Automic Trader claims to provide a consistent and compounded passive income without any prior experience in trading. It works on 6 currency pairs and comes with an account protection mode. The vendor assures up to 30% monthly profits with the lowest risk setting and up to 100% profits with a higher risk. In this review, we have evaluated the features, approach, performance, and other relevant aspects to check the veracity of the vendor’s claims.

Automic Trader company profile

This ATS is promoted by the LeapFX company. The company partners with seasoned providers to help you succeed in your FX investments. Managed account service, automated trading systems, broker, and VPS recommendations are some of the services the company offers. There are no details related to the founding year, team member info, location address, phone number, etc. The absence of info indicates lack of vendor transparency.

The highlights of Automic Trader

The vendor does not provide much info on the FX robot. Here are the features we could glean from the details revealed on the official site:

- The software is designed to work independently. It opens and closes trades automatically.

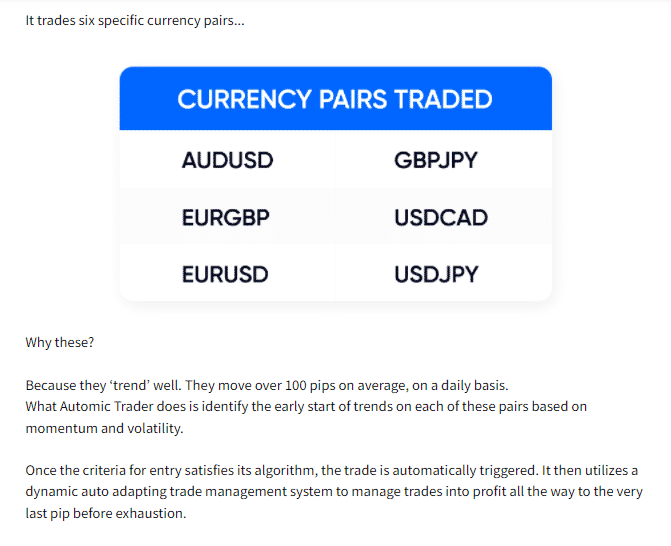

- It works on the USDCAD, USDJPY, AUDUSD, EURGBP, EURUSD, and GBPJPY pairs.

- The FX EA works by identifying trends on the pairs using volatility and momentum.

- It uses an account protection feature to ensure losses are minimized.

- A dynamic auto adapting money management system is present.

We could not find recommendations on the minimum deposit, the leverage, timeframe, and other relevant details.

Facts & figures

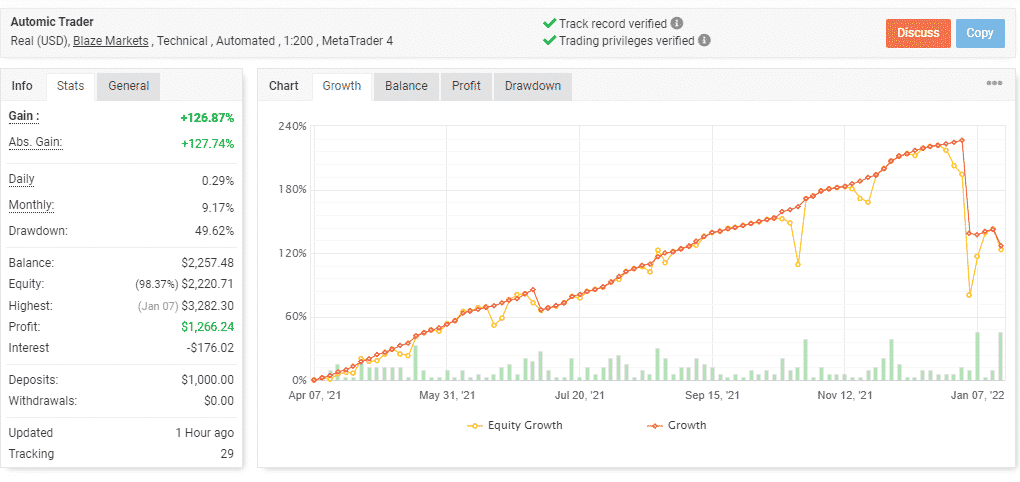

No backtesting results are present for the MT4 tool. A live real USD account verified by the Myfxbook site is present for the ATS. Here are a few screenshots of the results:

From the above stats, we can see the account using the leverage of 1:200 on the MT4 platform has generated a total profit of 126.87% and an absolute profit of 127.74%. The daily and monthly profits are 0.29% and 9.17%, respectively. A drawdown of 49.62% is present for the account that started in April 2021 with a deposit of $1000. From the growth curve, we can see the profits are not consistent with intermittent losses in June and a steep loss in December.

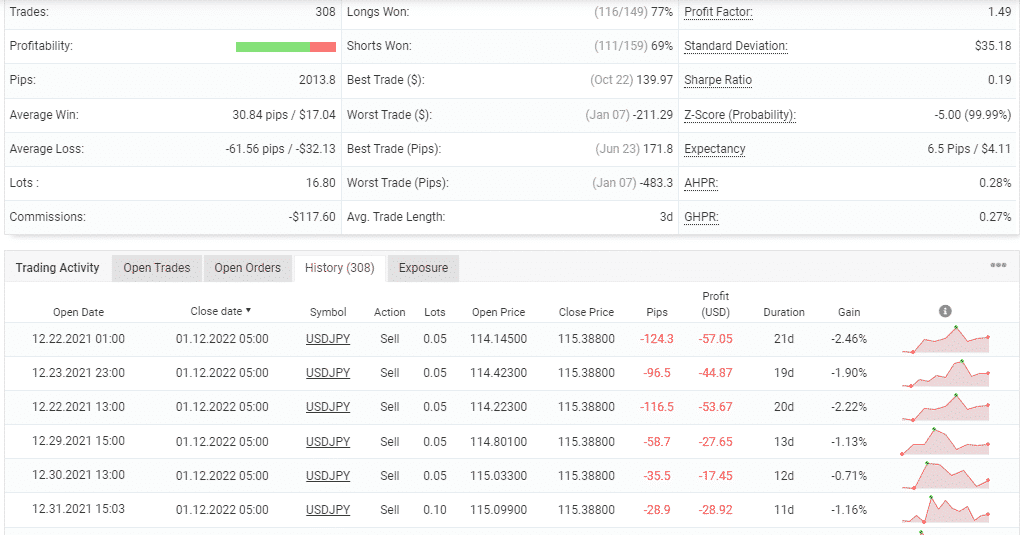

From the advanced stats, the profitability of 74% is present for a total of 308 trades. The profit factor is 1.49. Varying lot sizes are used by the EA ranging from 0.05 to 0.10. The big lot sizes and high drawdown signify a risky approach that can make you lose nearly half of your capital or more.

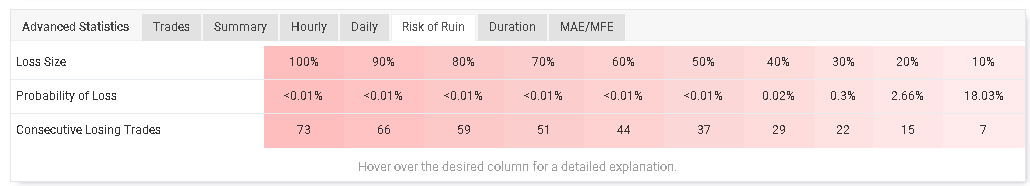

As you can see, the system trades with high trading risks as in case of 6 consecutive losing trades, 10% of the account balance will be lost.

Automic Trader packages

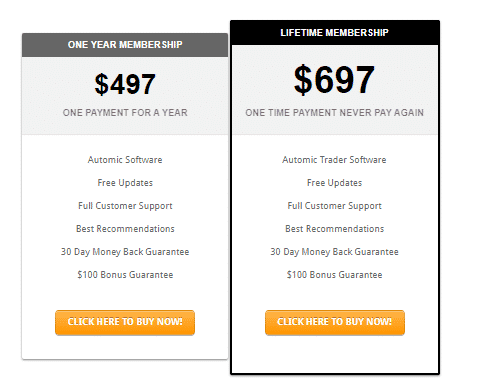

For using this FX EA, you have to choose from the two packages available. One is an annual membership package that costs $497. The features included in the packages are the software, free updates, customer support, the best recommendations, a 30-day money-back guarantee, and a bonus guarantee of $100. In the second package, you get a lifetime membership that costs $697. When compared to the price of similar systems in the market, we find the price of this FX robot is expensive.

Assistance

For support, the vendor provides an email address and an online contact form. There are no other methods present like a live chat feature, FAQ, phone number, etc.

Other notes

Unfortunately, we cannot find user reviews for this FX EA on reputed review sites like FPA, Trustpilot, etc.

Is Automic Trader a reliable system?

If you are interested in using this FX robot, here are some important factors you need to consider before you decide:

- There is a lack of vendor transparency indicated by the minimal info present on the developers and the company.

- The pricing packages are expensive despite the vendor offering a refund policy and bonus refund guarantee.

- Verified real trading results are present for the MT4 tool.

The high drawdown and big lot sizes in real trading indicate a risky approach.