- What are cobalt stocks?

- Are they worth investing in?

- How to choose best?

The world is moving to a new era of consuming patterns, and the economy is adapting just fine. While many fear the economy’s collapse due to the change of energy sources, the new options open opportunities to those willing to take them. One of the most exciting investment opportunities in cobalt companies.

This metal derived from the production of nickel and copper and today is a key element in the manufacture of batteries for electric vehicles and electronic devices. As the market recovers from the covid crisis, cobalt companies are profiting from the increase in demand for this ore. Learn now how you can profit from this activity that will shape the future of cars and technology in the next few years.

What are cobalt stocks?

They are shares of companies on the public market involved in cobalt mining, processing, and commercialization.

The world is changing at a speed we couldn’t imagine a few years ago. Electric cars are a reality, and they are going to rule mobility ten years from now. Governments are committed to meeting the zero-emission goal in 2050, so most of us will live in a carbon-neutral world.

It looks like we can adapt to the change in the economy by betting on new technologies like investing in Tesla stocks or solar energy companies. But let us present to you what we think is a better choice to invest in.

We don’t know if Tesla will finally win the electric car competition or if another company will take the lead. However, we know that there are no electric cars without batteries, and there are no batteries without lithium, nickel, and cobalt.

These companies are experiencing an increment in their value due to the increasing demand for ore. There are many ways in which investors can benefit from this phenomenon. Let’s take a look at the best option.

Are cobalt stocks worth investing in?

Not everything is perfect when it comes to cobalt. The main problem with the ore is where it is found. The Democratic Republic of Congo owns half of the world’s cobalt deposit. Unfortunately, the country has been historically investable, so the supply of cobalt for the industry is constantly in danger. There are other nations with large cobalt deposits like Cuba, Russia, and China, but none is even close to the magnitude of the RDC deposits.

Despite lithium and nickel being the key components of electric batteries, cobalt provides the required stability for the product. That’s why companies like Tesla and Apple, highly dependent on Cobalt for their chips and batteries, have made efforts to find an alternative, but experts say that at least for the next three decades, there is no alternative. So, the world will have to solve any issue related to Cobalt if they want to go to the environmentally friendly world we are trying to build.

Let’s see some of the best investment options to benefit from these stocks.

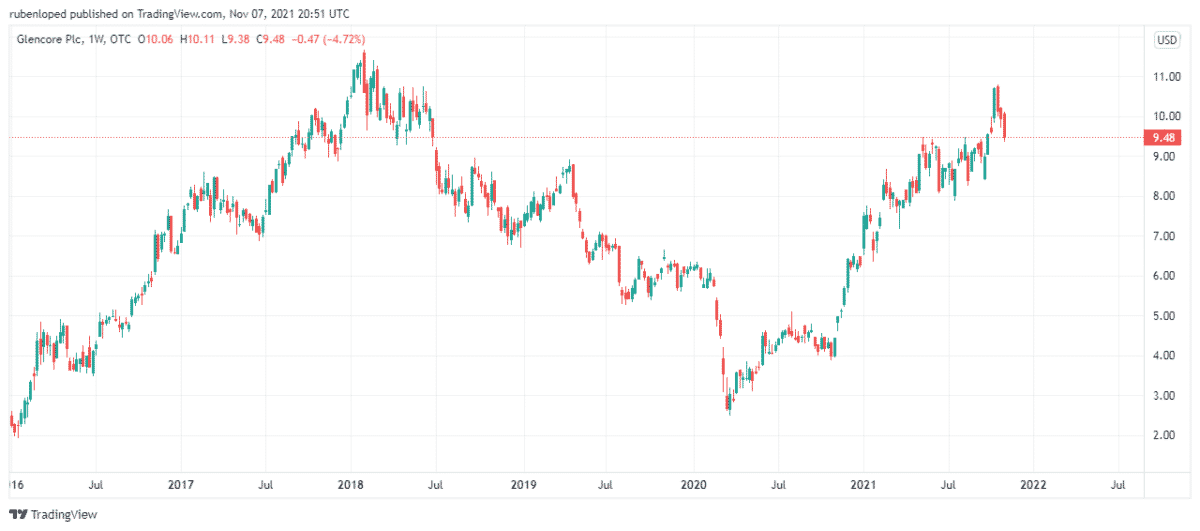

1. Glencore (GLNCY)

Price: $9.48

It is one of the world’s cobalt mining leaders. The company was founded in the ’70s and is based in Switzerland. Glencore engages in the production and marketing of metal, minerals, and energy. They run operations in the country with the largest cobalt deposit. Still, they also produce the mineral as a sub-product of тickel, which the company extracts from their deposits in Australia and Canada.

The company’s stock price reached its lowest level in five years in March 2020 when each stock quoted at $2.50, and since then, it has been recovering. The rise in the cobalt price helped Glencore, and now the shares of the company are around $10 each.

2. Vale (VALE)

Price: $11.61

In 1942, the company was created as a state-owned company, to then be privatized in 1997 as part of a Brazilian government privatization program. Today, Vale S.A. is one of the largest mining companies in the world. The company runs operations in almost 30 countries worldwide, operating through the segments of Ferrous Minerals, Base Metals, and Coal.

Nickel and copper are both mined by Vale in different countries. From these minerals, Vale extracts cobalt. The Nickel operations are in Brazil, Canada, Indonesia, and New Caledonia. The Copper operations are in Brazil and Canada.

3. Wheaton Precious Metal Corp. (WPM)

Price: $41.01

Canadian company Wheaton Precious Metal Corp was founded in 2004. Company operations include gold, silver, palladium, cobalt, and Others. These operations involve the sale of precious metals and the production of Cobalt. Wheaton’s business model includes agreements to purchase all or a portion of the precious metals or cobalt production from high-quality mines. Today, the company has streaming agreements for 24 operating mines. Among those streams, there are Salobo, Penasquito, Antamina, Constancia, Stillwater.

For its investors, the company offers growth through the purchase of streams, dividend yields, and leverage to increase the price of the metals.

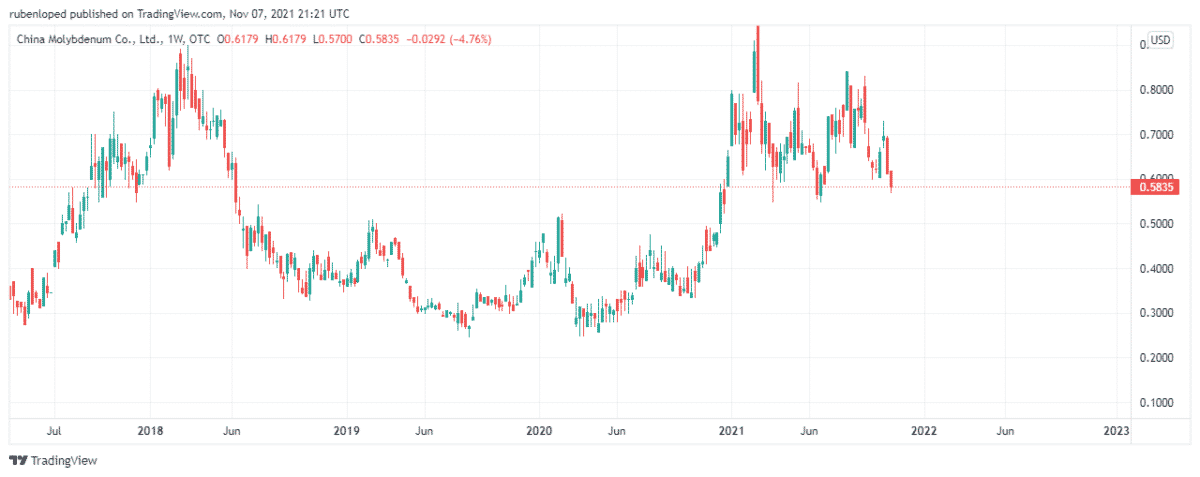

4. China Molybdenum Co., Ltd. (3993.HK)

Price: $0.58

This Chinese company was founded in 1969, but it got to its current organizational structure after some reforms were made in 2004. The company engages in the mining and processing of rare earth and precious metals. Today is a private company with state participation.

China Molybdenum has a presence in the five continents and is the second-largest cobalt producer in the world.

The company’s stock value has risen considerably since April 2020, but it remains a penny stock. However, experts bet strongly on these stocks, and they set their target price around $6 per share.

5. Carpenter Technology Corporation (CRS)

Price: $32.76

It is an American company with more than 100 years of history. Carpenter Technology Corporation engages in the fabrication of specialty metals operating through Specialty Alloys and Engineered Products segments. The company is based in Pennsylvania and today has over a dozen locations in America, Europe, and Asia.

The shares of Carpenter Technology Corporation are among the most attractive of the sector. Since the beginning of the pandemic, the stock value of the company has risen. However, since June, the value of the stock has fallen by one-third. However, the recovery of the world’s economy makes experts have a positive review of the company’s future, and it could recover its previous price level in the next few months.

Final thoughts

First, however, the supply instability will have to be overcome due to the industry’s dependence. Cobalt is one of those critical elements that will make possible the transition to a zero-emission world.

Also, cobalt is a chemical element that is found in minerals such as copper and nickel. This means that we don’t find it alone on the earth, so companies that produce cobalt also process nickel and copper, which gives these companies more stability against the volatility of cobalt.