- What are uranium ETFs?

- Why invest in this red-hot metal?

- Which five ETFs stand to profit the most from the growth of this energy niche?

When green energy is mentioned, the first thing to consider is either solar or wind energy. The truth is that for the world to achieve decarbonization and zero emissions, nuclear energy has proven to be the best option.

Accounting for only 10% of the global power grid at present, it is estimated that this figure will at least double in the next two decades, with the market expected to grow from $34.6 billion to over $49 billion in the next four years.

With uranium as the only fuel that can power nuclear reactors, it is in a bullish run that will last as long as the world’s appetite for clean, renewable energy persists.

What is the composition of uranium ETFs?

Exchange-traded funds comprise a basket of economic-related investment instruments for trading under a single asset. Therefore, uranium ETF composition brings together organizations in the uranium and nuclear energy value chain since the two niches are joined at the hip.

Uranium exploration and mining are only in a few countries, while the nuclear energy niche is in its infancy. What this means is that only a few firms operate in these two markets, heightening its volatility. It isn’t easy to pick individual winning stocks, necessitating an investment instrument that exposes the entire market.

By investing in uranium ETFs, you have access to the whole uranium and nuclear energy markets and, through diversification, mitigate against individual stocks’ volatility.

The best uranium ETF to hold in 2022 for profitability

With rising inflation comes investor appetite for hard assets that offer protection. Top among the inflation-protected asset list is commodities. Uranium has proven to be the top commodity to invest in in the past three years, both in the spot price change and the total returns coupled to associated ETFs.

With the global community calling for green energy led by developed economies, nuclear power is on the verge of critical mass. Its only viable fuel, uranium, is set to ride a long bullish run. Given their strategic positioning, the ETFs below are a great start to exploit the opportunities as these two market niches explode.

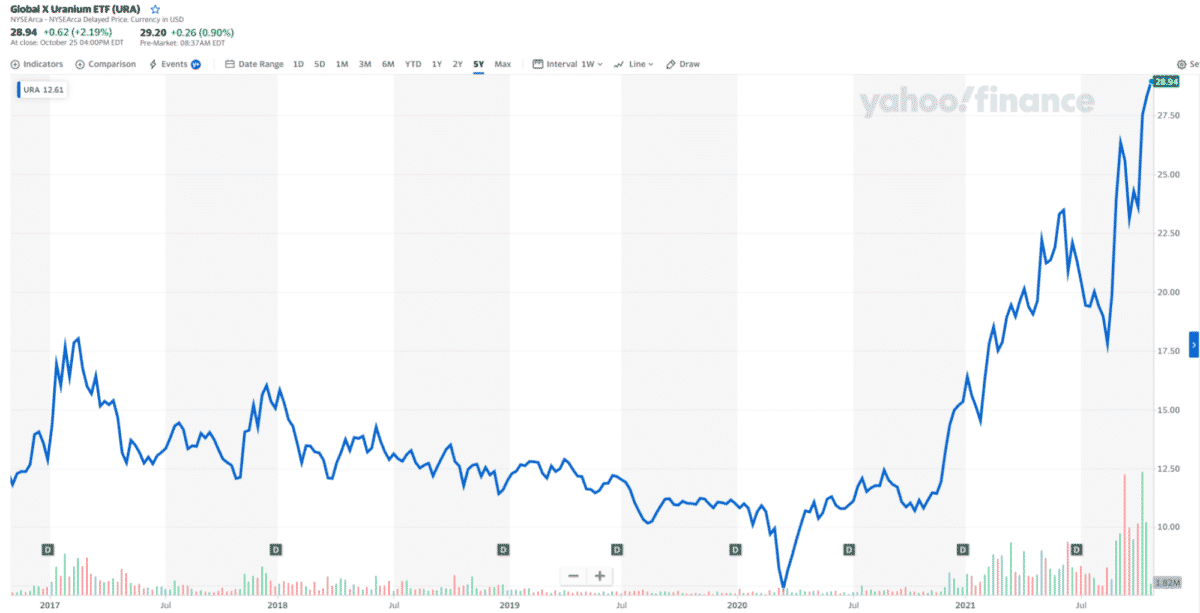

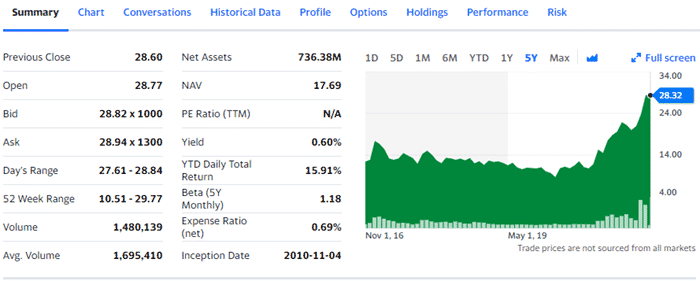

№ 1. Global X Uranium ETF (URA)

Price: $28.94

Expense ratio: 0.69%

Dividend yield: 0.60%

This ETF tracks the Solactive Global Uranium & Nuclear Components Total Return Index, with a view of returning similar returns net of expenses and fees. To achieve its objective, URA invests at least 80% of its total assets in the assets making up its benchmark index, in addition to GDRs and ADRs.

The top three holdings of this ETF as of now are:

- Cameco Corporation – 23.09%

- National Atomic Company Kazatomprom JSC Sponsored GDR RegS – 10.50%

- NextGen Energy Ltd. – 8.68%

URA has $1.24 billion in assets under management, with an expense ratio of 0.69%. A look at the historical performance of this uranium ETF calls for it to be among investment portfolio holdings for 2022; 5-year returns of 161.16%, 3-year returns of 134.64%, and pandemic year returns of 166.61%. With a current year-to-date return of 84.74% and exposing investors to the entire global uranium value chain, this ETF is one to monitor closely.

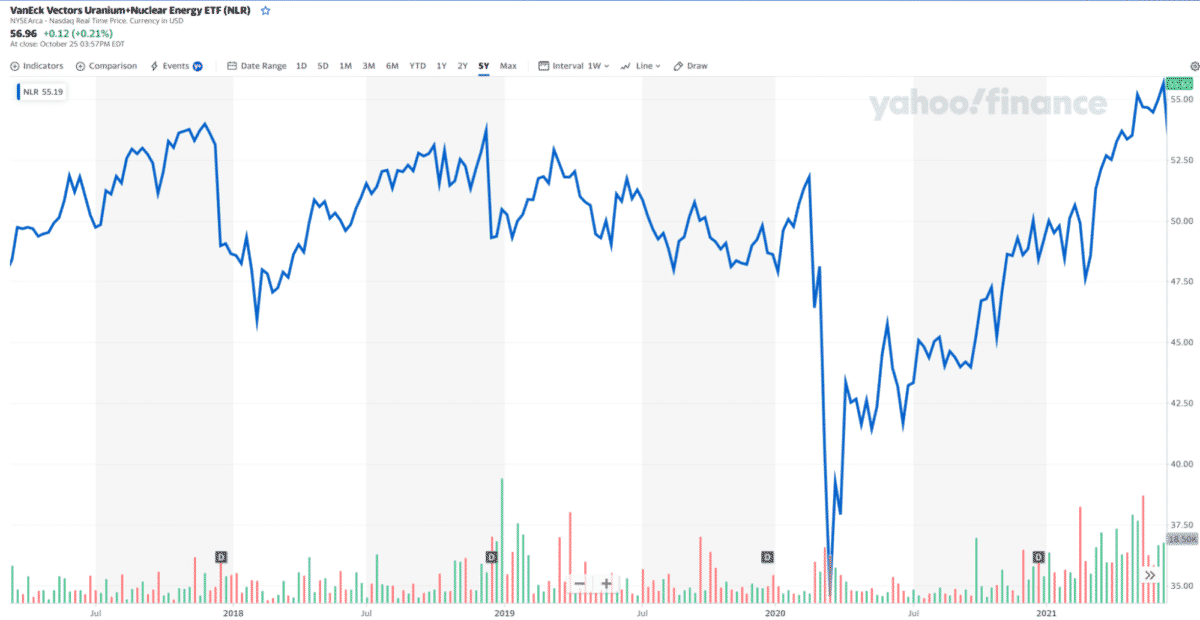

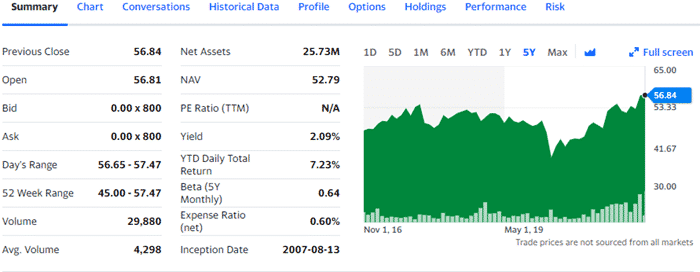

№ 2. VanEck Uranium Nuclear Energy ETF (NLR)

Price: $55.65

Expense ratio: 0.60%

Dividend yield: 2.09%

NLR ETF tries to replicate the performance of the MVIS Global Uranium & Nuclear Energy Index, net of expenses and fees. To achieve its objective, this ETF invests at least 80% of its total assets in holdings of its composite index.

The top three holdings of this ETF as of now are:

- Duke Energy Corporation – 7.51%

- Dominion Energy Inc – 7.40%

- Exelon Corporation – 6.82%

This non-diversified uranium ETF has $30.02 million in assets under management with an expense ratio of 0.6%. Unlike its counterparts in this list, NLR historical returns are decent but consistent with positive returns that beg for consideration if investing in uranium; 5-year returns of 40.43%, 3-year returns of 17.65%, and pandemic year returns of 22.52%.

NLR is an indirect play on the uranium market by providing exposure to the global nuclear energy niche. The diversification mentioned above and a dividend yield of 2.09% calls for this ETF to be in the crosshairs if considering the uranium sector for portfolio profitability come 2022.

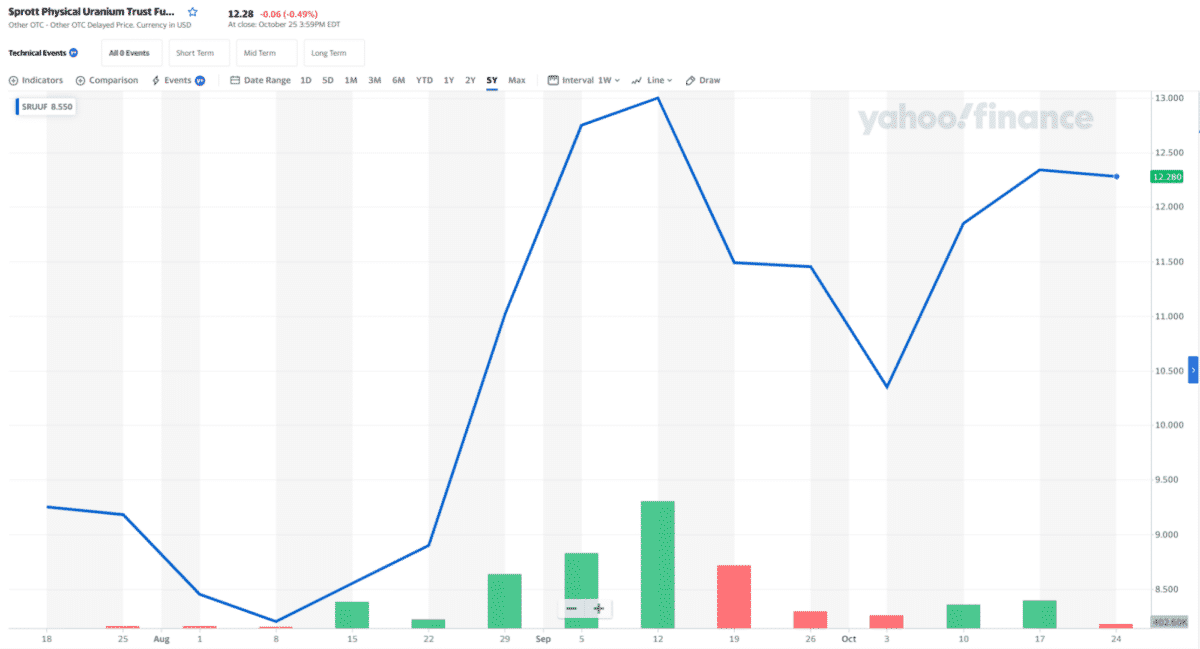

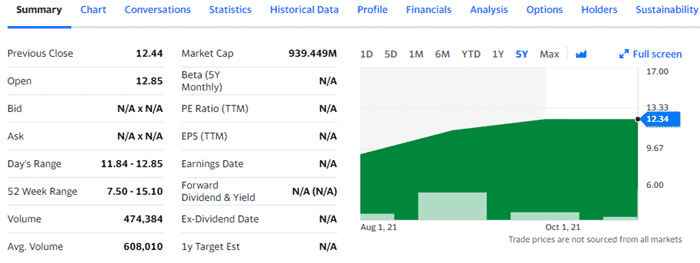

№ 3. Sprott Physical Uranium Trust (SRUUF)

Price: $12.30

Expense ratio: 0.35%

Dividend yield: N/A

SRUUF Fund is a commodity ETF that seeks to reflect current prices of physical uranium.

At present, it has these stocks of uranium:

- U3O8 with 30,614,382 kgs

- UF6 with 300,000 kgs

Sprott Physical Uranium Fund has $1.6 billion in assets under management, with an expense ratio of 0.35%. To many, SRUUF is the most significant driver for the bullish uranium run through its buying and stocking.

Just 19 million kgs of uranium can power France’s nuclear grid for nine months to put their stock into perspective. Couple their uranium stocks with limited uranium supply, and you realize it is in pole position to benefit as appetite for nuclear energy picks pace.

In addition, the price change of uranium over the last half a decade calls for holding SRUUF; 5-year price change of +92.90%, a 3-year price change of +91.15%, and a current year-to-date price change +51.53%.

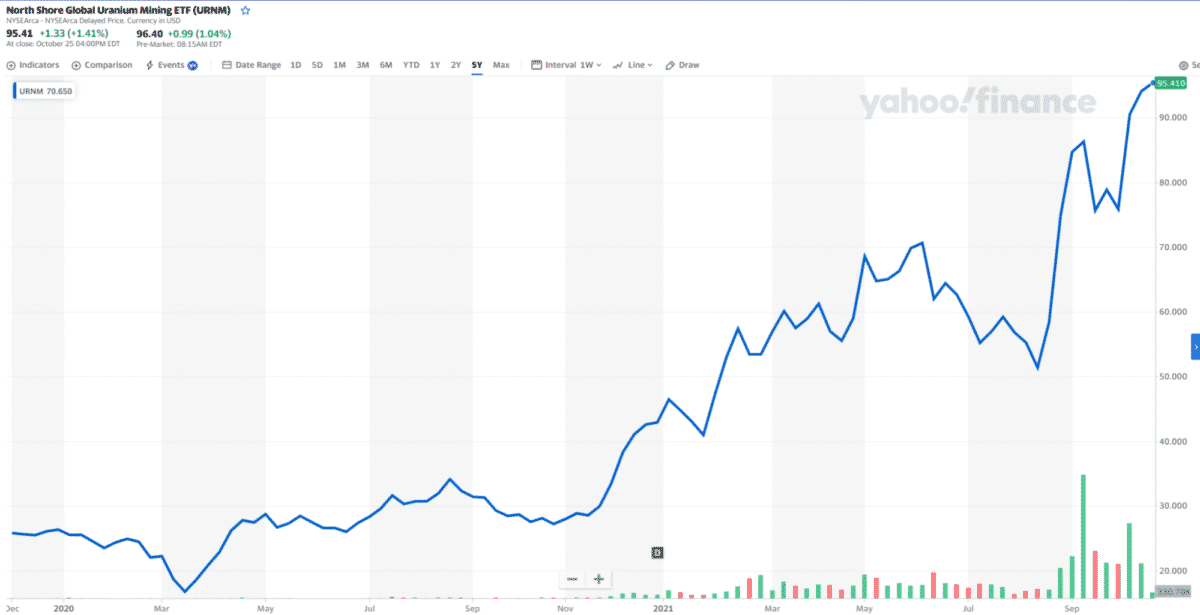

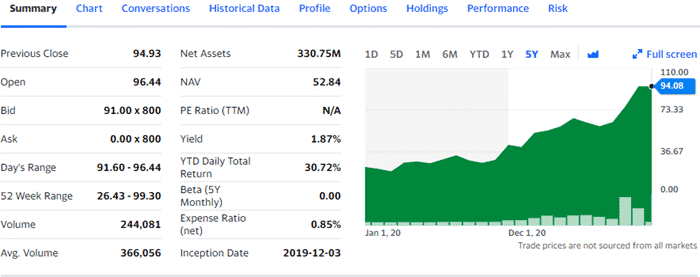

№ 4. North Shore Uranium Mining ETF (URNM)

Price: $95.41

Expense ratio: 0.85%

Dividend yield: 1.87%

This ETF seeks to replicate the performance of the North Shore Global Uranium Mining Index as closely as possible. It invests at least 80% of its total assets in the holdings of its composite index, exposing investors to the entire uranium value chain.

The top three holdings of this ETF as of now are:

- National Atomic Company Kazatomprom JSC Sponsored GDR RegS – 16.76%

- Cameco Corporation – 16.29%

- Sprott Physical Silver Trust – 7.84%

URNM launched in late 2019 but has already amassed a phenomenal asset base, $887.4 million in assets under management. Investors, however, have to part with $85 annually for every $10000 invested. In addition to staggering investment inflows, this uranium ETF in its first year of operation has also broken some returns records, 245.53%-among the best performing ETFs of the pandemic year. With a follow-through current year-to-date return of 123.59%, this uranium ETF presents a strong case for investing in 2022 for profitability.

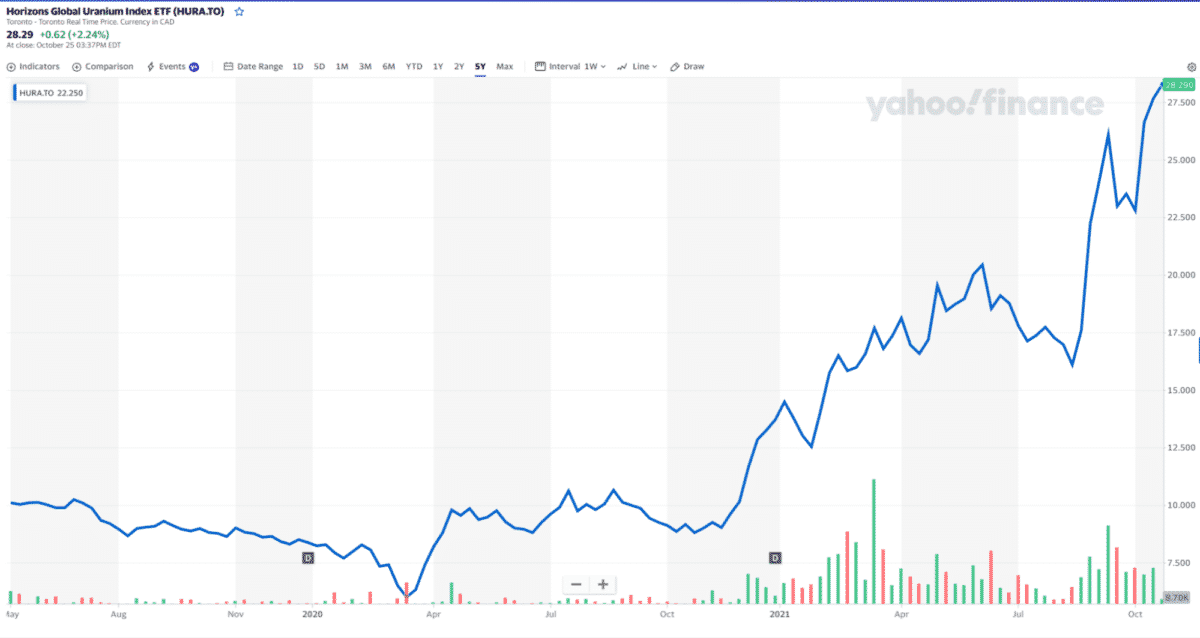

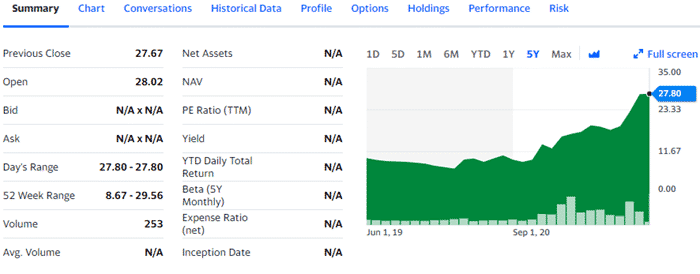

№ 5. Horizons Global Uranium ETF (HURA)

Price: $28.29

Expense ratio: 0.85%

Dividend yield: N/A

This Toronto exchange-based ETF seeks to replicate the performance of the Solactive Global Uranium Pure-Play Index, giving investors exposure to the uranium market in developed economies.

The top three holdings of this ETF as of now are:

- National Atomic Company Kazatomprom JSC Sponsored GDR RegS – 22.44%

- Cameco Corporation – 18.51%

- Yellow Cake PLC Ordinary Shares – 16.63%

HURA ETF has $41.5 million in assets under management, with investors having to part with $85 annually for every $10000 investment. Having operated only a few months before the pandemic hit, HURA managed one-year returns of 65.67%.

With a follow-up current year-to-date return of 66.05%, HURA is in pole position to make profits if played right come 2022.

Final thoughts

China, France, and the United States increasing reliance on nuclear energy has convinced people of its safety-according to scientists, only 1% of the radiation is attributable to uranium-related activities.

Couple this with the scalability and cost efficiencies associated with nuclear energy generation, and what you have is a market on the verge of massive growth in the decarbonization era. Rather than pick individual stocks and hope they thrive, why not go the Buffett way and invest in the above uranium ETFs to bet on the entire uranium and nuclear energy markets.