- What is an Iron Condor options strategy, and how does it work?

- What is this strategy’s reliability?

- What are its profit and loss margins?

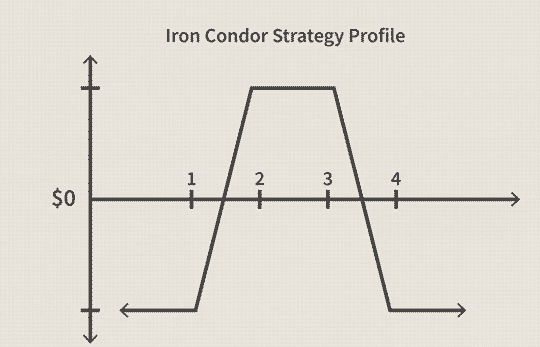

Iron Condors (IC) are delta-neutral options that allow you to profit even if the underlying value does not move considerably. Like an Iron Butterfly, a four-option IC consists of a long put that is out of the money (OTM) and the following:

- A short put that is closer to the money

- A long call that is even further OTM

- A short call that is even closer to the money

- A long call that is further OTM and even closer to the money

There is a limited probability of earning or loss based on the difference between the call and put strikes bought and sold minus the net premium received.

Iron Condor strategy: what is it?

It is the most suitable method to trade when the underlying assets are between intermediate prices. However, to be profitable, low market activity is required. Therefore, IC uses two options instead of just one to get the same reward. One IC option includes a short put, two longs, and two longs or shorts that expire at four prices simultaneously.

Constructing a trading methodology

The following is how the method works:

- Purchase an OTM put with a lesser strike price to reap the benefit of an asset’s recent market price. In addition, an OTM put option will save you from losing money if the core asset plummets sharply.

- OTM puts may be sold for less than the underlying asset’s recent price, while ATM puts can be purchased for more than the current value of core asset.

- If a call’s strike price is greater than the asset’s current market value, it should be sold at an ATM or OTM level.

- Take advantage of the present value of the core security by buying a call option with an above-market price. You may hedge yourself against a huge rise in the price with an OTM call option.

On both flanks, there are long positions, and there are OTMs as well. Since the premiums for these options are lower, the excess will be higher than the excess for the two options written.

You can change the direction of an option (bearish or bullish) by changing the strike price. The speculator aims to get a small asset on expiry if the current market price exceeds both average exercise prices. The buyer should benefit from the transaction despite the low profitability and low risk.

Iron Condor’s reliability

Due to the Iron capacitor blades, this strategy is less dangerous than others because it protects against the strong movement in both directions. However, due to the less risk, the winning probability is decreased.

All options are worthless if the underlying defaults are at one of the two average exercise prices. There is a commission, however, if the trade is profitable. As a result, the failure has little significance.

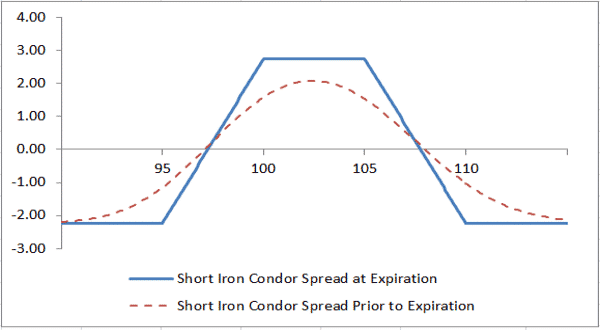

Iron Condor profits and losses

The most significant gain with the IC is the credit earned by building a position on a four-legged option.

Losses are also limited to a certain amount. A variance between the hits on long and short calls or between hits on long and short calls indicates the maximum loss possible. Consequently, it is possible to reduce trading losses by reducing the net credit received.

The highest loss will occur when the cost exceeds or falls above or during the long call and long put strikes.

Maximum profit

If the shares mature with a gain equal to the share price, you will receive a profit equal to the net credit received, minus any costs incurred. If all options expire, you will receive the net premium as compensation.

Maximum risk

The dissimilarity between the bullish spread exercise price and the bearish call spread exercise price is deducted from the payable amount. You get a net loan of 2.80 if you purchase a bullish put spread and a bearish call spread. There is a difference of 5.00 in the exercise price. There is an additional risk of 2.20 minus commission.

You can do this in one of the following ways. If the share price is above the minimum exercise price, put and call options are profitable after expiry. Losses and gains are maximized when both put options are profitable. The call and put options are profitable if the share price exceeds its maximum exercise price on expiry. Therefore, bear screams are both beneficial and harmful.

A stock with Iron Condor as an example

Imagine the impact on the share cost of ABC company if it stayed unchanged for the further three months. However, they are instead trading on the IC method at $212.26.

For this scenario, the cost for vending a $315 strike call and purchasing a $320 strike call was $11.44 each. So covering these two parts of the contract or 100 shares of the underlying asset costs $3.42. So we are still a long way from halfway through the project.

In addition to paying $11.44, the trader gives $5.52 and a put with the same strike price. In each market segment, one contract costs $1.68 or $168.

Complete balance for the spot is $396 ($2.28 x $1.68) or $3.96. Based on the depreciation after three months, the price should be between $315 and $310 at this point. This is the highest-earning for traders per day. The trader risks losing money if the price falls below $315 or exceeds $315.

There will be a significant impact despite how much and how deeply ABC companies’ stocks fall. Those who lose more than $320 and less than $305 are most likely to lose.

Suppose an expiration cost of $325 per share (or equivalent). Since the strike price of the call exceeds the upper limit of the contract, the trader is most at risk of losing money. Note that the seller’s call loses $10, and the buyer’s call wins $5. Additionally, the put options expire. In this case, the trader loses $5 or $500 (100 stock contracts). The reward was still $396. The trader is unlikely to lose more than $104.

Consider the case where ABC price falls but is not on the lower end of the put option. Instead, it reached its lowest level ever at $308. This change results in short put losing $300 and the long option expiring. There is also a limit on calls. The merchant earns $496 in rewards credits to offset the $300 loss. When commission costs are removed, the merchant has $296.

Final thoughts

Iron Condor’s options method will benefit professional traders who have traded for a while. The technique allows you to take the lead in the situation. When volatility is low, it is best to use the IC technique since you want all the options to decay without any benefit.

Using this method, the tipping point is somewhere in the middle between two internal exercise prices. You should first familiarize yourself with the basics if you are a beginner interested in using the IC approach. Since this method should only be used when favorable market conditions, you also need to make wise trading decisions.