- What is a Metaverse ETF?

- What are the top three funds to buy?

- How much would you earn if you had invested in these funds one year ago?

We are sure you have heard of the term “Metaverse” several times over the recent months. However, you might have a general idea or not know it. So, what is the Metaverse?

Virtual media is the world’s future, and the Metaverse is the forerunner. The Metaverse is considered a one-up to the internet where users can interact in 3D spaces. They will be able to communicate, play games, socialize, and collaborate on business-related projects. Even the educational sector is making attempts to set foot into the Metaverse.

When you open Instagram or WhatsApp, the “Meta” written at the bottom is what the growth of the Metaverse signifies. The extent of the vastness of the Metaverse and the wildfire-like prevalence is beyond the compass of this article. We can tell you about Metaverse ETFs that will bring you closer to this technology and consequent opportunities.

Let’s begin addressing the first question.

What is a Metaverse ETF?

ETFs are securities that one can exchange in the stock market. Similarly, Metaverse ETFs are securities that allow investment in Metaverse businesses and platforms. The Metaverse and the stock market overlap regarding NFTs, digital assets, virtual events etc. Besides this, the Metaverse also consists of gaming, virtual infrastructure, online shopping and social media, which is undoubtedly an attraction for big firms.

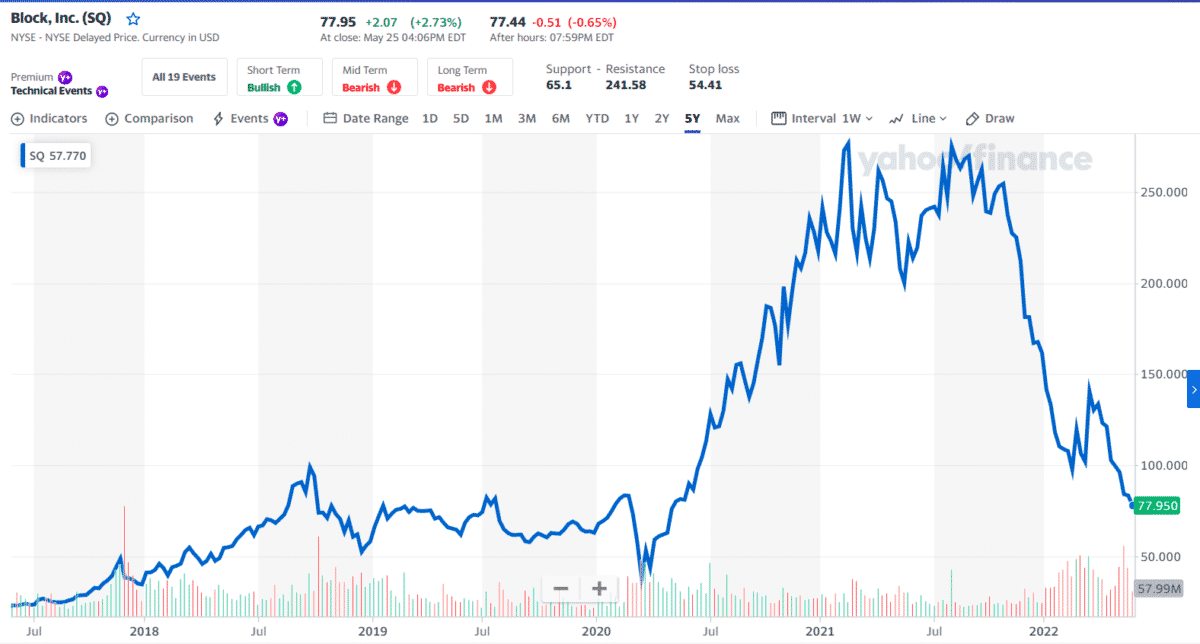

Did you know that the Metaverse signifies a revenue opportunity for much more than $1 trillion for companies giving their all for it? People who opt for Metaverse ETFs are usually investors who want to transact with companies involved in the Metaverse, such as Block Inc.

Now that the basics have been covered. Let’s unravel the answer to the second question.

Top 3 Metaverse ETFs to buy

There are numerous ETFs specific to the Metaverse. Below are the top three funds you should consider buying this year.

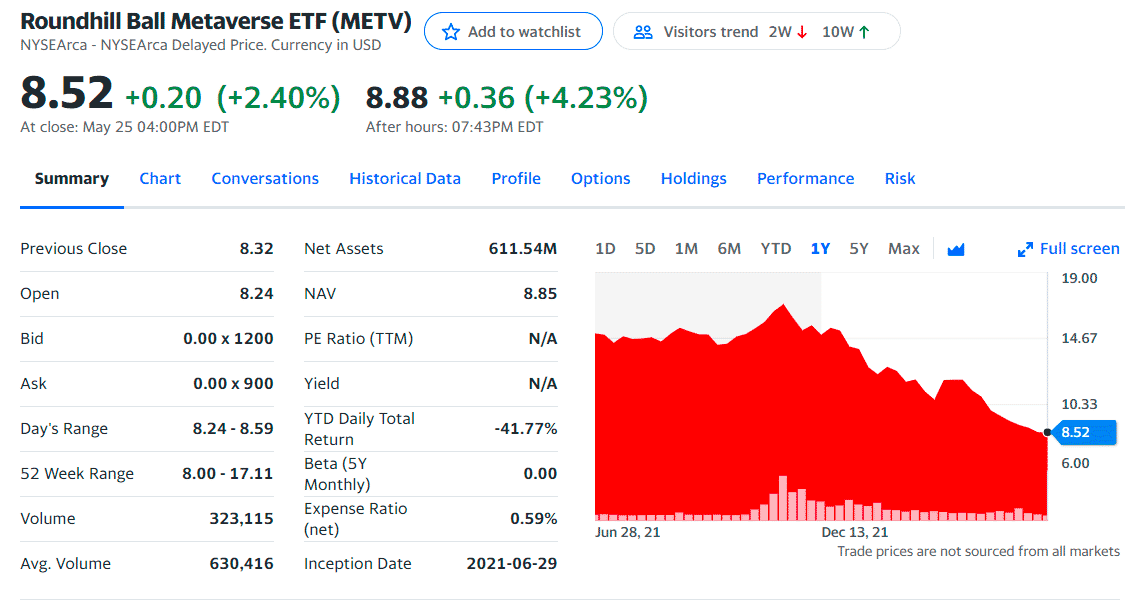

Roundhill Ball Metaverse ETF (METV)

Price: $8.52

Expense ratio: 0.59%

Assets under management: $832 million

The company has several Metaverses in its name. One of these is the Ball Metaverse Index, the first global performance tracker of the Metaverse. METV was Roundhill Investment’s second project, the foremost ETF to launch in the United States of America. But, besides the US, METV now has sufficient exposure in Asia.

Its expense ratio is average compared to funds in the Technology category. METV has an expense ratio of 0.59%, 6% higher than its category.

How much would you earn if you invested 1 year ago?

METV’s performance dropped from $15.00 in 2021 to $12.00 in 2022, so you would likely have earned less if you had invested a year ago.

Evolve Metaverse ETF (MESH)

Price: $5.90

Expense ratio: 0.60%

Assets under management: CAD 13.1 million

It is Canada’s first Metaverse ETF, which is also MESH’s most distinguishing aspect. 74% of its stocks belong to the US, compared to 80% of METV. Walt Disney, a company we are all familiar with, is involved with MESH. It enables investors to actively manage companies immersed in enhancing the digital world – i.e., the Metaverse.

MESH summary

How much would you earn if you invested 1 year ago?

At the end of 2021, when MESH came into being, the starting price was $8.15. Then the price declined in January 2022 but has been recovering gradually since. So if you invested a year ago, besides the drop at the start of the year, you might still earn a stable amount.

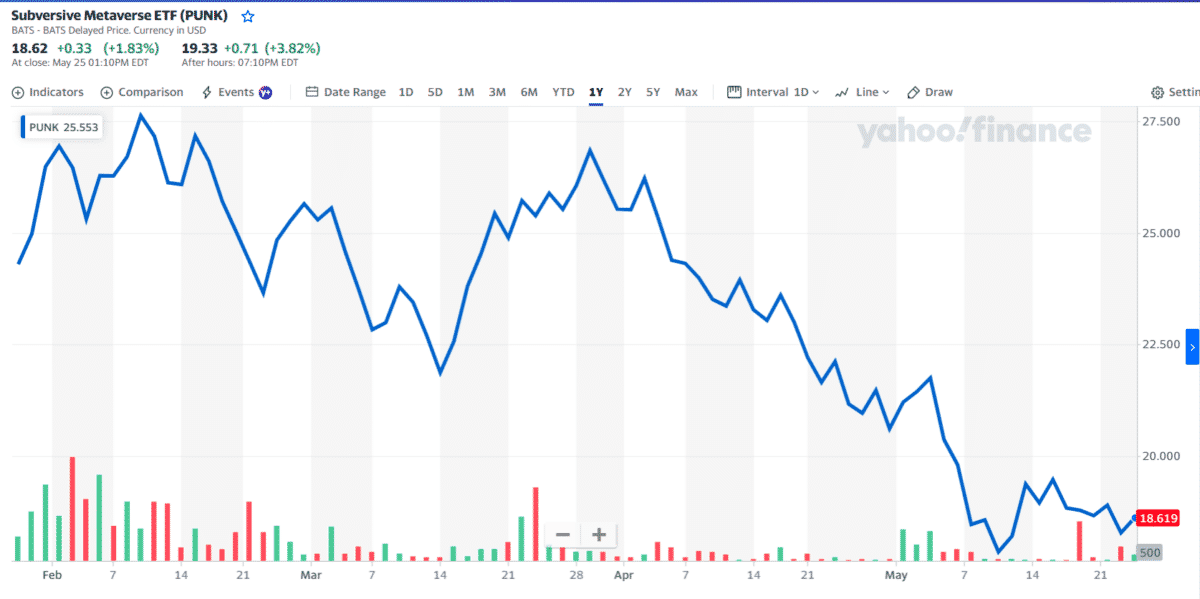

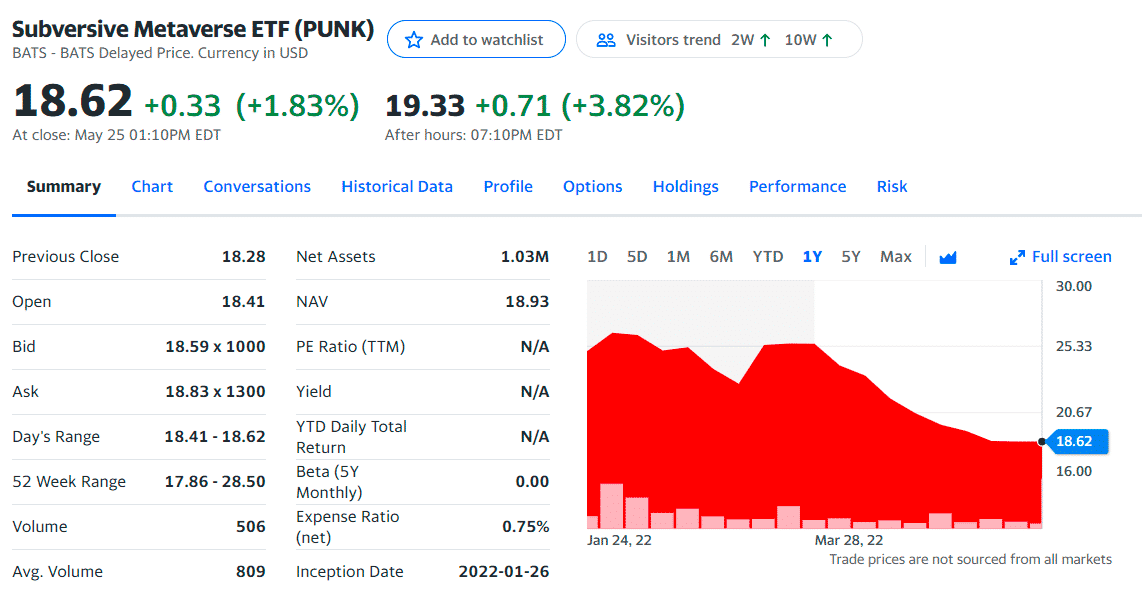

Subversive Metaverse ETF (PUNK)

Price: $18.62

Expense ratio: 0.75%

Assets under management: $1.31 million

PUNK is the most recent Metaverse ETF, but that does not mean it is of little value. On the contrary, it significantly contributes to the digital world by managing dozens of global securities and their products and services.

Its expense ratio is above average compared to funds in the Technology category. PUNK has an expense ratio of 0.75%, which is 34% higher than its category.

It chooses business in one of the seven layers of the Metaverse:

- Experience, e.g., eSports

- Discovery, e.g., search

- Creator economy, e.g., no code tools

- Spatial computing, e.g., voice and gesture commands and recognition

- Decentralization, e.g., NFTs

- Human interface, e.g., virtual reality

- Infrastructure, e.g., 5G and Wi-Fi

How much would you earn if you invested 1 year ago?

PUNK came out in January 2022. However, its market price has increased 2.11% since its inception, so you might be earning if you invested in PUNK early this year.

Final thoughts

Now that you have been through each Metaverse ETF in-depth, you will be able to decide which one is the best for you. The ever-increasing market will keep creating new and improved ETFs, so watch out for those that delineate success and opportunities and begin investing in the digital world.