- Is there an ETF for crypto?

- What is a blockchain ETF?

- What is the best way to invest in blockchain technology?

The blockchain exchange-traded fund market in 2020 was worth approximately $3 billion. This relatively small value compared to other market niches. Despite this, Bob Greifeld, former Nasdaq Chief Executive, says that blockchain technology is the most significant opportunity for the next decade or even more.

This sentiment might be solely attributable to the fact that blockchain technology solves the old age problem of safe data exchange. With adaptation in the popular cryptocurrency technology and supply chain management, healthcare, finance, among others. So it is no wonder that this market is projected to grow to $39.7 billion, a 67% year-on-year growth.

The need for simplified and secure business models and processes are at the forefront of the adoption and this phenomenal growth in the blockchain technology market.

With the onboarding of blue-chip big boys on board such as Oracle, JPMorgan, Baidu, and IBM, this market is on the brink of blowing up. Investment in ETFs has the potential for wealth creation and accumulation.

What is a blockchain ETF?

To many, the word blockchain has them thinking about Bitcoin and other cryptocurrencies. Despite this common misconception that blockchain and cryptocurrencies are interchangeable, crypto technology is just a small portion of the blockchain.

This technology refers to a decentralized information storage system that is unalterable and unhackable. Therefore, a blockchain is a digital transaction ledger available to all devices connected to the blockchain in real-time.

Every emerging market has a steep learning curve. In the investment world, the learning curve may result in financial ruin. Trying to pick individual blockchain equities and time when they will appreciate is quite tedious and, as the markets have proven time and time again, futile.

It is for this reason that exchange-traded funds exist. Rather than pick an individual stock, they comprise a basket of investment assets with similar characteristics. Blockchain ETFs are investment vehicles pooling together different blockchain-based investment assets.

The best blockchain ETFs

Not all blockchain technology is as volatile and unpredictable as the cryptocurrency niche. Still, an emerging market faces volatility and fundamentals adversely affecting equities, calling for a cushioned investment approach.

Blockchain exchange-traded funds provide this cushion. According to Bill Gates, “Blockchain is a technological tour de force,” and these three ETFs get you on the cation of this disruptive technology.

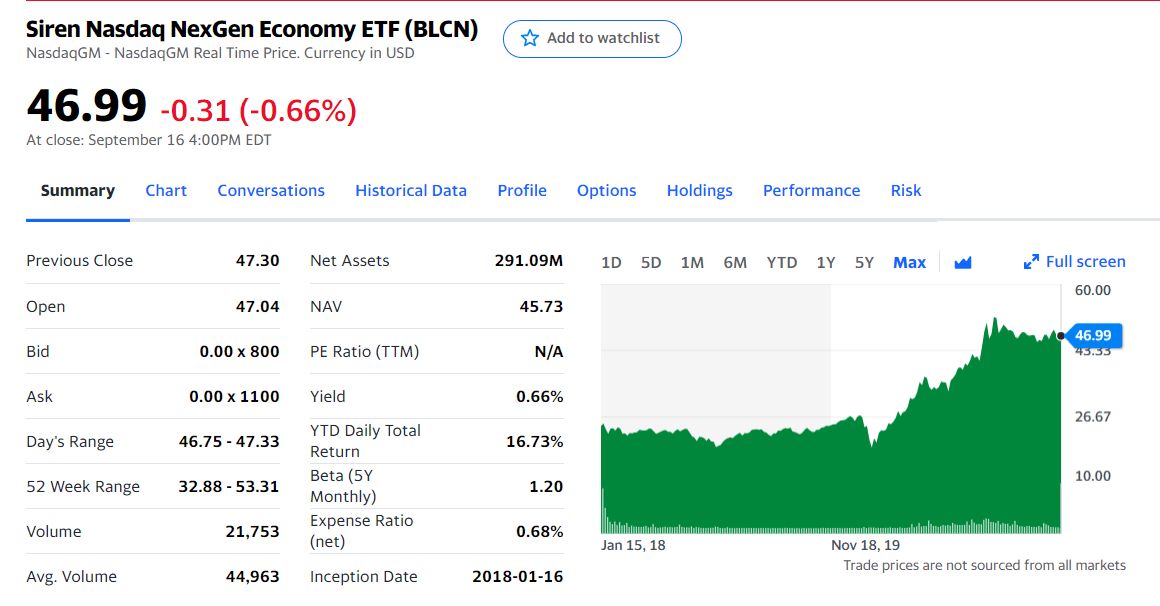

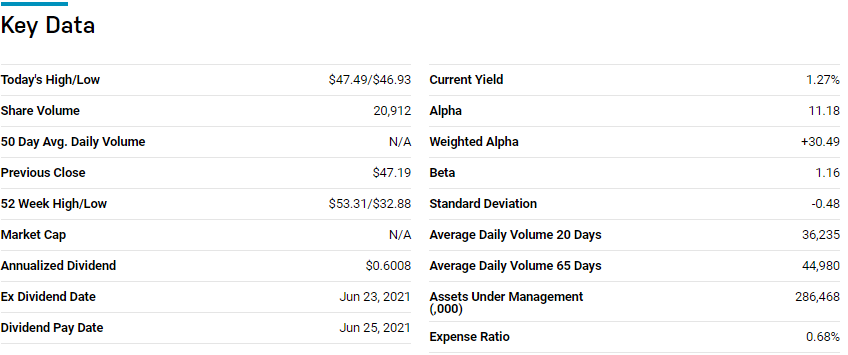

№ 1. Siren Nasdaq NexGen Economy ETF (BLCN)

Price: $46.99

Expense ratio: 0.75%

Siren Nasdaq NexGen Economy ETF is a growth ETF seeking capital appreciation by tracking the Siren Nasdaq Blockchain Economy Index.

It invests at least 80% of its total assets in companies of its composite index, which are organizations involved in developing, innovating, researching, or utilizing Bitcoin as their proprietary operational tool or for sale.

The top three holdings for this fund are:

- Huobi Technology Holdings Limited — 2.35%

- Coinbase Global Inc Class A Shares — 2.26%

- Accenture PLC Class A Shares — 2.13%

BLCN has $286.3 million in assets under management, with an expense ratio of 0.68%. So far this year, this non-diversified fund is up 16.39% continuing its earnings legacy since inception.

The 3-year returns of 108.62% and pandemic year returns of 37.37%. Combining blue-chip companies and lesser-known blockchain technology firms, this blockchain ETF has the right equity mix for growth coupled with acceptable risk levels.

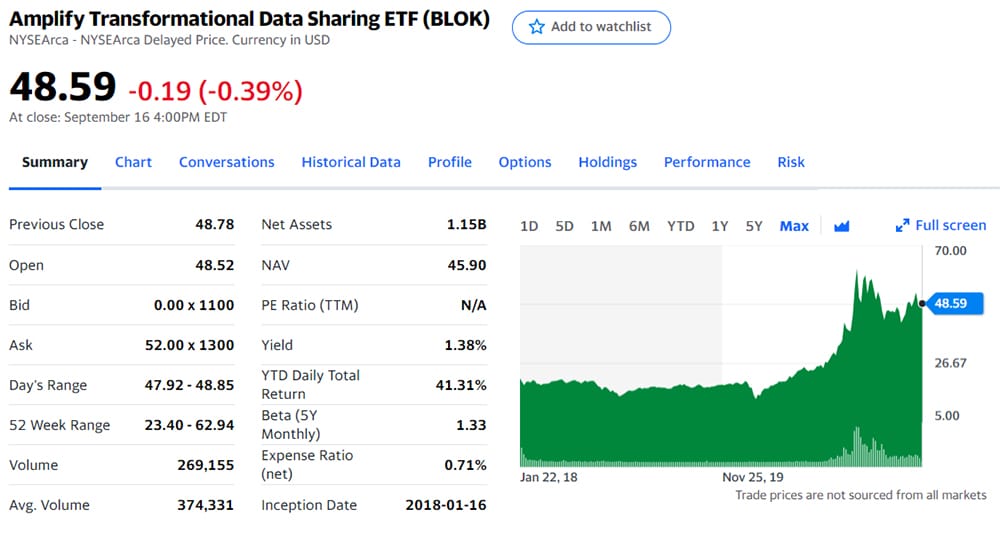

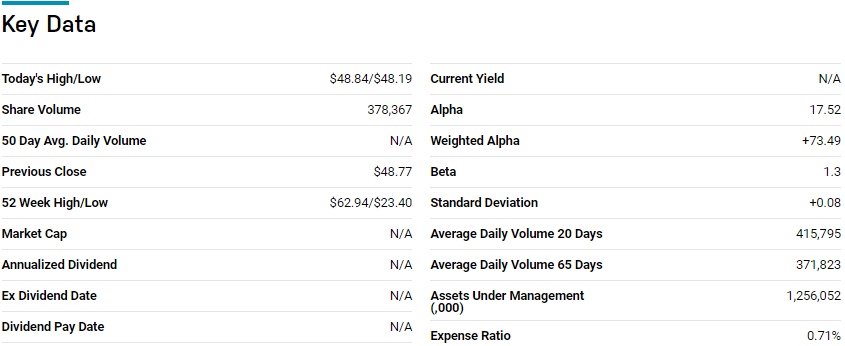

№ 2. Amplify Transformational Data Sharing ETF (BLOK)

Price: $48.59

Expense ratio: 0.75%

Amplify Transformational Data ETF, BLOK paved the way for all the other blockchain ETFs. It is an actively managed exchange-traded fund with a global reach whose objective is to provide total returns.

It invests at least 80% of its assets in firms that develop and use transformational data sharing technology and those in partnership with the firms mentioned above, a 7:3 ratio composition.

The top three holdings for this pioneer blockchain fund are:

- Hut 8 Mining Corp — 5.97%

- MicroStrategy Inc Class A Shares — 5.64%

- PayPal Holdings Inc. — 4.53%

BLOK is the most prominent blockchain ETF with $1.26 billion in assets under management, at an expense ratio of 0.71%. Continuing to outperform its counterparts in the blockchain technology market, this pioneering fund in its niche has recorded 3-year returns of 155.32%, 1-year returns of 101.70%, and current year-to-date returns of 39.45%.

This phenomenal performance might be due to diversification of BLOK and active management, which allows for flexibility in investment-important for taking advantage of opportunities in emerging markets.

With its historical returns and a dividend yield of 1.35%, this is not only a growth ETF but one with potential for profitable income investing.

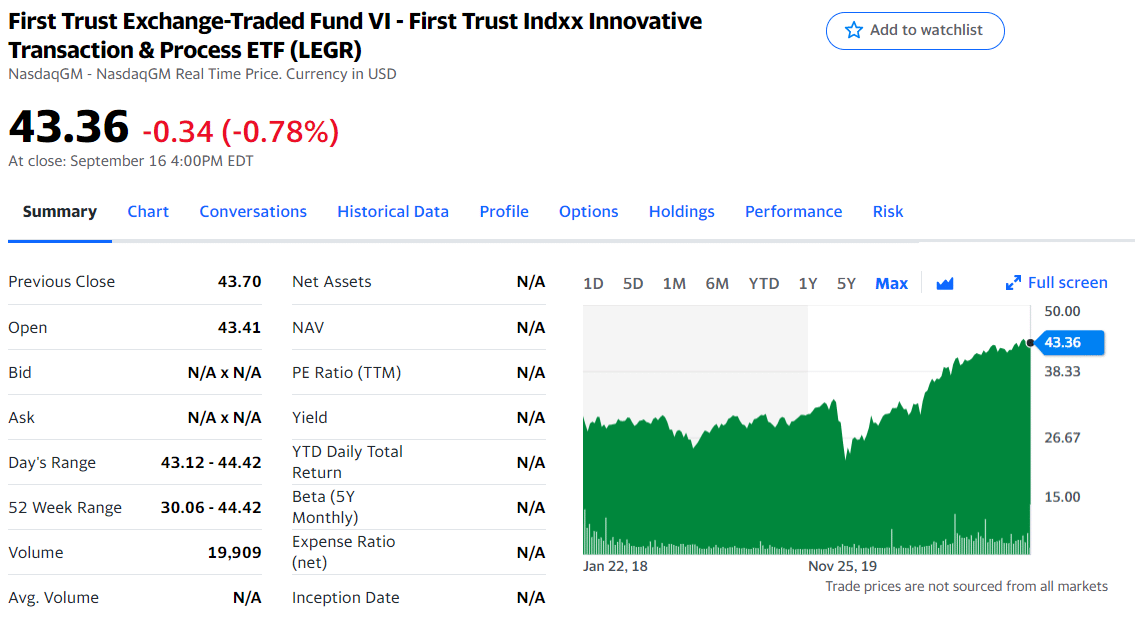

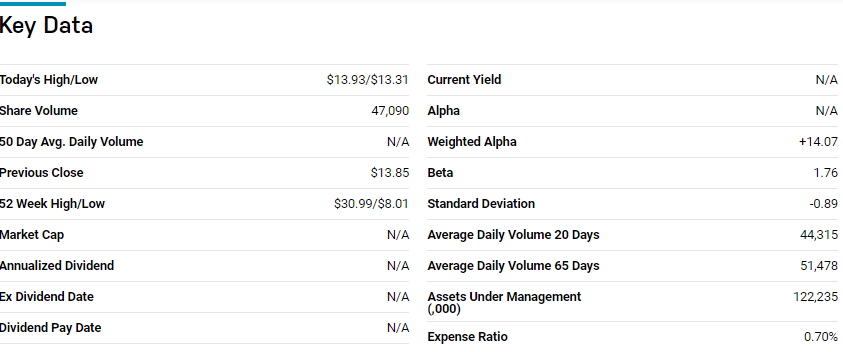

№ 3. First Trust Indxx Innovative Transaction and Process ETF (LEGR)

Price: $43.36

Expense ratio: 0.65%

First Trust Indxx Innovative Transaction & Process ETF, LEGR, is yet another blockchain ETF available to investors in 2018.

However, unlike BLOK ETF, LEGR tracks the Indxx Blockchain Index, investing at least 90% of its total assets in its composite index holdings. It, therefore, exposes investors to companies actively researching blockchain technology, using blockchain technology, developing blockchain technology, or being involved in products that benefit from blockchain technology adoption.

The top three holdings for this pioneer blockchain fund are:

- NVIDIA Corporation — 2.11%

- Wipro Limited Sponsored ADR — 1.75%

- Fujitsu Limited — 1.68%

LEGR has $125.82 million in assets under management, with an expense ratio of 0.65%. With global reach and interests in all things blockchain, this blockchain ETF is one to watch out for as the industry opens up given its historical performance.

The 3-year returns of 50.59%, pandemic year returns of 37.13%, and current year-to-date returns of 17.31%. In addition to this performance, LEGR has potential for regular income generation given its dividend yield of 1.10%.

Final thoughts

Any sector that utilizes a supply chain in any form can vastly benefit efficiency-wise from blockchain technology adoption. It means that blockchain technology is all-encompassing.

It is no longer a question of whether this market will blow up but when; recent cryptocurrency adoption and the charge are examples.

Being in their infancy, the ETFs above provide a relatively less risky way of playing the blockchain market while providing opportunities for making money in Q4 2021.