- What are the options?

- What about their profitability?

- Can you invest in these assets for the long term?

If you are looking for strategic and planned to invest, then options are your go-to source. They are a great way to diversify your portfolio. But the burning question is can you invest in options for the long term?

Let’s find out, but before going further down the lane, we will define options.

Options explained

Options consist of contracts that allow you to buy or sell an asset. It’s like stock trading, but with the twist of contract. This derivative contract will enable you to buy/sell depending on its type. The contract comes up with 100 shares of stocks, and you have to pay a certain amount for each contract. This payment is a premium fee.

For instance, if an option has a premium fee of $1 per contract, you must pay $100 ($1 x 100). The premium fee comes with an expiration date. Like an expiration date of your milk, you must use it within that date.

Like buy and sell, options come with put and call. With the first one, you can sell the asset within a specific date at the determined price. On the other hand, these options allow you to buy an asset at a particular price within a certain period.

Put and call options have two types:

- Buy call

When you are going to buy an option at a specific price.

- Sell call

When you already have the contract and you are looking for a buyer.

- Buy put

When you own/not own the asset with it, and you buy the option to sell it later for a specific price.

- Sell put

When you own the asset and are looking for a buyer to sell your contract.

Just keep in mind that if you buy a call or a put, your maximum loss is the premium you paid, and you are not required to purchase or sell. If you sell the assets, the premium represents your maximum gain, and you must sell if the buyer exercises their option.

A specific price

It is a strike price, which sets the cost of buying or selling a contract.

- For call options, the strike price is where you can buy an asset.

- For put options, it represents the price for selling the asset.

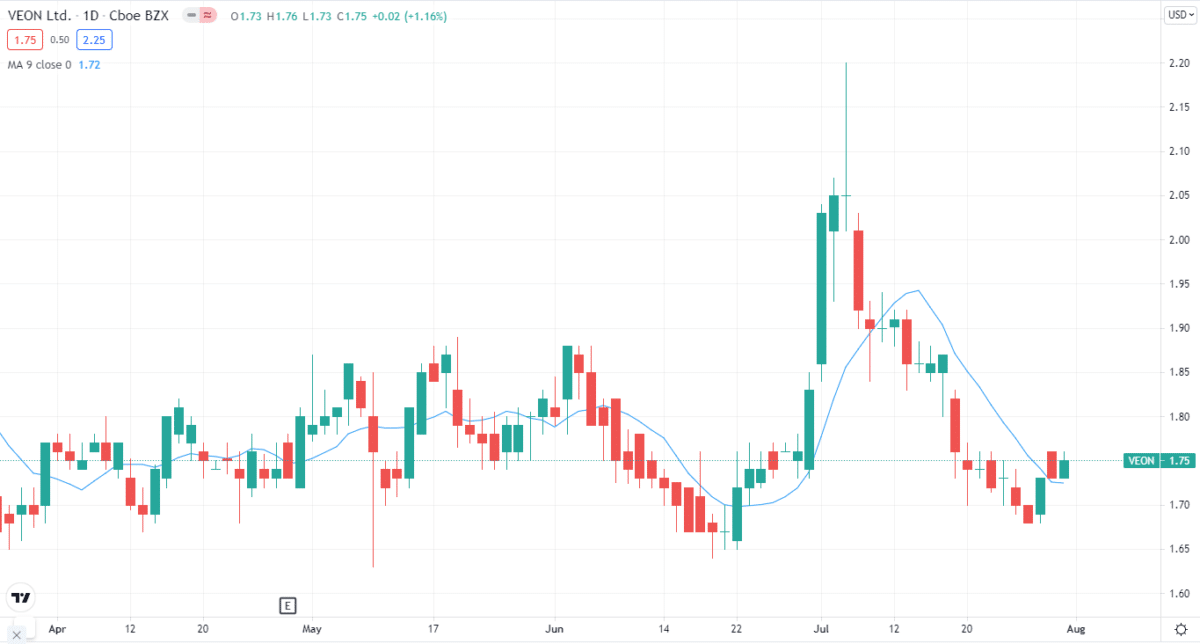

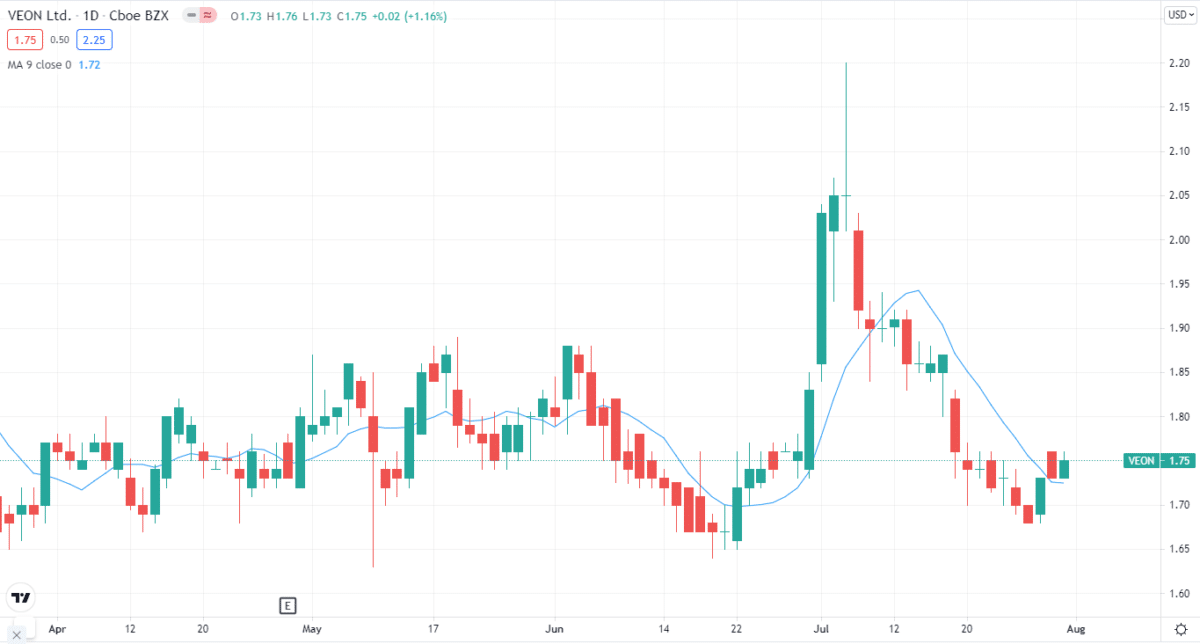

Let’s illustrate this with an example. Suppose you want to buy 1000 shares of Veon for $2 per share. However, you don’t have that kind of money, or you are just a bit jumpy that the price will drop. So, you buy an option contract of $2 per share for $2000. This contract will last for a month.

A few days later, the price of Veon skyrocketed because of their new project. The share price became $10. You exercise your contract and spend $20,000 to buy 200,000 worth of stocks. The profit you will have will be: $200,000 – $20,000 = $180,000.

What if you lose?

Let’s see. The stock price of Veon drops to $0.5. So you can let your option expire worthless, and you are only out the $2,000.

What about options for long-term profitability?

You need to follow specific guidelines if you want to achieve long-term profitability. Before jumping into the pool, think about these critical points:

1. Bullish or bearish

- Are you looking to go long or short on an asset you want to trade?

- Are you downright bullish/bearish, or are you in the middle?

- Which sector are you targeting? Is the sector currently trending?

Asking these questions helps you determine your long-term options strategy, the strike price, and when to enter the trade.

2. Volatility

It plays an essential factor in your long-term options strategy. We know the market doesn’t go according to our will. It chooses its path. If the volatility is high, then you should refrain from buying any options. On the other hand, if the volatility isn’t high, then go for it.

Consider an example. You are using a call option, and its volatility is around 50%. Would you buy it?

Not at all. In this situation, you can consider writing a contract instead of buying calls. Writing options means selling an option contract in exchange for buying or selling the contract later. As a writer, you receive a premium fee.

3. Strike price and expiration date

The most fundamental factor for long-term profitably is the strike price expiration date. It can be a bummer for you if you are looking to hold options for a long time. But the downside is the strike price rises with extra time.

For instance, you don’t want to spend more than $1 for the call option. You have a choice between going for a two-month option with the strike price of $10 for your $1, or you have a three-month option with the strike price of $15 for your available $1; which one would you pick?

This is probably the only hitch of investing in options for the long-term. As a long-term trader, you should look for the option with the highest expiry. Yeah, we know it comes with a higher strike price, but it’ll give your trade time to work out. In this way, your profits will be higher. Of course, as a long-term trader, you would select the three-month option, but it comes with a higher cost.

Also, acquiring contracts of cheaper stocks can improve your chances of long-term profitability.

Final thoughts

Remember to do a thorough analysis before investing in options. Also, it’s essential to define your risk appetite.