- What’s the deal with the long strangle strategic plan?

- What’s required for this trading approach?

- What are the benefits and drawbacks of these assets?

A long strangle, also known as a “buy-strangle” or “pure-strangle,” involves investing in both a call and a put option using a neutral approach. Both OTM options have the same expiration dates, yet none is in the money (ITM).

A considerable price adjustment is required to generate a profit. The basic goal is to profit from the investment if the stock price increases or falls considerably. A position’s cost is doubled with a put and a call, but its success rate is quadrupled.

What is a long strangle options strategy?

Only one method of profiting from an asset’s movement is used in this technique. If the asset’s value rises, purchase call options; if it decreases, buy long put options. Of course, market conditions might also affect an asset’s pricing. Nevertheless, it is the most usual conclusion when prices break out of the current range (which may be either a flat or a triangular).

Buying both call and put options simultaneously may help you make money as an options investor. When adopting a long strangle strategy, the strike prices are tilted many degrees. Long strangle is the focus when the strikes are even. Strangling is a strategy for placing long bets on both sides of a market. Both options expire on a stock based on the same stock on the same day.

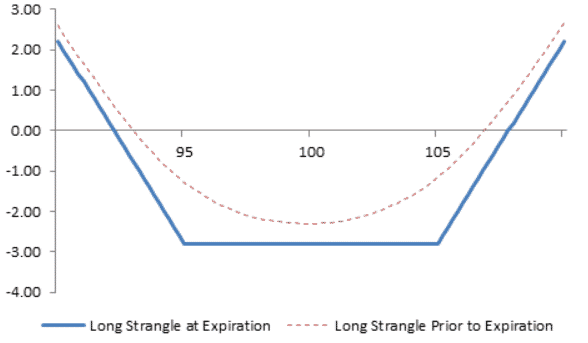

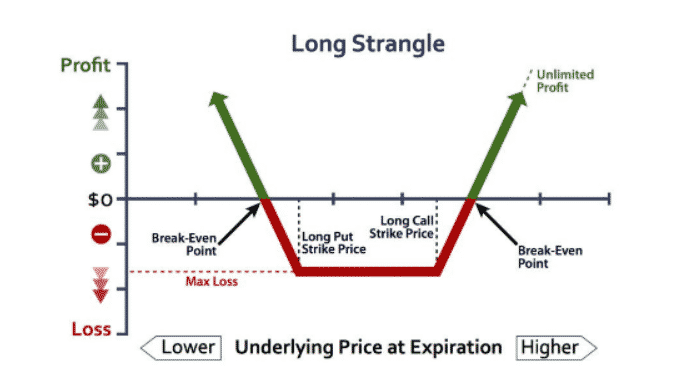

A long strangle is formed when the underlying stock is above or below the lower breakeven point. On the other hand, the potential for positive and negative profits is immense. This transaction has the potential to cost you whatever you paid for it.

What are long-term strangling trading tactics?

If the stock price is expected to shift significantly, but you don’t know which direction, you should utilize the strangling strategy. It’s good to start by looking at some recent purchases and financial information. Stock prices might rise or fall significantly due to any of these alternatives. Because call and put options lose value when the stock price does not change considerably, investors lose money.

The call and put contract pricing are determined by the options market’s forecast of the stock’s movement before expiry. According to these data, investors’ expectations are too low, and the stock price will climb or fall over the breakeven threshold.

Option pricing should reflect this approach before earnings reports and other events. As a result of their great reputation in the industry, these dates are often mentioned in the media. Even yet, it’s too early to say whether or not these comments will have a significant effect on the stock price. Calls, Puts, and Spreads have seen a rise in demand, driving up their prices (strangles).

Examine a contract’s implied volatility to evaluate whether it has more or fewer possible gains or losses. If you go with the more expensive option, you’re taking on more risk. Strangle bet buyers must wait for an increase in the stock price before they can benefit. For option sellers, strangle rises the volatility and loss of stock values. Consequently, the risk to those who deal with them is higher.

If you buy a strangle, you may profit from an increase and a fall in the stock price. Strangle pricing can properly predict how much a stock will climb or decrease before expiry because of the market’s “efficiency.” As with any other trading method, timing is critical for strangling deals.

What are the benefits and drawbacks of long strangling?

Let’s dig a little about the comparative benefits of long strangle.

Benefits

If you want to benefit from long-term market movements, you should employ a long strangle. For investors, long strangle allows them to benefit from market volatility while accepting more risk as a result.

A long strangle provides practically endless profit possibilities with little risk. Deliberation is the most susceptible to time loss (option premiums). Investors should be less at risk of suffering a significant loss in this situation. If investors want to minimize risk and maximize profit, the transaction may be structured in several ways by investors.

A long strangle has a minimal chance of losing the entire investment since one option is always worth something as the expiry date approaches.

Drawbacks

Strangle breakeven prices are affected by options costs. It is common for in-the-money options to cost more than out-of-the-money options because of the fluctuating implied volatility of the underlying assets. For an investor, the breakeven price of a long strangle prohibits benefitting from a huge increase or fall in stock prices.

Option prices often rise as important dates, such as earnings announcements or other notable events, approach. As a result, you can expect to pay more than the average.

For long strangle traders, the value of options decreases more quickly with time, causing additional time wastage than with a single-choice method. In addition, investing in options may be risky, so investors should limit their time there. Within the next several weeks, the implied volatility level will rise significantly. As a consequence, options contracts will cost investors more money.

Final thoughts

The long strangle options technique may be used to profit when the market moves quickly in both directions. By acquiring put and call options, you can protect yourself against the market’s wrong direction while still making money. Of course, the trader will lose money if the price of the strategy’s breakeven points is crossed until a specific deadline.