- What is slippage in crypto?

- How to control it while trading?

- What nuances to consider while trading?

Don’t panic if you buy a cryptocurrency from a level, but it opens from another price level. It is a common nature of the market that is known as slippage. It happens when there is a significant gap between the buying and selling orders. Like the other financial market.

If you are new in crypto trading, you should have explicit knowledge about slippage. Why it matters and how to minimize its risk. Let’s get a detailed view of this case in crypto trading to help you build a risk management system.

What is slippage in crypto?

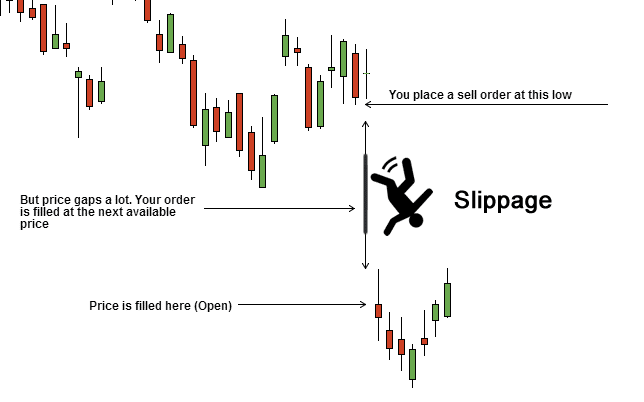

When you buy crypto from an exchange, you can expect that the buy will happen from the price you see on the trading platform. Unfortunately, the opening price might be different. When you open an order, it takes some time for the broker or exchanger to fill it at the current price. In the meantime, if the recent price changes, the trade will execute from the new price.

Let’s have a look at an example.

Mr. X opened a buy order in the BTC/USDT where the price was at $44,500. The amount of the trade was 1 BTC that would cost $44,500. However, once Mr. X opened the buy order, the trade was executed with the cost of $44,900 instead of $44,500. In that case, Mr. X made a loss of $400 due to the slippage.

When you open a buy order with no sufficient seller to remain active in the market, your order will be executed at the next best price. The change in the price level comes from the high level of volatility due to market uncertainty.

For the crypto market, if any market-changing event happens, we may expect volatility in the market that increases the possibility of slippage. It could be crypto acceptance or ban, adoption by big companies, improvement in hard forks, or halving, etc.

Slippage: positive vs. negative

Slippage can cost you money, but it often works as a blessing. There are both positive and negative slippages. No one knows whether you will make a loss or profit from a slippage.

- Positive slippage happens when the price opens lower than your executed price. If you open a buy position in the BTC/USDT at $40,300, but it opens at $40,100, you get a $200 discount.

- Negative slippage happens when the price opens higher than your executed price. In the above example, if the buy opens at $40,500, you have to pay an additional $200 due to the slippage.

There is no fixed rule regarding how much loss it may cost you. It is essential to know that the slippage will slightly change the price — 0.05% to 0.10%. In a highly volatile market condition, the slippage may extend to 0.5% and even 1%.

Traders should remain cautious while opening a position with a broker. Here the volume of buy orders matters. 1% slippage from $100,000 would cost $1000, while from the deposited amount of $1000, you might have to pay $10, which is not significant.

How to control slippage when trading crypto?

There is no way to eliminate the slippage. Even if it is frustrating to see unexpected loss instantly. However, you can set a tolerance level for this case. Most of the cryptocurrency platforms offer a tolerance level in the market order method.

Investors and traders can agree on a certain percentage of tolerance level. If the loss incurs more than this level, the broker will cover it. The general ratio of the slippage tolerance level is 0.1%, where the broker will pay any loss above 0.1%.

However, the best approach is to follow a manual trading system if you are not an intraday trader. Most pending orders can get hit with slippage during market volatility while you are away from the market.

On the other hand, manual traders can observe the market with the human brain and follow the wait and watch approach when the market volatility is extreme. Moreover, the daily and weekly opening and closing times are essential to consider where the market faces less liquidity. In that case, traders should keep themselves away from trading during those hours.

Example of slippage

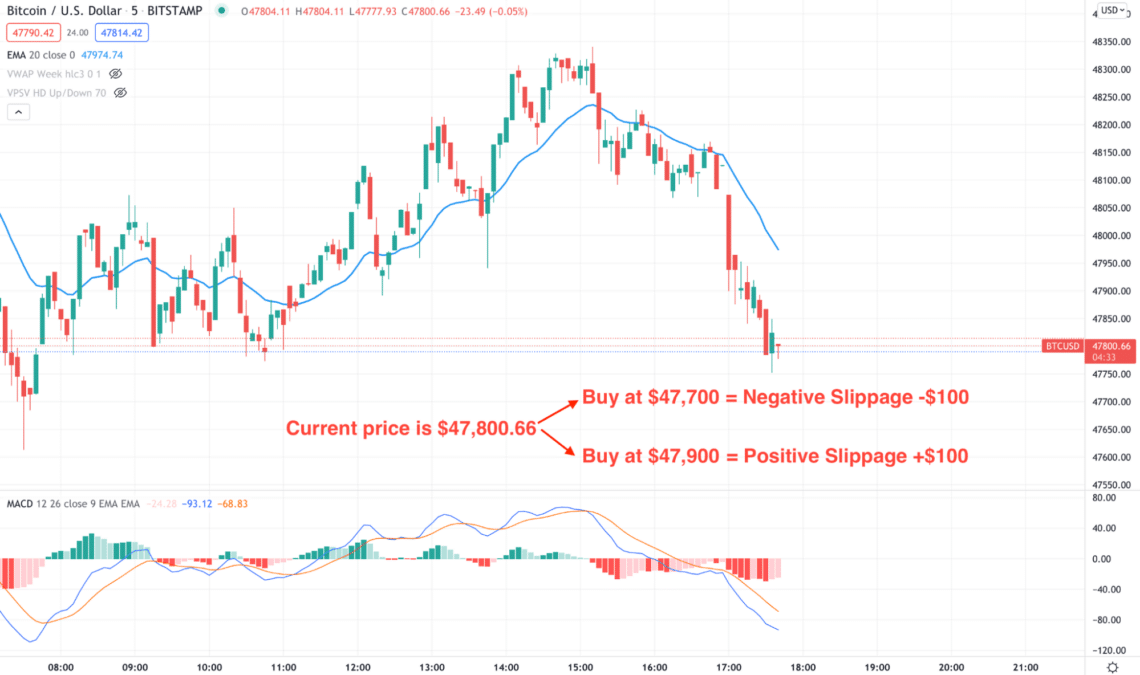

In the above image, we can see that the price is trading at the $47,800 level. If you want to buy 1 BTC, you have to pay $47,800 to the broker. However, if the price opens at $47,900, you have to pay an additional $100 as a slippage.

On the other hand, if the market becomes favorable to you and the trade opens at $47,700, you have saved $100 from the positive slippage.

What nuances to consider while trading?

Slippage is a part of the trade. So while trading, you have to be prepared for facing slippage from crypto trading. However, make sure to take precautions to minimize the loss from the slippage.

How can you do that?

First, you have to monitor market volatility. Do not open trades if the volatility is excessive due to any significant events. Consult your broker regarding the slippage tolerance level. Make sure to convince the broker to keep the level as low as possible. If you trade with a higher volume, remain cautious about the intraday market volatility.

Final thoughts

Slippage is a core part of risk management in the cryptocurrency market. In the online traditional financial market, you cannot see or anticipate where the slippage may happen. The crypto market is wholly decentralized that runs through blockchain technology.

Therefore, any slippage cost is a part of the system, and there is no way to eliminate it. However, more people are coming into this market that may make the structure stable with higher liquidity. Thus, you might get buyers when you want to sell and sellers when you want to buy without slippage.