- How does Iron Butterfly strategy work?

- What are the pros and cons of the strategy?

- What is this strategy’s level of reliability?

If you are looking for a low-risk and low-cost alternative to trade digital assets, you may want to consider buying Bitcoin options. It is possible to purchase or sell an underlying asset at a predetermined price when an option expires, but it is not required to do so. Or, in some cases, before expiration.

In crypto, options are among the most complicated trading instruments. The good news is that several distinct trading tactics may help you get started with the instrument. Today, our focus is on the Butterfly options technique, which enables traders to benefit even during stagnation in the market.

With options, there are a wide variety of ways to generate money that can’t be replicated with traditional assets, and not all of them are risky. Iron Butterfly is an example of a method that provides constant revenue and minimizes risks and rewards.

Butterfly trading strategy

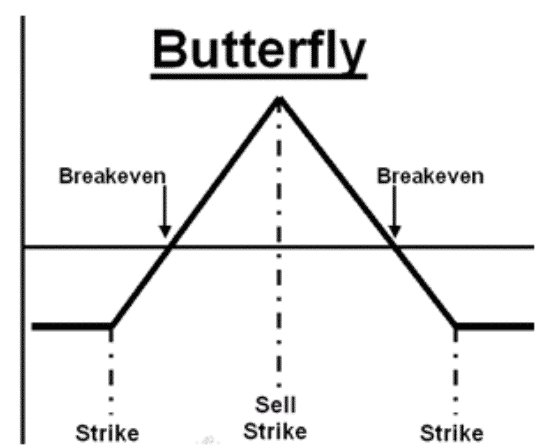

The idea behind the Butterfly approach is that the asset’s price will either remain inside a particular range until expiry, or it will breach the range in either direction.

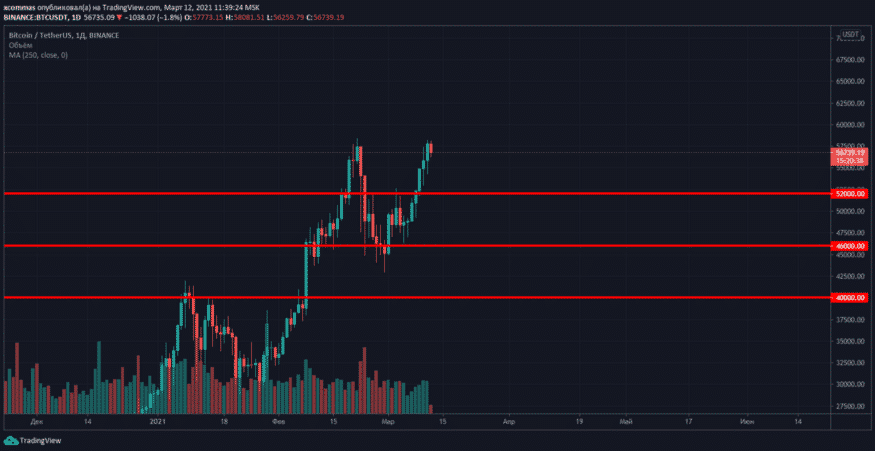

The 3commas options bot may be used to practice a Long Butterfly approach. When it comes to charts, it’s important first to identify a possible consolidation channel for Bitcoin prices. Consider a range of $40,000 to $52,000 on a one-day chart. Also, let’s set the range’s median value at $46,000.

The technique is straightforward:

Two call options are purchased with a strike price at the channel’s perimeter, and one is sold with a strike price in its middle. Also, we need to double the amount of the third option’s sell orders compared to the preceding ones.

We will profit if the price doesn’t fall out of the stated range by the expiry date. The trader will make the greatest money if the price is in the middle of the diapason by the expiry date. Let’s have a look at why:

- A $40,000 strike price option would have made money since the price of Bitcoin increased.

- An option with a strike price of $52,000 would be a loss since the price inside the range does not make it profitable for the trader to execute the contract.

- Short options with a $46,000 strike will bring in profit.

Consequently, the profit on the sold call option and the bought option will exceed the loss on the option with a strike price at the upper end of the range.

Using the 3commas options bot

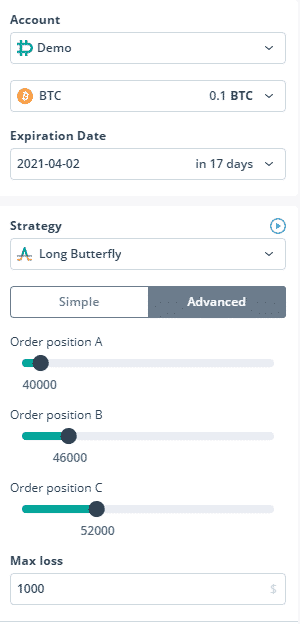

Go to the 3commas dashboard’s options bot tab, pick the long Butterfly strategy, and copy the order positions from the screenshot below.

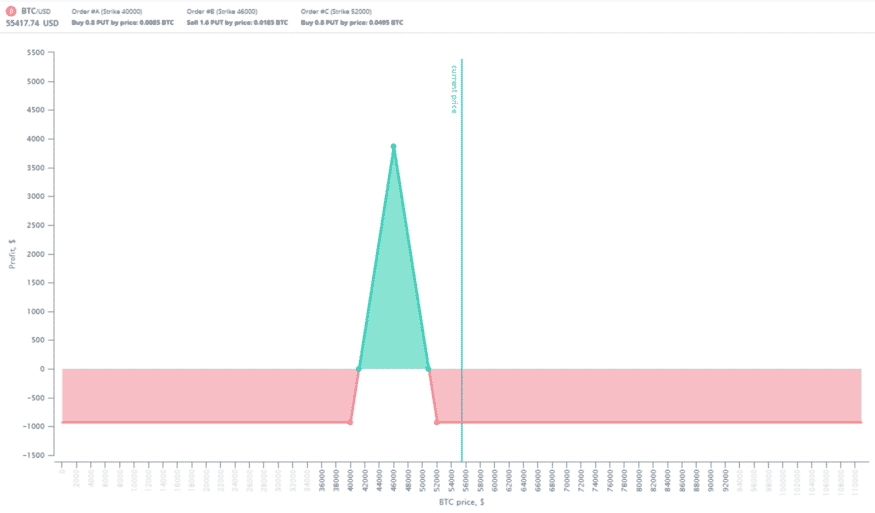

The current asset price, the boundaries of the options’ buy orders, and the possible profit are all visible on the created chart. Put another way, the trader will earn if the price remains in the green zone. Conversely, losses will be incurred if the channel is broken in either direction.

On the other hand, the short Butterfly technique can generate a profit. The trader in this example sells put options at the channel’s edges and buys twice as many put options with a strike in the channel’s center. A trader earns profit only when the price finishes above or below the channel.

When purchasing options, keep in mind that the longer the period to expiry, the more difficult it is to forecast market action. On the other hand, more significant risks are often linked to greater earnings.

Pros and cons of the strategy

| Pros | Cons |

| • They need a lesser initial investment and may provide a consistent source of income with less risk than traditional directional spreads. | • On Iron Butterflies, keep an eye out for commission costs since the underlying settles between the middle strike price and the higher or lower limit. |

| • Traders may roll them up or down like any other spread or close half of the position and profit on the remaining bear call or bull put spread if the price moves out of the range. | • When the spreads of the Iron Butterflies are so close together, as is generally the case, it is twice as likely to lose. |

| • Furthermore, the game rules clarify what benefits and risks players might expect. For example, profit may be obtained if the net premium paid is more than or equal to the difference between the long and short call or put net losses minus the initial premium paid. |

Final thoughts

This method is suitable for the post-growth phases of a coin, sometimes referred to as consolidation. The price tends to go horizontally at this point. The present positive feeling on the market tends to cause channels to break upwards into the next consolidation phase. Both long and short Butterfly options might be effective as a hedging strategy. Thanks for reading, and have a great day of trading.