- What is crypto options trading?

- How much does an options trader make?

- What are the five strategies to make a profit?

The need for advanced trading solutions is growing in tandem with the growth of the cryptocurrency market. In the crypto market, options trading is getting quite a buzz.

This article will focus on five strategies that allow investors to trade crypto options. However, let’s have a look at other crypto options first.

What is crypto options trading?

Crypto options are derivatives since they rely on underlying assets. Issuers sell them to traders. Derivatives are financial products that allow you to hedge or bet on a particular investment. They give the option buyer the right to purchase/sell an asset at a specific time and cost.

‘Call’ and ‘put’ options are the two main types of options. Call option holders can acquire an asset at a specific price within a specified time frame. The amount you must pay is known as the “strike price.”

Put options are the inverse of call options. It allows you to sell underlying securities at a defined strike price rather than possessing the right to buy them. They help to maintain equilibrium in the market by creating chances for arbitrage.

How much does an options trader make?

According to the stats, options traders can make an average of $167,386 annually. An options trader’s regular bonus is $14,315 annually, 9% of their annual compensation. Every year, 100 percent of people claim that they got a bonus.

Options traders’ wages vary from $29,313 to $791,198 per year, with a typical of $141,954 per year. 57% percent of middle Options Traders earn around $141,954 and $356,226, depending on their experience. While the top 86% earn $791,198 annually.

There are five important strategies that options traders employ to earn profit.

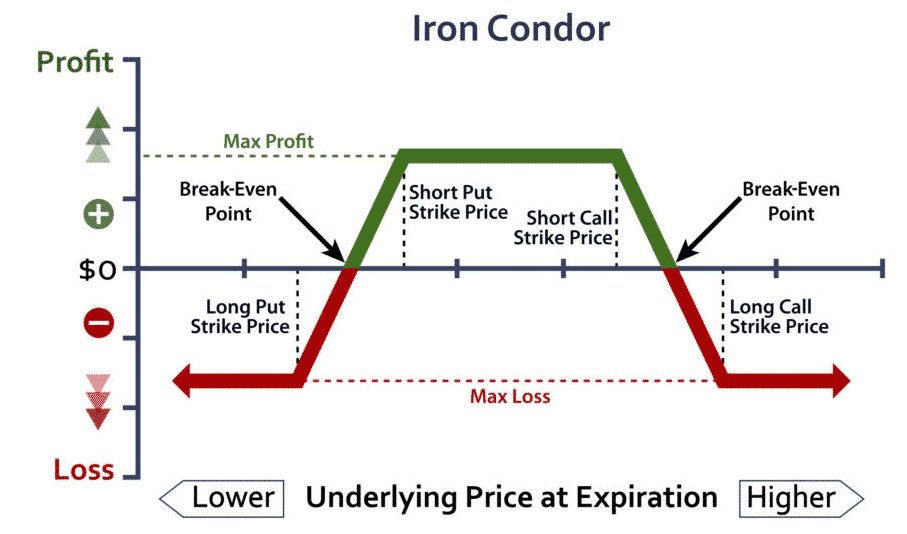

1. Iron condor options strategy

An iron condor is a two-put, two-call option strategy. One of them is long, and the other is short. There are four strike prices, all of which are set to expire on the same day. The iron condor earns the most profit once the underlying asset expires between the middle strike prices.

To put it another way, the objective is to benefit from the underlying asset’s low volatility. As a result, both the downside and upside risks of this strategy are limited. This is due to the wings, which defend against substantial changes in any direction.

Its potential profit is therefore limited due to the reduced risk.

How much would the trader make?

The iron condor approach is a market-neutral one. It makes money whenever the marketplace trades in a limited range. The premium, or credit, gained for generating the four-leg options position is the maximum profit for an iron condor.

There is also a limit to the maximum loss. When the crypto price gets too close to the strike price of one of the options you sold, the price of that option skyrockets. The iron condor, as a result, loses money.

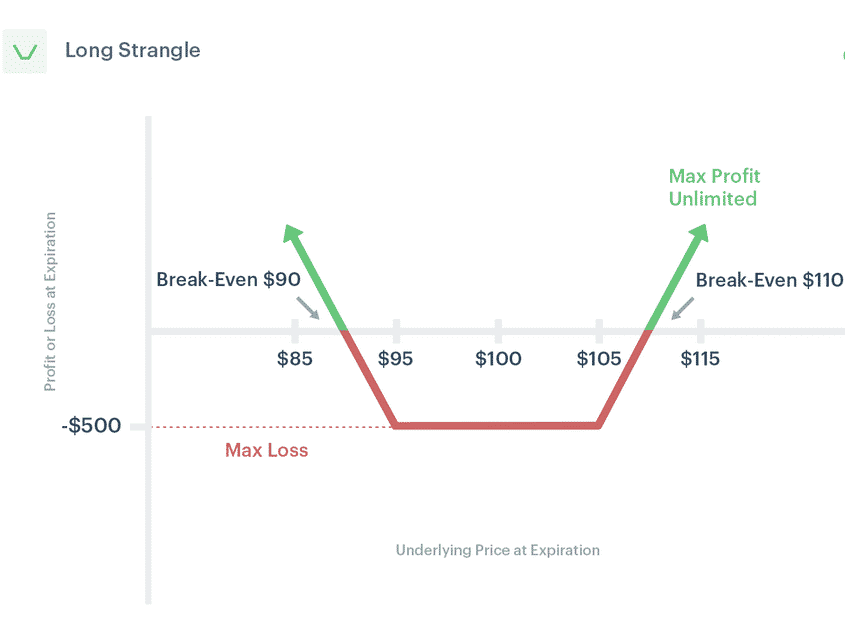

2. Long strangle options strategy

A long strangle comprises one long call and one long put with different strike prices. The underlying asset and the expiry date are the same for both options. They do, however, have varying strike prices.

We require a substantial price swing to make any form of profit. So the basic goal is to benefit from the crypto if it swings in either direction significantly.

How much would the trader make?

As the crypto prices can climb indefinitely, the upside profit is limitless. On the other hand, the gain potential is very high on the downside. This is because crypto prices can go as low as zero.

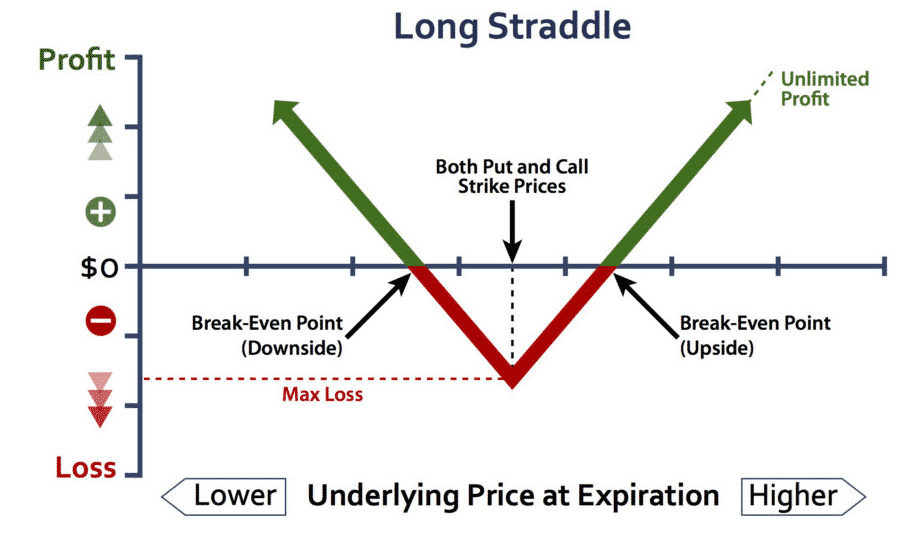

3. Long straddle options strategy

A long straddle is a strategy in which the trader buys both a long call and a long put. Both have the same underlying asset and the same strike price and expiry.

Another way to employ the long straddle strategy is to profit from the expected increase in volatility. If the need for these strategies grows, this will become more common.

How much would a trader make?

Long straddles offer enormous profit potential while posing a minimal risk. The potential advantages are endless if the price of the asset keeps rising. Conversely, if the underlying asset’s price falls to zero, the profit is equal to the strike price minus the paid premiums.

The overall cost of entering the position is the highest risk in either circumstance. This is the total cost of the call and put options combined.

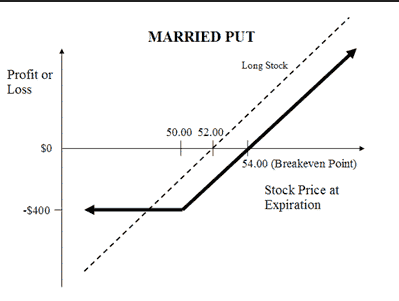

4. Married put options strategy

A married put is an approach in which traders own a put contract and crypto shares. By combining the two, the investor provides downside protection. Investors might use married puts as a sort of insurance.

If you want to invest in crypto but are worried about short-term volatility, this may help.

How much would a trader make?

The potential for profit of a married put is limitless. This is because the price of the underlying crypto has no limit. However, profits are usually lesser than if you owned the crypto. This is because the premium or cost of the put option bought reduces it.

Because downside loss is confined, this is also a capital-protecting strategy. Unfortunately, the put premium becomes a built-in expense, lowering the strategy’s profitability.

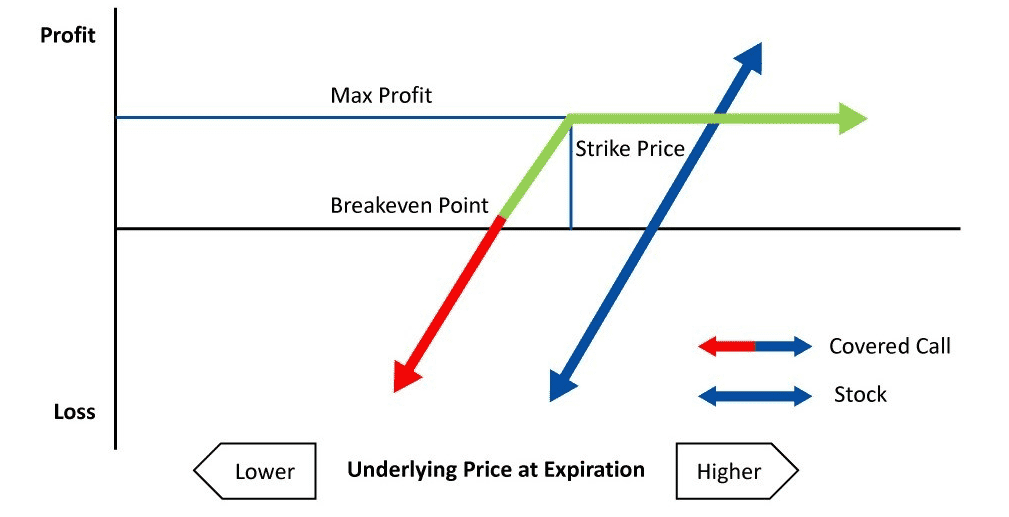

5. Covered call options strategy

It is an investment technique in which call options are sold. It’s the ability to buy crypto against the equity you own or recently acquired. As a result, such shares create more income.

Covered call techniques can help investors earn money while also limiting their possible profits. As a result, covered calls are frequently used by investors who plan to retain the underlying asset for a long but do not anticipate a price gain in the future.

This technique is appropriate for traders who feel the underlying pricing will remain relatively stable in the foreseeable future.

How much would a trader make?

This strategy is most advantageous if the crypto rises to the strike price. This allows you to benefit from your long crypto position whilst the sold option expires worthless.

Final thoughts

In this article, we’ve introduced you to cryptocurrency options trading and five profitable tactics.

Crypto options have several benefits. First, they allow consumers to hedge against risk while helping maintain market equilibrium by giving arbitrage possibilities. In addition, they are inexpensive since there is no upfront payment when you issue an options contract. Another advantage is that you are not obligated to exercise your options contract. So, good luck with your experience with crypto options trading.