- What is the significance of the recent BTC bull run for DeFi?

- What are past BTC bull runs trends?

- How is the recent BTC bull run distinct?

From late December to mid-April 2021, the price of Bitcoin surged by about 230 percent. Then, with a single word, it was all over.

As Elon Musk revealed that Tesla would no longer accept BTC as payment, crypto traders yelled, “Damn it, Elon.” Musk cited Bitcoin’s detrimental environmental impact in making his decision. Even though the carbon footprint was well-known, many thought he had manipulated the market to get more for less money, believing he couldn’t have been uninformed. It didn’t matter what his goals were. The market fell 40%, leaving traders with nothing.

The recent halt in the crypto bull run can raise interesting discussion points within the decentralized finance (DeFi) community, particularly among developers, despite the difficulties of staring in awe at candlestick charts, pounding fists on a desk in frustration screaming about Elon.

The recent bull run

The Bitcoin halves reduction was a primary driving force for this bull run. After mining 210,000 blocks, this happens every four years. Inflation will be reduced by half the block reward granted to miners due to this occurrence, which is important.

Because Bitcoin is a decentralized digital currency that is unaffected by the decisions of any central authority, it is important to understand how this affects the price of BTC. It means that fiscal or monetary policy cannot affect the supply and demand of Bitcoin.

The supply-demand relationship is the most important factor in determining a product’s price. Even though the total quantity of BTC is fixed at 21 million, halving the supply will increase the cost of mining for miners. Bitcoin’s price tends to rise in the wake of a disaster (based on our data so far). After the halving in May 2017, the price of BTC jumped to $9,999. Since then, the price has risen slowly and consistently.

The price of Bitcoin reached $19,000 for the first time in November 2017. A new peak was reached in December when the price hit $20,000. As a result, Bitcoin’s price increased to $40,000 by the end of 2021. The statistical forecast for 2022 is to close the price above $52,000.

What makes this bull run different?

Individual and institutional investors may acquire BTC easily due to a slew of online trading platforms, making this bull cycle unique. It’s simple to open a BTC account with Bitcoin Digital and keep tabs on the market.

The robot is driven by artificial intelligence, which means it can respond quickly to new information and maintain a high level of performance. You don’t have any prior knowledge or ability to use this automatic trading software. You may also earn up to $800 each day in this manner.

Another distinction is that institutional investors drive BTC demand and sustain it. Blockchain technology and cryptocurrencies are becoming more widely known, positively affecting market demand.

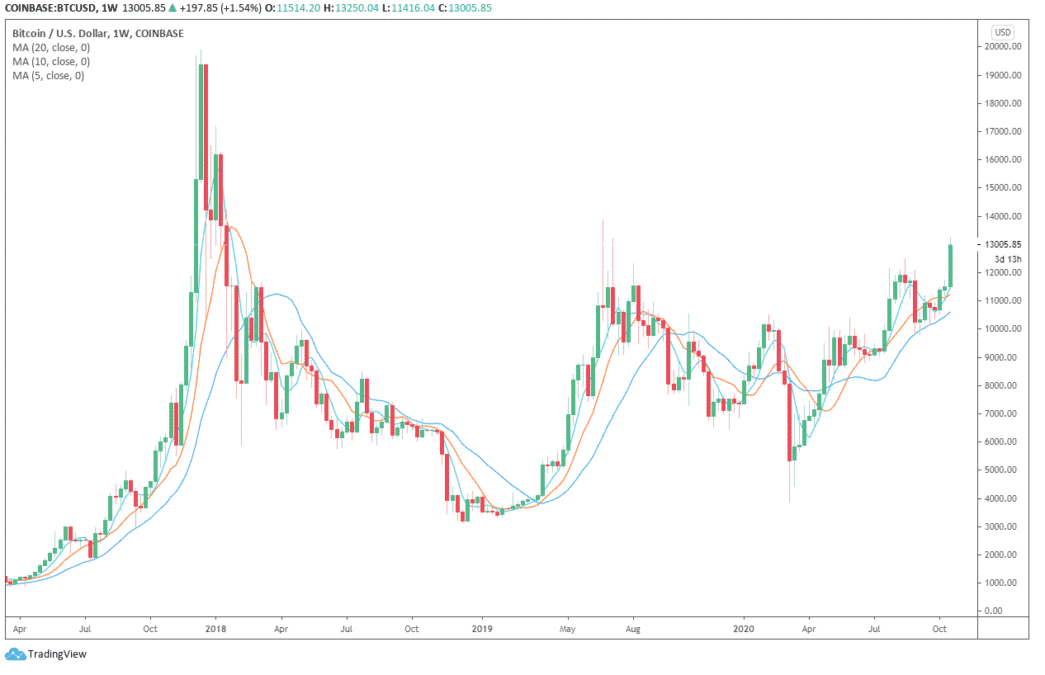

Past bull runs

Before, you’ll see that the price of BTC increased and trended upwards when it was halved. From $11 to $12, the price went up relatively little following the first halving in 2012. However, the price soared to $1,075 in November of the following year, over a year later. After halving the Bitcoin price in 2016, it rose from $576 to $650. A year after the initial milestone was broken, BTC reached $17,000 in December amid a prolonged growth period.

It’s been a rough year for Bitcoin’s price, but it’s finally starting to grow steadily in 2019, with a price of $10,000 expected in June. In addition, the growing interest in blockchain and cryptocurrency among businesses has resulted in optimistic predictions for its future growth.

DeFi and the recent Bitcoin bull run

Few individuals understood the potential value of cryptocurrencies in the early days. When BTC initially acquired attention in the run-up to the 2018 market crash, it was valued and useful to the average Wall Street broker like a penny stock or trading card.

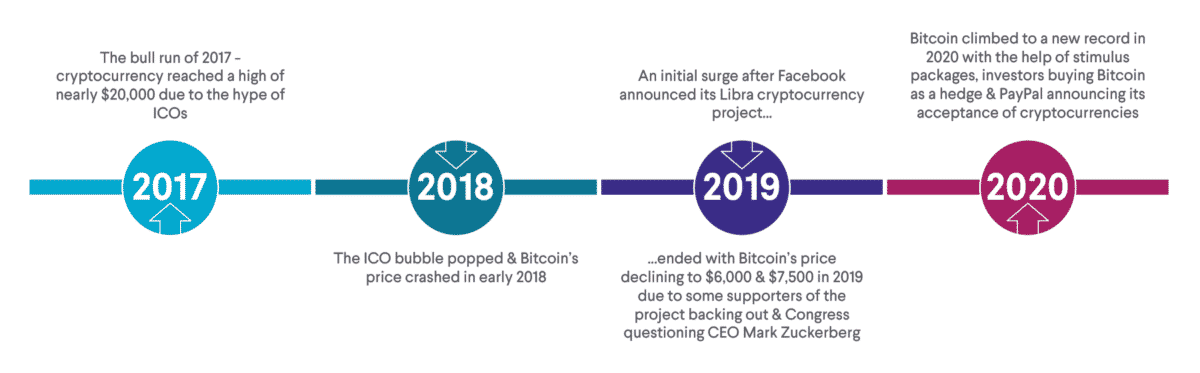

Pooled investors and institutions

The popularity of decentralized financial applications developed as a result of their decentralization. After Bitcoin’s spectacular rise and subsequent crash, the dark web and Reddit became havens for cryptocurrency. Cryptocurrency users mainly were retail consumers at this point, but that changed when Covid-19 was released and started to show its potential.

With the big fish in town, the stakes have risen. As CoinDesk observed at the beginning of January 2021, the second large bull in cryptocurrencies was contingent on significant institutional investors’ acceptance and quick rise. As well-known investors like Andreessen Horowitz, Michael Novogratz, and Bain Capital Ventures join the DeFi fray, developers must rethink their product to meet the needs of these more experienced investors.

Satoshi Nakamoto, the pseudonym of the coin’s mysterious creator, designed the blockchain on which it works with several fail-safes in mind. For example, if their vision of universal adoption came true, they would not have a comprehensive R&D team ready to address the issues that could occur. Nevertheless, a rising number of people want to get in on the activity.

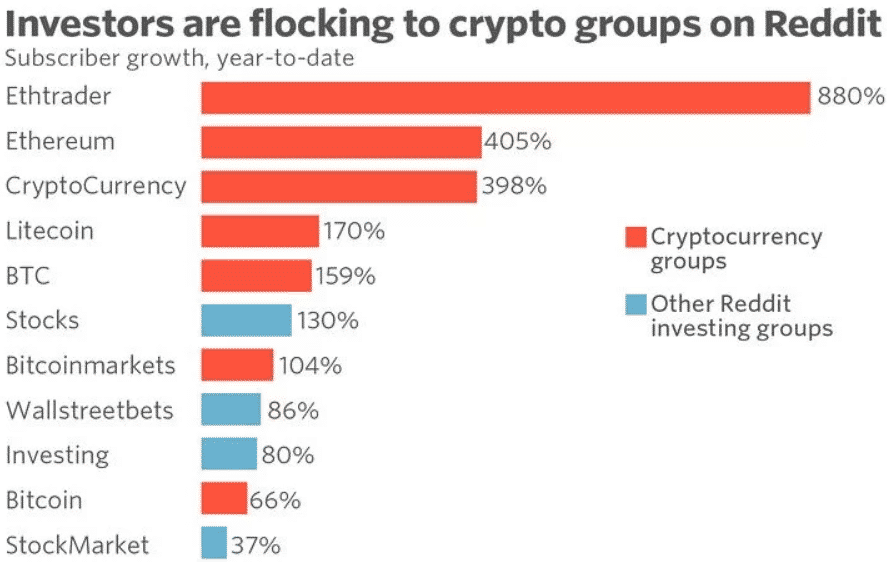

DeFi’s evolution

Bitcoin’s blockchain is currently limited to five transactions per second. VISA comes in at 1,700 transactions per second regarding transaction volume. The gap is enormous.

ETH, EOS, DOT, and ADA, named after Renaissance scientist Gerolamo Cardano, have emerged as competitors since Cardano’s inception in 2014. However, although new players and their unique network names are flooding in, they don’t seem to compete with Visa’s level of innovation and efficiency.

Even though Ethereum’s transaction costs are high and the transaction time is just 10-15 seconds, it is the most popular development platform. However, concerns have been raised regarding whether the platform’s anticipated summer 2021 improvements would be finished on schedule.

On the other side, EOS claims to process 4,000 transactions per second, but it’s running into issues with developers who aren’t on board. However, only time will tell whether Binance can compete with Ethereum and the world’s most popular cryptocurrency network.

Emerging crypto as an alternative

Trading alternatives comparable to central markets are currently available in various enterprises. However, while these efforts are lovely in democratizing finance, they must serve the new pool of customers who want institutional and retail liquidity. In addition, architectural issues make it difficult for networks like Ethereum and Polkadot, which have mostly separated liquidity, to segregate it.

It is hoped that ThorChain and LiquidApps will help change the present paradigm by bridging the gap between these two disparate systems and increasing “liquidity mining.” While EOS is a failing network, LiquidApps has connected it to Ethereum, an established blockchain. Despite the best efforts of the DeFi community, however, the larger DeFi ecosystem is still a mess. To change this, they must be emulated by other business owners.