- Is there an ETF for penny stocks?

- Which is the best?

- Is it profitable to buy penny ETFs?

One way to diversify your portfolio is to invest in penny stock ETFs. However, investors have a love-hate relationship with penny stocks. Regardless, no one can deny that penny stocks have a lot of potential as an investment.

Take note that a lot of big brands today once were penny stocks. For example, Apple and Amazon started as penny stocks. How much return could you have made if you bought these stocks when they were cheap?

Based on history, micro-cap companies consistently outclass the global market. Future market leaders may just be hiding behind the name of penny stocks. Plus, know that small companies can grow easier than larger firms.

While you can make money if you buy early and hold over the long term, penny stock funds involve higher risks than average. Let us get down to the basics of these funds in the next section.

What are penny stock ETFs?

An ETF is a basket of assets being traded in an exchange. The basket may be composed of bonds, commodities, and stocks. With an ETF, you can get exposure to multiple sectors to limit the risk. This allows you to have a balanced portfolio without spending too much effort and time on individual assets.

A penny stock EFT lets you invest in multiple penny stocks by purchasing one such fund. In the list discussed in the next section, the funds covered contain shares of companies trading at low prices, particularly less than $5. Make them an option to invest in individual penny stocks. With this option, the work is less, and the risk is lower than getting multiple individual stocks.

Top 3 penny stock ETFs to buy in 2022

Below are three of the best penny stock ETFs to consider buying in 2022. We arrange them based on the value of net assets.

No. 1. iShares Micro-Cap ETF (IWC)

Price: $125.75

Expense ratio: 0.60%

Net assets: $1.25 billion

IWC is the biggest ETF in its category, and the majority of its holdings are individual penny stocks. As an ETF, IWC monitors the results of the Russell Microcap Index. As of November 30, 2021, this ETF holds about 1,750 assets. What separates this fund from other options is that it holds assets from various segments in the market. The majority of its portfolio is invested in the financial, energy, and healthcare sectors.

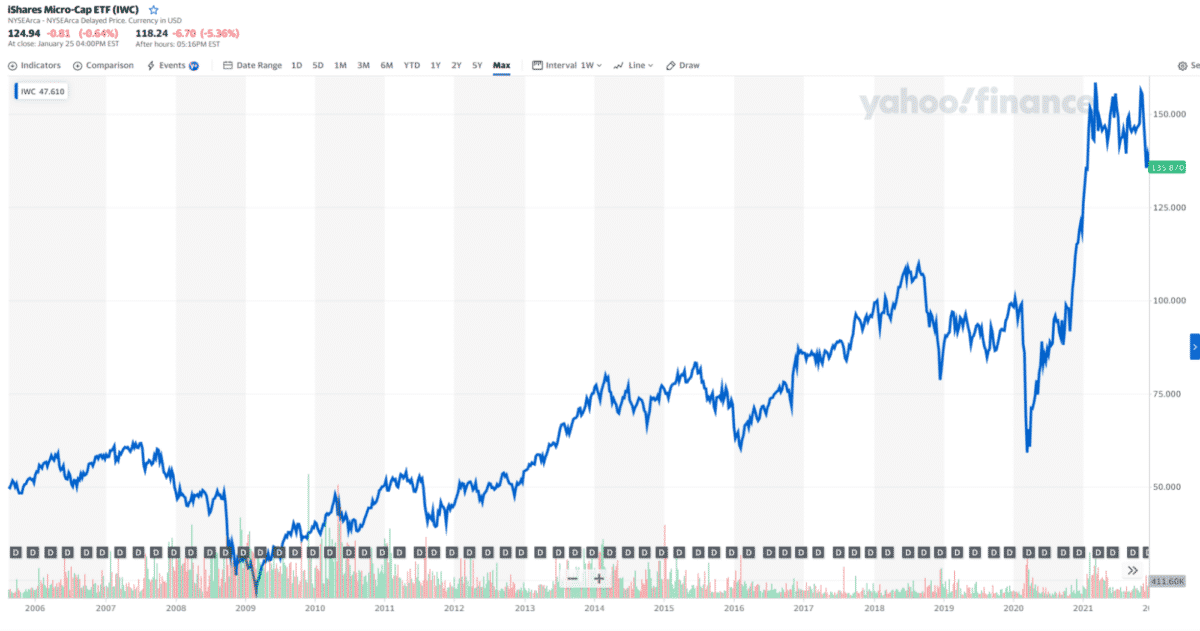

IWC is the biggest penny stock ETF on this list regarding net assets. One cool aspect about this fund is that it continually gives out dividends to investors year after year since it began in August 2005. Since the first quarter of 2009, the market rallied continuously until March 2021, at which point it registered a peak of $159.56.

After printing a triple top on the monthly chart, the price sold off. The good thing is that a series of support is coming up at around $110, $100, and $85. It might be best to wait for the price to test any of these levels before entering a position.

No. 2. First Trust Dow Jones Select MicroCap ETF (FDM)

Price: $60.45

Expense ratio: 0.60%

Net assets: $188.73 million

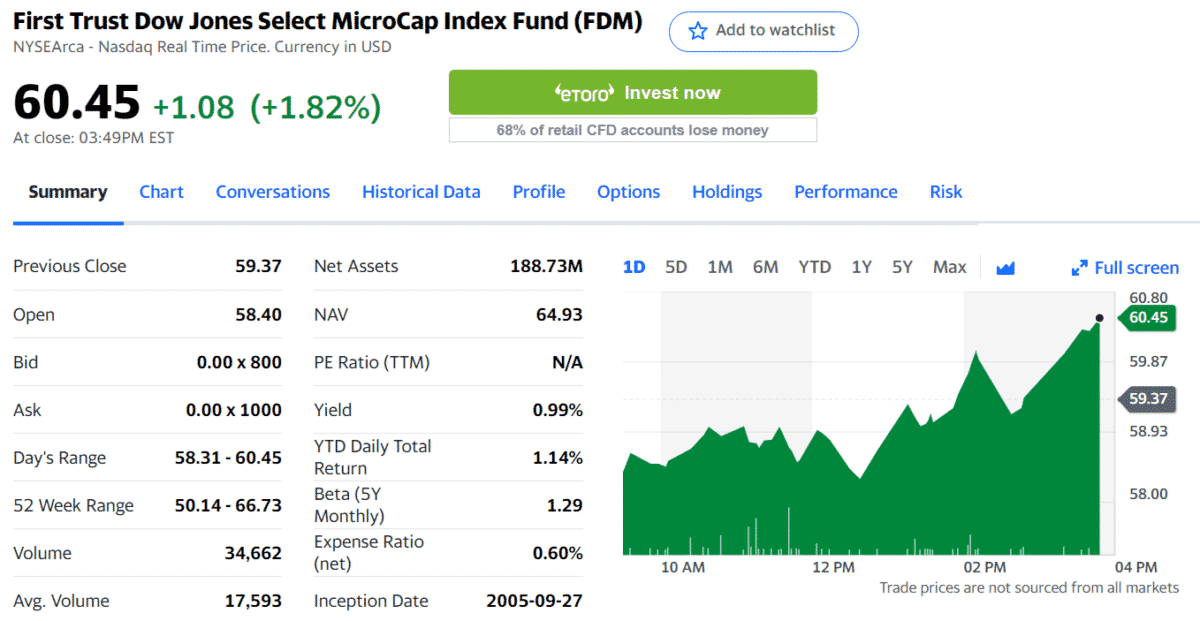

Holding about $188 million in total assets, FDM ETF is the second-biggest microcap fund. This ETF monitors the results of the Dow Jones Microcap Index. Meanwhile, this index selects equities based on trading volume, market cap, and other critical fundamental indicators. This fund heavily invests in the consumer discretionary, industrial, and financial sectors, and it holds more than 200 assets.

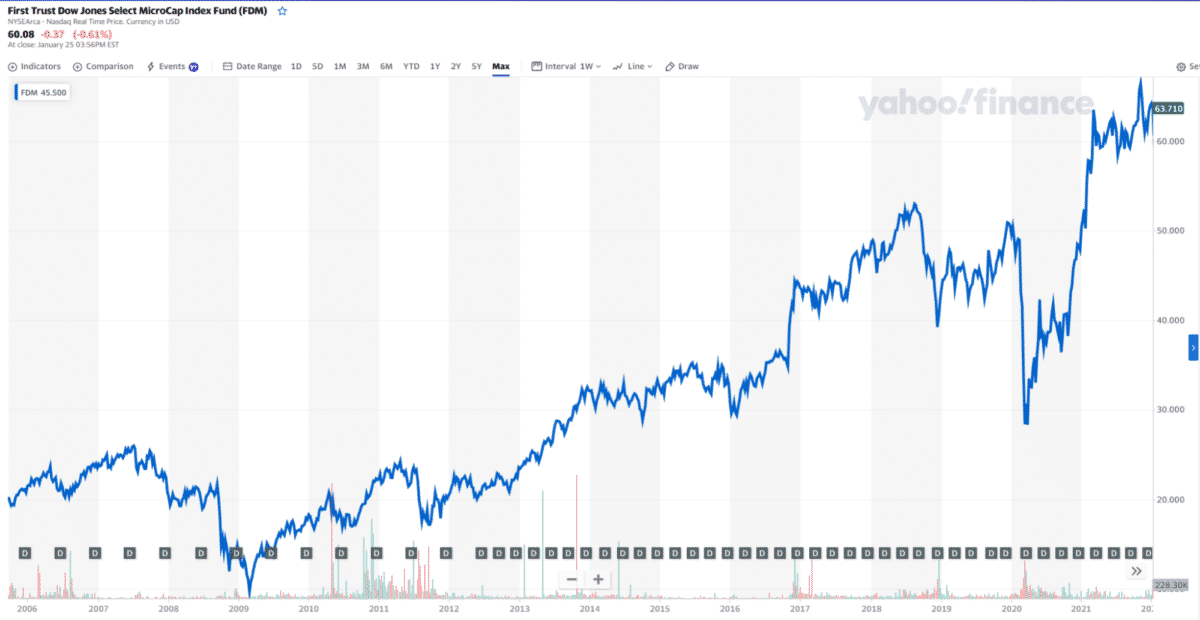

FDM is the second-biggest ETF on this list in terms of net assets. Like IWC, FDM can give out dividends to investors since it debuted in September 2005. Meanwhile, its monthly chart below is better than the first fund concerning upward potential.

Although the price is consolidating in a small range, the market is moving in an upward channel. The best way to enter this market is using dollar-cost averaging. You can open an initial position right now and add more positions later when the market rotates down.

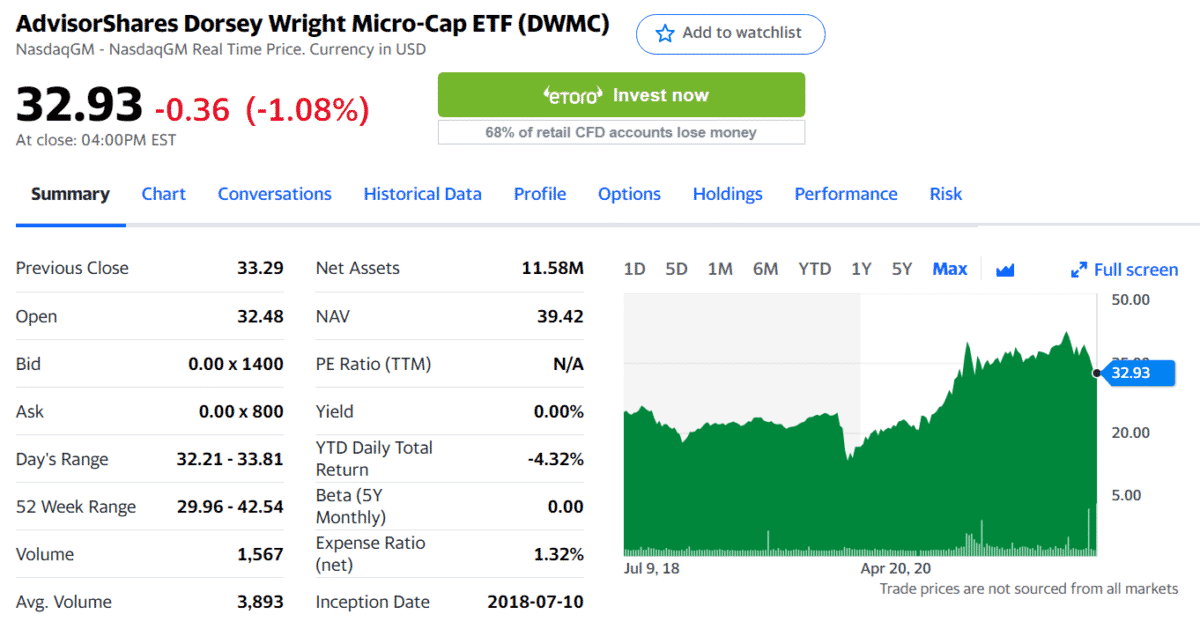

No. 3. AdvisorShares Dorsey Wright Micro-Cap ETF (DWMC)

Price: $32.93

Expense ratio: 1.32%

Net assets: $11.58 million

Like the other two ETFs previously discussed, DWMC ETF holds microcap stocks, and professional investors actively manage the fund. Although the fund is a newcomer in the industry, it managed to name itself in the microcap ETF segment. Holding about 150 assets, DWMC mainly invests in the consumer services, financial, and industrial sectors. The fund’s experts ensure it only keeps the best penny stocks in the market.

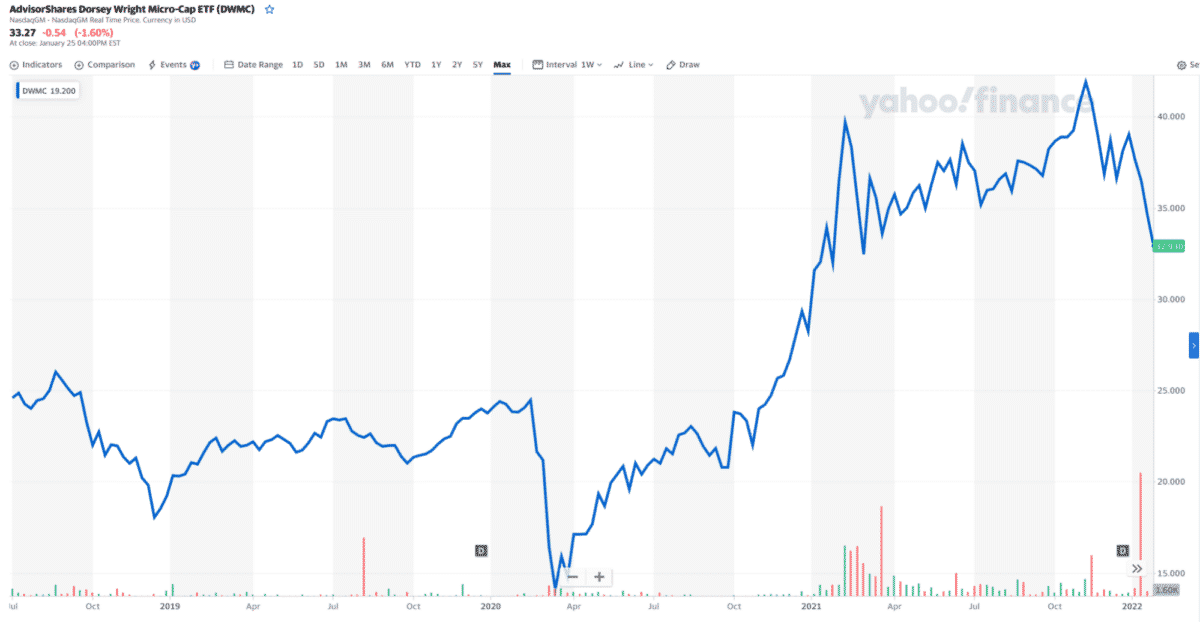

In terms of net assets, DWMC is the third on this list. Compared to the previous two funds, this ETF is relatively newer, debuting on July 8, 2018. From March 2020, the market made a massive rally, hitting a high of $41.61 on February 15, 2021.

After making a double top on November 15, 2021, the price sold off and is now sitting on the neckline. Since the price is at support, it could be an excellent time to buy, hoping the neckline holds. If the neckline breaks down, we could see further losses in the months ahead.

Final thoughts

Being some of the best in the industry, the above penny stock ETFs allow you to invest in microcap firms with limited risk. However, these assets are suitable for investors who do not shy away from volatile investments. Be aware that significant risk comes with great reward. Some of the penny stocks we know today may become market leaders in the future.

By their nature, penny stocks are volatile instruments. You should understand what this volatility means to your investment account as an investor. Just make sure that you do your assignment before putting your hard-earned money on the line. Be prepared to join a rollercoaster ride toward profitability.