- What are undervalued coins?

- What are the strategies to identify them?

- Are they worth searching for?

In the cryptocurrency realm, there are no balance sheets. Instead, it’s all about the promise of cutting-edge new technology and a lot of marketing hype that determines the price.

As a result, it may be challenging to navigate the world of micro-cap currencies, especially when there are so many scams and failed coins to contend with. So what are the value of these currencies and the businesses they represent?

Ways to identify undervalued coins

For the most part, the way value investors evaluate stocks is not all that different from how cryptocurrency investors find undervalued coins. However, the following are a few ways that can help you make the process of spotting undervalued coins a bit easy.

Examine the market value

Examining whether an inexpensive asset is one of the most straightforward approaches to detecting an excellent investment opportunity. This requires measuring the initial market capitalization of firms that haven’t yet launched. This is the total value of all of the company’s token units in circulation following the token generation event (TGE).

Because the market tends to boost the token price toward its fair value in the days and weeks following its TGE, projects with an initial market cap lower than their expected fair value can appeal to investment possibilities.

In general, a project that begins with a lower market cap than expected has a decent possibility of rising in value until it achieves its fair worth. Conversely, projects with a higher-than-expected market value, such as those emerging from a sudden, fleeting rush of orders, may, on the other hand, gradually fall back to a lower, more fair market cap.

Let’s consider the scenario of AstroSwap, a token with a market price of $120,000.

It’s straightforward to compare the market worth of Cardano’s inaugural DEX to that of other well-known DEXs like PancakeSwap and Uniswap, both of which have a market capitalization of well over $1 billion.

Following its inception, AstroSwap soon rose closer to its fair market value, moving from a market valuation of $120,000 to $120 million at its peak.

Take a peek at its backers

It’s a good idea to check the company before invest in it. In reality, this means digging into the company’s early backers, paying specific attention to any significant VC firms and angel investors they’ve recruited on board.

Most initiatives will list the most notable donors on their websites. However, this only applies to venture-backed firms.

Port Finance, for example, is sponsored by several well-known venture capital companies, including Rarestone Capital, Morningstar Ventures, and JumpCapital.

You may visit each VC’s website to discover more about their track record. According to a deeper examination, Morningstar Ventures has also funded early heavyweights such Elrond, Covalent, and Yield Guild Games. But, maybe more critically, you can see that AscendEX supports it. Port Finance was listed on AscendEX, and early exchange backers could indicate a CEX listing down the future.

In an ideal scenario, you’d see a list of well-known VC companies with a proven track record, as well as supporters who are acknowledged to give value to the project, whether through marketing, strategy, development, or something else.

On the other side, if the project is backed by unknown VCs or has no money at all, this can be a red flag. Why would you want it if the experts don’t?

Check its team

A strong team is important for a successful project. There’s no getting around it. You may substantially boost your chances of success by picking projects that have an established, experienced staff behind them.

The majority of your effort should be concentrated on the executive team. Pay special attention to the CEOs, CBDO’s, CMO’s, and, perhaps most crucially, CTO’s backgrounds and competence.

We can break down how to perform necessary due diligence on a team before investing using Precog as an example — a prospective futures ecosystem and basis trade aggregator protocol.

The CEO comes first. A competent CEO is crucial as the project leader and the person in charge of organizing and guiding the team. Gehan Rajapakse’s LinkedIn profile demonstrates that he has created and managed several enterprises in numerous sectors throughout the preceding decade, demonstrating strong commercial acumen.

Moving on to Artur Ferreira, the CTO, we find that he developed UTrust (one of the best-performing projects of 2017) and is a partner at a well-known crypto fund. Finally, the platform’s CMO, Xavier Garcia, has spent the past half-decade in high-level marketing roles in the blockchain business, focused particularly on blockchain-based financial products.

A strong team is useful to the project, yet a bad team could imply weakness. Look for evidence of prior success and a track record of persistence. The mission becomes more difficult if the team isn’t facing the public. In this scenario, it’s vital to hunt for extra measures to confirm the team’s accomplishments, such as analyzing the project’s GitHub, seeking accolades, or relying on the testimony of other reputable individuals.

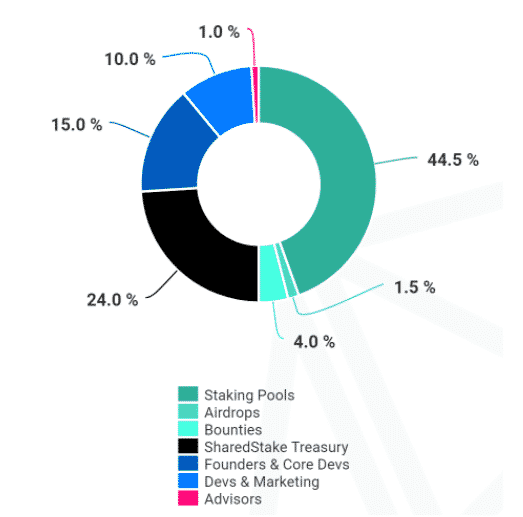

Examine its tokenomics

Sustainable Tokenomics is one of the most critical aspects of any successful organization. However, if there isn’t enough utility in place, very inflationary Tokenomics will always lead to price suppression, regardless of how wonderful a project is.

Unfortunately, some projects aren’t open about their token issuance, making it impossible to estimate how rapidly a token’s supply will expand. On the other hand, others have explicit Tokenomics that may help you determine if this is a concern.

Checking the vesting schedules of early supporters, tea, and advisors, checking if the project is hosting a huge airdrop, or executing a long-term yield farming operation are some of the best strategies to evaluate whether a project may suffer from excessive inflation.

Check if there are any processes to lower the circulating supply, such as a staking system or any burn mechanics, for projects that look to have a relatively large degree of inflation.

PancakeSwap is an excellent demonstration of how this may be done. Although the project has a degree of inflation that would cripple most projects (at 371,600 CAKE per day), it also has several burn mechanisms to control supply and demand.

Determine its market fit

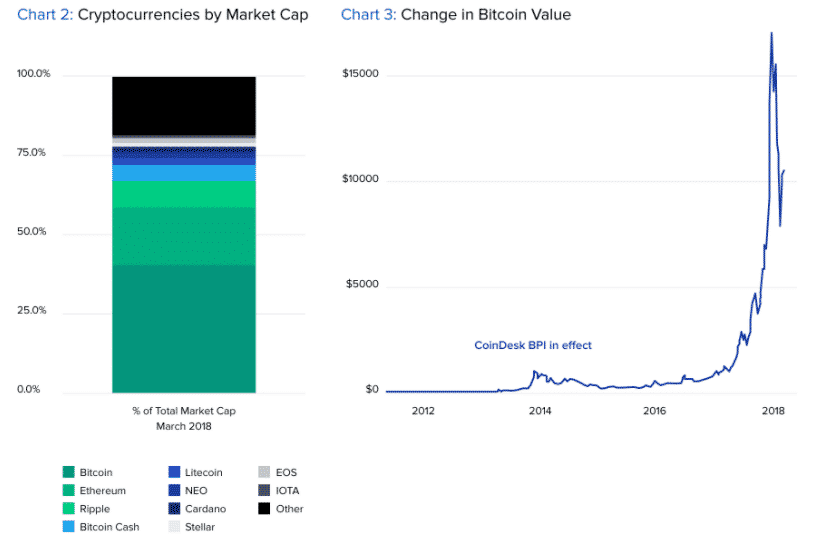

As you may know, the Bitcoin market goes through ebbs and flows. As a result, projects that appear to be performing exceptionally well at one point may not perform as well once they are released.

Similarly, projects that appear to be less than excellent at the time of their debut or before it may turn out to be just what the market needs.

Identifying projects that have a good market fit, or are likely to suit the market later, demands being on top of the market and having a comprehensive grasp of current trends.

Doing some simple keyword research is one of the most straightforward approaches to analyzing a project’s market fit. For example, look at the website of the recently founded Bloktopia. You’ll discover that it’s developing in some of today’s most promoted and publicized sectors, such as decentralized real estate, games, non-fungible tokens, and the Metaverse.

Checking the performance of some of a project’s keywords on Google Trends or following popular tags on social media may help assess whether it matches with current trends.

Bloktopia is a platform for establishing a decentralized Metaverse on Polygon. It got the nail on the money by releasing right when interest in the Metaverse soared. It also has an advantage over the competition since it developed before the Metaverse became a hot issue.

However, you should make sure that the project you’re looking at isn’t just copying existing patterns to fool investors is double-checked. Such an event would serve as a stark reminder to stay on the lookout.

Final thoughts

There is much more to crypto than BTC, despite its current popularity. While “Bitcoin” and “digital money” have come to mean the same thing for some, the digital money market is overflowing with choices. There are so many currencies out there that it might be tough to pick out the best ones to invest in, so we’ve come up with a few strategies to help you find the best ones.