- What is Tesla?

- What is swing trading?

- How to trade Tesla using the swing trading technique?

Swing trading is a fantastic technique of trading and making the trading journey less stressful.

Swing trading is widely liked and used by traders around the globe for the reason that it is somewhat relaxed and less stressful than other forms like scalping and day trading. Talking specially about some volatile stocks like Tesla is traded using swing trading techniques to profit from the wild moves and swing.

Swing trading is also great because it allows you to trade from the vast availability of indicators and strategy, as there is no certain or fixed rule, as it is a trading form and not a strategy.

If you feel swing trading is fascinating and want to learn how to use swing trading techniques to trade stock like Tesla, this is the article to look into.

Brief about Tesla

Tesla is an American electric vehicle and clean energy company in California, United States. Tesla is widely famous for manufacturing electric cars. Elon Musk, the famous entrepreneur and technology influencer, is the current CEO of Tesla.

Tesla in 2020 has seen significant growth in its stock price, rising from $90 and going up to $900.40. Such a magnificent growth in the stock price helped Musk sit on the throne of the richest man in the world on January 8th, 2021.

Tesla stock’s total market cap is 703.524B. This by far is one of the most widely traded companies with an average volume of 21,018,942.

Tesla ranks 17th in most active share volume on nasdaq.com and among the top 10 in many other resources. Now all the information here makes it worth trading this stock, and if you have similar feelings, dive in to learn more.

What is the swing trading technique?

Swing trading is a technique or form used to trade a financial asset while keeping the trade open for more than a day, three, or even weeks.

Swing traders usually trade at reversal or breakouts to get the correct position open for higher profits and exit it before the trend changes. The longer the position runs, the higher the profit if entered in the proper trade.

Here choosing the right asset is also very important. For example, an asset must be volatile enough to move faster to cover the desired pips according to your risk: reward ratio.

How to trade Tesla with swing trading technique

Tesla is a very volatile stock to trade. We will use a technical swing trading strategy to deal with Tesla. Using technical analysis and quick-cutting profits is essential to avoid important news affecting the market direction.

We will first keep the chart plain without any indicators to analyze the trend to trade this strategy. Remember always to take or consider trade when the trend is evident, either moving up or down. Sideways movement is not suitable for this swing trading strategy.

First, move to the 1hr time frame and look for apparent dynamic support and resistance levels. Support is the zone where you will find the price making a low or where the price is touching a certain zone one or more times and cannot push down further.

So while resistance will be a zone where the price makes a high or a zone where it halts one or more times and is not able to push further.

Once you have your zones, try looking for a break of either high or low.

- If the price is near support, look for price breaking the high.

- If the price is near resistance, look for a break of the low.

Bullish trade setup

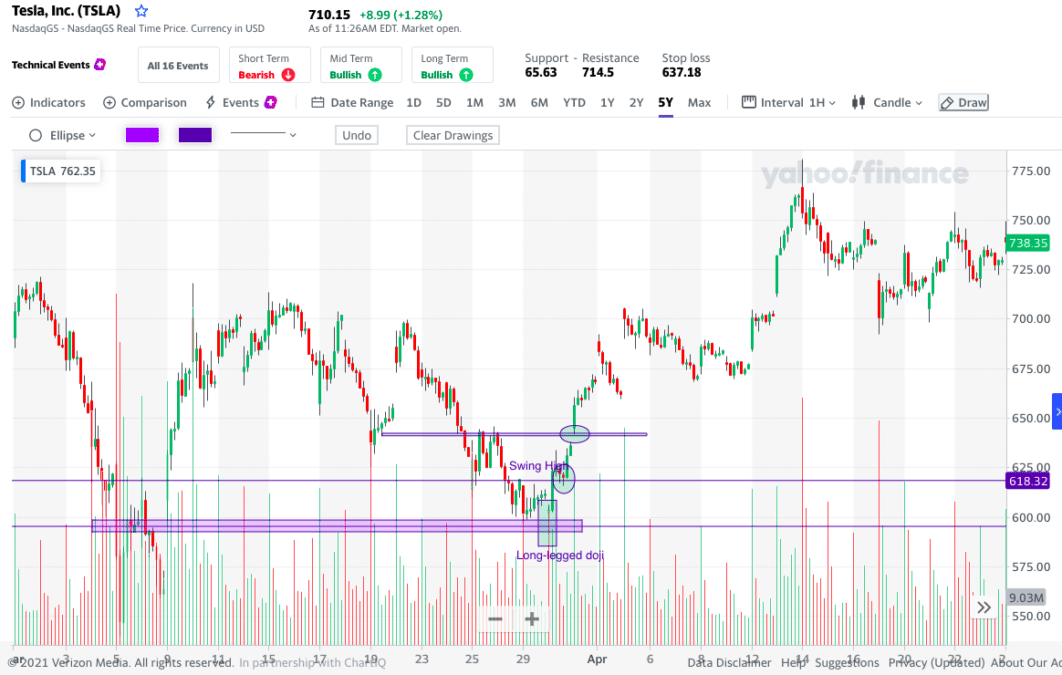

For better understanding, take a look at the Tesla chart below. Here the price was moving down and was not able to push below the support zone. At the same time, the price made a continuous candlestick — long-legged Doji. This lovely green candle shows that the buyer’s pressure is high. Moving forward, the price was seen breaking the previous high, giving us a green signal for a buy position of Tesla stock.

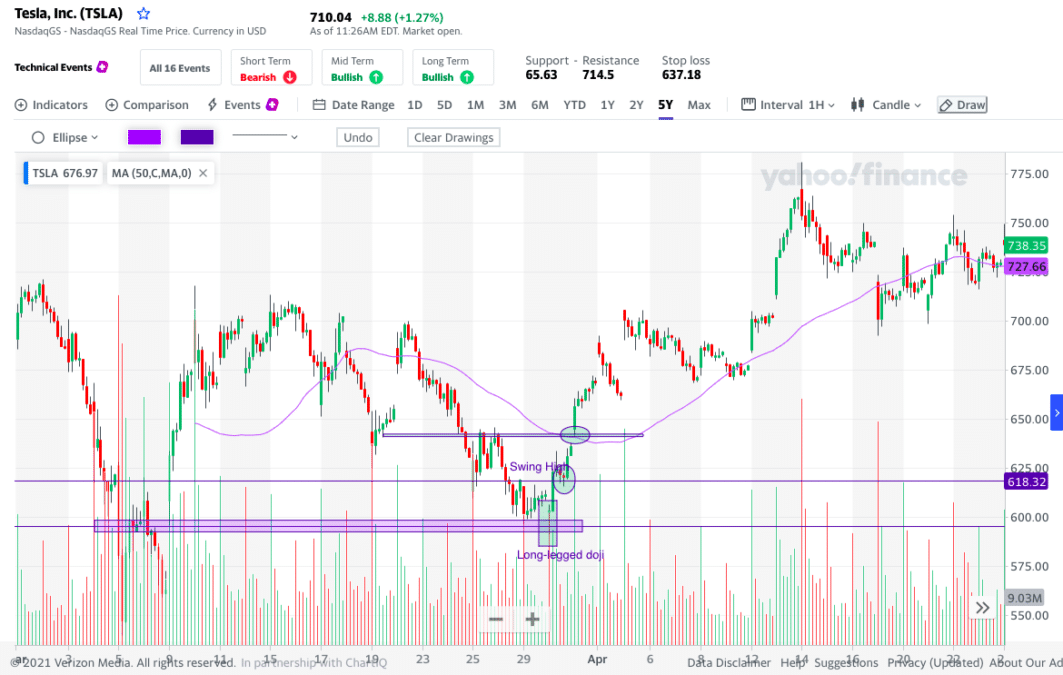

To make the trade setup more accurate and worth taking, we will take the help of moving averages of period-50, which will show the average price that all investors have paid to obtain the asset over the past ten trading weeks.

You will use the moving average to trade by looking for price touching it while making the highs and lows.

In the below chart, you can see, just after the higher high and the break of resistance, the price is touching and taking support from the 50-period moving average, giving a good signal for buying.

Note: always remember to take three or more confluence signals for a more accurate trade setup.

Here in the example, you can see, we had four confluence:

- The price was near the support, meaning we can look for buying opportunities

- The price made a long-legged Doji candlestick

- The price was able to break the previous high

- The 50-period moving average backing up and supporting the breakout

Bearish trade setup

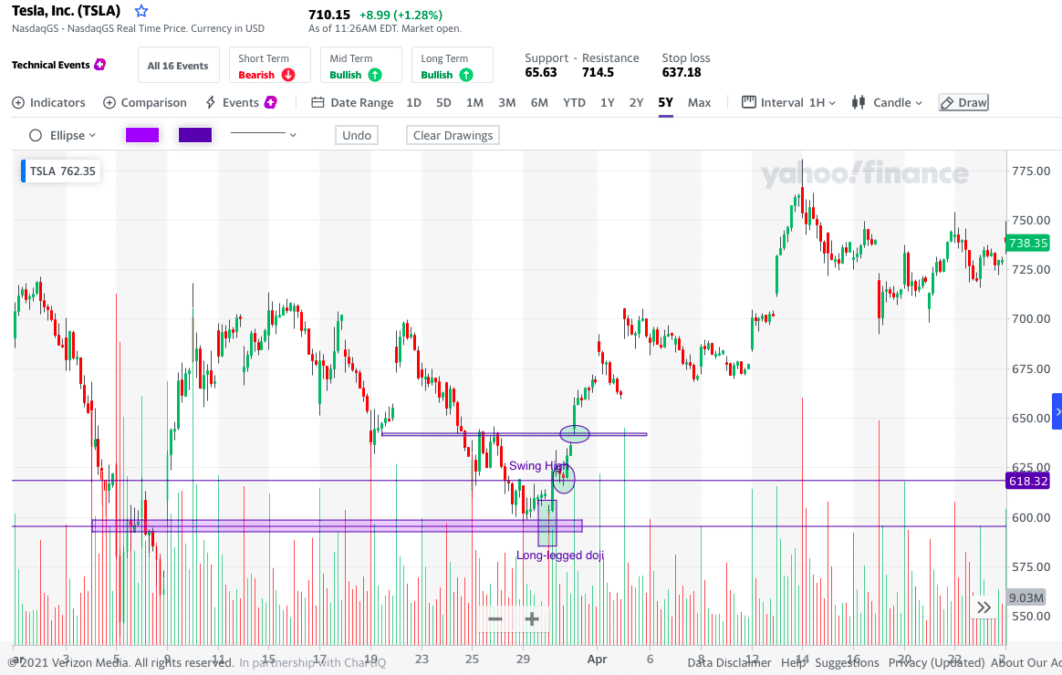

While trading a bearish setup, you will focus on the price near the resistance zone or trendline. Also, the price must break the lower low and make a lower high.

In the below example of Tesla, you could see the price came up and made a big bearish red candle with a long wick. The long wick here is insufficient for you to decide if the price will go down, so you will wait patiently and see the price movement. After three days you can see the price fell down and also successfully broke the previous low.

Moving forward, the price went up and touched the trendline, making it dynamic for further use. In the green rectangle box, you can see the market went sideways; this is where prices will break out, moving up or down.

Now on day 27th, you can see the price breaking below the sideways zone. If you are an aggressive trader, you may choose to enter the trade right after the breakout, but the best way to trade is to wait for the price to retest the breakout zone. As you can see in the chart, the price came back and respected the breakout zone, giving a strong sell signal.

Adding a 50-period moving average, you can see the price touching MA and giving a signal for selling.

Final thoughts

Tesla is one of the most highly volatile stocks to trade-in. While trading any stock or financial asset, always remember to keep your risk low and follow a proper risk management strategy. This strategy will help you find the proper trade setup by eliminating the noise and keeping it simple.

Always try to have more than more confluence to make your trade setup better and accurate.