- What is a naked option?

- How to trade this asset?

- Why are put options so popular?

Market participants want to have the highest winning rate in their trades. The more winning trades you make, the more money you will earn. So, it will be great to find a type of trade with high winning rates so you can constantly make money.

By selling naked put options, you can make a profit due to the premiums paid to you consistently. On the other hand, when buying put options, the reward can be unlimited. However, both sides have their disadvantages.

The seller of the put option will profit more frequently, but the risk is much higher. While the buyer of the option, we’ll take a much lower risk but profit much less regularly.

If you want to know the fundamentals of trading naked put options, keep reading to decide if this popular strategy is the right for you.

What is a naked put option?

It is a trade in which the option seller is not covered to fulfill the obligation of the contract. To consider a put option “naked” or “uncovered,” the trader who sells the option can’t own the underlying assets or the equivalent amount represented by the option.

A naked put option is a widespread trade made for advanced traders due to the high risks involved. Unfortunately, most brokers don’t allow beginners to trade put options.

When writing a naked put option, the seller wants to earn the premium by betting that the option will expire worthless, making the seller earn the premium without the obligation of buying the currency.

We know that there are always two parties involved with an option: the buyer and the seller. So, if we talk about a naked put option for the seller, you may ask if there is a naked side of the put option for the buyer. The answer is that the word “naked” refers to the writer of the option being uncovered from the potential losses. So, it doesn’t make much sense to talk about a buyer of a put option being naked since the only risk he takes is the payment of the premium.

How does a naked option work?

We have established that trading put options are hazardous. As a result, brokers don’t allow all traders to make this type of trade. To be able to sell a naked option, the trader requires approval from his broker.

After getting the approval, the trader will borrow money from the broker to make the trade, called margin trading. As you can imagine, brokers won’t loan money to anyone who asks. So, that’s the first obstacle for selling put options. Brokers lend money to market participants depending on their financial records, so only experienced traders can make this type of trade.

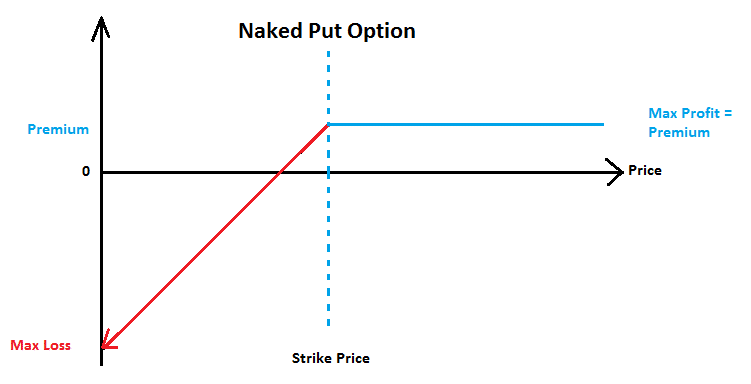

Naked options are made under the seller’s assumption that the price won’t reach the strike price. Thus the option’s buyer won’t exercise the right to sell the underlying currency, and the seller will keep the premium without being obligated to buy.

Risk and rewards of naked put options

The reason why naked put options are only available for experienced traders is due to the high risk of the trade. Of course, it’s not true that the risks are unlimited when selling put options. Nevertheless, the risks are still very high.

By having the obligation of buying an asset, if the asset’s value goes to zero, the option seller is obligated to pay the agreed price for a currency that no longer exists. In that case, the only thing that would minimize the losses would be the premium received.

Of course, this is an extreme scenario, but it illustrates the risk when selling put options.

In short, the maximum risk for the seller of a put option is: max risk = strike price – premium.

On the other hand, you may think that the reward should be equally high for such a high risk. But that’s not the case. The profits from naked put options are low, as low as the amount paid for the premium.

So you may ask, why are put options so popular? Why would anyone sell a put option? And the reason for that is the third concept that many traders don’t consider and is key to being profitable in the long run: probability.

Although the trade is not very profitable, the probabilities of winning the trade are very high. Some sources even say that the probabilities are as high as 70%.

Also, you need to consider that the scenario of a currency dropping even 50% below its current price is very low and is even lower if you trade major currency pairs. So, even when the seller will lose some trades, the chances are that his winning trades will cover his losses.

How to reduce the risk for naked put options?

Let’s explore some standard practices to curtail the risk while trading naked options.

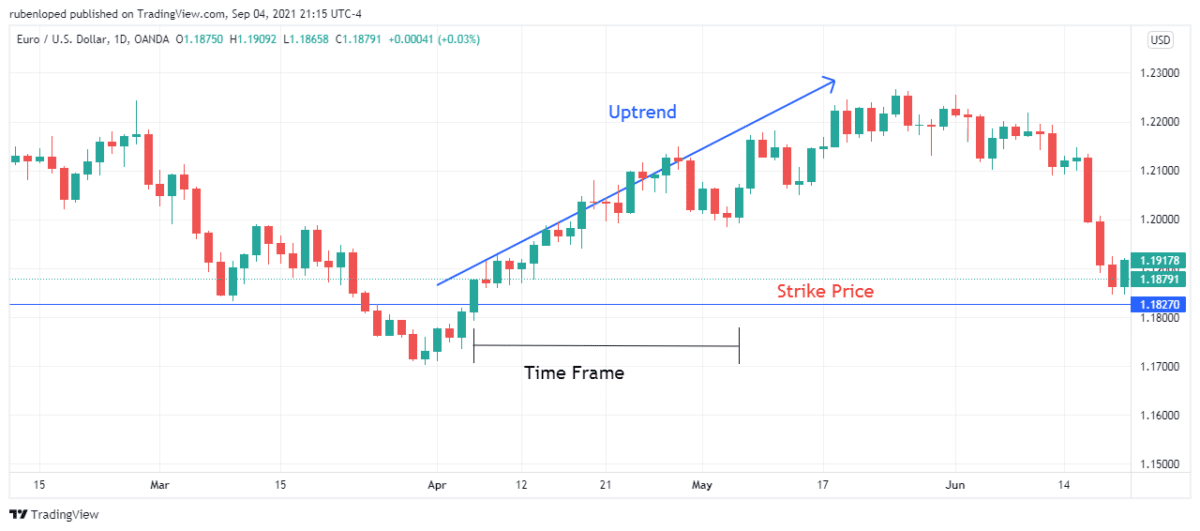

Write naked put options in bullish markets

If the key to being profitable with naked put options is the probability of winning the trade, you should do anything to improve it. In a naked put option, you want to avoid the price falling to the strike price level. So, if you sell a put in the opposite direction, your chances will be better.

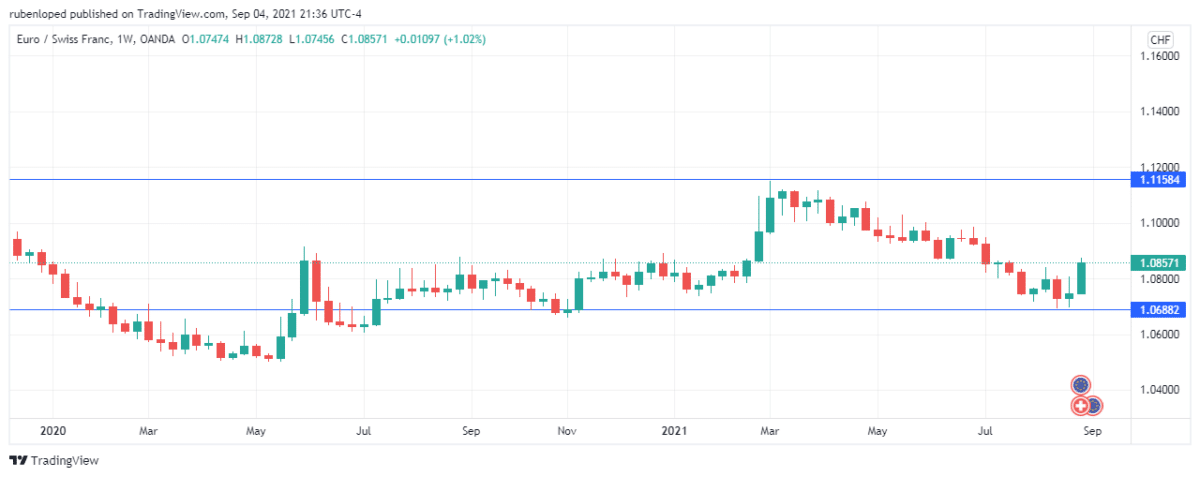

Select currencies with low price volatility

Again, to increase your chances to win the trade, going in the opposite direction is good, but not moving is even better. When prices uptrend, the bears will respond sooner or later, and in volatile markets, this response can take the price as low as the strike price.

Only write out of the money options

It would be best to only sell options with strike prices very far from the current price to stay out of the money. This way, the probability of the price reaching the strike price will be lower.

By setting a low strike price, the seller increases his chances of getting a winning trade. The image above shows an example. See how setting a strike price of 15% OTM protected the seller from a loss of 10%.

Final thoughts

Naked put options are a risky trade to make. An unfair trade could make you lose a lot of money you don’t have by not being covered. Although the risk/reward ratio is far from attractive, many traders love to use naked put options due to the high probability of winning.