- How to screen for the best ETFs?

- How to invest in the ETF market?

- Why should you be part of the ETF market?

An ETF, an exchange-traded fund, is an investment instrument comprising several investment assets under one standard banner. ETFs track either an index, a commodity, other assets, or an industry sector.

Despite being very similar to mutual funds in their composition, ETFs trade like stocks. The combination of both mutual fund and stock characteristics to give investors exposure to an investment vehicle that is relatively cheap yet has massive potential for consistent returns has seen ETF popularity skyrocket, from $0 to over $5.5 trillion markets in three decades.

Add relatively lower investment risk and instant portfolio diversification to the list of what ETFs offer, and what you have is an investment cocktail that even the sage of Omaha recommends.

If you had $100 to invest, the stock market would give you just a single share if not dealing with penny stocks. The other option would be to invest using fractional shares and have multiple shares in different companies. It is pretty tedious, and the risk is massive. What if, with the same $100, you could access a portfolio of equities with less hassle? That is the ETF market. But, how do you go about it?

Why invest in ETFs?

With the global ETF market growing at a phenomenal average annual rate of 26%, it is no longer a question of whether to get into the bandwagon but when. For both seasoned hands in investing and the novice, the driving factors for this phenomenal growth are:

- Diversification

Through ETFs, investors gain instant exposure to a diversified portfolio. ETFs, by definition, are a collection of investment assets either across the entire economy or a specific industry. ETFs give investors a diversified portfolio at relatively lower cost and less hassle in terms of management.

- Transparency

The SEC requires ETF sponsors to declare their composition daily, unlike other investment assets. ETF broker accounts are also accessible 24/7, enhancing transparency and tracking of investments.

- Relatively cheap

ETFs are a relatively cheaper option compared to other investment vehicles in terms of cost and management fees. Most ETF brokers have waived commission fees on select ETFs in a bid to be more competitive.

- Tax benefits

ETFs are one of the most tax-efficient investment instruments. Investing in ETFs is a long-term investment strategy meaning that primarily, the returns taxation rate is at the long-term capital gains rate. They also attract taxation only on redemption.

- High liquidity

The liquidity of an ETF is a factor of the liquidity of its underlying holdings. As such, ETFs tend to be highly liquid in comparison to the other pooled investment vehicles.

ETF types

The ETF market is indifferent niches depending on the underlying holdings, and the index tracked. Therefore, individual investment objectives and allowable risk levels guide investors to their preferred ETF type from among the following:

- Commodity ETFs

Track indices in the commodity market and make investments in a commodity such as precious metals, oil, and agricultural produce.

- Industry ETFs

Track economic segments or the whole economy by tracking indices representative of the chosen particular industry and are made up of companies in the sector they follow, for example, banking, technology, energy, and finance.

- Bond ETFs

To invest in bonds, considered the safest investment assets, rather than shop around for many options, all you need are bond ETFs. Bond ETFs track the performance of the different bond types with varying periods of maturity.

- Currency ETFs

Track the value of individual spot currencies and give investors a chance to hedge against changes in the foreign exchange value.

How to be part of the ETF market

To be part of this multi-trillion dollar market, investors can either own shares in a chosen ETF or make money by speculating on the ETF price fluctuations through CFDs, contract for differences.

Both approaches require the services of a broker; you choose between a traditional call brokerage firm and online broker trading platforms. The former option gives investors more control and visibility of their investment since it is available 24/7.

Once a broker has been identified, being part of the ETF market is a simple three-step process.

| Step 1 | Step 2 | Step 3 |

| Open | Screen | Invest |

| Open a trading account with a broker offering ETFs as an investment asset. | Screen the ETFs and decide on whether to own shares or trade CFDs. | Place your order either through a market order or a limit order, and monitor performance. |

How do you screen ETFs?

With over 2,200 ETFs to choose from globally, it is quite a daunting task to settle on one or two. The choice made should be in line with individual investment goals and risk tolerance levels. The indicators below are a great starting point for ETF screening to ensure the right pick.

№ 1. Performance

Past performances are not a guarantee of future results, but they go a long way in showing the performance patterns of an investment asset. Go for ETFs that offer consistent returns over the long haul, three, five, and ten-year periods.

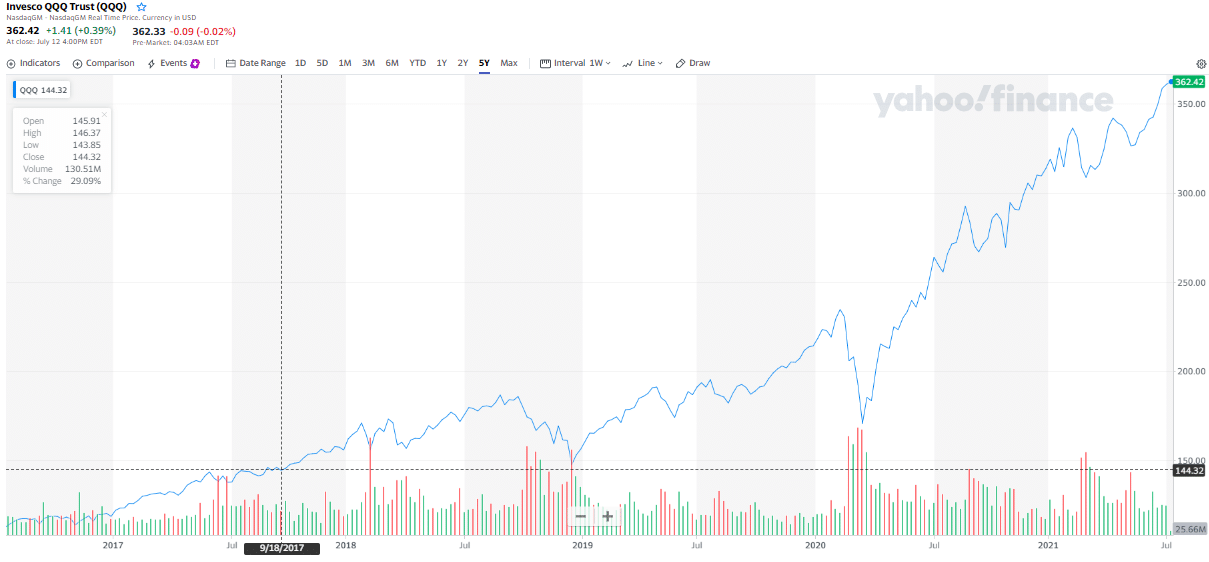

For example, the Invesco QQQ ETF tracks the Nasdaq 100 index. With a bias towards the tech industry, this ETF has an average annualized return of 26% over the last three years.

№ 2. Expense ratio

Most people fail to consider all the costs coupled with an investment. Once you consider all the costs, pick an ETF with the lowest expense ratio to ensure a better return on investment ratio. Go for ETFs that have 0 commission fees to reduce the cost of investment further.

№ 3. Liquidity

Liquidity is a measure of how easy it is to redeem, create, and transfer ETF shares. Highly liquid ETFs allow sell-offs in market downturn times and scaling in with ease during market upturn times.

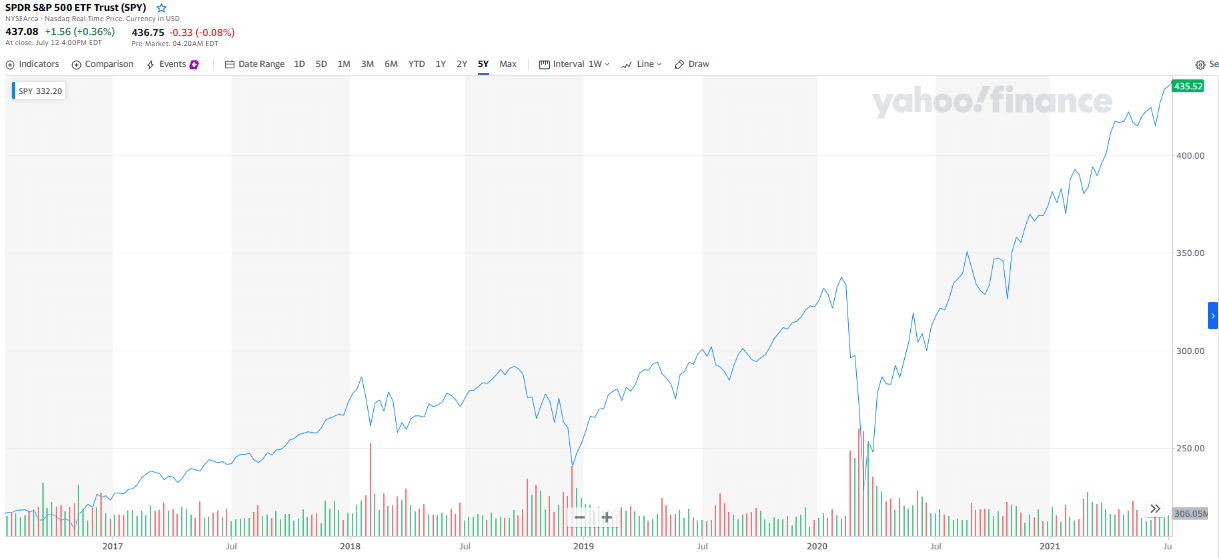

The SPY ETF is the most traded exchange-traded fund globally. Investing in the SPY means that scaling in and redemption is hassle-free.

№ 4. Tracking deviation

ETFs’ objective is to track the performance of its benchmark index as closely as possible, after expenses. Go for an ETF with a very low standard deviation compared to the Index ETF performance.

Final thoughts

ETFs can be called a great passive investing tool. Such funds are balanced enough not to sink much in a crisis, and management fees are negligible compared to mutual funds.

This tool will help even an experienced investor to diversify their portfolio and generate additional income from dividends. In general, the passive investing industry is what the entire financial world needs.