- What are stablecoins?

- Are they worth investing in now?

- What potential do they have to grow in the future?

Dollars, euros, and gold are among the fiat assets added to the stablecoin list. “Cryptos” are coins linked to the value of the primary foreign currency.

Stablecoins are blockchain tokens connected to another asset in the broadest sense. It’s most often used to refer to tokens directly connected to fiat currencies like the US dollar or the euro. The most popular stablecoins are those based on the USD.

Best stablecoins to watch right now

Let’s look at the top five best stablecoins to invest in 2022.

Tether (USDT)

In 2014, RealCoin, the forerunner of Tether, was launched as the first stablecoin. With $77.5 billion ($107.9 billion), Tether is the world’s most popular stablecoin.

Why does it have the potential to grow?

For investors, Tether is the most readily available stablecoin since 428 exchanges support it throughout the world. However, despite its excellent functionality and market dominance, Tether has been under heightened legal attention due to its recurrent defiance of audits and subsequent conviction for unlawful activities.

One of the largest crypto exchanges, Tether, has been fined $41 million ($57 million) and banned from operating in New York City. These findings have had no impact on Tether’s day-to-day activities in the crypto market. Still, investors should be cautious when dealing with Tether, especially if they own a significant USDT.

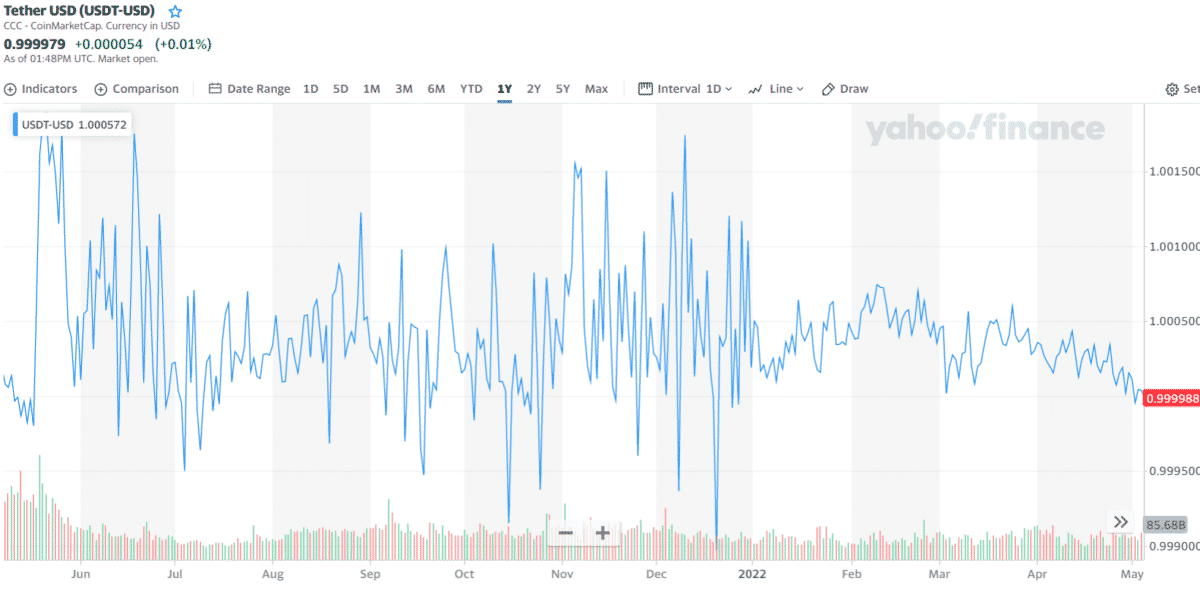

How much would you earn if you invested in USDT 1 year ago?

Tether coin price on 8 May 2021 was $1.000078. A year later, the coin price closed at $1.00. So if you had invested $1,000 last year, your account could have lost $0.077.

Digix Gold Token (DGX)

In contrast to the other stablecoins on our list, DGX works in a unique method. Consequently, InvestorsObserver has given this currency a higher risk rating than the others. However, even if DGX’s price fluctuates more than usual, it is doubtful that its value will be manipulated since it is a medium-risk coin.

Because it is not linked to a fiat currency, DGX is more volatile. In contrast, one gram of gold may be exchanged for each DGX coin. According to this information, the coin’s value depends on the price of gold. As the price of gold fluctuates, so does the value of DGX. Because they believe in the worth of physical products, many investors find this enticing. DGX has a market value of $4.1 million, with 58,000 coins in circulation.

Why does it have the potential to grow?

Digix gold is a gold-backed stablecoin. Gold bullion’s identity is safeguarded by creating DGX tokens for each token. A smart contract implemented at the token’s creation governs its use and management. Owners of DGX tokens can convert their tokens for gold bars at a predetermined price.

How much would you earn if you invested in DGX 1 year ago?

DGX coin price on 8 May 2021 was $64.80. A year later, the coin price closed at $19.43. So if you had invested $1,000 last year, your account could have lost $700.15.

Binance USD (BUSD)

As the world’s most popular crypto exchange, Binance launched BUSD in 2019. BUSD is presently the third most valuable stablecoin, valued at $14.3 billion ($20 billion). However, because just 103 exchanges provide BUSD as an option, it is less accessible than its competitors. Instead, on Binance, BUSD offers investors a distinct set of features.

Why does it have the potential to grow?

A stablecoin lending service that pays up to 15% a year is available to BUSD users on the Binance platform and zero-fee trading and conversion. In addition, investors may rest easy knowing that BUSD is one of just three stablecoins to be recognized by Wall Street officials.

How much would you earn if you invested in BUSD 1 year ago?

BUSD coin price on 8 May 2021 was $1.0001. A year later, the coin price closed at $1.0006. So if you had invested $1,000 last year, your account could have gained $0.499.

Terra USD (UST)

UST is the newest algorithmic stablecoin, with a fast-expanding market cap. Market cap-wise, the UST stablecoin is now valued at $9.2 billion USD ($12,971,418,375 AUD). It was established on the LUNA blockchain in September of 2020. The UST is only accepted by 21 exchanges worldwide.

Why does it have the potential to grow?

UST’s popularity among cryptocurrency investors has soared because it is one of the few completely decentralized stablecoins. Tether uses a custodial technique, whereas Terra’s UST uses an algorithm based on data from Terra’s native LUNA blockchain to modify its supply. With this in mind, UST has developed the safest lending product in the stablecoin market, enabling investors to deposit their UST into a yield account that provides a 20% annual income utilizing Terra’s Anchor Protocol.

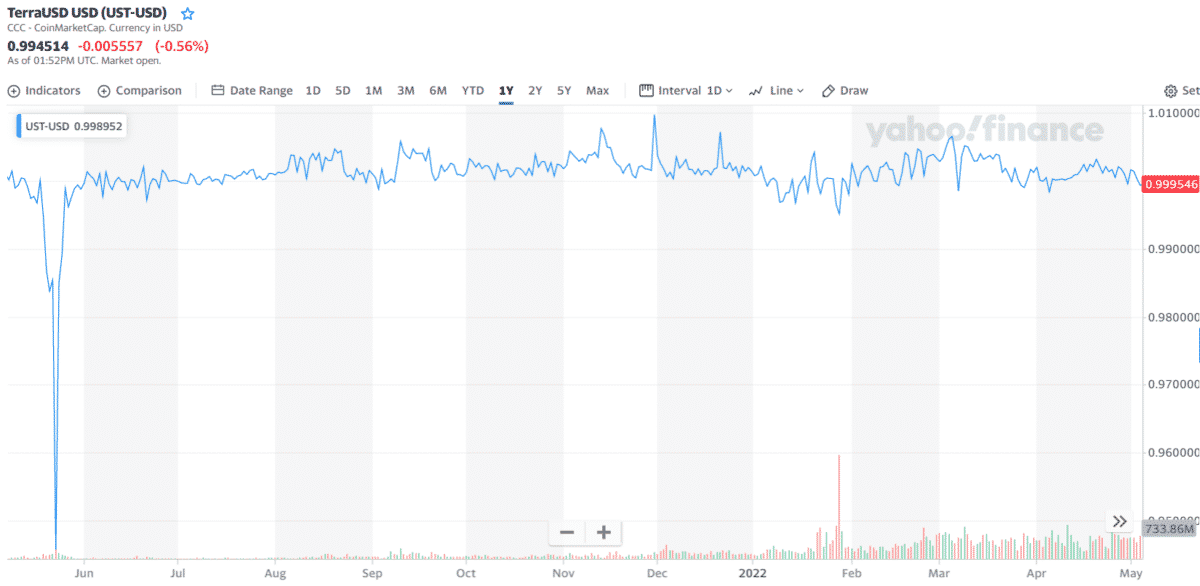

How much would you earn if you invested in UST 1 year ago?

Terra coin price on 8 May 2021 was $1.00047. A year later, the coin price closed at $0.99. So if you had invested $1,000 last year, your account could have lost $10.46.

TrueUSD (TUSD)

TUSD was released in 2018 and is primarily considered one of the best three-dollar stablecoins. Using it is a breeze because of its dependability, fluidity, and complete transparency. TrustToken is the issuer of the tokens. With a 1:1 dollar-to-cryptocurrency exchange rate, cryptocurrency reserves are backed by fiat money. Audits and reports on reserves are accessible to all asset owners at TUSD, unlike its competitors, who do not.

Why does it have the potential to grow?

The crypto’s creators promise that traders will have online access to monitoring tools to ensure that investors can keep tabs on the reserve fund’s current situation. Users will soon be able to monitor TUSD’s USD reserves through a dashboard that provides real-time information.

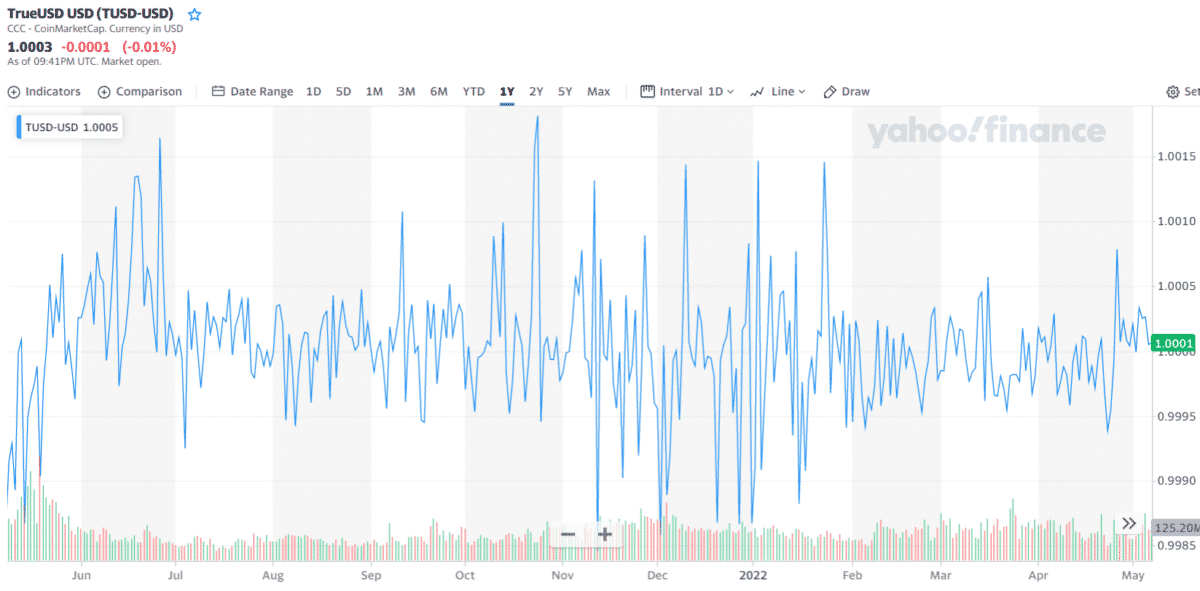

How much would you earn if you invested in TUSD 1 year ago?

TUSD coin price on 8 May 2021 was $0.9987. A year later, the coin price closed at $1.0005. So if you had invested $1,000 last year, your account could have gained $1.802.

Final thoughts

Stablecoins are thus preferable to ordinary cryptos since they remove the danger of their value fluctuation. This is why they are so often used on Bitcoin exchanges, where they let traders keep their funds secure. For example, if a trader feels the price of BTC will decline shortly, Bitcoin may be traded for stablecoins. Stablecoins are also ideal for value transfers since many cryptocurrency exchanges accept them.