- When does the Santa Claus Rally begin?

- How much stock growth can I expect?

- Which stocks often move during the rally?

Market experts observe that stocks make sizable rallies just when a year is coming to a close and at the beginning of the new year. Although this market phenomenon does not happen every year, the frequency is so high that investors who expect it to come each year are seldom disappointed.

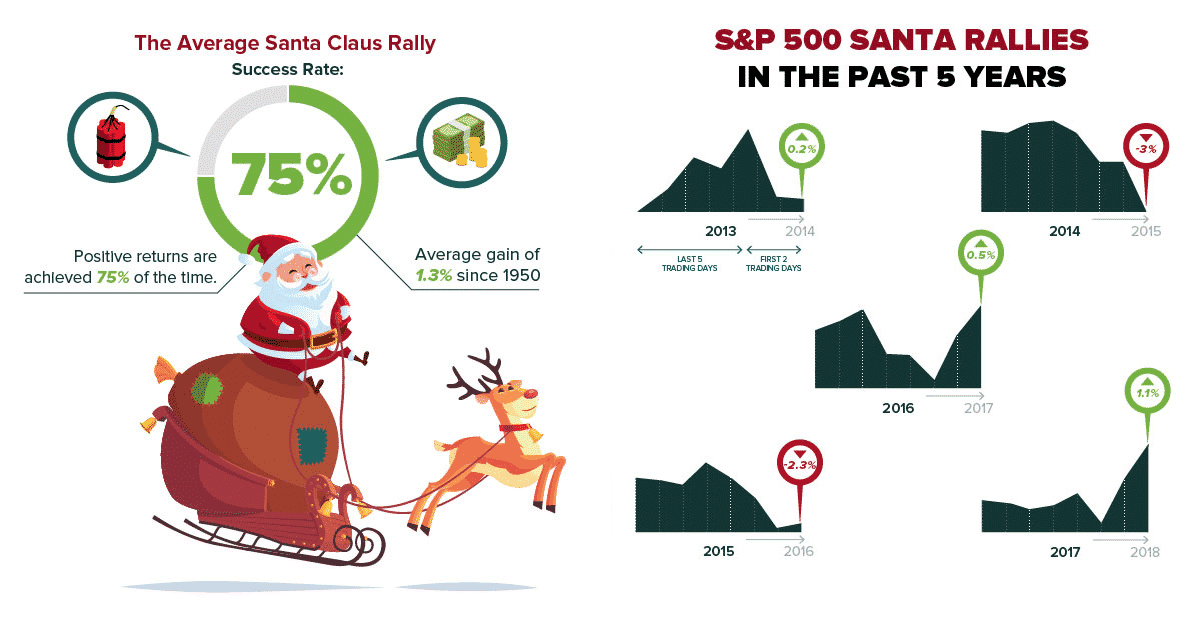

Yale Hirsch calls this occurrence the Santa Claus Rally. He first observed it in 1972. He noticed that the S&P 500 index grows in value over the last trading week of each year and on a couple of trading days of the coming year. The average gain for the seven trading days is 1.3 percent.

Should you buy stocks too in the last trading week of the year? Why not? However, it would help if you chose wisely. Pick those stocks that historically join the rally. Here we outline five such stocks for your consideration. Try to figure out why these stocks move during this time of the year.

In this post, we will dig deeper into this phenomenon, understanding its history and the date of the year of its inception and culmination.

What is the Santa Claus rally?

It is an event that occurs on the last week of December and the first two days of the next year. This is when many stocks appreciate value just when many expect market activity to slow down.

The Saint Nicholas rally that brought the highest gain in recent memory occurred in 2018. Typically, S&P 500 returns an average gain of 1.3 percent during this time, but in 2018 it experienced a higher-than-expected 1.5 percent growth.

What is the Santa Claus rally history?

Some people argue that this event is only a myth so does Santa Claus itself. However, the numbers do not lie. Hirsch studied the Dow Jones indicator and traced it back to 1896. Today, anyone can check the performance of the S&P 500 index and get a similar result. Year after year, compare the closing price of this index at the start of the rally and that at the end of the rally.

Of course, not every year is positive for the index. However, most of the time, the index produces positive returns. Out of the 26 Christmas holiday seasons from 1993 to 2019, the index makes a good return 17 times (or about 65 percent). When you review the index’s performance for the seven-day rally from its emergence in 1993, you can get exciting information.

When does the Santa Claus rally start in 2021?

Stocks generally perform well every December. Based on history, most of the growth comes from the rally under discussion, which begins on the trading day after Christmas Eve. As long as December 25 is a trading day, that is the starting date of the rally. Obviously, this is the reason why this event is called that way.

Knowing the inception date of the rally is crucial for stock investors who are looking to capitalize on this event. A simple play is to buy your beloved stocks at the beginning of the rally and keep the position until the end of the rally. Historically, those stocks that join the rally are often seen playing out well throughout the whole year after the rally. Should you keep the position longer? You make the call.

Top 5 best Santa Claus rally stocks

Below are our top five picks of Santa Claus rally stocks for your consideration.

No. 1: Apple (AAPL)

Apple is a designer, manufacturer, and vendor of consumer electronics and computer software. In 2020 Apple generated an income of $274.5 billion, earning a reputation as the most prominent IT firm in America. Since the beginning of 2021, it has carried the name as the most valuable company across the globe. Today, the company is the fourth biggest seller of personal computers and smartphones in America.

No. 2: Amazon (AMZN)

Amazon is a retail powerhouse. It sells virtually everything, from clothing to food, electronics, toys, and anything you can imagine. The company focuses on digital streaming, artificial intelligence, e-commerce, and cloud computing. It is among the ranks of the five biggest IT firms in America, Google, Apple, Microsoft, and Meta. The acclaims it has gained over the years are the most valuable brand and most influential brand.

No. 3: General Electric (GE)

General Electric was among the most prominent American firms in the recent past. The company was founded in 1878 by the famous inventor of the incandescent bulb, Thomas Edison. Until 2021, the company operated in several sectors, including aviation, locomotive, power, digital industry, renewable energy, and many more. Due to the setbacks it has encountered. Lately, GE has reduced its focus on the first four sectors mentioned above.

No. 4: McDonald’s (MCD)

You might not think MCD is a good prospect for the Saint Nicholas march, not with the effect of the coronavirus in businesses and the fear it left in people’s hearts. However, be aware that many people love fast food. Now that things are getting back to normal post-pandemic, you can see cars lining up in McDonald’s drive-through lanes. This is a sign that MCD could be an excellent stock to buy long term.

No. 5: Disney (DIS)

As you might have expected, Disney is among the blue-chip companies that give investors good returns during the rally. Since 1960, it has averaged a gain of 1.4 percent. This return might not be the best for the company. Disney is a famous brand during the winter holidays and Christmas season. A critical logic might have played a crucial role in why this rally has been working for many years.

Final thoughts

The last trading week of the year often sees a smaller volume than any other stock trading week in history. Indeed, it comes as a surprise when stocks post higher-than-normal gains during this week and in the two trading days after it.

While previous performance does not entail similar future results, data says something. The coming of Santa in the neighborhood may not be as you might have expected as a bit of child, but the stock rally after Christmas Eve is evident. It may not come year after year, but it seldom fails.