- What are gold stocks?

- Are they worth investing in?

- How much would you have earned if you invested in them one year ago?

As a metal, gold is considered a safe haven. To hedge against inflationary pressures, political unrest and economic downturns, investors buy gold as a hedge against these, and other potential sources of volatility. Starting in 2022, this has been the situation. Gold prices rose by double digits due to inflationary and geopolitical concerns in the first few months.

When it comes to enjoying the benefits of gold investing, buying gold stocks rather than the actual metal offers various advantages. Businesses in the gold industry have the potential to outperform physical gold in terms of long-term returns. This is because these firms can expand production while reducing costs. As a consequence of these factors, gold mining companies may be able to outperform the gold price.

However, not every gold stock outperforms the metal. Since this is the case, investors need to be cautious while selecting the best gold stocks.

Best five gold stocks to watch right now

Let’s look at the top five best gold stocks to pick up and hold in 2022.

Barrick Gold Corp. (GOLD)

There are about 14.5 million shares traded on an average trading day for Barrick Gold, making it a famous mining company. The Canadian company is also one of the most valuable, with more than $35 billion.

Gold mines with a life expectancy of more than ten years and an annual gold production of at least 500,000 ounces are considered Tier One Gold Assets by Barrick. With six gold assets of superior quality and a high expected return, this company is well-positioned. However, these reserves are slowly depleted when gold is dug out of the ground.

Why does it have the potential to grow?

Barrick is always on the lookout for new properties to investigate and buy and work on developing new mines. To identify and develop new assets, the company concentrates on long-term opportunities with strong operating margins that are likely to endure.

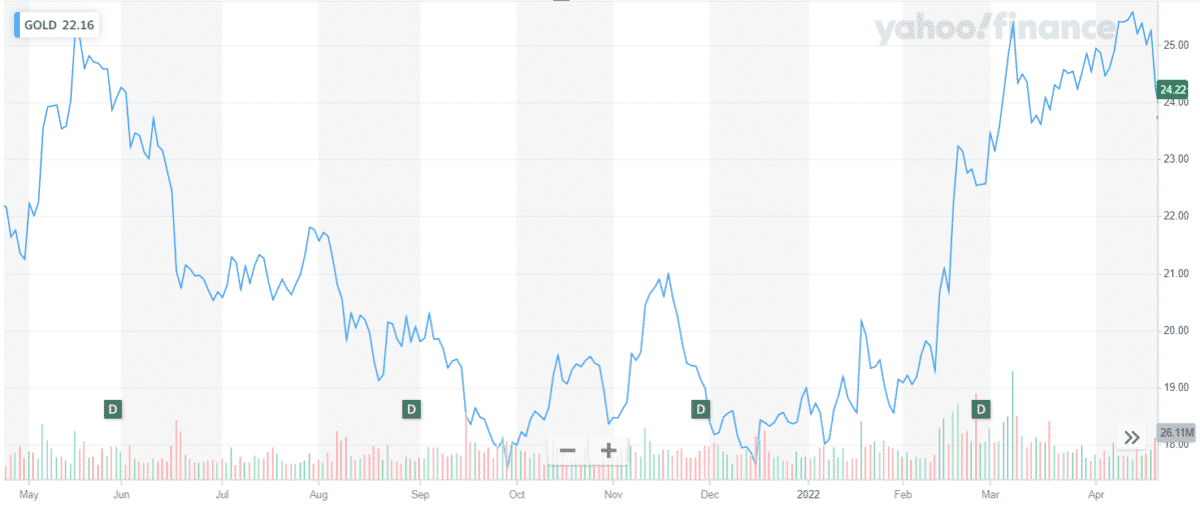

How much would you earn if you invested in GOLD 1 year ago?

GOLD’s share price on 23 April 2021 was $23.73. A year later, the share price closed at $21.40. So if you had invested $1,000 last year, your account could have lost $98.18.

Newmont (NEM)

Global gold mining giant Newmont has a market worth of over $47 billion and a solid balance sheet to match. In addition, some of the world’s largest goldfields are managed by the company, with more than 31,000 employees. Today, the company has 22 mines in operation, with ten underground and the other 12 on the surface.

Why does it have the potential to grow?

In the same manner, like Barrick, Newmont is continually striving to expand its reach by developing new mines before old resources run out. For 2019, both companies have decided to work together on the Nevada Gold Complex. Including three of the top 10 Tier One Gold Assets globally, the complex is anticipated to be the world’s largest gold production facility.

More than 90% of Newmont’s gold reserve base is located in top-tier jurisdictions; this distinguishes the company from its competitors. Therefore, it is reasonable that the company’s value will continue to climb as it develops its mining capacity and retains a commanding position in its field.

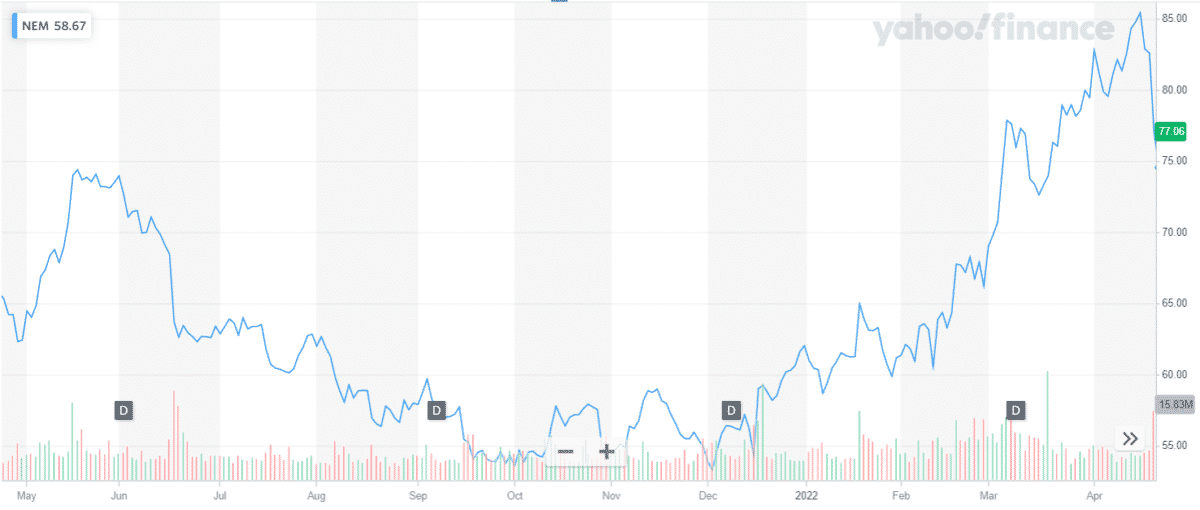

How much would you earn if you invested in NEM 1 year ago?

NEM’s share price on 23 April 2021 was $63.53. A year later, the share price closed at $74.52. So if you had invested $1,000 last year, your account could have gained $172.9.

Royal Gold Inc. (RGLD)

At over $7.5 billion in market value, Royal Gold is one of the world’s leading streaming and royalty companies. There are two ways that the company makes money. To begin with, it is an investor providing mining companies with upfront capital in exchange for legally prescribed discount rates on the gold they produce.

Like those on music and art, Royalties are the second source of money. In the same way as streaming contracts, Royal Gold provides mining companies with the upfront financing they need to establish and manage gold mines. A royalty is paid to Royal Gold rather than a low price for the gold produced. It allows partaking in the profits from the sale of the gold.

Why does it have the potential to grow?

The company has seen increasing sales and investor interest due to implementing this business plan with great success.

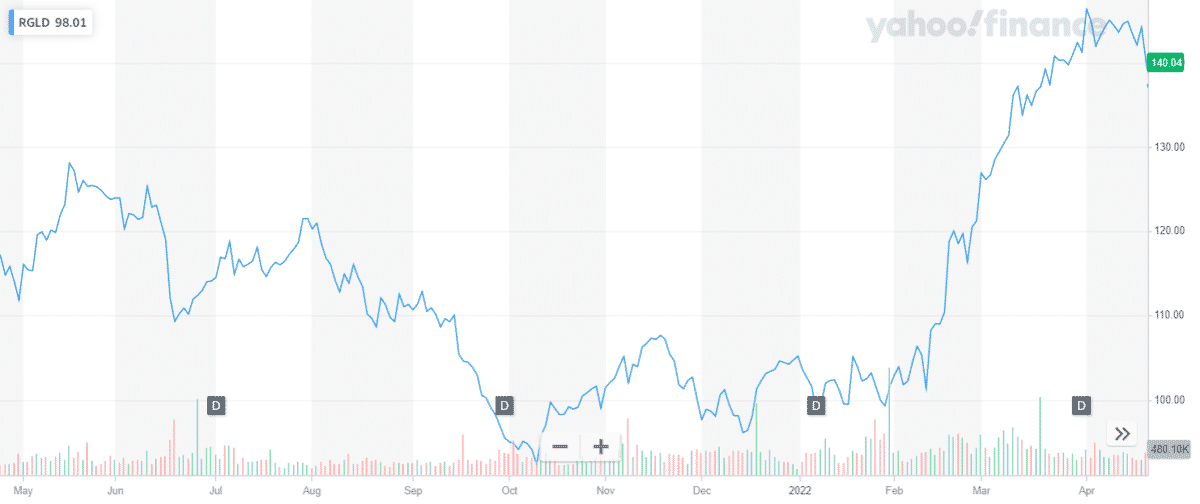

How much would you earn if you invested in RGLD 1 year ago?

RGLD’s share price on 23 April 2021 was $116.77. A year later, the share price closed at $137.29. So if you had invested $1,000 last year, your account could have gained $175.7.

Franco-Nevada Gold (FNV)

Gold mining isn’t Franco-Nevada Gold’s only business. The company is focusing on streaming and royalties instead of mining, which would require a lot of hard work and danger.

For the right to acquire part or all of the gold produced at a much reduced contractual cost, a company may enter into a streaming arrangement in exchange for paying upfront capital to develop and operate the mine.

Why does it have the potential to grow?

Mining can be expensive, and Franco-Nevada Gold effectively provides miners initial financing to manage their mines. In addition to the expense of land and labor, mining companies must spend a great deal of money on equipment and fuel.

In exchange for the cash upfront, Franco-Nevada Gold obtains the opportunity to purchase gold at contractually lower prices than current prices.

Therefore, Franco-Nevada Gold will benefit regardless of the fluctuations in gold prices. Contractual rights allow it to acquire gold at considerably lower prices when it rises. The firm makes the most critical deals at low gold prices because miners are anxious to get their hands on cash.

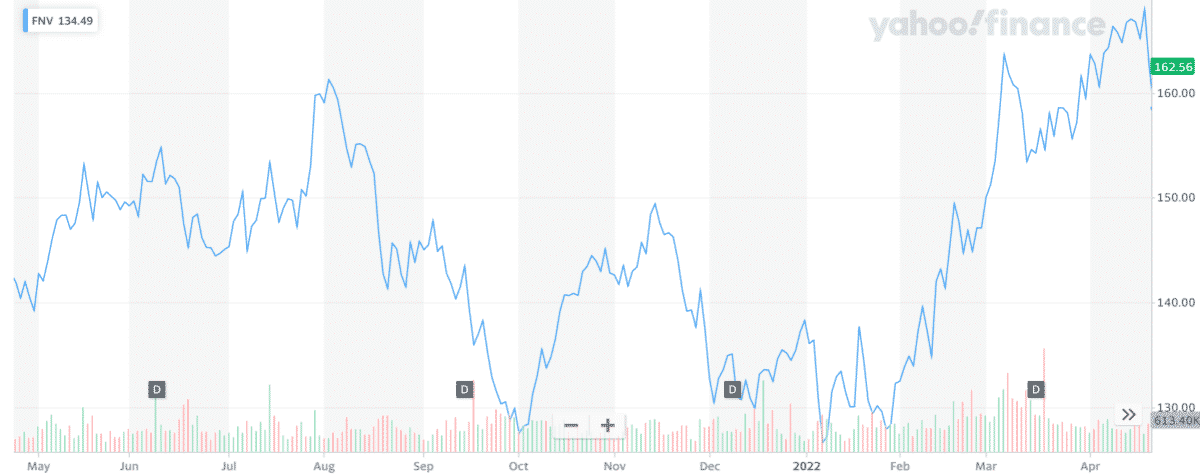

How much would you earn if you invested in FNV 1 year ago?

FNV’s share price on 23 April 2021 was $141.47. A year later, the share price closed at $158.54. So if you had invested $1,000 last year, your account could have gained $120.6.

Agnico Eagle Mines (AEM)

Another significant gold mining company in Canada is Agnico Eagle Mines. With active mining projects in Finland, Mexico, and the United States, this mining giant has a global reach.

One-of-a-kind gold sales approach shows Agnico Eagle Mines’ trust in its product Agnico Eagle does not participate in forwarding gold sales like many other mining firms. No, it doesn’t want to take money upfront in exchange for a discount on future gold output. In place of this, the company only sells what it produces after it’s done producing.

Why does it have the potential to grow?

Even when gold prices were low, the company maintained its strength and stability because of its business approach. Even though gold’s price fluctuates, the company has paid out yearly dividends to stockholders since 1983.

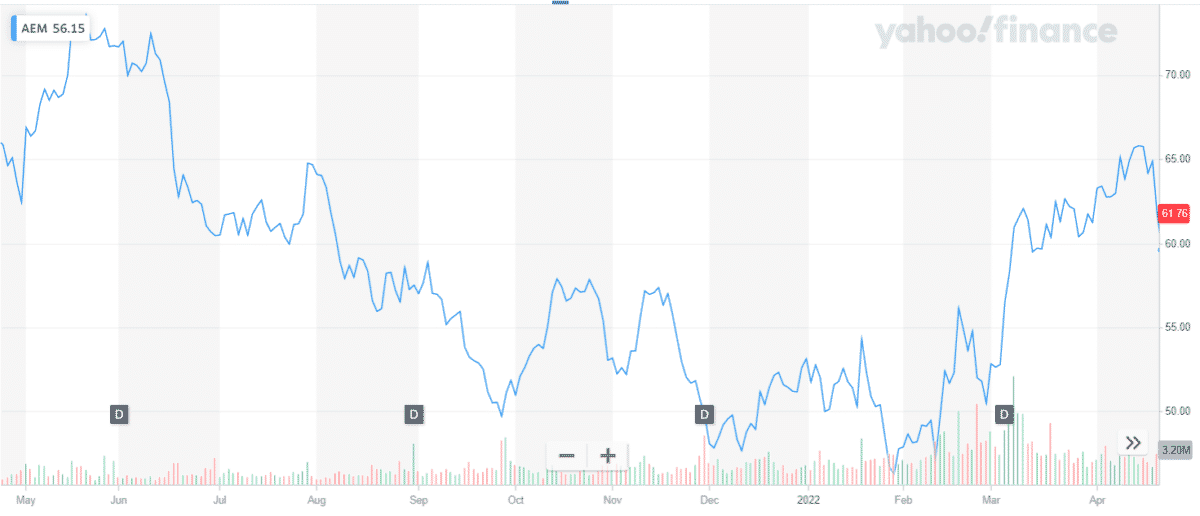

How much would you earn if you invested in AEM 1 year ago?

AEM’s share price on 23 April 2021 was $64.44. A year later, the share price closed at $59.60. So if you had invested $1,000 last year, your account could have lost $75.10.

Final thoughts

Monetary policy and inflation are two factors that impact gold’s price. To hedge against these risks, gold has long been the go-to investment. On the other hand, gold might lose its sparkle due to the rise of cryptocurrencies, which investors should keep a watch on.