- Is there a 100% FX strategy?

- What are the best FX strategies?

- Which is the most accurate trading strategy?

While trading in currency pairs, you ought to minimize the unprofitable trades and maximize the lucrative ones. For this, it is vital to have a solid plan in place. When you have one of the best forex strategies at your disposal and have been tested with archival data, you feel more hopeful about making the trading choices.

A scheme is essential to success in FX trading since it is a highly unpredictable market where price shifts sometimes occur without any prior warning. As a trader who wishes to avoid losses as much as possible, you must eliminate the uncertainty. This will help you make more prudent decisions.

While people with various trading modes develop several procedures, you need to determine which one is most suitable. To help you out, we have listed some of the best FX strategies in this article.

Top ten best forex strategies

No one trading scheme can be declared the best FX strategy. While a particular scheme might bring large profits to one trader, it might lead to disastrous consequences for another. So finding one that suits you requires some testing.

Here are the top ten strategies we’ll be discussing today:

- Carry trade strategy

- Day trading strategy

- Forex scalping strategy

- News trading

- Position trading

- Price action trading

- Range trading strategy

- Scalping strategy

- Swing or momentum trading

- Trend trading strategy

What is a forex strategy?

The FX market is ever-changing, and it takes only a few seconds for the price lines to shift drastically. To stay in the competition, you must take a dynamic approach. The best strategies can give you a much-needed edge and allow you to outperform your competitors.

The primary objective of a trading scheme is to bring about gains by purchasing and selling pairs. You need to risk a particular portion of your capital and expect to earn some rewards in the process. Each trader’s situation is different, and finding the best FX trading strategy for yourself is paramount if you wish to survive in the market.

In these strategies, price patterns and indicators are combined to derive trading signals. While some strategies work based on fundamental indicators, most short-term schemes have a technical aspect to them.

How to choose the best forex strategy?

Selecting the best strategy for trading FX is one of the most crucial decisions you will make as a trader, so you should make sure it’s an informed one. Most market participants don’t have the time to sit in front of their computer screens all day or endure the stress of a high-frequency strategy.

See that matches your available time

Time frame is a highly vital aspect of any trading scheme. Traders who are comfortable with M15 charts might face difficulties while analyzing weekly charts. If you prefer scalping schemes that try to take advantage of minor price movements, you should concentrate on the smaller time frames, such as M1-M15.

If you think swing trading is the best FX strategy, you can find lucrative trading occasions in H4 and daily charts. Thus, before selecting your trading scheme, you should decide the duration to keep your positions open.

See that matches your personality type

Selecting the best FX strategies also involves taking your personality type into account. If your lifestyle is not compatible with the trading scheme, you will find it challenging to maintain. On the other hand, if the strategy suits your personality, you can work with it long-term.

If you are an organized person, you should consider medium-term trading schemes like swing trading that do not require you to invest a lot of time. If you have ample time at hand, position trading might be the best option since it requires you to monitor the long-term market scenario.

Be sure of your risk tolerance

Before choosing a trading scheme, you must consider how much loss you are willing to take. While some strategies require you to risk a substantial portion of your account, others follow a low-risk approach. Each trader has a certain level of risk tolerance based on their personality, so if you take too much risk, you can end up making early exits that may be detrimental to your trading success.

Due to the volatile nature of the market, the price line may move against you for a while, only to jump back to its previous state. Thus, decisions based on fear can lead to you missing out on some sizable profits.

Select short or long-term FX strategies

It is hard to earn a massive amount of gains overnight while you are trading in currency pairs. Applying a long-term strategy will give you a better win rate, but some traders prefer short-term trading schemes due to the compounding factor.

If you are a novice trader, it is always better to follow a long-term trading scheme. It allows you to minimize the risks while gaining more knowledge about trading in general. Short-term schemes require you to be more careful, and they leave very little room for error. Also, you need to invest more time, which might not be suitable for all.

Test each strategy in a demo account

Even when you think you’ve found the best FX strategy, you should test it using a demo account first. This type of account lets you trade using virtual money while still allowing you to try all the indicators and functionalities of the scheme. Thus, you can get an idea about how the strategy works without risking any real money.

Novice traders should always use a demo account first to analyze the price charts and market scenarios. Seasoned traders also use demo accounts to try new schemes they have developed.

What are the best FX strategies?

Here, we shall discuss some of the best forex strategies that are used by merchants these days. Sometimes, you need to select a trading scheme based on market situations, so it is vital to know about the different schemes and what they involve.

1. Carry trade strategy

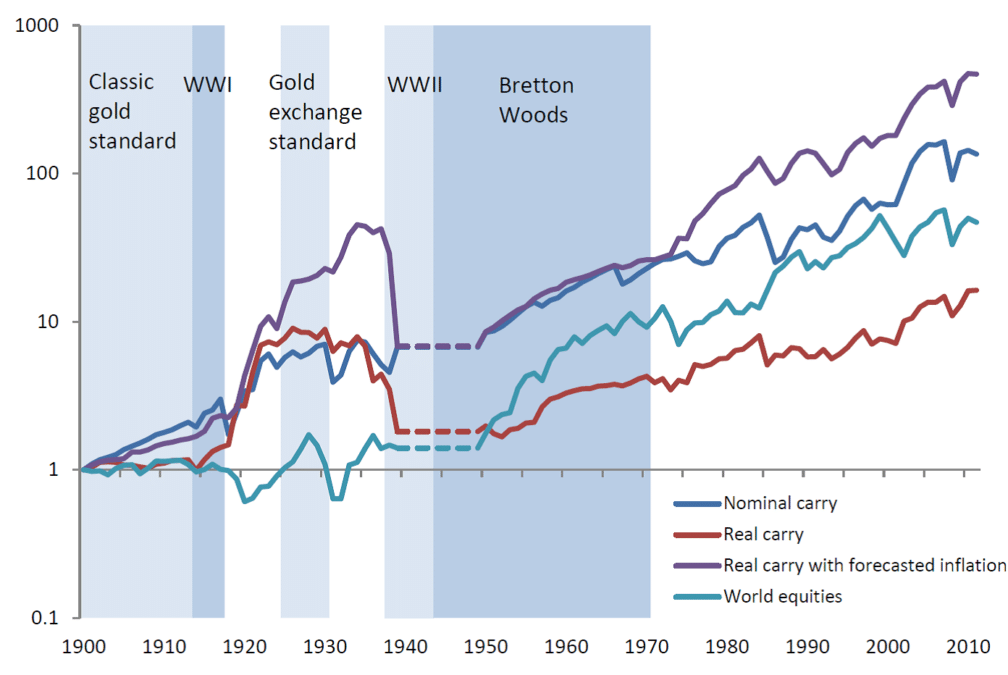

This trading scheme involves capitalizing on the bank rate difference between two currency pairs, provided the rates are not subject to significant fluctuations. First, the trader needs to borrow a currency with a low rate and then invest in another having a higher rate. This allows for risk-free gains that do not take much effort on your part.

When faced with a recession, the central financial institutions tend to reduce the bank rates to promote growth. This prompts merchants to take short positions for these currencies. These deals can extend from a few weeks to several months, and sometimes even years.

Since the trades are conducted over a long period, it is wise to employ this trading scheme for markets with strong trends. To fully use the bank rate difference, you should initiate your positions just as the trend commences. Remember, trading occasions are limited for this scheme.

2. Day trading strategy

If you are looking for short gains, this is one of the best FX strategies for you. You can use this trading scheme only for specific trading sessions. Traders who use this scheme do not hold onto their positions overnight, and every day, they exit all trades. Therefore, they can diminish the influence of price shifts when it is impossible to monitor the market.

Day traders usually follow charts that show short-term movements. The scheme is ideal for short-term traders who don’t like the high-frequency pace of scalping. Of course, you need to do your research and understand how economic changes influence the pair’s price.

The time frames used in this strategy include M30 and H1. Traders usually select a maximum level of risk for each day, with 3% being the most common. Breakout trading is one of the most used schemes in day trading.

3. Forex scalping strategy

This strategy involves taking advantage of slight differences between pairs. It requires you to place a large number of trades every, extracting small profits from each. The positions are typically kept open for a few minutes. If you are a scalper, you need to react immediately to price changes, or you might end up losing profits.

Because it’s such a high-frequency trading scheme, not all traders are comfortable with it. Although it deals with minor price shifts, the risk of loss is still pretty high when using high leverage. If you have enough time to invest in this trading scheme, only then should you go for it.

As a scalper, you need to keep an eye on the price charts that allow you to forecast changes in exchange rates. It is best to sign up with the broker with swift order execution capabilities, tight spread, and minimum slippage.

4. News trading

Economic data has a significant impact on the price of currencies, especially in the short term. If you are dealing in major pairs, it is imperative to follow the news related to the US economy. Although it is an effective strategy, it can sometimes be hard to execute since some are not officially published.

Each week, you need to know about the news releases before making trading decisions. By consulting an economic calendar, you can learn about the future macroeconomic events that can impact the FX market. Some of the essential factors include industrial production, sales figures, inflation, etc.

Sometimes there might be corrections made to old data, so you need to check the previous figures as well. If there is a sharp fluctuation in the bank rate within a short period, the market is volatile. This presents a chance for more profits, but the risk is also enhanced.

5. Position trading

Many long-term merchants deem this the best FX trading strategy as it requires you to invest a few hours every week in exchange for large profits. It does not take into account small market maneuvers and requires the merchants to concentrate on fundamental factors. The positions are kept open for a long time to capture some of the significant price shifts.

If you are a position trader, you typically conduct just a handful of trades each year. These trades have high-profit targets, so you should not use too much leverage. It requires you to be disciplined and not react to short-term movements.

Although you need to spend some time performing market analysis, executing the scheme requires very little time. It is prudent to begin trading with the pair you are knowledgeable about. Try to determine the trading volume, and you will figure out the perfect moment to make your entry.

6. Price action trading

This is one of the best FX strategies for merchants who focus only on the value. Here, it would help to analyze pullback and trending waves to figure out the trend’s orientation. For an upwards trend, you will notice higher swing lows and higher swing highs, while the opposite occurs for a bearish trend.

When the impulse waves are more significant than the pullback waves, you know the trend is progressing. The highs and lows remain between support and resistance zones. Although the FX market remains open at all times, most pairs are unlikely to shift when the markets are closed, despite the development of price action signals.

You can combine the price action with other schemes like scalping and swing trading. For basing their trading decisions, market participants often look for continuation and reversal shapes. Besides, you can use different indicators like RSI, stochastic, and Fibonacci.

7. Range trading strategy

This is the best strategy for trading FXin a non-trending market. It is not advisable to use this scheme when a trend exists. Here, you need to identify support and resistance zones, going long for support periods and short for resistance zones.

To be profitable with this trading scheme, you need to know about the different ranges:

- Rectangular

- Diagonal

- Continuation

- Irregular

Among them, rectangular ranges offer trading occasions for the short term. Diagonal ranges are ideal for predicting breakouts, while continuation ranges lead to swift breakouts and quick profits.

Because this scheme involves breakouts, you need to manage your risk efficiently. If there are range-bound trading positions, you ought to close them. Some of the common indicators used with this scheme include stochastic, CCI, and RSI. However, for each trade, you need to invest a lot of time and understand technical analysis.

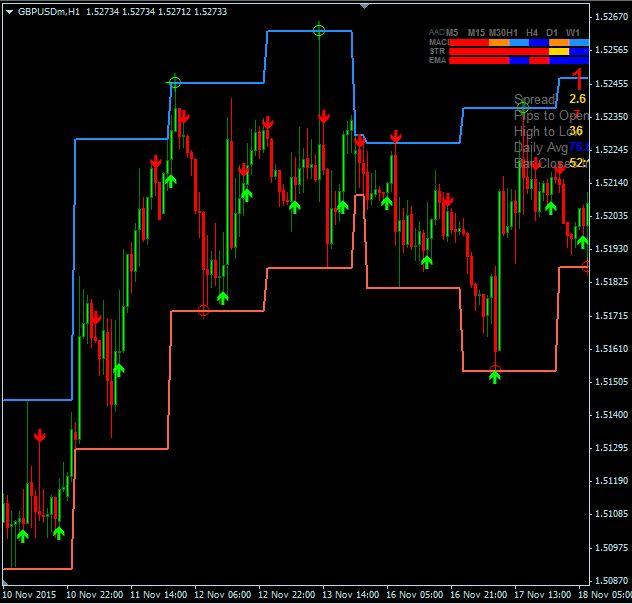

8. Bounce strategy

Currency traders must monitor the prices of the euro and dollar, and if you wish to make gains from this dynamic market, this is one of the best FX strategies to apply. It involves setting up a MA line for short-term charts and dealing with the price line bouncing off the MA line. For this purpose, you can use M15 and M5 charts.

For bounce strategy, the positions are kept open for a maximum of one hour. This trading scheme works on the assumption that a substantial price trend will gradually return to the MA line and then return to its previous position after bouncing off the line. By using it, you can determine the trend direction for a particular pair.

If the pair is trending upwards and lingering above the MA-line, you should go long after the bounce. For a downtrend, you need to sell when the pair goes back after reaching the EMA.

9. Swing or momentum trading

While using this trading scheme, you need to watch the fundamental news releases and the charts. It is unnecessary to stick to a fixed time frame; however, most trading positions are closed within a week. Traders using this scheme prefer to follow the most potent trend in the market.

When the momentum is upward, you should place a buy trade, and when it’s downward, you should go short. The basic strategy is to buy at lows and sell at highs. This way, if a short-term trend reverses, you won’t suffer too much.

To be successful with this strategy, you need to get your timing right. You can only obtain small profits for each swing. Typically, a trader targets 20 pips for every swing. If you invest small amounts, you can lose a large part of your profit due to spreads and trading fees.

10. Trend trading strategy

Because of its simple nature, many traders consider this the best FX trading strategy. Here, the decisions are made based on the assumption that the current trend is going to endure. The trader uses fundamental and technical indicators to analyze the nature of price movement for a pair.

One of the common indicators used for this scheme is moving average. Traders monitor the average price for a certain period by using MA lines. Some of them use MACD for forecasting the trend, while others use RSI. If RSI is more than 50, it signals a price drop, and when it is less, you know a bullish trend is about to kick off.

FAQs about the best FX strategies

Let’s look at some FAQs related to FX strategies.

How profitable is FX trading?

Yes, it can be profitable provided you know what you’re doing. If you risk too much money for one trade, you might end up losing too much, but a long-term strategy can bring your profits.

How much time should you set aside to use the best FX strategies?

It depends on the type of scheme that you choose. High-frequency strategies like scalping allow you to invest a lot of time, while others like position trading give you some breathing space.

What are the best currency pairs to focus on your FX strategy?

The best pairs to trade at this moment include USD/EUR, USD/JPY, USD/CAD, GBP/USD, USD/CHF, and AUD/USD.

What is the best FX strategy for the short term?

Day traders can use this strategy in any market and for any pair. It is not as stressful as other short-term schemes like scalping, and it allows you to avoid the overnight fees.