- Is it possible to trade inside the crypto market volatility?

- What are some of the most volatile cryptos right now?

- Are there some coins that stay afloat in today’s bearish crypto market?

While volatility is common in the crypto market, some coins are more volatile than others, which can be good or bad, depending on your perspective. Below are five volatile cryptocurrencies with good market caps.

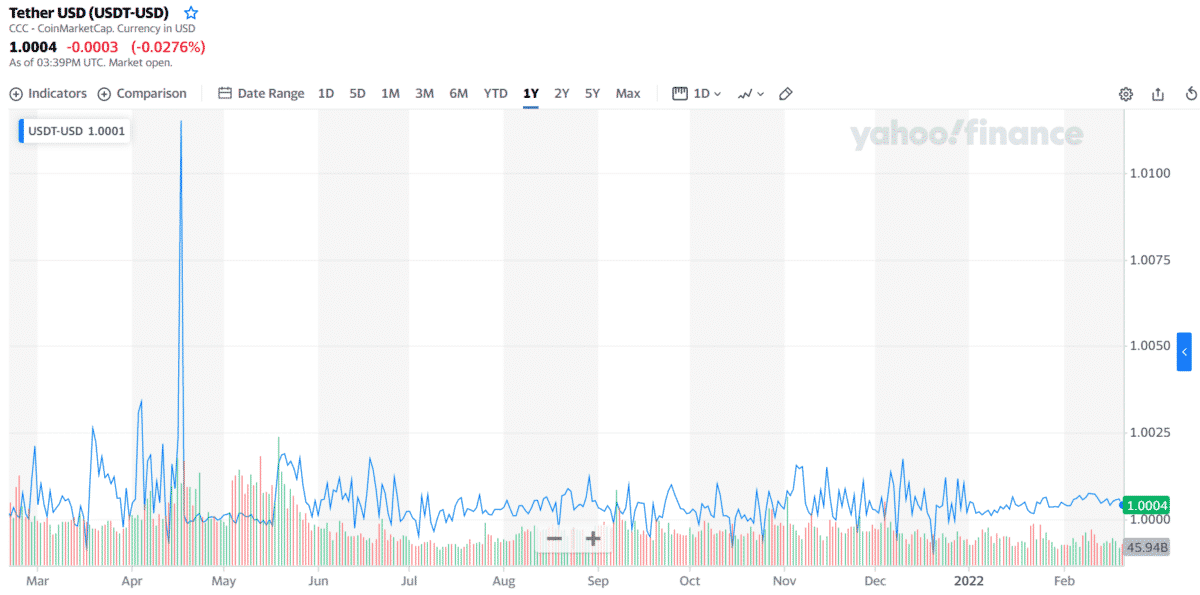

Tether (USDT)

It is a stablecoin whose number of coins is supported by the same amount of fiat money in US dollars. As a stablecoin, Tether is expected to maintain a value very close to one US dollar. The only way to judge if the coin has grown in value is to look at its market cap. Its market cap stands at $79 billion, making it the third-largest crypto globally.

Why does it have the potential to grow?

One major case for Tether’s continuous growth is its use in crypto exchanges. In Binance, for example, users use Tether to convert their local currencies into digital currencies. From there, they convert their USDT holdings to other types of crypto assets. This role of Tether is tough to replace with an altcoin. Because Tether is a stablecoin, users do not worry if they keep their holdings in USDT for some time while they develop their trading or investing strategy.

How much would you earn if you invested in Tether (USDT) 1 year ago?

Tether had a closing price of $1.0001 on 20 February 2021. One year later, its price crawled up to $1.0004. That minute price change is equal to about 0.03 percent growth. You would have gained a negligible return if you invested $1,000 one year ago.

Bitcoin (BTC)

Bitcoin was made public in 2009 and started getting some attention in 2010. By the end of 2010, each BTC was valued at $0.09. From that point, Bitcoin price has grown by leaps and bounds, at times gaining or losing hundreds of dollars in one day. Many factors influence the volatility of bitcoin. These include user and investor sentiments, supply and demand, media hype, and government regulations.

Why does it have the potential to grow?

Billionaire bitcoin investor Tim Draper stated that network developers are working hard to upgrade bitcoin. The first BTC upgrade occurred on 14 November 2021, called Taproot. This upgrade resulted in higher transaction efficiency and privacy. On top of that, developers introduced the smart contract protocol into the blockchain.

How much would you earn if you invested in Bitcoin (BTC) 1 year ago?

On 20 February 2021, bitcoin had a price of $56,099. One year later, its price was around $40,000. This price change is about a 28% drop in value. If you invested $1,000 last year, you could have lost $280.

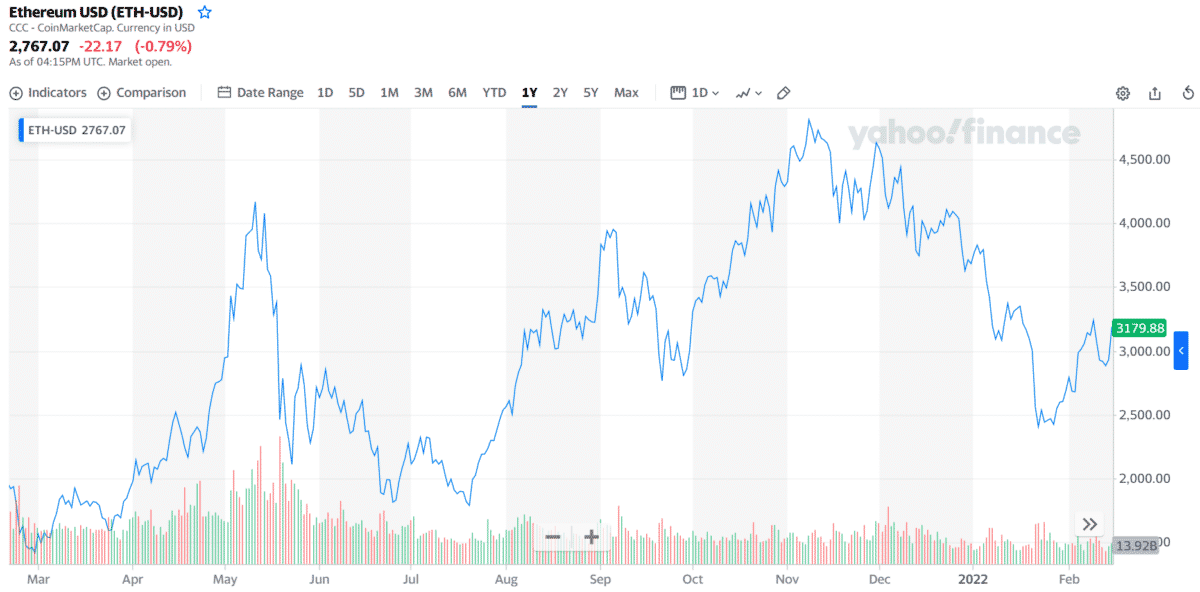

Ethereum (ETH)

Conceived in 2013, Ethereum uses an open-source blockchain code with smart contract capability. Other crypto projects can use this platform to create and launch decentralized applications. Ethereum is one of the most volatile crypto judging by its standard deviation. Yahoo Finance reported a mean volume of $18.7 billion for Ethereum in the past three months.

Why does it have the potential to grow?

Ether is a promising coin because of its actual utility and value-storage ability. Ethereum embodies the concept of smart contract and programmable finance that the premier crypto Bitcoin cannot accomplish. For these reasons, investors note that Ethereum could overtake Bitcoin in terms of market cap.

How much would you earn if you invested in Ethereum (ETH) 1 year ago?

Each Ethereum coin cost only $1,919 on 20 February 2021. One year later, its price jumped to $3,179. Such price change is about 65% gain in value. Had you invested $1,000 last year, you could have earned $650 today.

Bitcoin Cash (BCH)

Bitcoin Cash is a copy of Bitcoin. It came into existence in August 2017 due to a joint decision by developers, influential miners, users, and investors who did not support the SegWit2x mechanism. Today the network is a peer-to-peer payment system. BCH takes reputation as the coin for daily transactions.

Why does it have the potential to grow?

If you look at the chart, the price of Bitcoin Cash is right where it started in 2017. However, the coin managed to seize the 25th spot in the ranking for the largest market cap in Coinmarketcap.com. This is an indication that investors have confidence in this crypto asset.

How much would you earn if you invested in Bitcoin Cash (BCH) 1 year ago?

BCH closed at $682 on 20 February 2021. One year later, its price hovered around $311. This price change equals a negative 54 percent of the original value. Had you invested $1,000 last year, you could have lost $540 today.

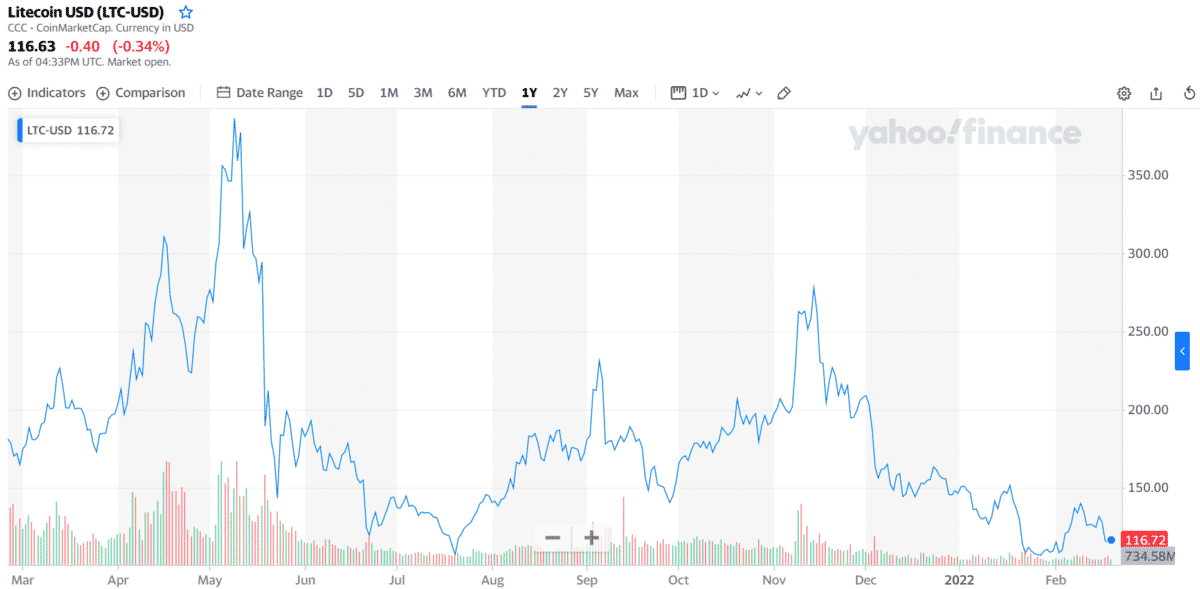

Litecoin (LTC)

Litecoin began public trading in 2011. Similar to Bitcoin, Litecoin is generated from an open-source blockchain code. The difference between the two is that Litecoin generates new blocks much faster than bitcoin and uses the Scrypt algorithm. Barchart.com shows that Litecoin has a YTD percent change of -21.12%, 200-day change of -63.93%, and a 100-day change of -30.66%. This shows that its price is not only falling but also highly volatile. One research study even finds out that Litecoin is even more volatile than Bitcoin.

Why does it have the potential to grow?

Litecoin is a favorite among crypto investors due to its strong technical aspects. Despite the current sell-off, Litecoin is still regarded as a good investment option. One reason for this is that Litecoin processes transactions faster than Bitcoin. Another reason is the growing adoption of Litecoin. In September 2021, about 3,000 merchants adopted Litecoin as an alternative payment system.

How much would you earn if you invested in Litecoin (LTC) 1 year ago?

On 20 February 2021, Litecoin was priced at $227 per coin one year ago. Today each coin cost $116. This means that the price dropped about 49 percent one year later. If you invested $1,000 last year, you could have lost $490.

Final thoughts

Volatility is inherent in the crypto market. Although some traders and investors look at volatility negatively, it is not bad per se. Without volatility, trading the crypto market can be boring and might not be so profitable. What you can do is find a way to trade within price fluctuations. You can gauge market volatility using various tools. Some of them are trading volume and price change.