- What is a strategic investment?

- How to profit from options trading?

- What are different options to work with?

Here’s the saying about this popular trading strategy: it is more complex than it seems. An option trading is complicated when the trader jumps into it without understanding the complete strategies. There are numerous strategies that many traders implement to increase their revenue or secure their positions in market movement.

But here’s another bridge in your path called “Strategic investment.” It would help if you learned the basics before taking the plunge into options trading.

What is a strategic investment?

To reach financial goals, strategic investment is designed to help investors. The main purpose is to make the investor analyze the risk factors and revenues related to the investment. An investment strategy can also help make quick decisions after analyzing the components.

Strategic investments involve numerous ages, lifestyles, financial capabilities, future returns, etc. These aspects assist the investors while selecting the kind of investment they want to make.

Strategic investments vary from person to person. It means not everyone can take advantage of the same strategy. Some might be beneficial with one of the same risky for others. Investors have to revamp and modify their strategies and investment plan to re-evaluate the portfolio with increasing age.

By focusing on only one strategy, you can meet your financial needs, including immense profits with less risk. A written, measurable, sustainable and repetitive strategy is the real fact behind high revenues with a 1% risk factor in businesses.

Ensure you write down the entire process, as well as why your investment is underrated and how you can outperform the market. Remember, a good strategic investment will generate profit when well-planned.

Options as a strategic investment

Trading instruments that permit you the right to sell or purchase particular security, date and price is called options trading. Options trading is a potential profit when a market is less or quite volatile. Profit and loss (P&L) statements are included in option contracts to help you understand how much money you are making or losing.

The amount of premium collected is your profit when you sell an option, including a few downsides. But when you buy an option, the chances of upsides are more significant, and the least you can lose is the option cost premium.

The reason behind choosing options trading is the market leverage. Although, investors like to undertake options trading to secure long positions by buying puts. Or by purchasing calls to protect short-term positions.

Following are the trading options strategies you should know to sky-rise the profits.

Covered calls

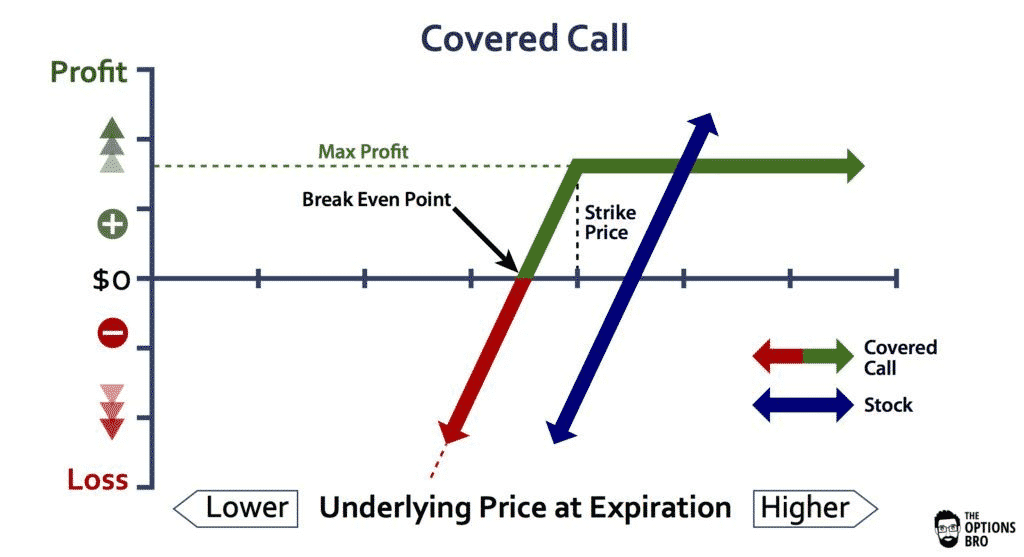

This trading strategy originated more money and minimized the risk of being for a long interval into stock. Having to sell your dividends at a set price — the short strike worth — is the trade-off. A call option on those similar shares is purchased simultaneously with the core stock.

Investors generally implement this strategy for a short period in stocks. After that, they usually look for generating income from the sale of the call income or protecting against a drop in the value of the underlying stock.

Selling the protected calls daily or monthly to add some cashpoint percentages to the annual returns. In short, the premium amount received from a covered call could be utilized as daily income.

If the stock moves up for the strike price, the covered call strategy is most profitable in that case. This is often called maximum profit. The minimum loss count in the covered call strategy is to stick to the price paid for an asset.

Put writing

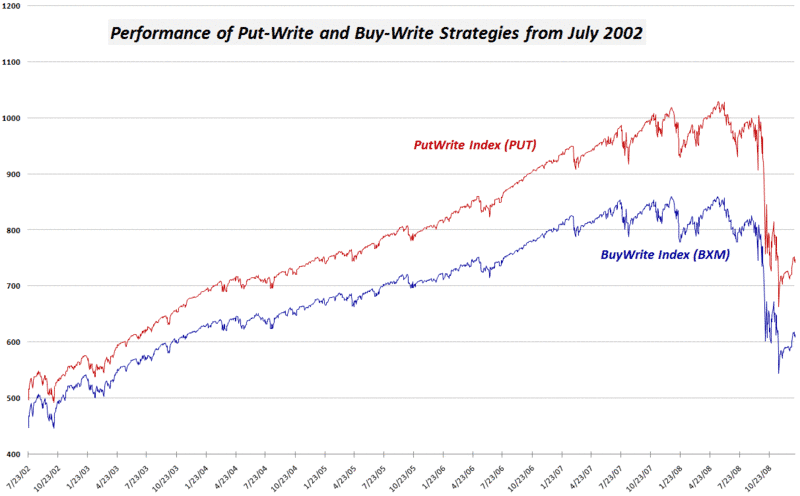

It’s beneficial for advanced options traders. They have to assign the writer, but they will have to buy the stocks. Put writing is a win-win situation for both traders and writers as the writer will enjoy the full amount of option premiums, and the buyer will obtain the options trading rights. If the strategy is well-planned, the buyer can generate more profits.

When writing options for income, the writer must assume that the underlying stock price will rise or stay the same until expiration.

Bull call spread

Buying calls at the same strike amount but selling them higher continuously than the real price is the name of the Bull call spread approach. This strategy is beneficial when the investor is buoyant under the assets and can afford a moderate rise.

There is no possibility of runaway losses when using the bull call spread strategy until the trader closes the long call positions. Therefore, it’s best when your stock/index is moderate or not aggressive. The advantage is that it stops the risk but also freezes the profits.

Protective collar

Protective collars involve the purchase of out-of-the-money (OTM) put options and lettering corresponding call options with the same expiration date when the underlying asset is already owned. It could offer short-term downside protection and a low-cost plan to save you from losses.

A long position in a stock is often used after substantial gains have been realized. A protective collar also allows you to make effective money when the market increases.

Long strangle

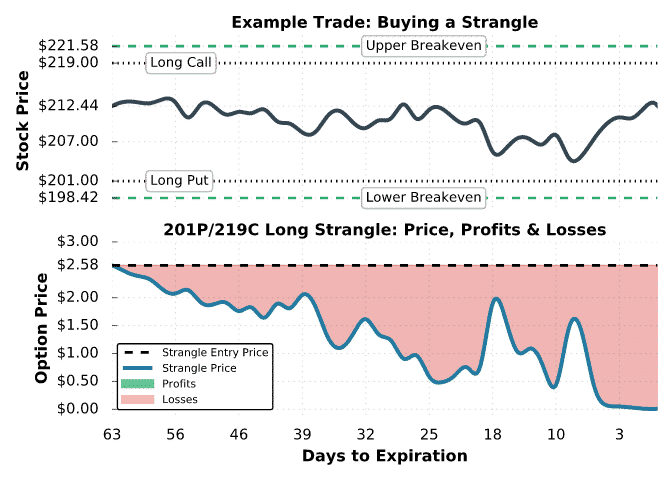

The strategy of choice when the forecast indicates a significant stock price change, but the direction of the change is unknown. When the stock moves mainly in one direction, the stock becomes more profitable.

The investor doesn’t care regardless of how the stock moves; all that concerns is that it begins to move in a manner higher than the total premium paid for the structure.

Final thoughts

Options trading is the best investment but somehow risky too. That’s why numerous strategies have been discovered to ease investors’ investing issues. Low risk with high profits is still the top priority of every options trader.

Make sure to try out every strategy before stepping foot into options trading. It’d help you to make a wise decision.