- Which cheap crypto projects are worth investing in?

- What are some of the most affordable cryptocurrencies today?

- Which crypto assets have low prices but large market caps?

Below are five cryptocurrencies trading below one cent. This means their current prices are even lower than penny crypto. Despite the meager prices, some of them have a large market cap among the 17,514 cryptos currently in existence. The five coins listed below are arranged based on their market cap.

Shiba Inu (SHIB)

Shiba Inu was the hottest coin in 2021 and was the leader among meme coins, surpassing Dogecoin. As you might have guessed, the Shiba Inu token got its name from and bears the image of that friendly and lovely Japanese dog of the same name. It was conceived to take down Dogecoin from its lofty position. Shiba Inu is not a coin but rather a token to be more accurate. The reason is that this crypto runs on Ethereum and does not have its blockchain.

Why does it have the potential to grow?

Experts think that this token has a great possibility to grow in value to a cent or even beyond. What makes Shiba Inu attractive to investors is its very low price despite the meteoric gains in 2021. There have been plans for the token to cater gaming and join the Metaverse. Also, numerous crypto exchanges have listed the token, including Bybit, BitStamp, etc.

How much would you earn if you invested in Shiba Inu 1 year ago?

SHIB/USDT was listed on Binance on 10 May 2021 and opened at a price of $0.00001412. On 13 February 2022, its price went up to $0.00002871. This represents a change of 103 percent. If you invested $1,000 upon the exchange listing, you could have earned $1,033.

Tron (TRX)

TRON is a governance token and a virtual currency you can trade in crypto exchanges. An operating system based on blockchain, Tron allows you to create dApps and distribute media content. The system was developed in 2017 by Tron Foundation founder Justin Sun. The goal of this network is to support the distribution of digital content cost-effectively.

Why does it have the potential to grow?

Tron boasts multiple use cases and extensive adoption. At present, the Tron ecosystem hosts more dApps than any network in the industry, such as Ethereum. As the number of dApp developers joining the network grows, Tron cements its reputation as a leader in the crypto space.

How much would you earn if you invested in Tron 1 year ago?

On 13 February 2021, TRX/USDT had a closing price of $0.05995. One year later, its price hovers around $0.06430. This price change represents a gain of 7.26 percent despite the recent correction. If you invested $1,000 last year, you could have gained $72.6.

Holo (HOT)

Holochain is a platform where people get together and share content. It also links the internet with the users in the network. Developers looking for a cheaper and more efficient alternative to blockchain go to Holochain. This movement gives rise to the creation of hApps or Holochain apps. Holochain is powered by its governance token HOT.

Why does it have the potential to grow?

In a span of five years into the future, Holo has the potential to grow regarding development, partnership, and adoption rate. Communication is the area where Holo might find great success. Because HOT is a token for ordinary internet users, it could grow bigger than other digital currencies.

How much would you earn if you invested in Holo 1 year ago?

Last year on 13 February 2021, HOT/USDT closed at a price of $0.001393. One year later, its price sits around $0.004930. This price change is equal to a gain of around 254 percent. If you invested $1,000 last year, you could have earned $2,540.

Zilliqa (ZIL)

Zilliqa is a blockchain that uses the database partitioning method known as sharding to address the slow processing issue inherent in several blockchains. With this platform, you can quickly develop dApps that are user-friendly, secure, and efficient.

Why does it have the potential to grow?

Zilliqa may experience further growth due to its ability to process transactions efficiently and its number of products available to users. The network also hosts an NFT marketplace where collectors, investors, and creators meet to provide and find valuable digital content.

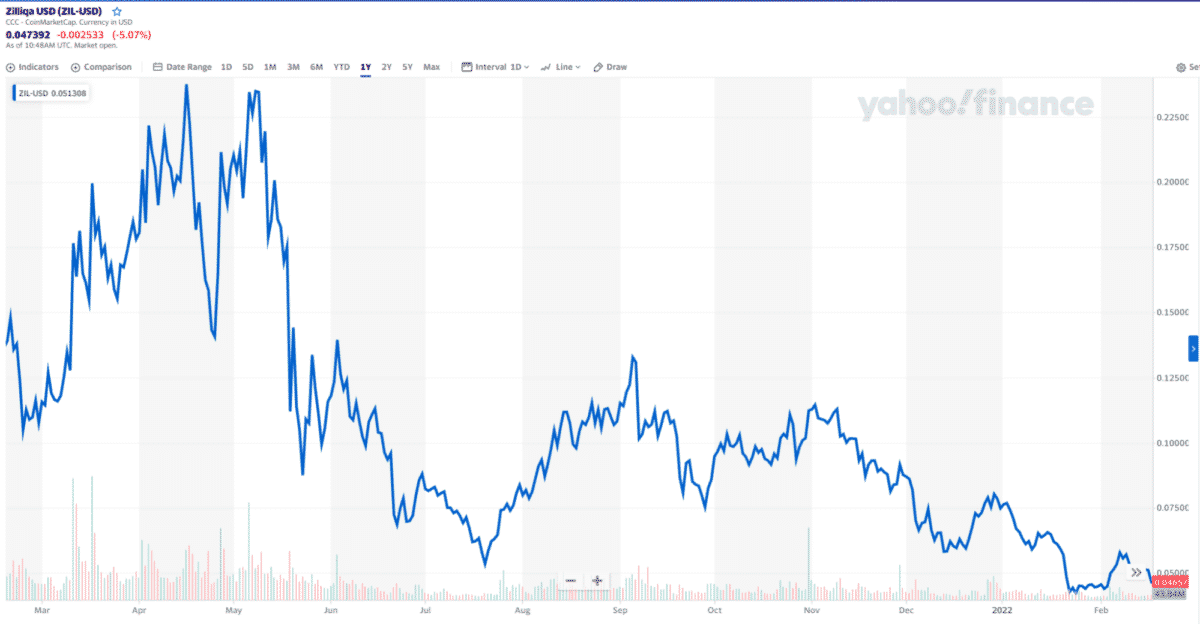

How much would you earn if you invested in Zilliqa 1 year ago?

Last year on 13 February 2021, ZILUSDT closed at $0.14755. One year later, its price sits at $0.04925. While the coins presented above-gained value, Zilliqa lost some value. This price change is equal to a negative 66.6 percent. If you invested $1,000 last year, you could have lost $666.

Akropolis (AKRO)

Akropolis is a platform that supports dApps providing financial services using crypto. Users can take affordable loans with no collateral access to pensions and other services with this platform. It also supplies DeFi products running the akropolisOS, making yield farming in multiple blockchains possible.

Why does it have the potential to grow?

Akropolis is suitable for long-term investors. Because of continuous developments and upgrading, the network and its token AKRO could see steady growth. Experts predict that the all-time high of $0.08 may get broken in 2022.

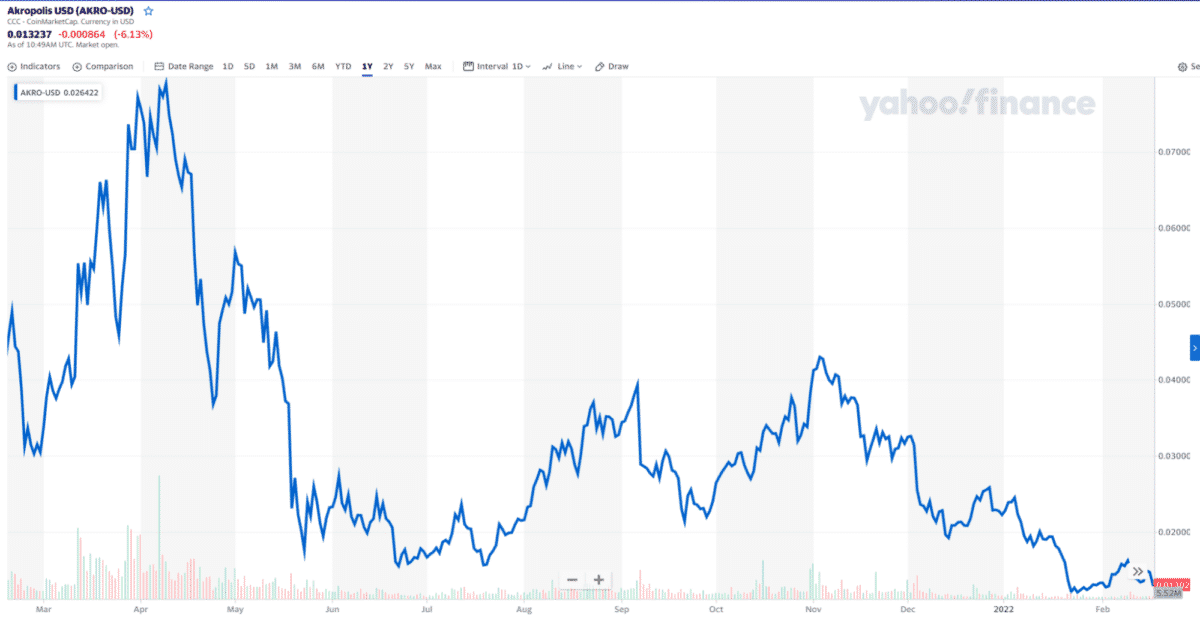

How much would you earn if you invested in Akropolis 1 year ago?

One year ago, AKRO/USDT closed at a price of $0.05456. Today (13 February 2022), its price hovers around $0.01396. This means that the market encounters a downturn of 74.4%. Had you invested $1,000 last year, you could have lost $744.

Final thoughts

The above crypto assets have meager prices, but their market caps are high enough, proving investors see their values and have confidence in their potential. Although they are considered riskier investments than the major cryptos, they are the most affordable assets. Investors can make a fortune or get outsized returns when their value grows multiple times.