in crypto trading?

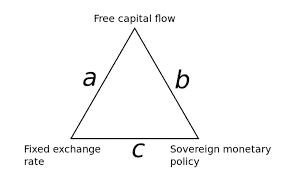

The purpose of stablecoins is to provide price stability in the crypto market, which reduces price volatility. Different types of stablecoins tend to be classified according to the collateral they are backed by, such as fiat-backed, crypto-backed, commodity-backed, or algorithmically-backed.

What are the risks of stablecoins?

Stablecoins have many advantages, but they also have some drawbacks. The risk of third-party printing money and keeping the crypto stable means that the dollars are fractionally reserved instead of fully backed. In such an instance, a bank run could drastically reduce the value of the crypto.

Risks associated with centralized operations include embezzlement, blocking, and unauthorized access to accounts. Fiat currencies face the same monetary issues when a central authority prints money without oversight when a central authority can issue them. Hyperinflation is a possible consequence.

Manipulation of algorithms: since most centralized stablecoins live within smart contracts on platforms like Ethereum or Stellar, their algorithms may fail to keep the currency stable. Even third parties can manipulate algorithms. The fact that “code is law” means that updates to the network impact previous intelligent contracts – a major inconvenience for decentralized projects.

How safe are stablecoins?

Cryptos are generally safer than stablecoins. The price usually is unlikely to plummet. While stablecoins may seem helpful, they are not currently subject to consistent regulatory safeguards, making them even riskier to consumers and possibly threatening the financial system’s stability.

A stablecoin is a digital asset that is not subject to the volatility of other digital assets. For example, the US dollar is pegged to many of these coins, meaning that each coin is backed by a dollar in cash, Treasury securities, or other safe assets and thus redeemable at will.

Top 5 most popular stablecoins

The following are the five most popular stable coins.

Tether (USDT)

The world’s first stablecoin, Tether, is the most liquid and most traded stablecoin on the crypto market. By market cap, Tether is the largest stablecoin globally, worth around $80 billion, ranking third behind Bitcoin and Ethereum’s Ether.

It was initially known as Realcoin when Brock Pierce, Craig Sellars, and Reeve Collins launched it in 2014. Stablecoins maintain their value by pegging them one-to-one to the dollar. However, unlike TerraUSD, Tether broke its peg to the US dollar in May, trading as low as 96 cents, not 30 cents.

Binance USD (BUSD)

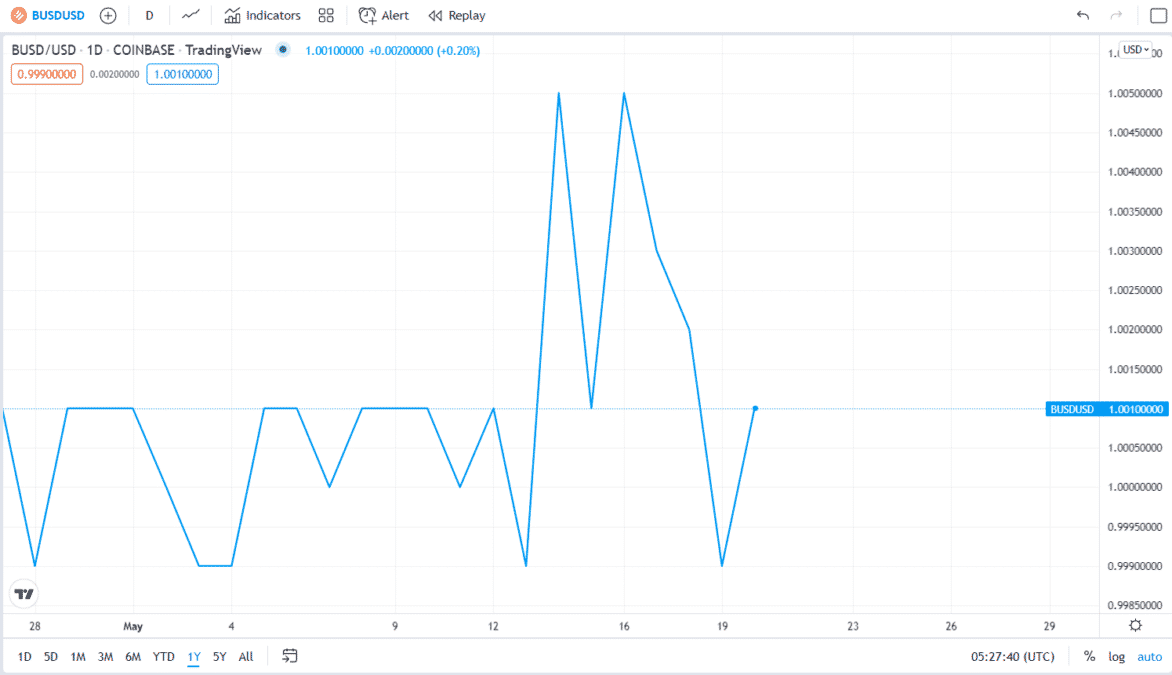

The Binance stablecoin is backed by the US dollar 1:1. As a medium of exchange, it allows for faster funding of your transactions. Therefore, it is essential to sustain a lasting value over time.

Invest in BUSD today to own a regulated stablecoin backed by US dollars. Paxos Trust Company and Binance Exchange formed a partnership to create it. This is an excellent method to hedge against the market’s volatility and gain access to markets without purchasing ether. In addition, the US dollar will be kept at parity for a long time, thus maintaining its value.

On the settings page, you can leverage the benefits of blockchain technology without experiencing massive price fluctuations. Furthermore, you can also use this stablecoin for payments in the global crypto space.

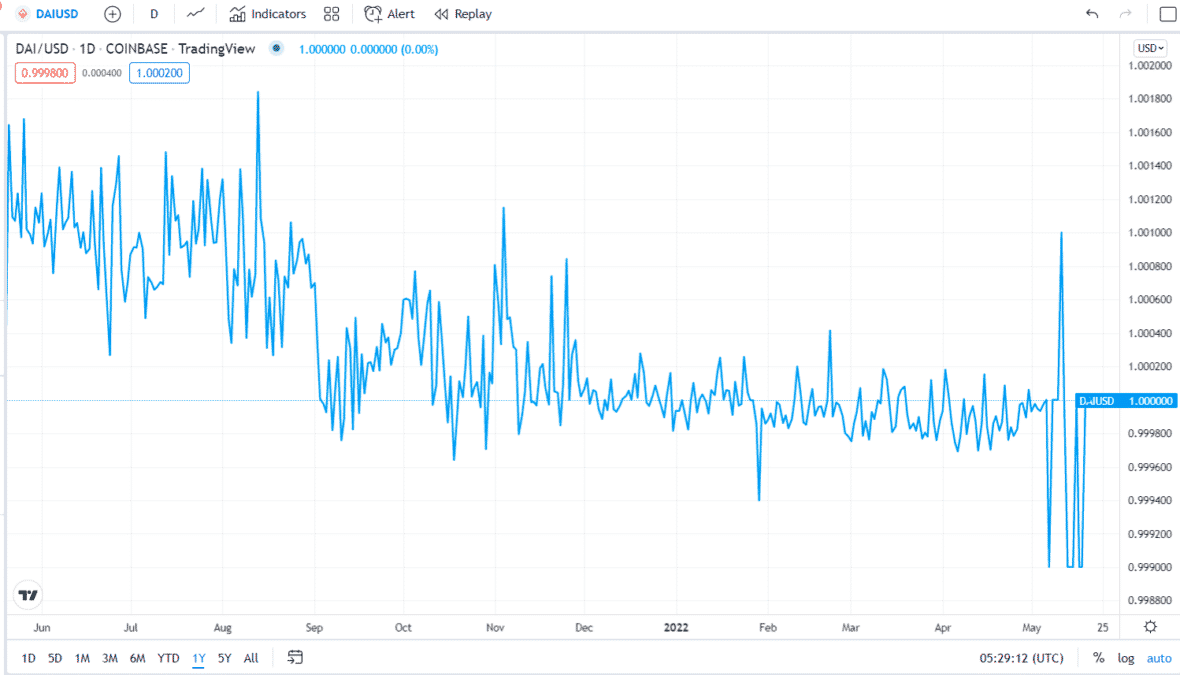

Dai (DAI)

Dai is a stablecoin based on MakerDAO, an Ethereum protocol. As a result, stablecoins such as Dai connect to the dollar. Still, unlike many others, Dai can also be collateralized by other cryptocurrencies. It includes assets like Ether, USD Coin (USDC), and others, allowing them to serve as collateral.

As a stablecoin, Dai’s multi-collateral option and its transparent use of smart contracts to secure sufficient collateral help it maintain a stable price. In the MakerDao community, users can vote to include more collateral options. Dai has over $6 billion in market capitalization, ranking it among the top stablecoins available.

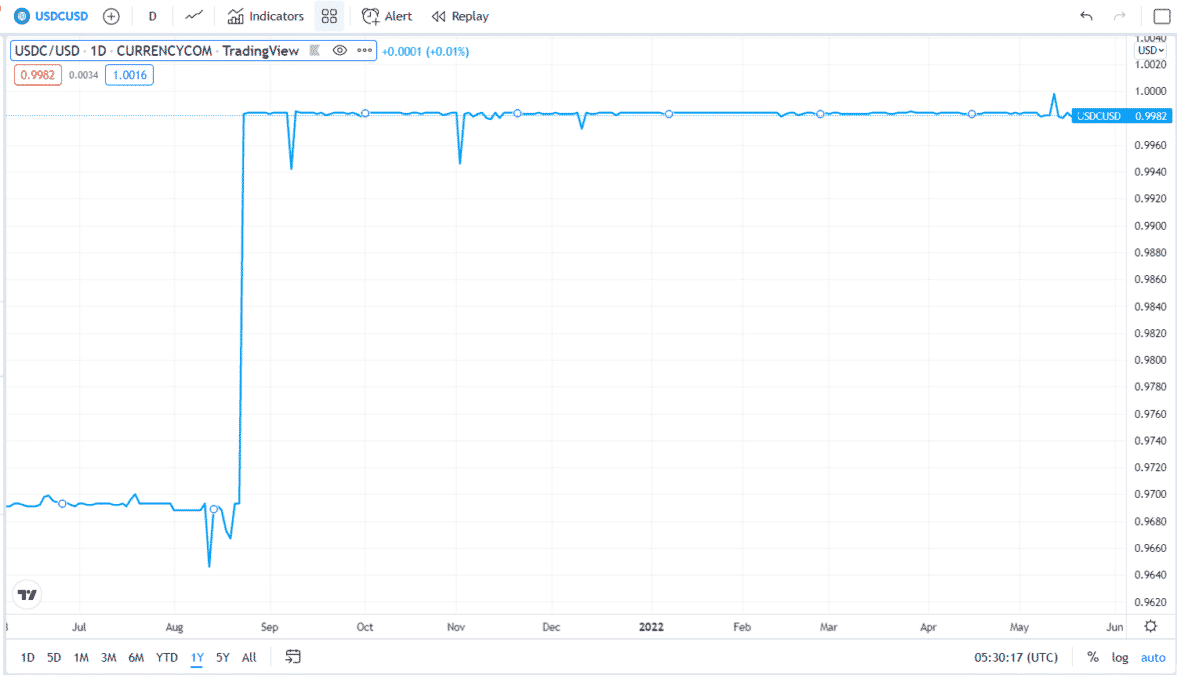

USD coin (USDC)

Likewise, USD Coin (USDC) links to the US dollar at 1:1. Circular and Coinbase co-founded the Centre Consortium, which manages it. It came out back in 2018.

USDC ranks 9th among all cryptos in terms of value. According to USDC, every USDC in circulation provides collateral with a mix of cash and cash equivalents and US Treasury bonds.

Digital Gold Token (DGX)

Stablecoins are an excellent option for digital enthusiasts who rely on gold for stability. Stablecoins are backed by gold, such as the Digital Gold Token. It runs on the Ethereum platform. DGX tokens serve as a stable store of value in the digital space.

Final thoughts

Most business platforms in the digital space have begun to embrace crypto as a mainstream domain. However, the market’s volatility has caused businesses to move away from this domain and look for alternatives. Its development aims to address this flaw and recover the lost revenue.

Maintaining market volatility is the primary function of stablecoin. The digital space has become more vibrant as a result. As a result, now is an excellent time to introduce effective stablecoin development capabilities into business.

Their development is the next big thing in the crypto market. It will likely be the driving force of the digital economy in the future, with business platforms entering this domain for extensive rewards and profits.