- How can staking crypto generate revenue?

- How will you choose the correct coins to make passive income?

- Which cryptocurrency is best to stake?

Many crypto platforms offer a staking feature. Some coins are worth staking, and some have better staking rewards than others. That’s a good thing. The user and platform can benefit from making blockchains more secure while earning rewards.

Bitcoin and other cryptocurrencies are generating a lot of excitement, and it’s hard not to understand their appeal. Cryptos are appealing for many reasons, so the best staking asset is a handy guide for those who want to invest in them.

So, what’s the best coin to stake?

Best crypto staking coins to watch right now

The new era of investing includes trading in top digital currencies, and it’s a fun way to support. The market participants usually trade digital currencies on an underground market. When people are in the mood for gaming, they stake coins, and it is an activity they do when they’re motivated.

Throughout the article, you’ll discover all the details you need to make an informed investment, including market conditions, industry trends, and trendsetters. In addition, this section discusses the most promising staking cryptos and the best assets to make.

Therefore, why not invest your time and resources in a way that will yield a positive APY?

You will learn how investors earn interest income on their digital asset holdings when we introduce you to the entire concept and platforms for investing in crypto assets in 2022. Additionally, this guide will help investors reap the benefits of value appreciation and growth on their investments. This creates a win-win situation for both parties.

How much would you earn if you invested in such projects 1 year ago?

Staking on PoS platforms has experienced success in 2021 that goes largely unnoticed at the moment.

After being launched on prominent platforms of the past year, staking has taken over the consensus model for top-ranking platform tokens, including Cardano, Polkadot, and Solana. In addition, the Beacon chain of Ethereum 2.0 launched in December 2017 and has since started attracting the attention of institutional investors.

For example, Blockdaemon, an infrastructure provider specializing in staking, recently raised $28 million from Goldman Sachs. Sygnum, a Swiss-registered digital asset bank, also says it will support ETH 2.0, having previously incorporated stakes on Tezos.

Ve Chain (VET)

Ve Chain is a blockchain platform based on ETH, specializing in enterprise and supply chain industries. VET’s staking ranking saw a significant improvement after the introduction of blockchain.

Why does it have the potential to grow?

Platform services include inventory management, monitoring, quality assurance, and quality control, primarily focused on logistics. Additionally, the company’s intuitive and efficient mobile app makes staking effortless.

Staking rewards vary between 3% and 4%, depending on the market conditions.

Tezos (XTZ)

Tezos is another popular cryptocurrency, which you can stake on Binance and Kraken, among many other reputable exchanges.

Tezos has various hardware and software wallets, including Ledger and Exodus, available for staking.

Why does it have the potential to grow?

So, what are the benefits of Tezos staking? Besides the variety of staking platforms that Tezos offers, you do not usually need to stake a lot of the cryptocurrency. Many venues require as little as one XTZ to stake in Tezos, making staking accessible to almost everyone; additionally, staking Tezos rewards you with some fantastic tips.

Rewards will fluctuate depending on which platform you use and for how long you stake your XTZ, but you can usually expect to earn between 4% and 8.5%.

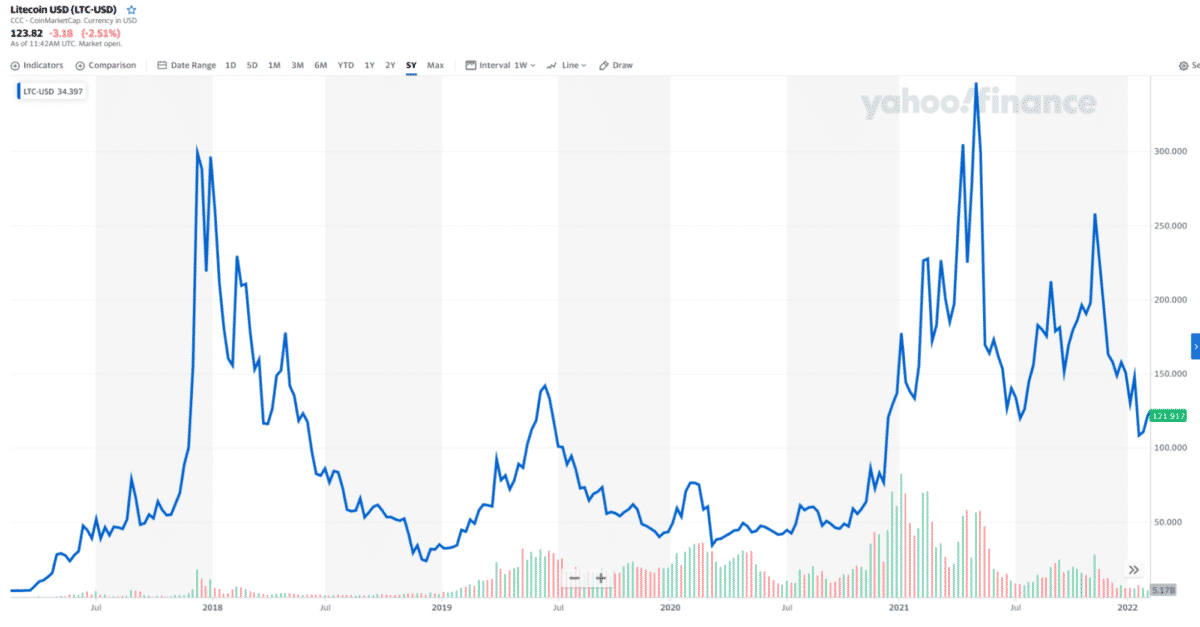

Litecoin (LTC)

Litecoin is a peer-to-peer currency that allows instant payments with close to zero fees. Like BTC, it is a decentralized currency, but faster transaction times and its use of blockchains make it superior.

Litecoin has been making waves in the market lately, making it one of the best staking cryptos. Litecoin currently ranks third after BTC as the world’s most popular cryptocurrency. A Google internal crypto team member, Charlie Lee, started this company after leaving Google to start his own. In addition, various financial institutions use it and payment systems such as Apple Pay and Visa.

To begin investing in cryptocurrencies, you should remember to research and pick the right one for you.

Why does it have the potential to grow?

Staking crypto can be a good choice if you want to invest in a cryptocurrency that pays interest rather than giving it away freely. You can pay interest in these cryptos, so they offer an excellent return of around 5% to 8% on your investment.

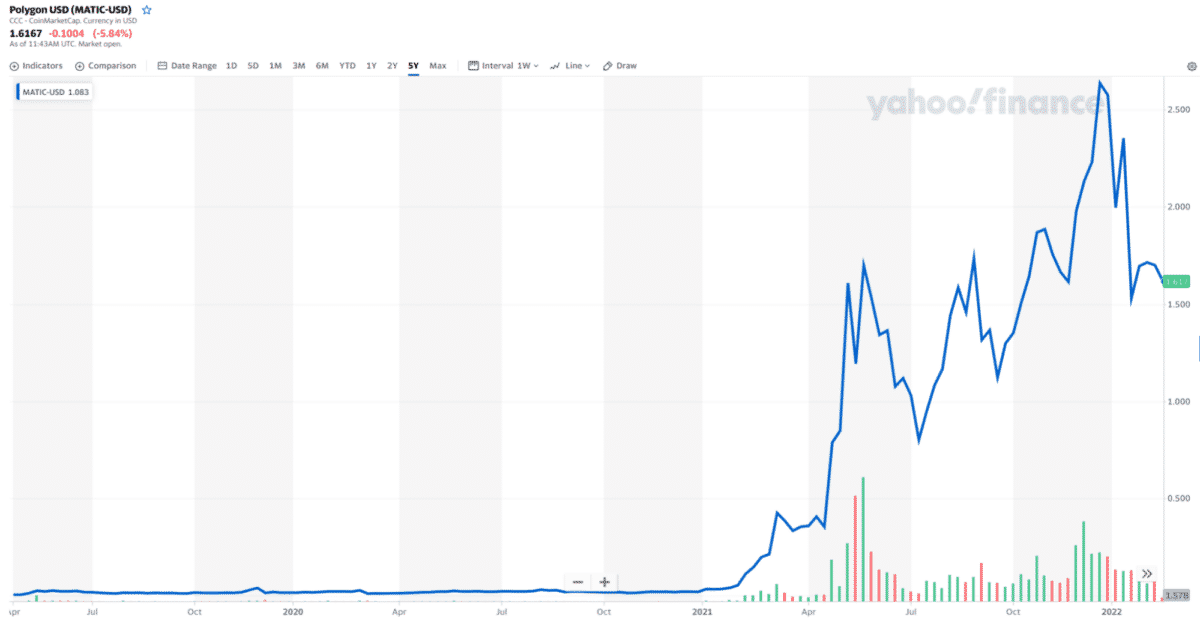

Polygon (MATIC)

The Polygon project aims to scale ETH. “Ethereum’s Internet of Blockchains,” Polygon serves as a layer-2 protocol designed to interconnect all Ethereum-based decentralized applications to ensure compatibility.

Why does it have the potential to grow?

Currently, the Polygon network can validate 65,000 transactions per second in its blocks, ensuring that the various ETH networks can interact smoothly. You may require validators for this project; they leverage their MATIC to validate transactions within the network. The average reward for staking is 3.5%.

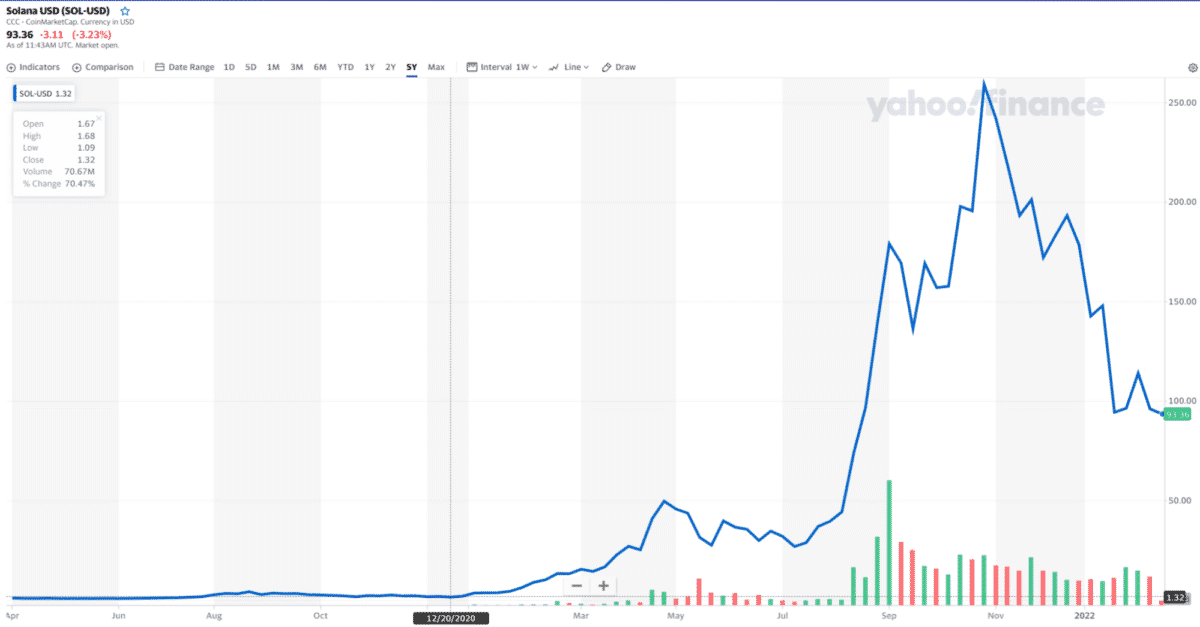

Solana (SOL)

The Solana platform (SOL) is a blockchain-based smart contracts technology intended to deploy decentralized applications (dapps). Solana’s native cryptocurrency is a tradable token that facilitates cross-chain transactions and pays for network costs.

Why does it have the potential to grow?

Currently, Solana rewards both validators and delegations. A validator with more SOL delegations has a greater chance of recording transactions on the blockchain, thus generating more rewards for both the validator and delegator. Therefore, validators may reduce their commissions from delegators to remain competitive. The slashing effect affects both validators and delegators. It leads delegators to choose to stake with the highest-performing validators.

Solana’s adjusted staking yield determines both validator and delegator staking rewards. Staking rewards are dynamic under the staking dilution structure, and they depend on the percentage of tokens staked out of the current supply of SOL.

Staking Rewards reported that delegated staking yields an annual percentage (APY) of 6.41 percent, with most validators now charging a 10% commission. So staking 1,000 SOL would result in you earning roughly 64.1 SOL next year. The 52-week high on SOL is $260.06, which means you’d be placing a $1,666.99 stake for a $26,006 profit.

Final thoughts

After reading all of this, it may still stay in the back of your mind whether you should stake cryptocurrency. However, if you have the means to invest, and one of these projects appeals to you, many would argue that staking a share is a good idea. For example, this is a way to earn rewards through network participation rather than betting on a specific project’s price.

Depending on the project, staking can be a worthwhile option and meet the minimum threshold if comfortable.